Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Market manipulation on Bitcoin

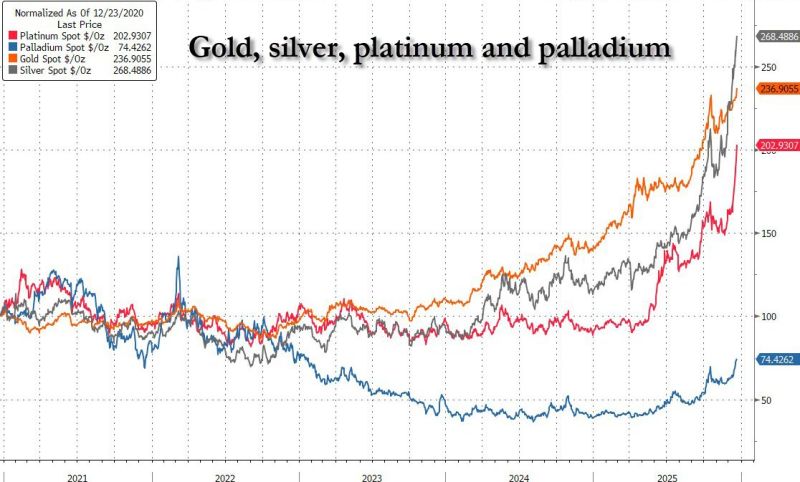

GOLD - new ATH SILVER - new ATH S&P 500 - near ATH NASDAQ - near ATH DOW - new ATH While Bitcoin is down -28% from its peak, having the worst Q4 in the last 7 years without any negative news, FUD, or scandal. There is no explanation for this except pure market manipulation. Source: Bull Theory @BullTheoryio

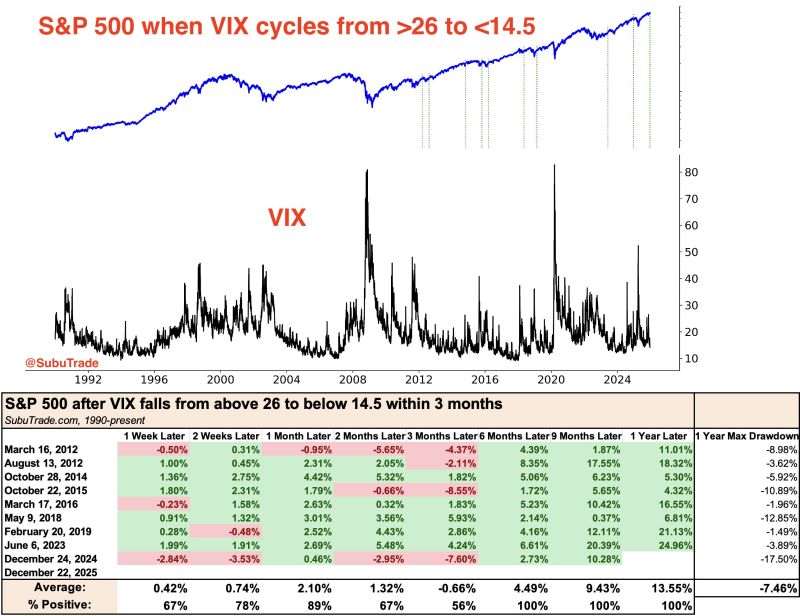

$VIX dropped to 14 today, down from 26 just a month ago

Is volatility "too low"? In each of the last 8 times this happened, $SPX was higher a month later. Source: Subu Trade

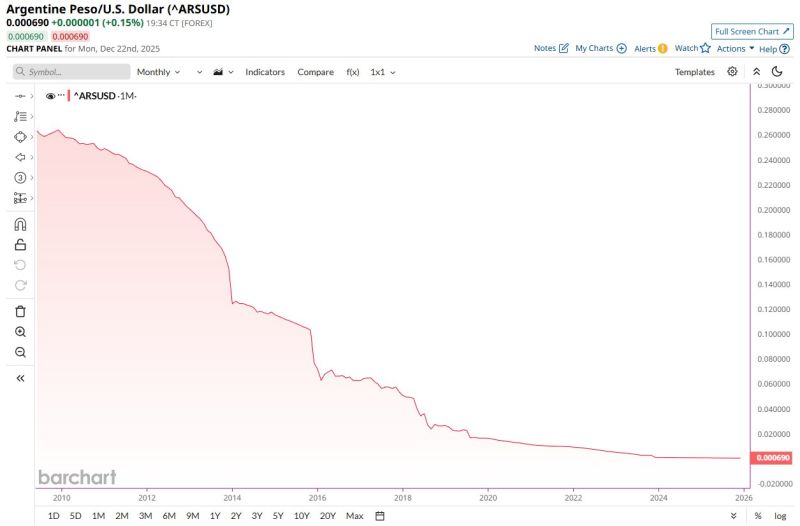

BREAKING 🚨: Argentina

Argentina's Peso has now collapsed 99.8% against the U.S. Dollar since 2009 📉📉 Source: Barchart

"Macro hedge funds are enjoying their best year since at least 2008…"

Per the @FT thru Mo EL Elrian: "An index from data provider HFR tracking the returns of such funds — which aim to profit from economic trends by trading equities, bonds and commodities — was up 16 per cent at the end of November”

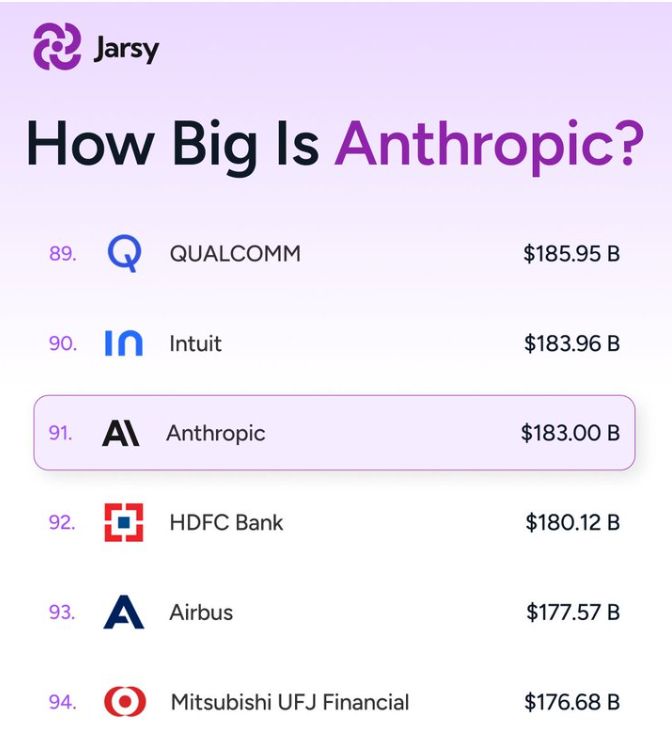

According to Reuters (via an FT report), Anthropic is laying groundwork for an IPO as early as 2026.

They’re also reportedly in talks for a private funding round that could value the company north of $300B — a huge step up from their most recently disclosed ~$183B post-money valuation. If Anthropic were public today and you simply treated that ~$183B as its market cap, here’s the fun part: 📈 It would land around the low-90s globally by market cap — roughly #91 — just ahead of Airbus (≈$181B). For context, that neighborhood looks like: Blackstone ≈ $186B HDFC Bank ≈ $180B (Anthropic) ≈ $183B Airbus ≈ $178B Source : Reuters, FT

The K-shaped economy is not just about the US

Indeed, the German economy is increasingly K-shaped: stock markets are rising, while consumer confidence is in free fall. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks