Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

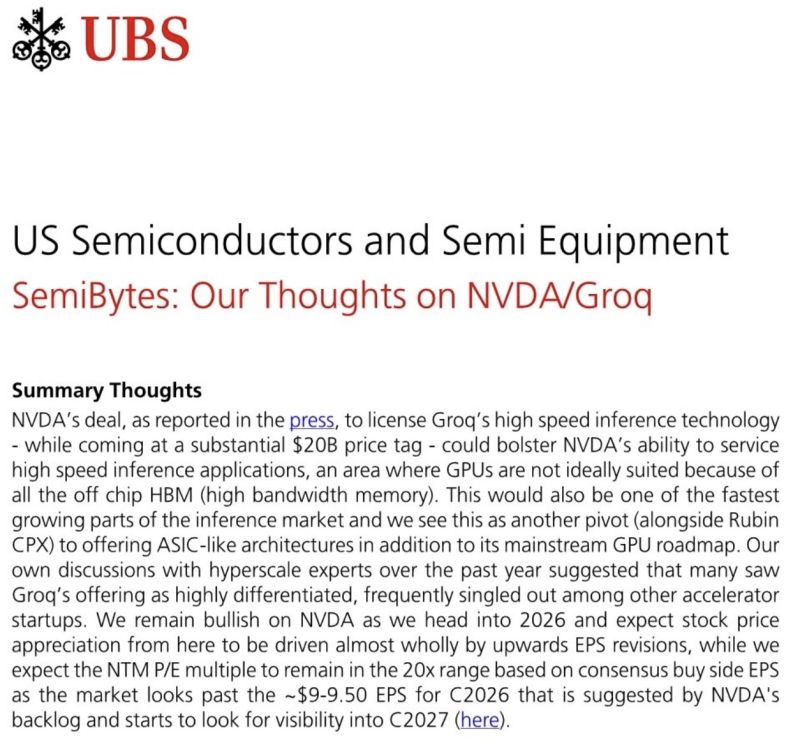

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

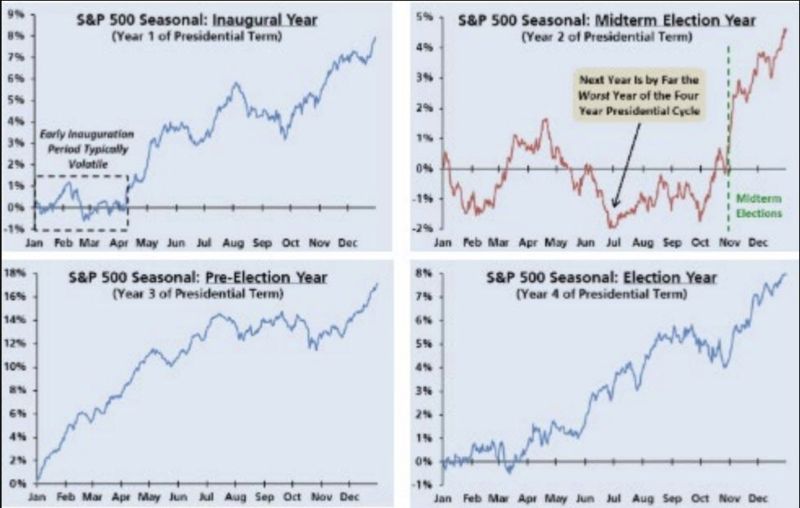

The midterm election year is without question the worst year in the four-year election cycle.

