Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

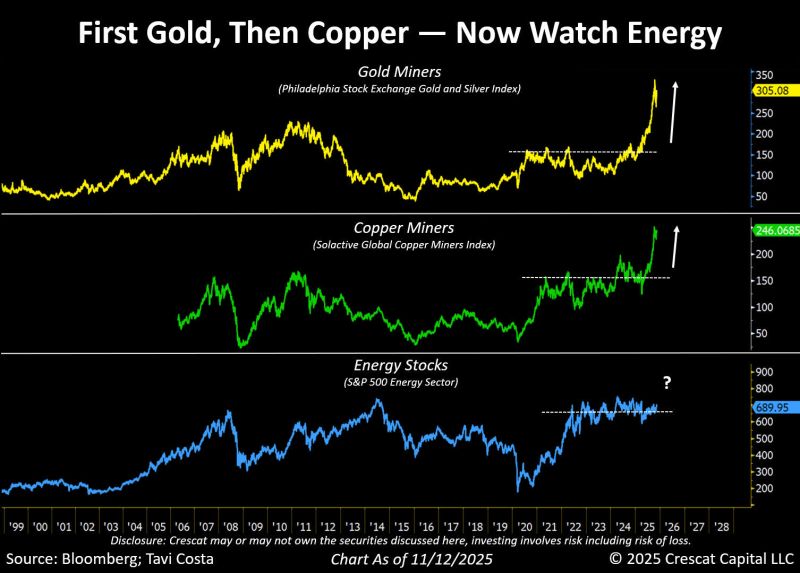

Otavio (Tavi) Costa just made a case for energy stocks, which have been quietly inching higher.

Here's his view: ▪️Positioning remains deeply bearish. ▪️U.S. oil and gas rigs are contracting meaningfully. ▪️Oil is trading near one of the cheapest levels in history relative to the money supply. ▪️Energy’s weight in the S&P 500 is hovering near record lows. He sees energy equities as one of the most fundamentally attractive corners of the market right now. Your thoughts? Source: Tavi Costa, Crescat Capital, Bloomberg

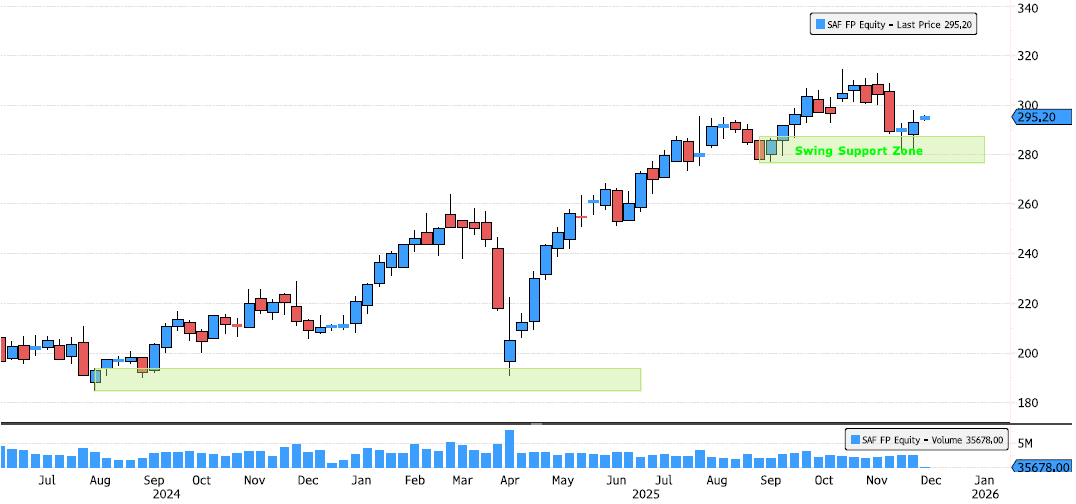

Safran Bouncing Off Swing Support Zone

Safran is showing early signs of strength after a healthy consolidation phase. After a 10%+ pullback since October, the stock is now rebounding off the 276–286 swing support zone. The long-term trend remains firmly bullish, with price action continuing to respect major higher-timeframe supports. Source : Bloomberg

🛑 WAKE UP CALL: Could the AI Trade trigger a 15-20% S&P 500 correction? (Goldman Sachs Analysis)

It's not about the current earnings—it's about the Capex future. And if that future changes, the market is in for a shock. Goldman Sachs just dropped a massive warning. The Core Risk: AI Spending Reversal They say that our current S&P 500 valuation is priced for an incredible, long-term AI Capex boom (spending on AI infrastructure). What if that boom stalls? If AI capex growth expectations revert to early 2023 levels, GS estimates the S&P 500 valuation multiple could see a 15-20% DOWNSIDE. That's a huge potential correction driven only by multiple compression. The Extreme Scenario (The Nightmare Fuel) -> Imagine the Hyperscalers slamming the brakes on spending. 🔴 The expected Capex for 2026 is approximately $433 billion. A reversion to the 2022 Capex level of $158 billion would result in a massive reduction of $275 billion—the "Lost Capex." 🔴This $275 billion shortfall represents a 30% reduction to the consensus estimate of $1 trillion in S&P 500 sales growth. Consequently, the expected S&P 500 revenue growth rate would drop sharply from the consensus of 6% to approximately 4%. ➡️ Ultimately, this decrease in spending would pose a substantial downside risk to both the AI investment trade and the broader S&P 500 market. The Takeaway for investors: This isn't about today's P&L. It's about the market's perception of tomorrow's AI-driven growth. A dramatic cut in capex would signal the long-term AI earnings thesis is broken, leading to a much steeper decline in stock valuations than a simple revenue reduction would suggest. 🔑 Don't miss this point: Near-term revenues might only drop modestly, but the hit to long-term earnings growth expectations will crush valuations. Source: Goldman Sachs, Neil Sethi @neilksethi

When you see this chart, do you really want to go short Tesla ?

