Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

When you see this chart, do you really want to go short Tesla ?

Source: J-C Parets, TrendLabs

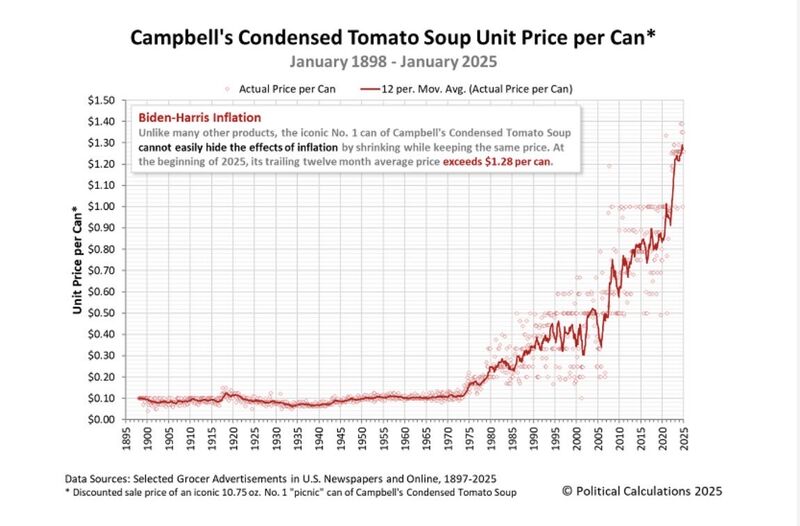

"One of the more straightforward ways to show debasement is via the price of Campbell’s tomato soup."

"Rather than relying on a complex set of estimates and substitutions, it’s just a history record of what the same can of soup cost over time.” Source: Lyn Alden thru The Long View @HayekAndKeynes

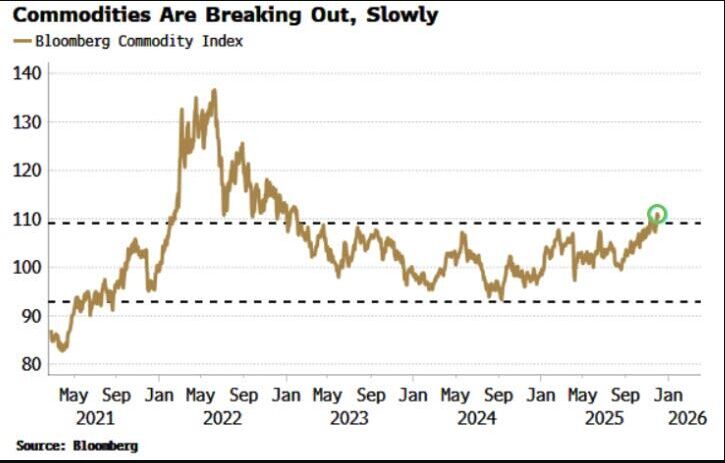

The Bloomberg Commodity Index is breaking out from a three-year range.

Source: Connor Bates @ConnorJBates_ Bloomberg

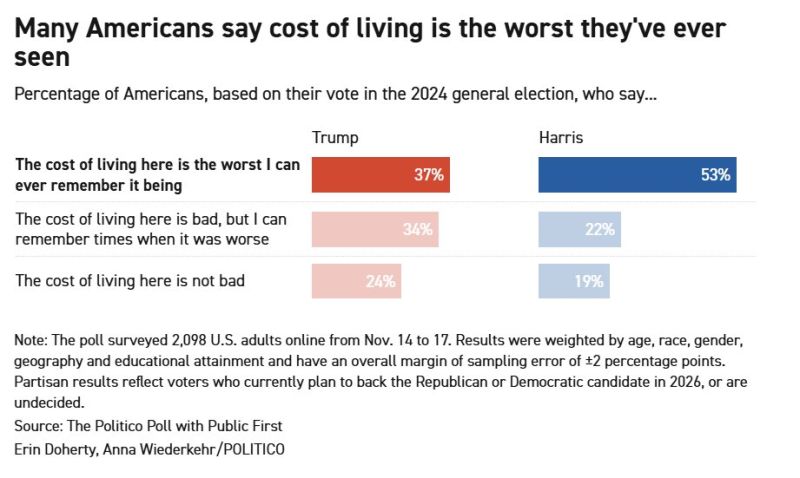

Politico released a poll yesterday with these alarming results:

Almost half — 46 percent — say the cost of living in the U.S. is the worst they can ever remember it being, a view held by 37 percent of 2024 Trump voters. Americans also say that the affordability crisis is Trump’s responsibility, with 46 percent saying it is his economy now and his administration is responsible for the costs they struggle with. Source: Bianco Research

Gold's long-term correlation with the S&P 500 has just reached an extremely high level, only seen in...August 2007.

Source: Guilherme Tavares i3 invest

Wall Street just dropped its 2026 stock market forecast... and they're expecting another year of double-digit gains for US equities! 🚀

The consensus among major investment banks surveyed by the FT sees the S&P 500 soaring past 7,500 by the end of 2026—a roughly 10% increase from current levels. What's fueling the bull market? 📌 The Triumvirate: Analysts at Morgan Stanley point to "easy fiscal, monetary and regulatory policy," including the estimated $129bn in corporate tax cuts from the Trump administration. 📌AI Tailwinds: The market believes it has shrugged off recent jitters over Big Tech valuations. Companies like Nvidia, the world's first $5T company, continue to power the index. 📌Rate Cuts: Investors are pricing in 3-4 quarter-point Fed rate cuts by the end of next year, boosting sentiment. The Great Debate: 🐂 Most Bullish (Deutsche Bank): Sees the S&P hitting a massive 8,000, betting on corporate earnings broadening out beyond tech. 🐻 Most Cautious (Bank of America): Forecasts just 7,100, warning that AI spending and data center build-out have yet to appear in better earnings. "For now investors are buying the dream." Note however that while such gains would mark the seventh year of double-digit gains in the past eight, they would represent a slowdown from the 16.6 per cent rise so far in 2025 and the average over the past decade - see chart below https://lnkd.in/eKYt6PK7 Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks