Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Gold is on pace for its best year since 1979, up over 60% in 2025.

Source: Charlie Bilello

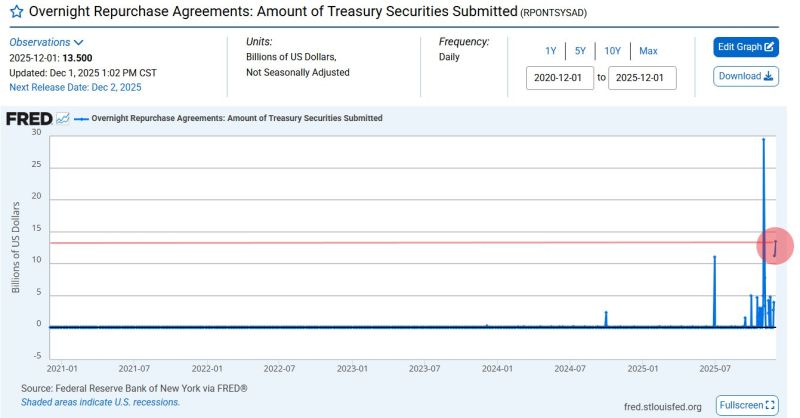

Fed Reserve just pumped $13.5 Billion into the U.S. Banking System through overnight repos.

This is the 2nd largest liquidity injection since Covid and surpasses even the peak of the Dot Com Bubble Source. Barchart

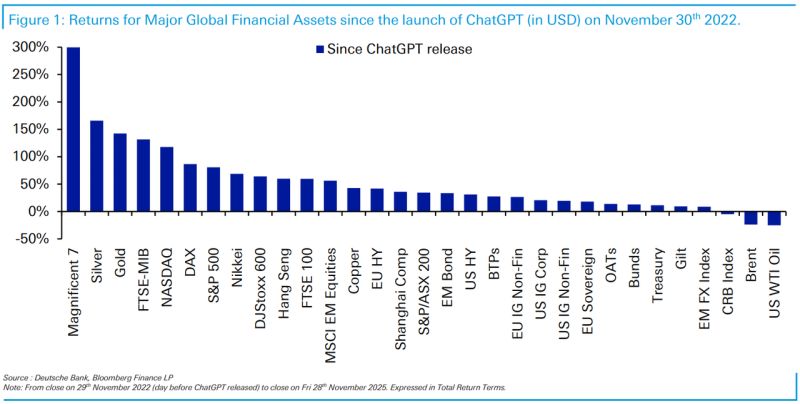

🔥 Three Years Since The Launch Of ChatGPT, Here Are The Biggest Winners And Losers 🔥

To celebrate ChatGPT’s 3-year anniversary, Deutsche Bank kicked off “AI Week” — using AI to build every Chart of the Day. And the first set of charts tells an incredible story: 🚀 Winners: The Magnificent 7 didn’t just outperform… they rewrote market history. Nvidia: +1,020% Broadcom: +712% Western Digital: +500% Meta: +499% The Mag-7 as a group? ~+300% since late 2022. Stunning. 💥 Losers: Market darlings turned disasters: First Republic – gone SVB – collapsed Moderna – -85% from 2022, -95% from peak Pfizer? Now trading back at 1998 levels and -60% from its highs, despite 3× the earnings it had in 2000. 💡 The Lesson: In just three years, AI exploded, market leadership flipped, and the biggest winners and losers were almost impossible to predict in real time. Nothing in markets is permanent — not hype, not dominance, not even “blue-chip safety.” A perfect way to kick off AI Week. Source: DB, zerohedge

Japan 10 year - US 10 year: the big crocodile jaw

Japan might have to use yield curve control again to save its bond market Source chart: The Market Ear

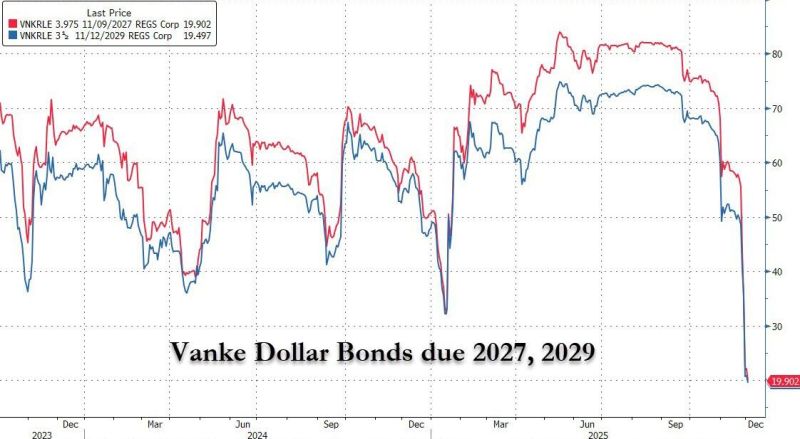

🔥 China’s Latest Property Shock: Vanke Just Broke the Last Illusion 🔥

Vanke, once viewed as China’s “safe” developer after Evergrande, just stunned markets. It’s asking for a 1-year delay on a ¥2B bond with zero upfront payment and even the interest pushed back a year. Creditors expected support. Instead, they got nothing. 📉 The fallout: ➡️ Bond crashed from near par to ¥27 ➡️USD notes collapsed to 20 cents ➡️Analysts warn this “shatters investor confidence” Vanke is now pledging core assets, being rejected for emergency loans, and facing warnings that its commitments are “unsustainable.” This isn’t one company’s problem — it’s the latest sign that China’s 5-year property downturn has no bottom. Home prices continue to fall, sales data is going missing, and global banks see years of decline ahead. And with China’s middle class holding most of its wealth in property, a deeper slump could be devastating. The crisis is no longer at the fringes. If Vanke is wobbling, the entire foundation is shaking. Source: zerohedge

