Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

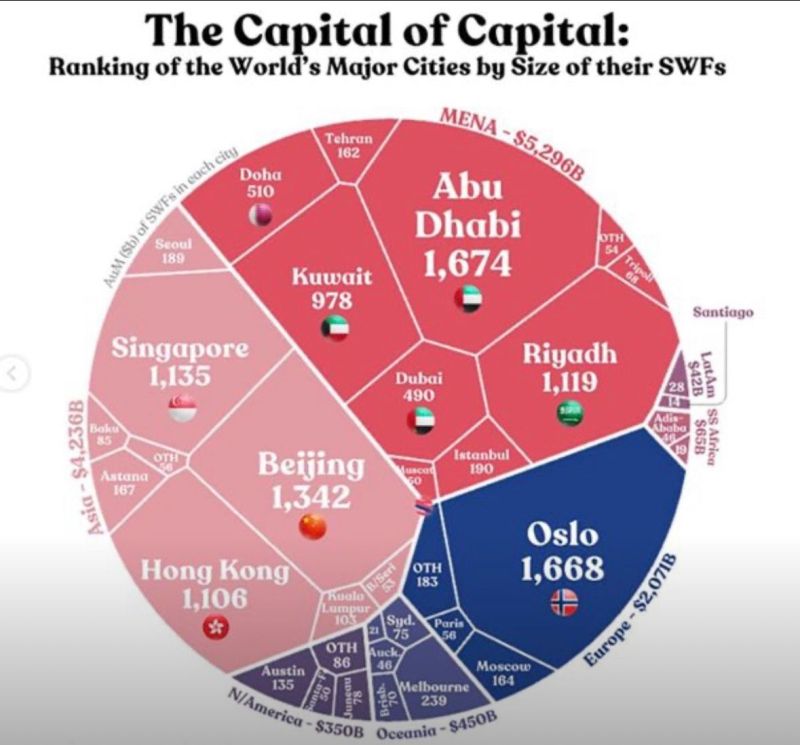

Abu Dhabi, the Capital of Capital: leading the World’s major Cities by the size of their SWFs.

Source: Najeh Awad, Visual Capitalistwolf

This is Warren Buffett's last full week as the CEO of Berkshire Hathaway

source : wolf

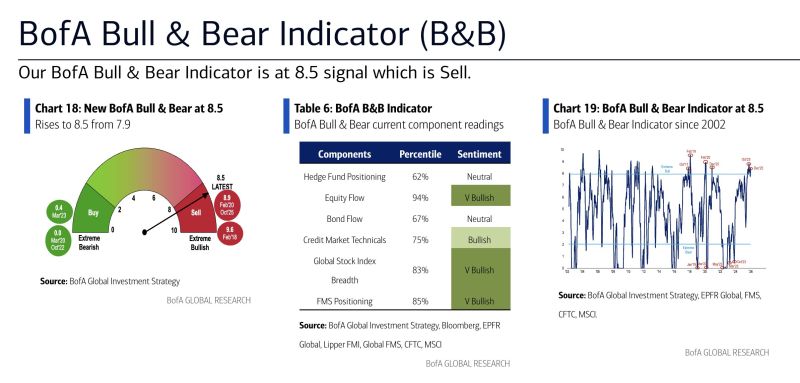

CONTRARIAN ALTERT >>>

BofA’s Bull & Bear indicator has moved into Extreme Bullish territory, rising to 8.5 from 7.9 and triggering a contrarian sell signal for risk assets. Readings above 8.0 have often preceded pullbacks, with global equities declining a median 2.7% over the following 2 months, with a 63% hit rate. Source; HolgerZ, BofA

Silver now outperforming Gold by the largest margin in almost 5 years and closing in on the greatest outperformance in more than a decade 🚨🚨

Source: Barchart

All major equity markets outperformed the US in 2025

Source: Goldman

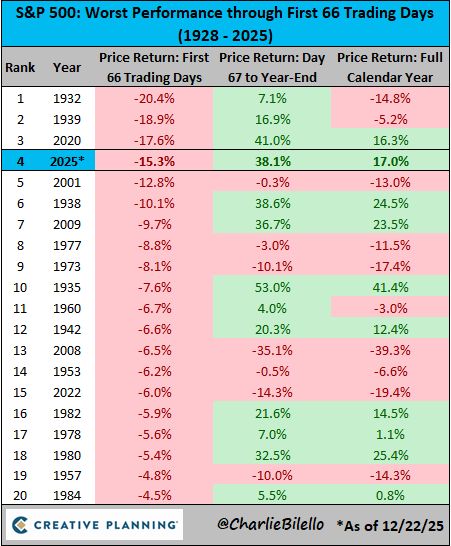

One of the greatest market comebacks in history

On April 8, the S&P 500 was down over 15% on the year, its 4th worst start to a year ever. But after a 38% rally, it's now up 17% on the year, hitting 37 all-time highs along the way. Source: Charlie Bilello

If you adjust the price of bitcoin for inflation using 2020 dollars, BTC never crossed $100k

Source: Alex Thorn @intangiblecoins

BREAKING: Gold trades above $4,500 for the first time in history.

Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks