Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

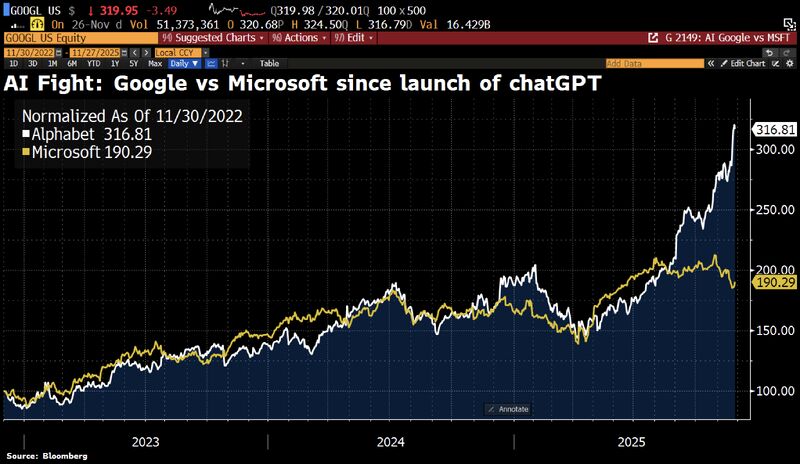

It now looks as if the race between Microsoft and Google for the best AI strategy has been decided

Source: HolgerZ, Bloomberg

JPMorgan has taken a surprising leap back into Bitcoin – this time with a leveraged structured note tied directly to BlackRock’s iShares Bitcoin Trust (IBIT), the world’s largest BTC ETF.

The filing, made this week with U.S. regulators, arrives just days after the bank criticized MicroStrategy, faced boycott calls over alleged crypto debanking, and pushed MSCI to consider excluding Bitcoin-heavy companies from major indexes. Now, the same institution is rolling out a product built to ride Bitcoin’s next major cycle. JPMorgan Unveils IBIT-Linked Note Built Around the Halving Cycle The structured note mirrors Bitcoin’s well-known four-year pattern: weakness two years after a halving, followed by renewed strength heading into the next one. With the last halving in 2024, JPMorgan is effectively positioning investors for a potential dip in 2026 and a surge in 2028. According to the filing, if IBIT hits or exceeds a preset price by December 2026, the bank will call the note and pay a minimum 16% return. But if IBIT stays below that level, the note extends to 2028 and the payoff becomes far more aggressive. Investors would earn 1.5x whatever gains IBIT delivers by the end of that year, with no cap on upside. High Rewards, High Risk The note also includes partial downside protection. Investors recover their principal in 2028 as long as IBIT doesn’t fall more than 30%. But once that threshold breaks, losses mirror the decline. JPMorgan warns that holders could lose over 40%, or even their entire investment, if Bitcoin collapses during the period. A Sharp Reversal in Tone From JPMorgan The launch comes amid a rapid shift in messaging from the bank. JPMorgan now says crypto is evolving into a “tradable macro asset class” driven by institutional liquidity rather than retail speculation. Source: Trading View, Decrypt

The gap between UK borrowing costs and other advanced economies isn't just persisting, it’s widening:

A stark reminder of the "UK premium" currently baked into markets. The more this "UK premium" embeds itself in the public finances, the higher the risk of a self-feeding vicious cycle. Source: FT, Martin Wolf

When Zoom ($ZM) was $600/sh in 2020, it had $20 million in income.

Now, Zoom is $87/sh with $2 billion in income. What does that tell you about the current AI companies? Source: Kevin Malone @Malone_Wealth

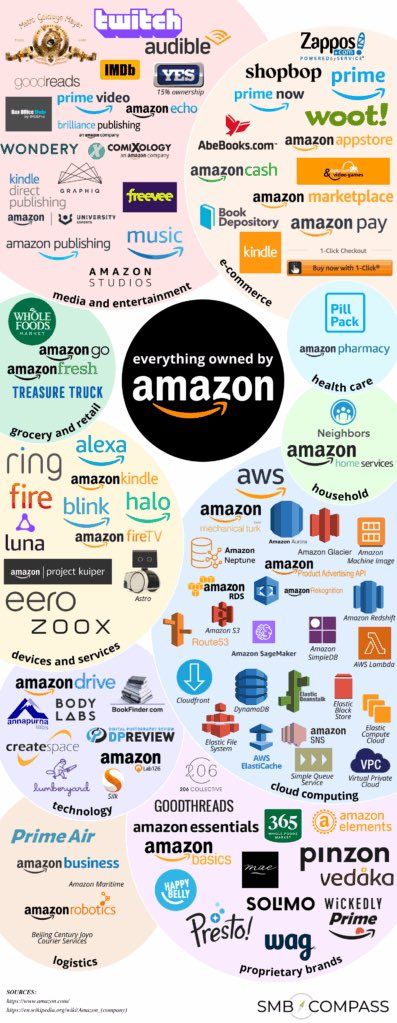

Amazon owns half the internet…

Prime, AWS, Twitch, Whole Foods, Ring, Zoox, Audible, Kindle, Alexa - the list never ends. Source: Dividend Talks on YouTube @DividendTalks

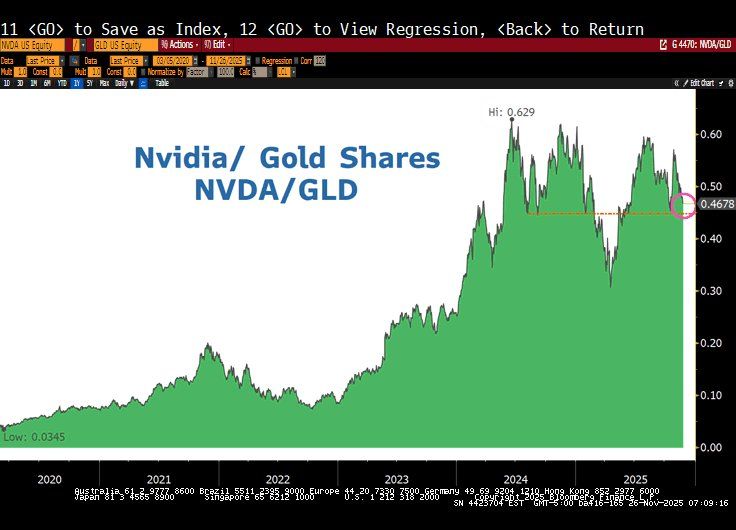

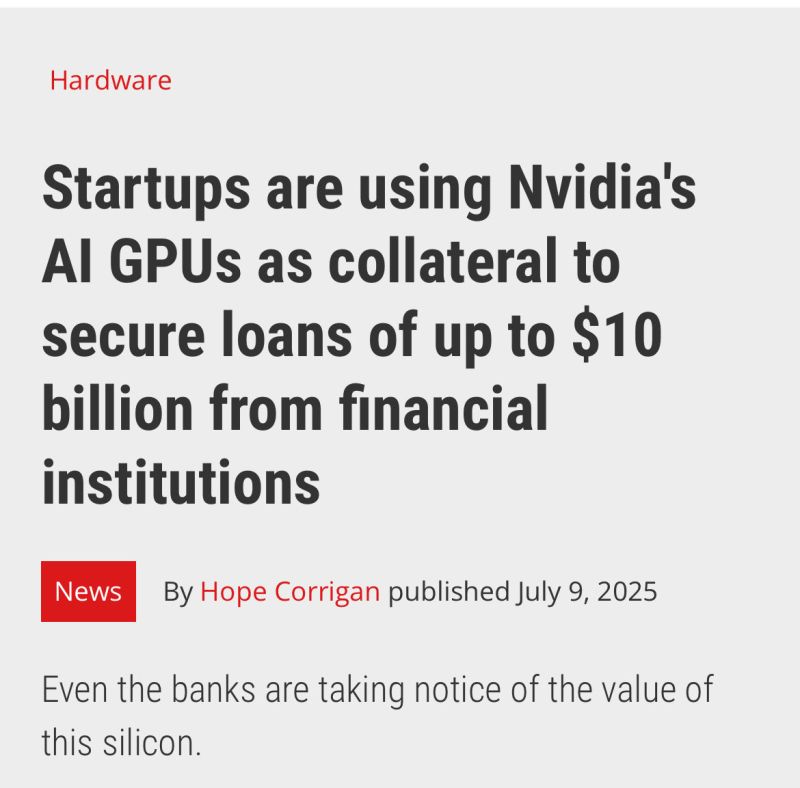

How many loans to negative cash flow start ups were made using Nvidia chips as collateral?

Source: Edward Dowd @DowdEdward

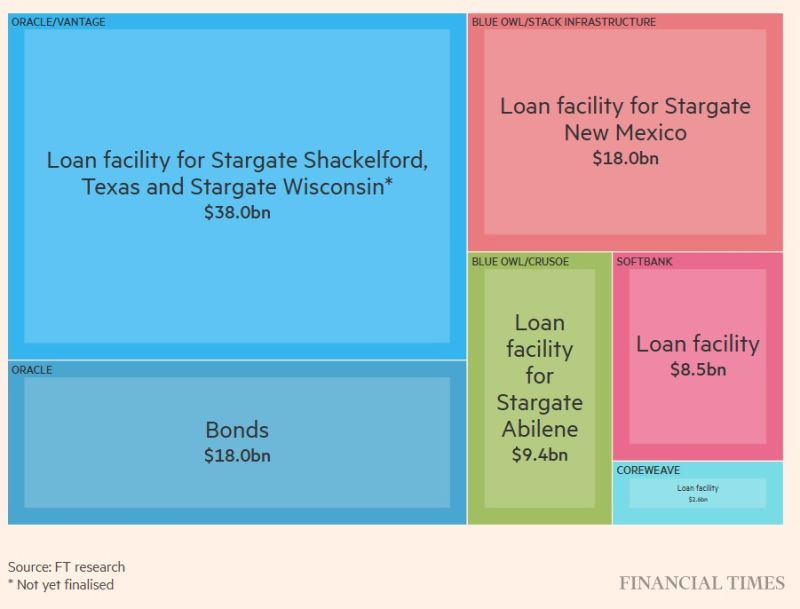

A great FT article on how OpenAI partners amassed $100bn debt pile to fund its ambitions

A great FT article on how OpenAI partners amassed $100bn debt pile to fund its ambitions.

Investing with intelligence

Our latest research, commentary and market outlooks