Source: Connor Bates

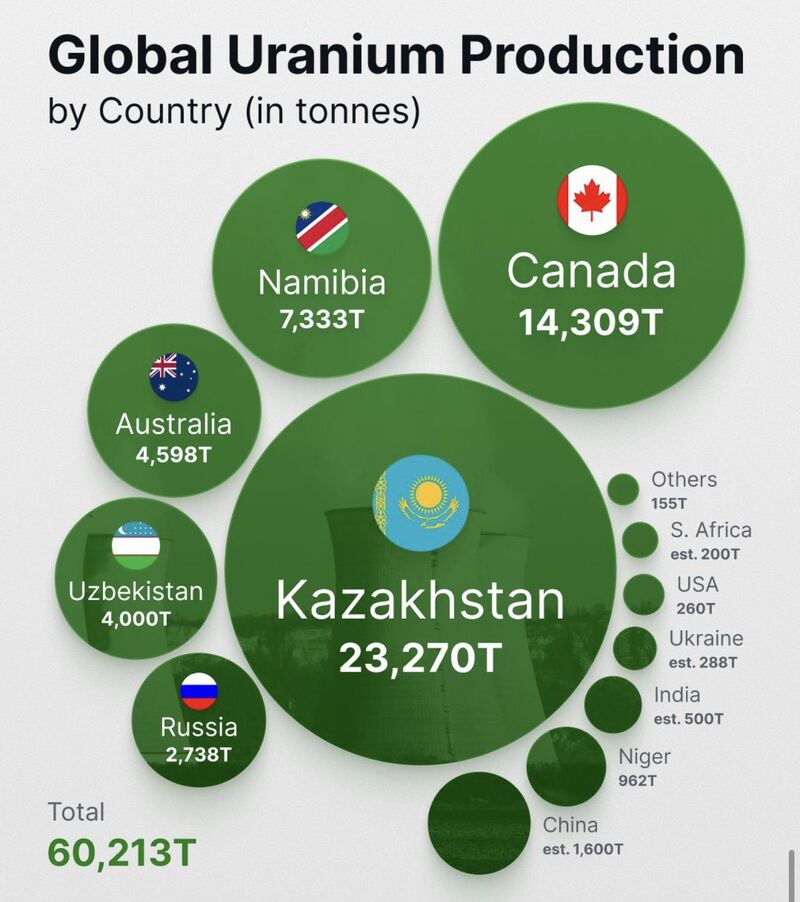

⚛️ THE "URANIUM SQUEEZE": DATA CENTERS VS. SUPPLY CHAINS.

If you think the energy transition is just about solar panels and wind turbines, you’re missing the biggest structural shift in the market right now. Uranium is no longer just a commodity. It is becoming a top-tier strategic asset. 🛡️ Here is why the "Nuclear Renaissance" is reaching a boiling point: 1️⃣ The AI Power Hunger 🤖 Large language models don't just need data; they need uninterrupted, carbon-free baseload power. * Tech giants (Amazon, Google, Microsoft) are pivotting to nuclear to power their massive AI data centers. Unlike renewables, nuclear provides the 24/7 "always-on" energy that AI requires to function. 2️⃣ Extreme Supply Concentration 🇰🇿 The global supply map is shockingly narrow. Kazakhstan dominates the market, producing ~40% of the world’s uranium. Canada and Namibia form the critical "second tier" for Western energy security. In a world of geopolitical tension, depending on a single region for 40% of your fuel is a massive risk. 3️⃣ The Looming Deficit 📉 The math doesn't add up. We are seeing record reactor restarts and new builds globally. Primary mine production is lagging behind actual reactor requirements. Secondary supplies (stockpiles) are thinning out fast. The Bottom Line: As we move toward a high-tech, low-carbon future, the demand for "reliable green power" is skyrocketing—but the "fuel" for that power is controlled by just a handful of players. In a tight, concentrated market, security of supply is the only thing that matters. Source: Jack Prandelli on X

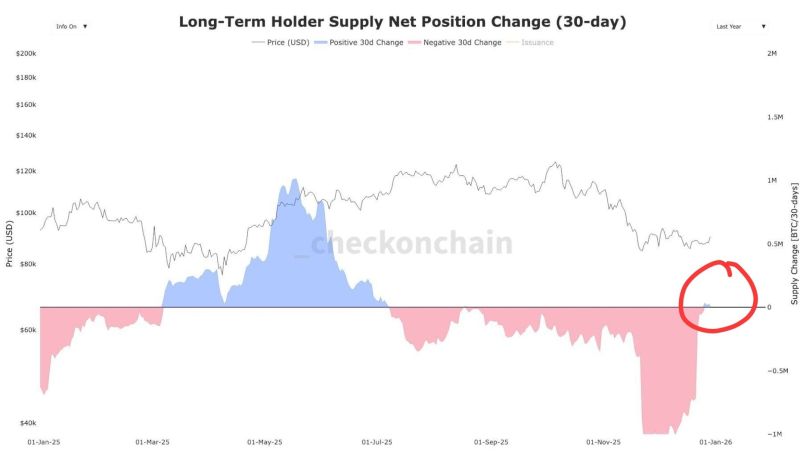

We got a pulse... Long term bitcoin holders have started accumulating

Source: MAGS 🔑⛏️🚒 @Crypto_Mags

New all-time high for $XOM!

The chart shows Exxon Mobil’s total return, including dividends This happened in a year where oil prices fell below $60, and Exxon Mobil raised its 2030 free cash flow targets by $35 billion Now imagine what happens if oil prices start rising again Source: Karel Mercx @KarelMercx

⚠️ Silver – Bearish Reversal Day Alert

Silver (XAG) is printing a bearish engulfing pattern today — one of the most reliable reversal signals in technical analysis. 📈 Context matters: The market has rallied more than +50% since the ~50 level last November. Price is trading in all-time high territory, where profit-taking and volatility often increase. 🧠 What this suggests: A consolidation would be healthy and logical at this stage. A 50% Fibonacci retracement of the recent leg points toward a potential target around 64.78. Such a move would help the market rebuild energy rather than signal a trend break. 🔎 Big picture: Long-term trend remains bullish. However, the market likely needs more fuel before attempting a sustainable continuation higher. ➡️ In short: stay cautious in the near term, respect the signal, and watch how price behaves during any pullback. Source: Bloomberg

Time to be contrarian on bitcoin?

Interesting comment by Gert van Lagen @GertvanLagen on X: $BTC / GOLD is hitting the purple downtrend on RSI for 5th time in history. 🟠Occurrences: + Bear market bottom 2011 + Bear market bottom 2015 + Bear market bottom 2018 + Bear market bottom 2022 + Bear market bottom 2025 ? Each time a higher low on BTC/GOLD was printed 🟠

Investing with intelligence

Our latest research, commentary and market outlooks