Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Uranium, $URA extends it’s rally, gaining +5% The bull market is broadening

Source: Hedgeye

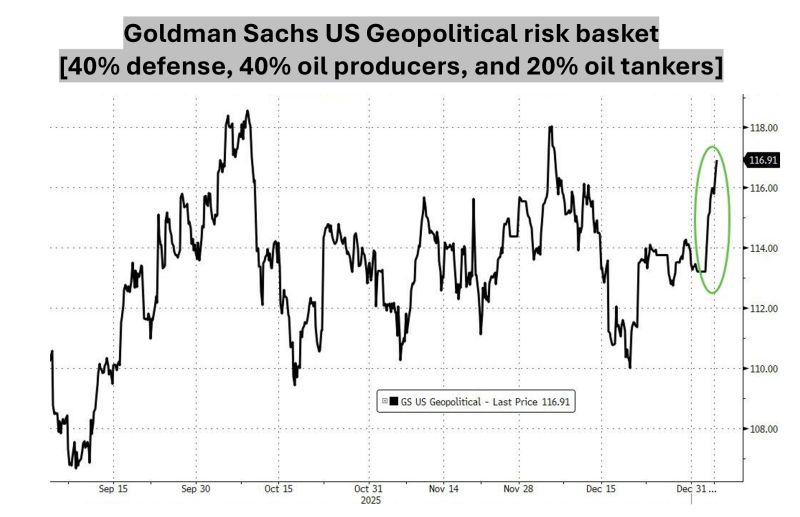

How to go long geopolitical risk...

Goldman's US Geopolitical Risk basket (composed of US-listed equities that are sensitive to geopolitical risk, diversified across 40% defense, 40% oil producers, and 20% oil tankers) has surged to start 2026... Source: zerohedge, Bloomberg