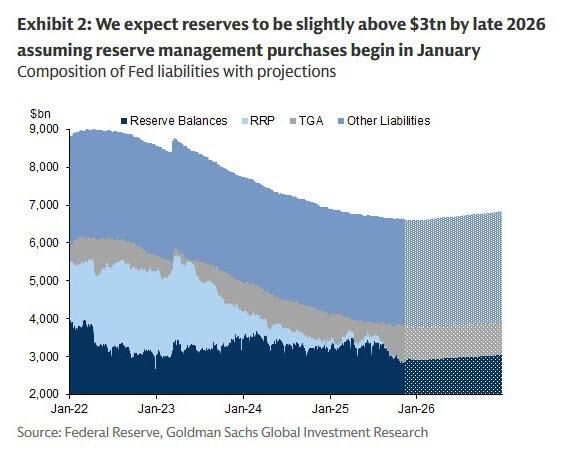

🔥 Big Shift Today: The Fed Just Ended QT - What This Means For Overall Liquidity according to Goldman 🔥

After months of draining liquidity and a one-month delay that tightened markets, the Fed’s quantitative tightening officially ends today. Here’s what Wall Street is watching: 💧 Reserves Are Scraping Bottom Fed reserves hit a low in October, but should end 2025 around $2.9T - still uncomfortably close to “not enough.” Repo markets have already shown stress, with Standing Repo Facility usage hitting its 2nd-highest level since COVID. 🏦 Goldman’s Call: QT Ends, Balance Sheet Growth Returns Fast Goldman expects the Fed to start buying ~$20B/month in T-bills starting Jan 2026, plus reinvesting MBS runoff - together adding ~$40B/month back into the system. Reserves could climb back above $3T by late 2026. 💣 Why the Pivot? Liquidity Is Too Tight Repo rates (TGCR, SOFR) are trading well above where they “should” be. Funding markets keep flashing red. The Fed is quietly preparing to reflood the pipes. 📈 Treasury Supply Stays Heavy - But the Fed Becomes a Buyer Again With massive deficits ahead, Treasury issuance remains huge. But thanks to the shift in policy: Fed is expected to absorb ~$480B of next year’s T-bill issuance Non-Fed buyers only take ~$390B — the lowest since 2023 🍃 But There’s a Catch… The Fed will let $2T of MBS roll off, pushing a wave of mortgage-backed supply into markets. That means: ➡️ More pressure on housing and mortgage rates ➡️ A slow-motion shift from MBS → Treasuries in the system ⚠️ Bottom Line: QT ends today, but the liquidity story is far from over. Funding markets are strained, repo is volatile, MBS supply is surging - and the Fed may be forced to restart balance sheet expansion faster than anyone expected. The next big test? April tax season. If liquidity cracks again, the Fed’s “reserve management purchases” may turn into something much bigger. Source: Goldman Sachs, zerohedge

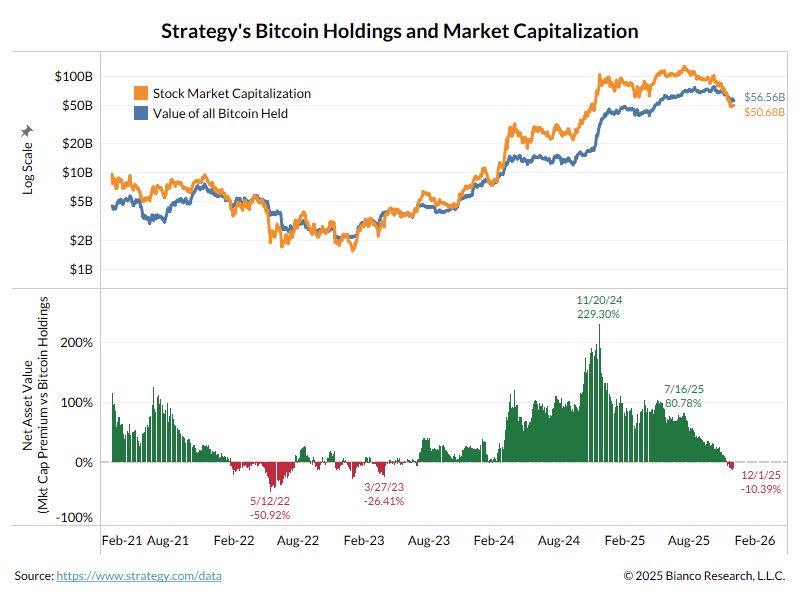

Stats about Strategy $MSTR's NAV by James Bianco Bianco Research L.L.C.:

* NEGATIVE (!) since Nov 12 * Lowest NAV since Mar 27, 2023 (SVB failure) * It reached -50.92% on May 12, 2022 (Terra/Luna collapse) * Consistently negative for 18 months (Jan 22 to Aug 23) The peak of 229% on November 20, 2024... this was the height of BTC excitement over Trump's win.

Investing with intelligence

Our latest research, commentary and market outlooks