Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

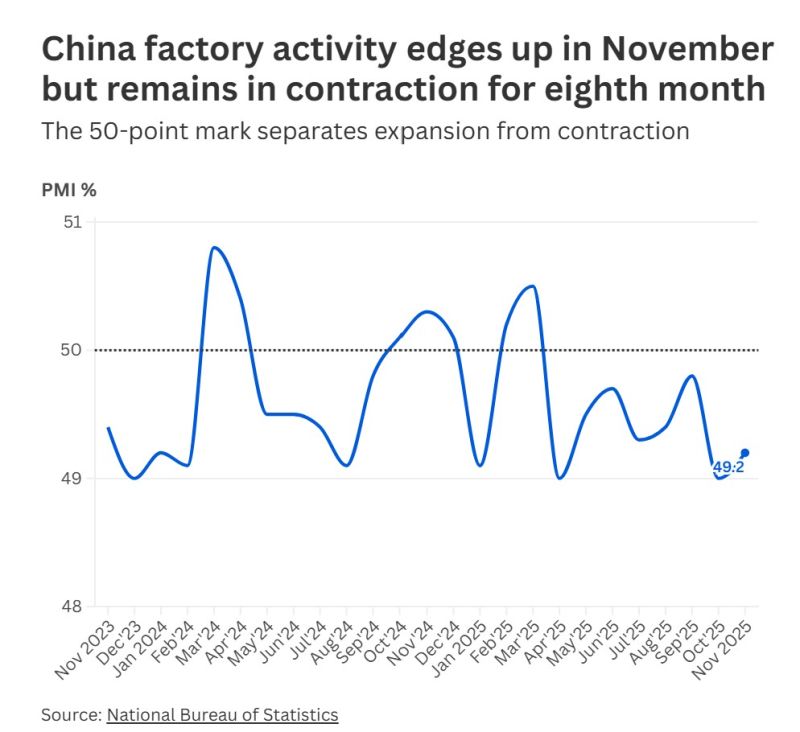

China’s factory activity edged higher in November but remained stuck in contraction for the eighth consecutive month

Services weakened as the boost from earlier holidays faded, according to official data released Sunday. The manufacturing purchasing managers’ index rose to 49.2, up 0.2 points from October, the National Bureau of Statistics said. The figures were in line with economists’ expectations in a Reuters poll, but remained below the 50-point mark that separates expansion from contraction. The non-manufacturing business activity index fell to 49.5, down 0.6 points from October, while the composite PMI output index eased to 49.7, indicating a slight pullback in both manufacturing and services activities. Supply and demand in manufacturing improved modestly, said Huo Lihui, chief statistician at the bureau’s Service Industry Survey Center, with the production index reaching the 50 threshold and new orders rising to 49.2. Source: CNBC

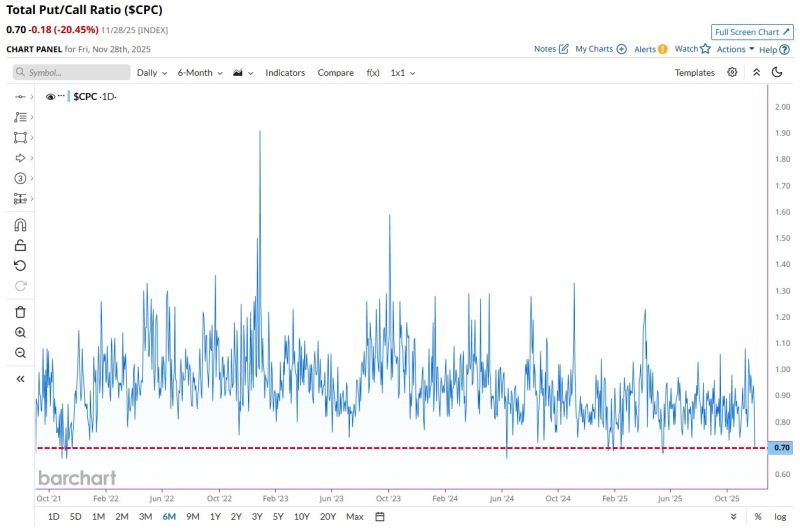

Total Put/Call Ratio drops to 0.70, one of the lowest levels in the last 4 years 👀

Source: Barchart

So what's going on in markets this morning? Why are Cryptos tumbling again?

A ris-off signal to start December? Well, it seems that the spike in Japanese bonds yields is the culprit... Indeed, Japanese bonds are puking on renewed expectations of rate hike, as the 2Yr JGB yield is above 1% for the first time since 2008. The yen is firming and the Nikkei 225 index is tumbling. And since nowadays Bitcoin always correlates with anything that's down, we have a 5% dump in Bitcoin in Asian trading to $85k.... In the middle of Asian session, BoJ Governor Ueda said he was consider the "pros and cons" of raising interest rates at the BoJ's December and idea that the market got hold of last week as the odds of a BoJ Dec rate hike increased from 30% to 50%. Source: Bloomberg, zerohedge

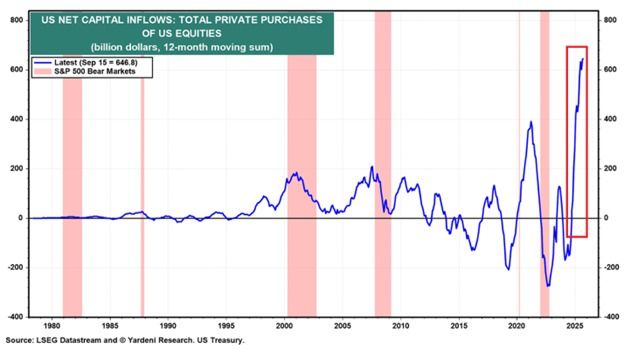

Foreign investors are buying US equities at a record pace:

Private investors outside the US purchased a record +$646.8 billion of US equities in the 12 months ending in September 2025. Purchases have doubled since the start of the year. This is now 66% ABOVE the+$390.0 billion high seen in 2021. Meanwhile, foreign private-investor purchases of US Treasuries were +$492.7 billion during the same period. Rolling 12-month non-US buying of Treasuries has remained above +$400 billion for 4 straight years. Source: The Kobeissi Letter

As a remainder, The FED ends QT tomorrow !

For years, they've been pulling money out of the system Tomorrow, that drain stops... Source: @PaulGoldEagle

Imagine buying a 100-year Austrian bond only to see it trade at about 25% of the value you bought it just a few years ago

🚨🚨 Ouch!! Source: FT

Nasdaq $NDAQ is making its tokenized stock plan a top priority and says it will “move as fast as we can” to get SEC approval.

The proposal, filed in September, would let investors trade on chain “stock tokens” that are just digital representations of existing listed shares, with the same ticker, CUSIP, voting rights and dividends, and target rollout around Q3 2026 under current SEC market rules. Source: Wall St Engine

The S&P 500 has been up 7 months in a row with a 20%+ gain.

Historically, what comes next after such a rally? See the anser below. On average, the S&P 500 record positive returns. But the last 2 times we had a similar streak (Sept 2009 and August 2021), the market paused a month after. Source: RBC, TheMarketStats

Investing with intelligence

Our latest research, commentary and market outlooks