Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

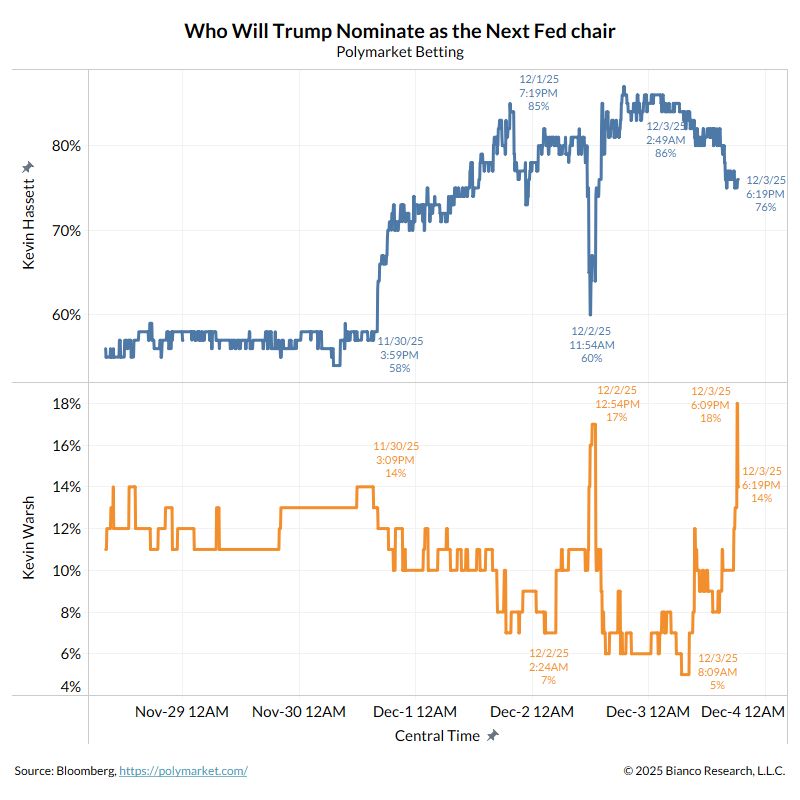

As shown by Jim Bianco on X, Hassett (blue) has been wildly gyrating the last 48 hours (85% to 60% to 86% to 76%).

Warsh (orange) has been trading inversely (7% to 17% to 5% to 18%). Source: Bianco Research

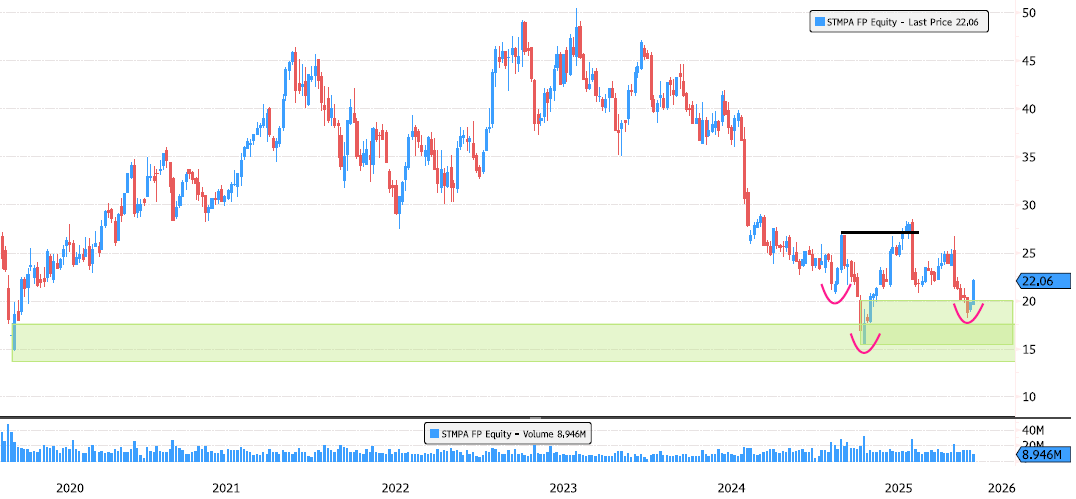

STMicroelectronics : low in place?

