Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

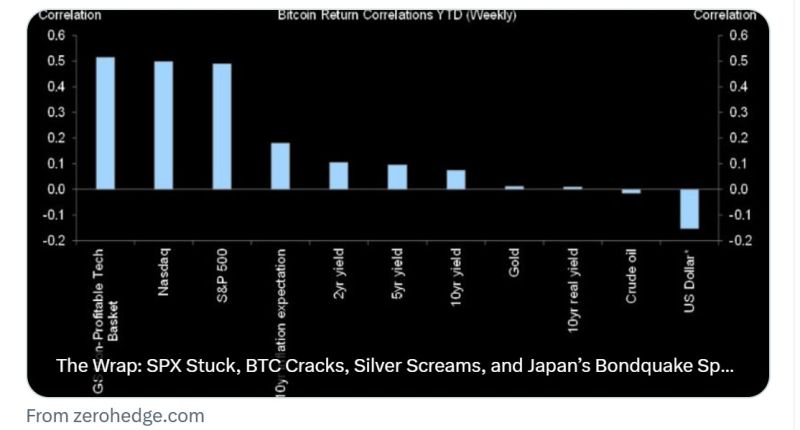

The Market Ear: "When you trade BTC, you're basically trading unprofitable tech, not a store of value, not dollar debasement".

As shown below, bitcoin has a high correlation with unprofitable tech stocks and the Nasdaq.

$IBM CEO says that at today’s costs it takes about $80B to build & fill a 1 GW AI data center

So the ~100 GW of announced capacity implies roughly $8T of capex & “no way you’re going to get a return on that,” since you’d need “about $800B of profit just to pay for the interest” Source: Wall St Engine

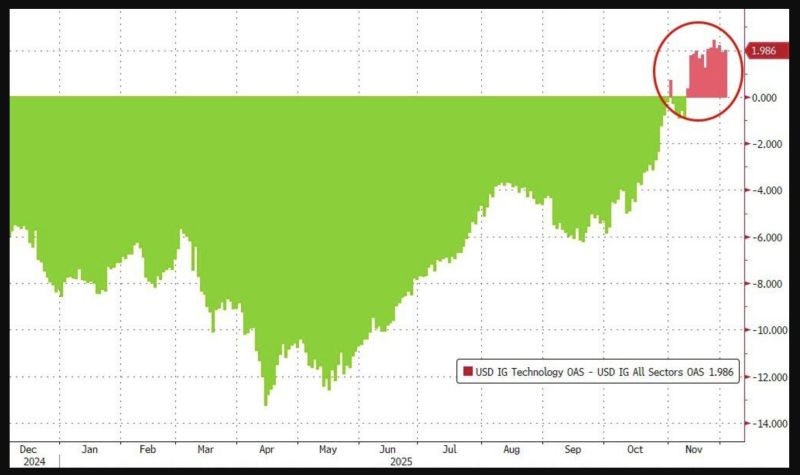

Overall Tech credit Spreads continue to trade wide to the overall IG credit market...

Source: zerohedge

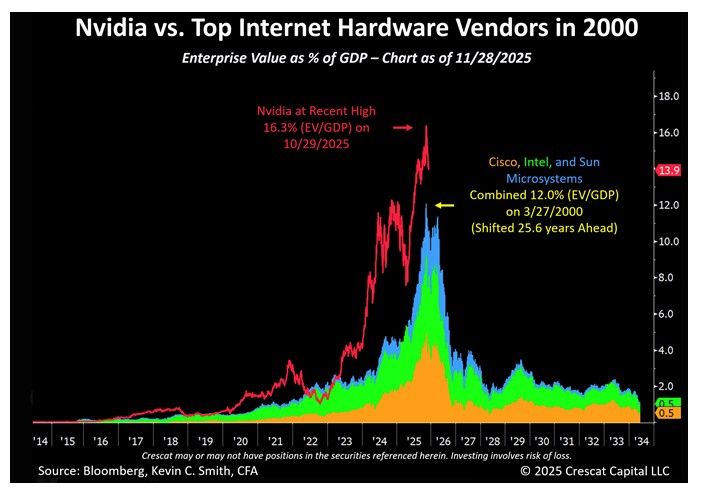

Great chart by Tavi Costa showing Mega-caps hardware stocks Entreprise Value as a % of GDP - 2000 vs. today...

We think Nvidia has a different profile. Still, this is a scary one...

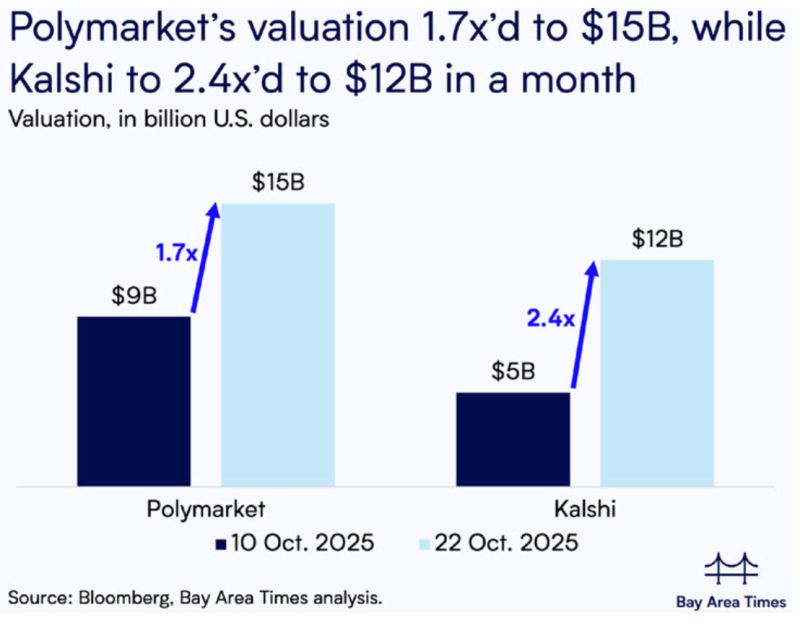

Kalshi and Polymarkets are among the pre-IPOs superstars right now...

Source: Bloomberg, Bay Area times, RBC

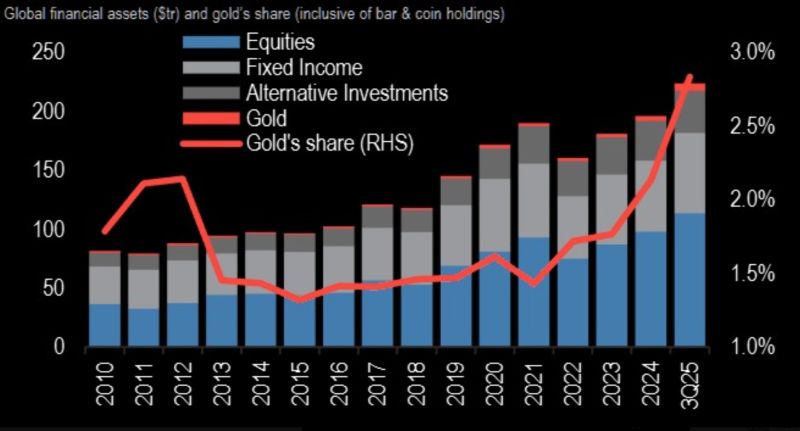

Gold is only 2.8% of investor AUM... imagine 4–5%.

Source: The Market Ear

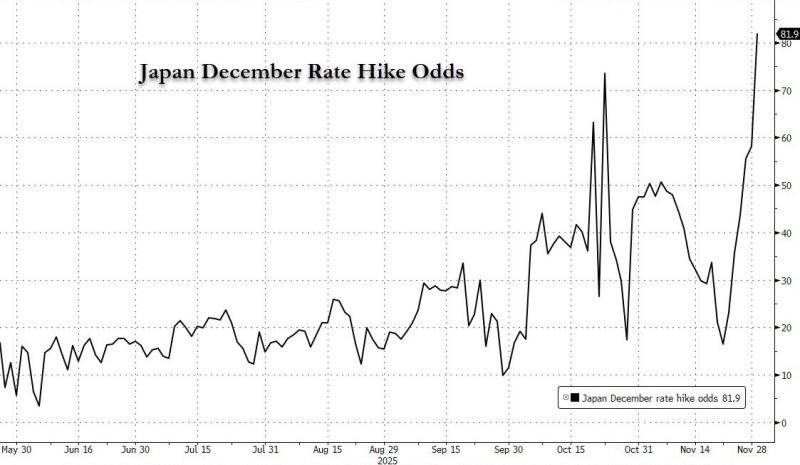

Central banks have completely messed up market messaging.

First Fed's schziophrenic communications sent Dec rate cut odds from 80% to 30% to 100%, and now the BOJ just send Dec rate hike odds to 80% from 20% ten days ago! Source: zerohedge

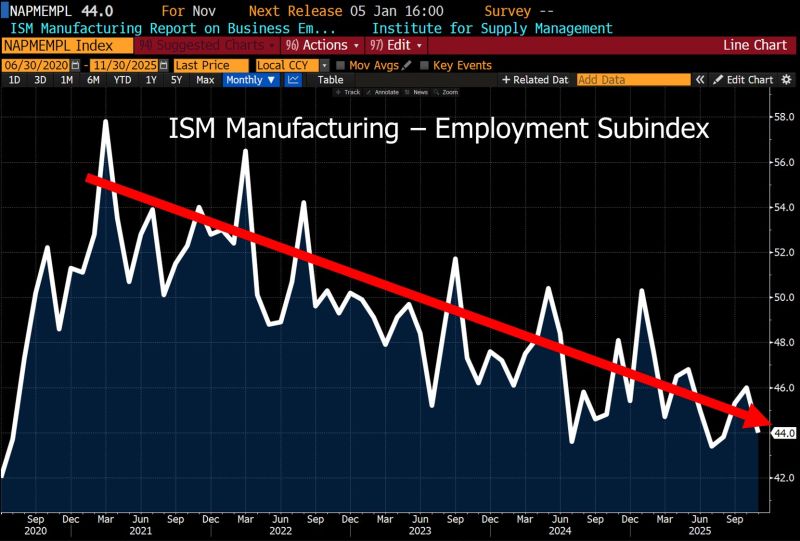

This might force the hand of the Fed...

Powell may have floated the idea of a pause, but the cooling U.S. labor market tells a different story — and it’s opening the door to lower policy rates. Here’s the twist: Inflation is holding around 3.0%, dipped to 2.3%, and is averaging 2.7% for the year. GDP? Still strong. Demographics? Warping the job market. And yet… rate cuts are coming. Why? Because the other half of the Fed’s mandate is screaming for it. Lower rates conveniently support: Debt sustainability Financial-sector stability Liquidity across the system Central banks want lower rates — and their messaging shows it. That’s why we’re hearing nonstop about financial-sector risks, bond-market volatility, and liquidity needs… and far less about headline inflation.

Investing with intelligence

Our latest research, commentary and market outlooks