Source: J-C Parets, TrendLabs

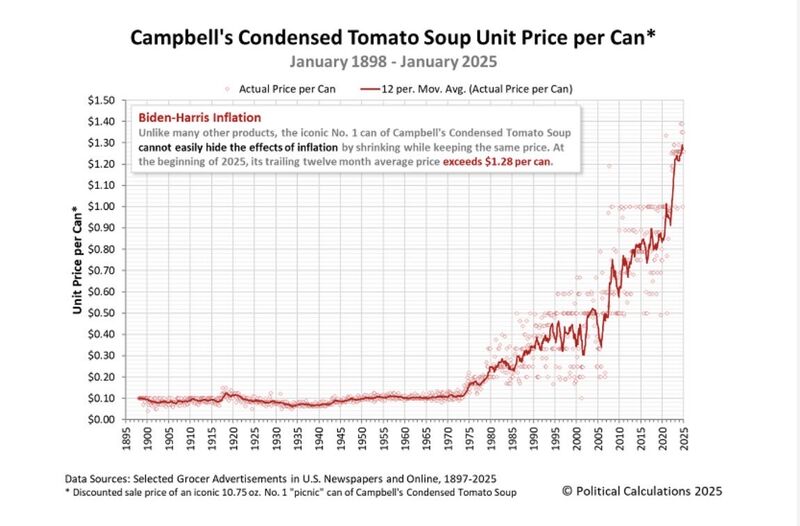

"One of the more straightforward ways to show debasement is via the price of Campbell’s tomato soup."

"Rather than relying on a complex set of estimates and substitutions, it’s just a history record of what the same can of soup cost over time.” Source: Lyn Alden thru The Long View @HayekAndKeynes

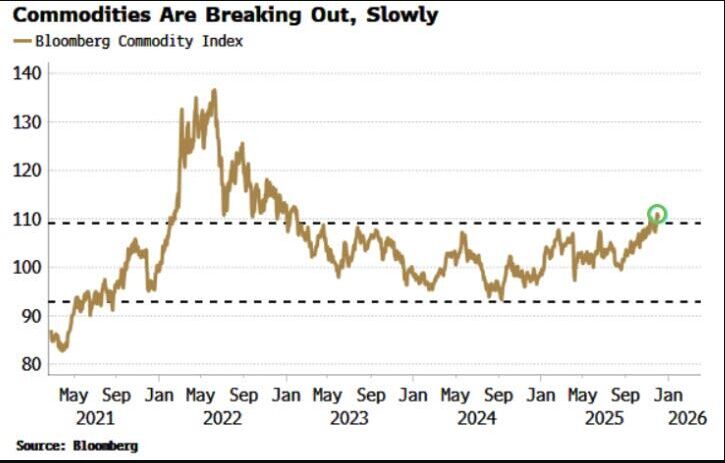

The Bloomberg Commodity Index is breaking out from a three-year range.

Source: Connor Bates @ConnorJBates_ Bloomberg

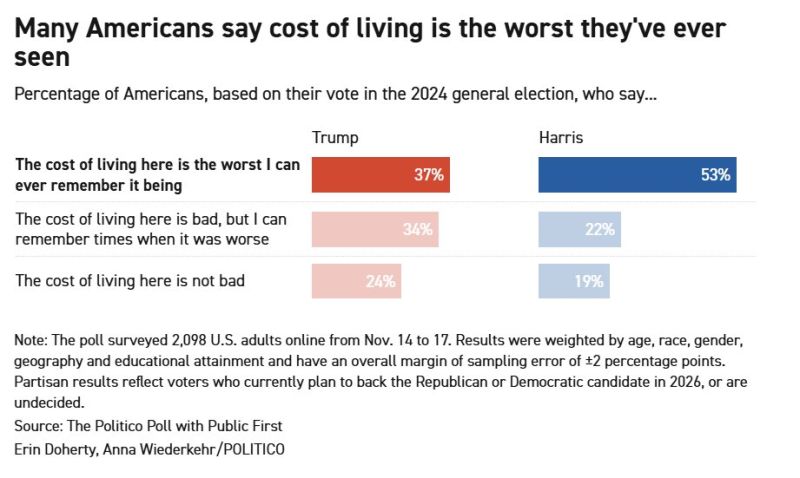

Politico released a poll yesterday with these alarming results:

Almost half — 46 percent — say the cost of living in the U.S. is the worst they can ever remember it being, a view held by 37 percent of 2024 Trump voters. Americans also say that the affordability crisis is Trump’s responsibility, with 46 percent saying it is his economy now and his administration is responsible for the costs they struggle with. Source: Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks