Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Some inspiring thoughts by Ibrahim Majed on X And why this is not about Maduro. Not even about Venezuela. 🌎

We are witnessing the rollout of a global energy stranglehold. If you think the recent moves in South America are local politics, you’re missing the forest for the trees. This is a masterclass in Geopolitical Chess, and the target is much bigger. Here is why Venezuela is the "Patient Zero" for a new era of American dominance: 🔴 1. Cutting China’s Lifelines By taking control of Venezuela’s oil and aligning Nigeria under Western oversight, Washington is effectively pulling the plug on China’s access to cheap, reliable energy. Control the supply + control the transit = control the rival. 🚢 2. The Chokepoint Strategy Look at the map. From the Bab al-Mandab (Somaliland/Yemen) to the Strait of Hormuz, the U.S. is positioning itself to insulate its own economy while leaving China’s economy vulnerable to any disruption. 🛡️ 3. Neutralizing the Iran Factor Securing the world’s largest oil reserves in Venezuela provides a massive "buffer." If the Persian Gulf goes dark in a conflict with Iran, the U.S. won't flinch. Venezuela becomes the ultimate insurance policy, making military escalation in the Middle East "affordable." 💵 4. Defending the Petrodollar This is about ensuring the U.S. Dollar remains the undisputed king of energy markets. By restructuring sovereign states to align with U.S. interests, Washington is reinforcing the financial plumbing of the global economy. The Bottom Line: Venezuela is a strategic precedent. If this succeeds, it’s a blueprint for reasserting dominance over trade routes and energy flows for the next 50 years. But there’s a massive "IF." If the U.S. gets bogged down in a prolonged crisis in Caracas, it drains the very capital needed to project power in the Middle East and Asia. Is this a brilliant strategic realignment, or a high-stakes gamble that could overextend American power?

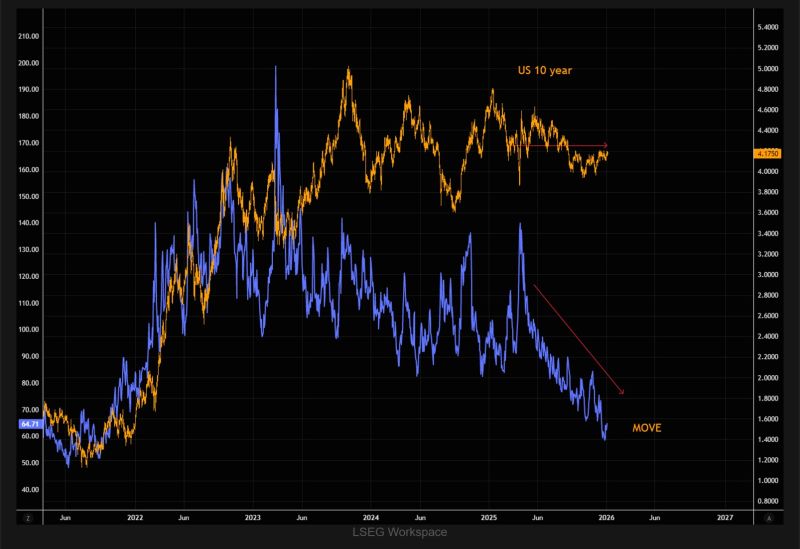

The great vol reset

We’ve seen a massive reset in bond volatility since the Liberation Day chaos. US Treasuries yields have gone nowhere, but at these levels owning some bond volatility offers limited downside with asymmetric upside. Source: The Market Ear, LSEG

We aren't just talking about trade embargoes or "backdoor deals" anymore. We are talking about a direct naval showdown on the high seas. 🌊⚓️

Here is the situation: The U.S. is moving to seize the Marinera, a Russian-flagged tanker carrying sanctioned Venezuelan oil. Russia’s response? They deployed a submarine to escort it. 🇷🇺🇻🇪🇺🇸 The Breakdown: -> The Move: The U.S. is enforcing sanctions with physical force. -> The Counter: Moscow is signaling they will use military hardware to protect their assets. ->The Global Ripple: China is watching closely. 🇨🇳 Why this matters: This isn't just about oil prices. It’s about the shift from Economic Diplomacy to Kinetic Confrontation. If the U.S. succeeds, American sanctions become the ultimate global law. If Russia blocks them, the era of U.S. naval dominance faces its biggest test in decades. Source: Mario Nawfal on X, Reuters, @sentdefender, WSJ

Financial conditions keep loosening as investors get excited about the potential for both fiscal and monetary stimulus this year.

Yields on junk bonds have fallen to the lowest since 2022, despite bankruptcies starting to creep higher. Source: Bloomberg, Lisa Abramowicz @lisaabramowicz1

In case you missed it... In Germany, inflation slowed more than expected at the end of last year.

Consumer prices rose 1.8% in Dec YoY, below the 2.1% forecast. The slowdown was driven mainly by falling energy prices and a sharp easing in food inflation, which dropped to just 0.8%. Core inflation also declined to 2.4%, although service inflation remains stubbornly high at 3.5%. Source: HolgerZ, Bloomberg

Saudi Arabia has removed all restrictions for foreigners to buy local stocks.

The decision allows non-residents to invest directly in the main market effective Feb. 1.

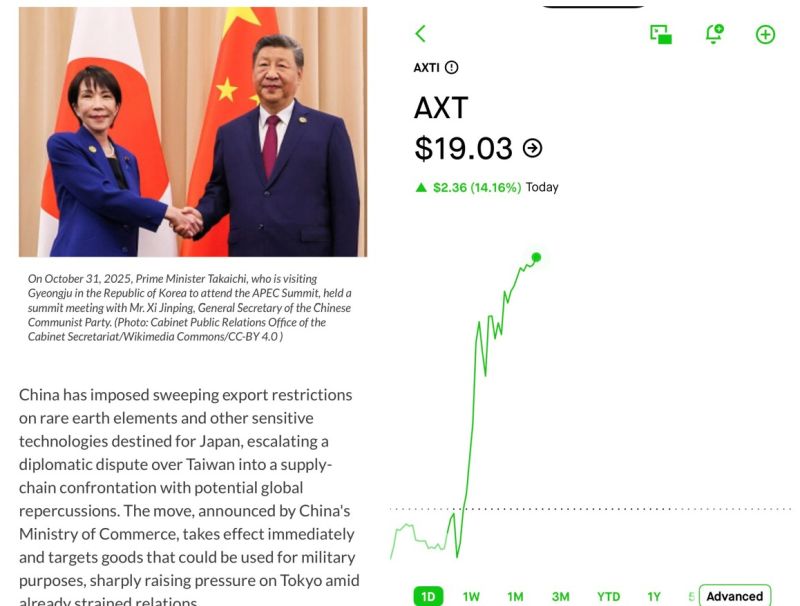

Nvidia CEO said yesterday that the “Memory Bottleneck is Severe”

SK Hynix ($330B) $MU ($355B) Samsung ($595B). Wait and see the look on everyone’s face when they find out the entire AI buildout will be bottlenecked by the tiny $AXTI ($1B) after the China’s new export controls. Source: Serenity @aleabitoreddit

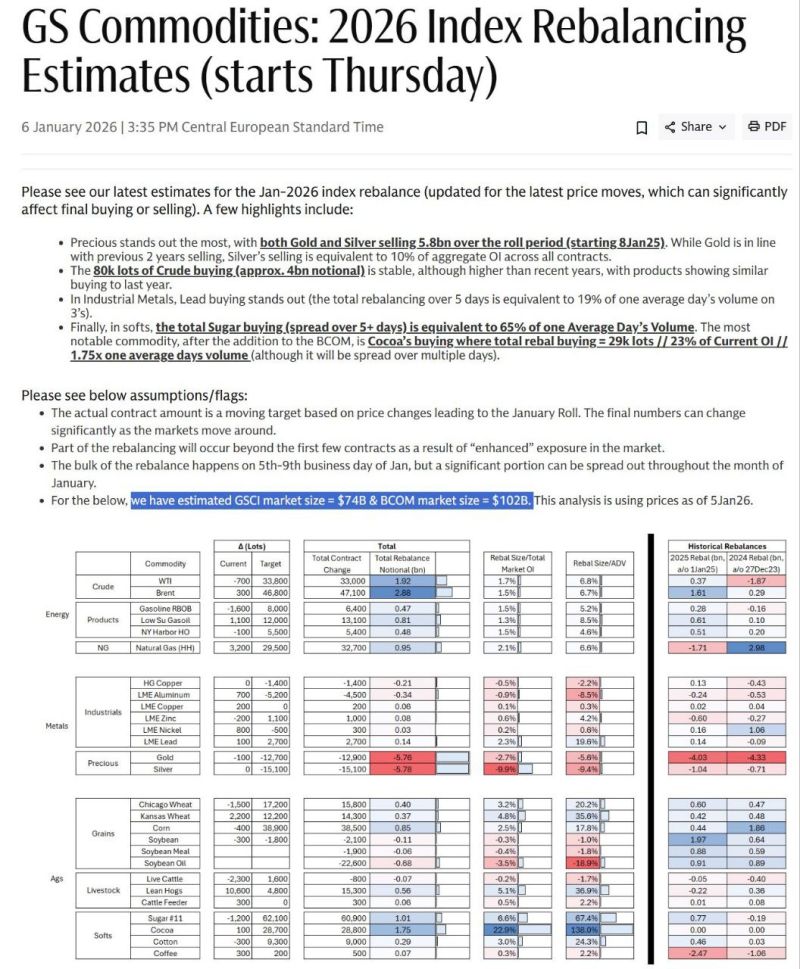

As highlighted by Lia the Trader @Liathetrader on X BEWARE $SILVER holders ‼️

The 2026 commodity index rebalancing (BCOM & GSCI) kicks off this week, forcing big adjustments in holdings. Precious metals stand out with massive estimated outflows—over $6.8B in gold and $6.8B in silver selling pressure. Silver's weight in BCOM drops sharply from ~9.6% to ~1.45%, triggering passive funds to dump futures. This could create short-term downward pressure on silver prices starting Thursday (Jan 8-14 roll period). Silver is trading around $78/oz today after huge 2025 gains (~150%), making it a prime rebalancing target. Expect volatility—analysts warn of potential dips, but fundamentals (industrial demand, deficits) remain bullish long-term.

Investing with intelligence

Our latest research, commentary and market outlooks