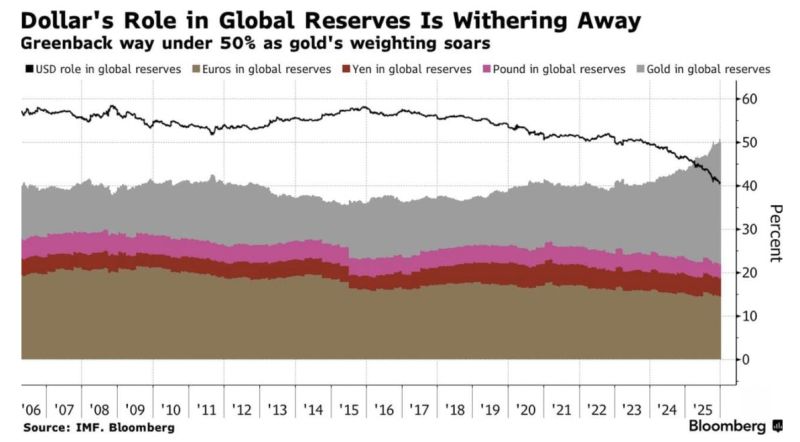

Gold has overtaken the U.S. Dollar as the largest Global Reserve Asset 🚨🚨🚨

(of course performance helped) Source: Barchart, Bloomberg

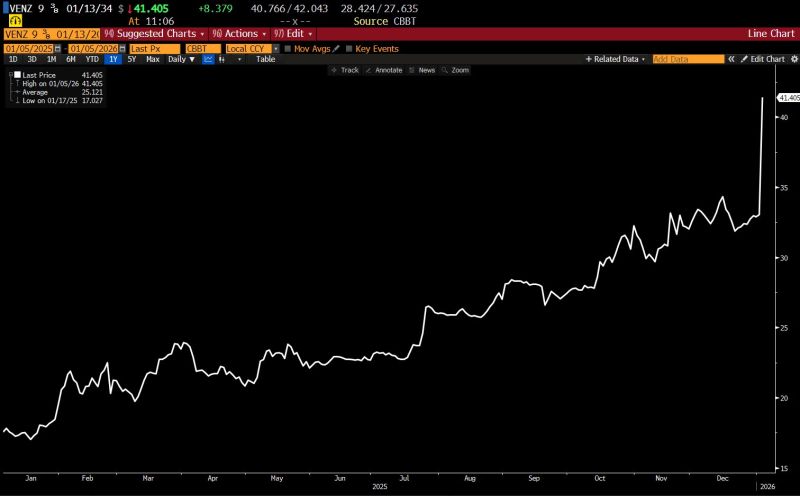

Bonds - not oil - were the play... Venezuela debt has doubled in the last 6 months.

Source: The Long View @HayekAndKeynes

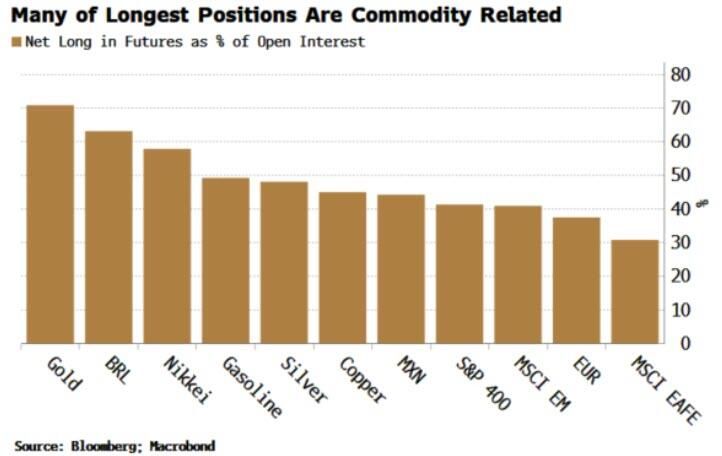

Speculators Are Moving Towards Commodities

Gold, gasoline, silver and copper have the largest net longs, along with emerging currencies related to resources, BRL and MXN. Chart below is in raw percentage terms, that is the net long position as a percentage of open interest. Source: zerohedge, Bloomberg, Macrobond

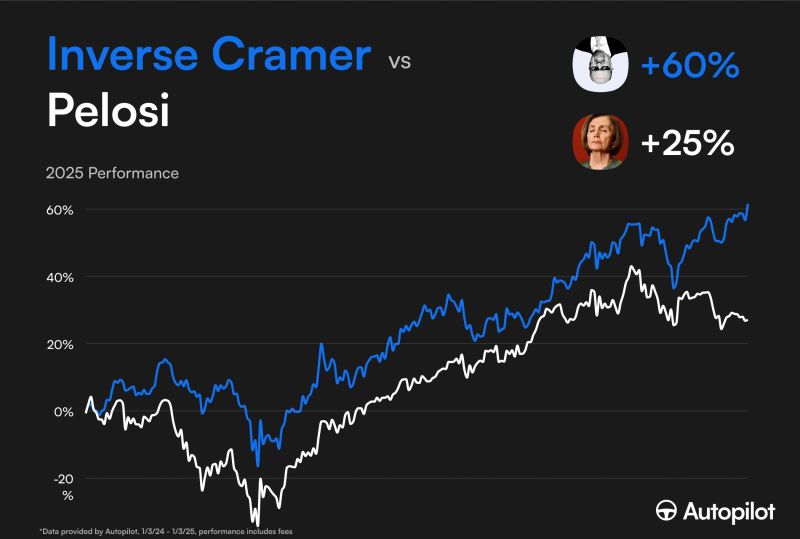

The Queen has been dethroned

Inverse Cramer officially beats out Pelosi for the top portfolio on Autopilot Source: Nancy Pelosi Stock Tracker ♟ @pelositracker

LME Copper surges to $13,000 for the first time to new record high

Source: www.investing.com

Investing with intelligence

Our latest research, commentary and market outlooks