After a 69% consolidation from the July 2023 high, STMicroelectronics may finally be showing signs of a structural shift. - April rebound inside the key support zone 13.73–17.55 - Bullish breakout in July, opening the door to a potential trend reversal - Retest of swing support at 15.50–20.07, followed by a higher low formation - Structure improving, but confirmation still needed Keep an eye on volume — it could provide the next confirmation. Source: Bloomberg

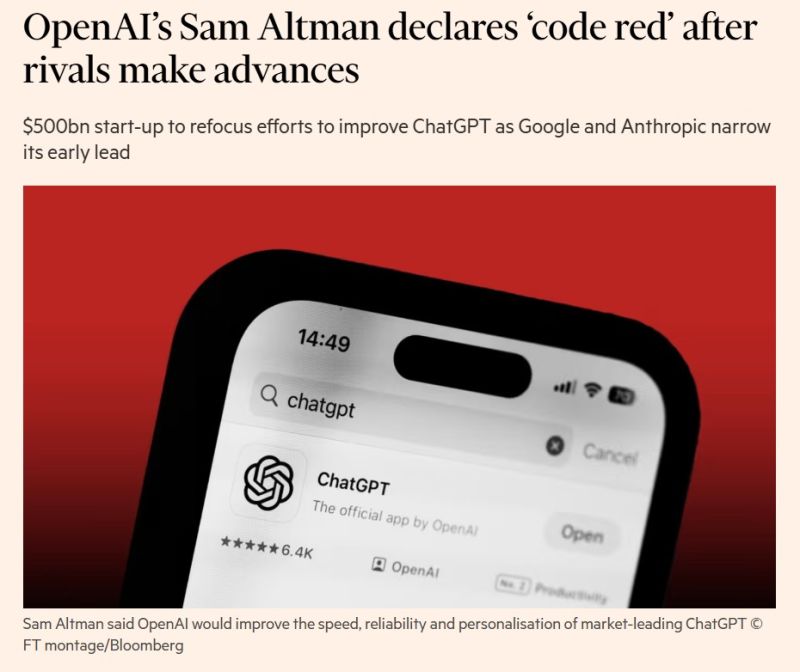

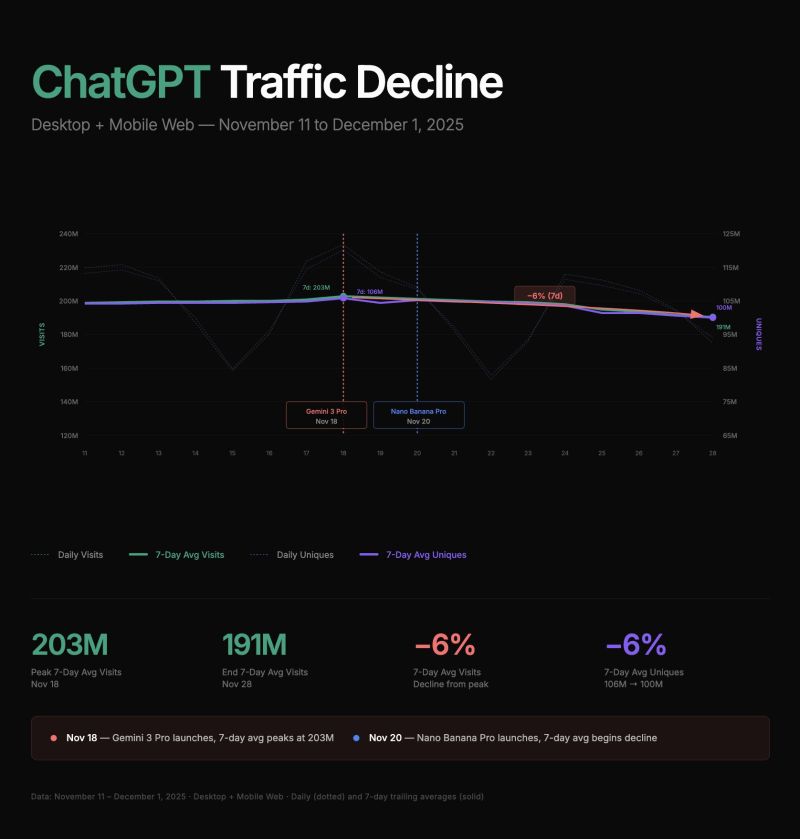

🚨 CODE RED at OpenAI! Sam Altman sounds the alarm! 🚨

The AI race just got a lot hotter, and the early leader is feeling the heat. 🔥 OpenAI CEO Sam Altman has declared a "code red" to completely refocus the company's efforts on its flagship product, ChatGPT. Here's the critical breakdown you need to know: The Threat: Rivals like Google (Gemini 3) and Anthropic (Opus 4.5) have recently leapfrogged OpenAI's GPT-5 on key industry benchmark tests. The lead is shrinking FAST. The Fix: A "surge" effort is underway to significantly improve speed, reliability, and personalization of ChatGPT. The Sacrifice: OpenAI is delaying other ambitious projects—like AI agents for shopping/health, advertising products, and personalized news (Pulse)—to dedicate resources to the core chatbot. The Stakes: This is a "critical time" for the $500bn start-up, grappling with intense competition, soaring data center costs, and the non-stop battle for top AI talent. Stats That Matter: ChatGPT still has a dominant market share with over 800 million weekly users. BUT, users are now spending more time chatting with Google's Gemini than with ChatGPT (per Similarweb data). ChatGPT already accounts for roughly 10% of global search activity and is growing quickly. The Bottom Line: The AI frontier is moving at warp speed. As Google integrates its powerful, bespoke-chip-trained Gemini 3 models immediately, OpenAI is forced to pause future innovations to defend its core product. The fight for the AI crown is officially on! Who do you think wins this high-stakes race? 👇 Source: FT

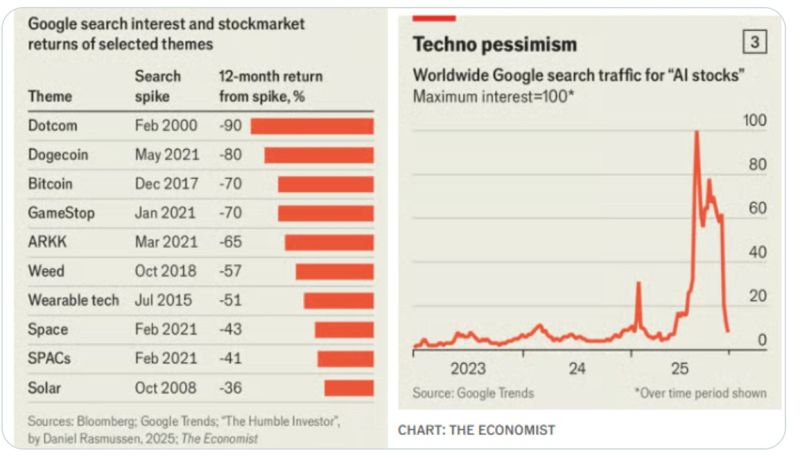

'How to spot a bubble bursting. Forget valuations. Look out for search-engine hits and fund managers getting fired.'

'Surges in Googling do a much better job than valuations at forecasting an imminent fall as the chart’s third column shows. In each case the price of the stock, basket, fund or cryptocurrency dropped considerably over the 12 months following the peak in internet searches.' 'Naturally, such observations do not constitute a rigorous study. There will have been many instances of internet traffic concerning popular investments spiking with no subsequent fall in prices. In fact, searches for 'AI stocks' hit their zenith in mid-August and their prices continued to rise serenely for weeks.' https://lnkd.in/epm6nUdP Source: MastersInvest.com, The Economist

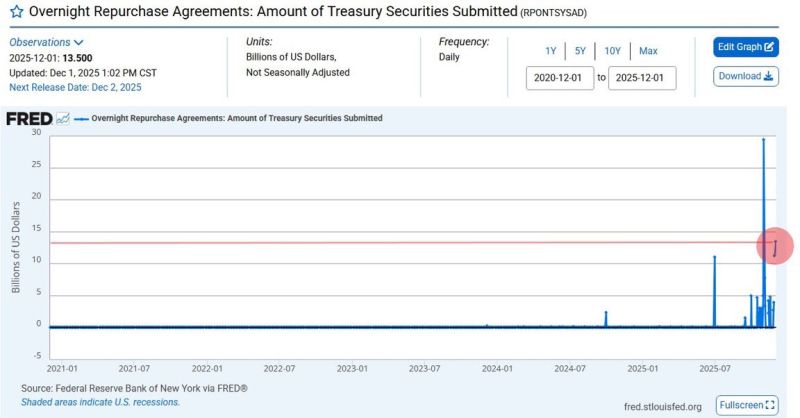

⚠️ The $13.5 Billion Fed Repo Operation: Ignore the Noise, Understand the Signal

The headlines are running wild, calling the massive overnight liquidity injection "The Biggest Since COVID!" and predicting the return of Quantitative Easing (QE). Here is the objective truth: ➡️ The Problem: Banks ran into simultaneous, acute, and unexpected shortfalls of overnight cash. This created an immediate, sharp spike in inter-bank borrowing rates (liquidity stress). ➡️ The Fed's Role: The Federal Reserve stepped in not as an asset purchaser (QE), but as the essential backstop. The $13.5B was a tactical operation to stabilize the overnight lending market and prevent a systemic spike in financing costs. ➡️ The Historical Precedent: This scenario is not a predictor of a new bull cycle. It happened in 2019 after Quantitative Tightening (QT) ended. It's a structural issue in the funding markets, not a macroeconomic pivot. 👉 Conclusion: This is not QE. This happened when QT ended in 2019 as well. This is a clear indication of financial plumbing stress. Treat it as a warning light within the system, signaling potential underlying friction. Source: FRED, Brett

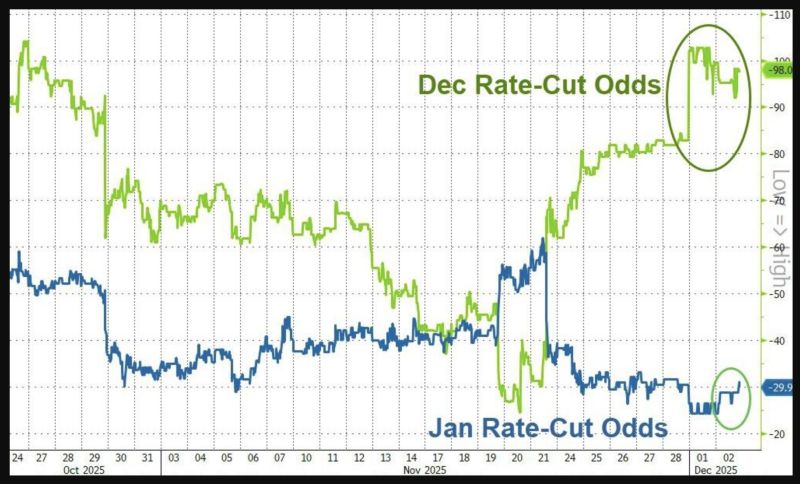

Rate-cut odds seem to indicate December meeting is a done deal.

But we also note that January odds are rising... Source: zerohedge

TRUMP: “I guess a potential Fed Chair is here too…I don’t know, are we allowed to say that? Thank you Kevin.”

It looks like the next Fed Chair will be Kevin Hasset, who is obviously very close to Donald Trump. At many occasions, Kevin Hassett has emphasized the need for lower interest rates to stimulate economic growth and criticize the Federal Reserve (Fed) for being too slow to ease monetary policy. Here are some of his key dovish sentiments: ➡️ Advocacy for Immediate Rate Cuts: Hassett told Fox News that he would be "cutting rates right now" if he were Fed chair. ➡️Call for Aggressive Easing: He advocates faster and deeper rate cuts than the current Fed leadership. ➡️Focus on Lower Borrowing Costs for Consumers: He has emphasized the importance of “cheaper car loans and easier access to mortgages,” framing lower rates as a tool to support middle-class financial health. ➡️Criticism of Current Policy as Too Restrictive: He has consistently argued that interest rates in the United States are too high and risk constraining investment, hiring, and household borrowing. He has warned that staying too restrictive for too long could undermine growth just as the economy is showing signs of cooling. ➡️Alignment with Presidential Preferences for Lower Rates: Hassett has publicly aligned himself with the view that interest rates in the United States are too high. He has also said Americans should expect the President to pick a chair who will help deliver lower borrowing costs.

Investing with intelligence

Our latest research, commentary and market outlooks