Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

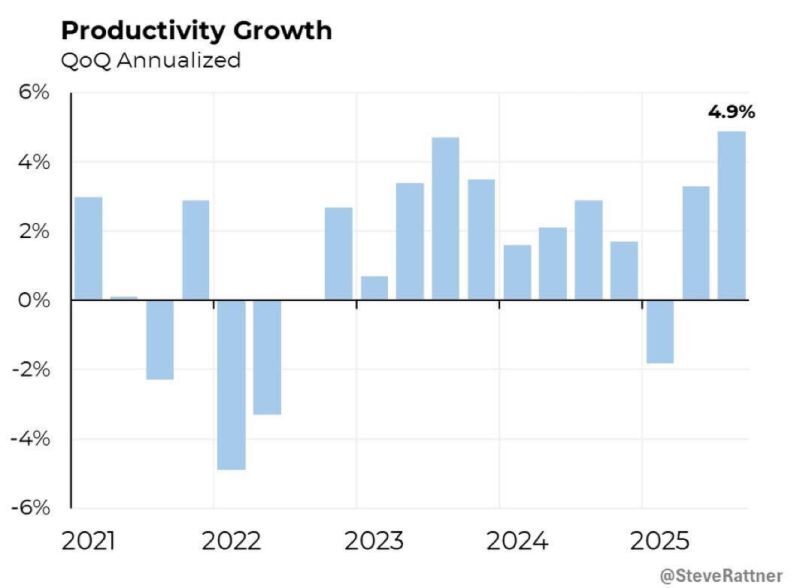

Is this the Goldilocks economy? 📈

US Bureau of Labor Statistics (BLS) released yesterday preliminary Productivity and Costs data for Q3 2025 (July-September) and it’s a masterclass in efficiency. U.S. productivity just surged +4.9%—the strongest reading we’ve seen in nearly 6 years. The number is sharply above 3.3% consensus expectation, and higher than the previous 4.2% (revised up for Q2). But here is the real kicker: While output is soaring, labor costs actually fell -1.9%. In the world of economics, this is the Holy Grail. 🏆 The breakdown: Productivity: Jumped from ~3.3% ➡️ 4.9% Labor Costs: Flipped from +1% ➡️ -1.9% Indeed, Hourly compensation increased with figures varying around +4-5%. But Unit labor costs (compensation adjusted for productivity gains) declined or rose modestly, reflecting that productivity growth outpaced wage gains. Why does this matter to you? It means we are seeing massive growth without the inflationary "tax." This indicates accelerating economic efficiency, often driven by technology, innovation, or better processes. This is probably why the Atlanta Fed just hiked its Q4 GDP forecast to a staggering +5.4%. The Productivity and Costs report measures how efficiently the economy produces goods and services. This robust productivity growth is positive for the economy, as it helps contain wage-driven inflationary pressures and supports potential Fed rate cuts without overheating. This is bullish for markets, the economy, and risk assets. Source: Quantus Insights, Truflation

Is Trump launching his own QE? Buying MBS via Fannie and Freddie…

Source: Bloomberg, Geiger Capital

In case you missed it…

"German manufacturing orders for November surprised sharply to the upside, with the year-on-year figure rising +10.5%, versus expectations of +2.9%. Outside of the post-Covid rebound, this marks the strongest increase in almost 15 years. The data were boosted by large orders linked to government rearmament plans, but even stripping out such lumpy items, there has been a clear and gradual improvement in underlying momentum over recent months“ (Jim Reid, Deutsche Bank) Source: DB through Daniel D. Eckert @Tiefseher on X

President Trump says he is banning dividends and buybacks for Defense companies.

📉 $LMT | $RTX | $NOC | $GD Source: Trend Spider

President Trump announces steps to ban large institutional investors from buying single-family homes.

"People live in homes, not corporations." Blackstone shares are tumbling. Source: Brew markets

LARGEST FED FUND FUTURES TRADE IN HISTORY 🚨

A bond trader just made the largest fed fund futures bet in history. The trade was a total of 200,000 contracts for January which amounts to a total risk of $8 million per basis point move. Source: Barchart @Barchart Bloomberg

Is it an "invasion" if the US captures a world leader, but doesn't stay to occupy the land? 🌎

On Polymarket, $10.5M is currently hanging on the definition of a single word. The drama unfolding right now in the prediction markets is a masterclass in Risk, Regulation, and the "Information Edge." 🧵 Here’s what’s happening: 1. The "Maduro Capture" Controversy US Special Forces extracted Nicolás Maduro from Caracas. Polymarket bettors who bet "YES" on an invasion thought they had hit the jackpot. But Polymarket says: Not so fast. The platform is refusing to settle the "Invasion" contract, arguing that a military raid isn't an "offensive to establish control over territory." 2. The $400k "Mystery Trader" While the crowd fights over definitions, one anonymous account is laughing all the way to the bank. Account created: Dec 26. Bets placed: Days before the raid. Outcome: Turned $32k into $400,000 by betting on Maduro’s removal when the market gave it only a 7% chance. Coincidence? Or the ultimate "information edge"? 🕵️♂️ 3. The Trust Gap in DeFi This highlights the massive hurdle for prediction markets. When the "Source of Truth" is subjective, the house becomes the judge, jury, and executioner. As one user (Skinner) put it: "Words are being redefined at will." The Big Takeaway: Prediction markets are the future of price discovery, but they are currently the "Wild West." Without clear definitions and insider trading protections, "betting on the news" is a dangerous game. Congress is already moving to ban insider trading on these platforms. The days of the "Mystery Trader" might be numbered. Source: FT

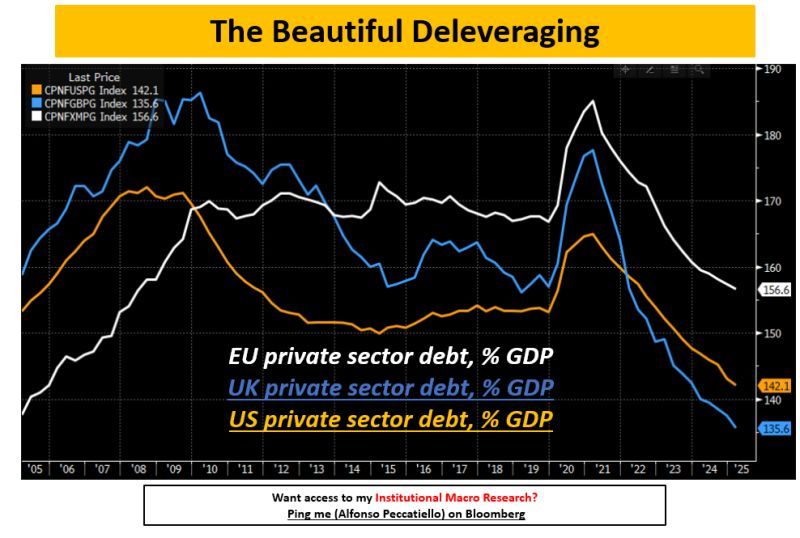

Stop worrying about the "debt mountain." You’re looking at the wrong mountain. 🏔️❌

High interest rates were supposed to "break" the economy by now. We all expected a collapse. So why are we still standing? It comes down to one massive shift that almost everyone is missing: The Great Private Sector De-leveraging. Here’s the breakdown: 1. Private Debt > Government Debt 🏦 Unlike the government, you and I can’t print money. If a household gets buried in debt, the pain is real and immediate. This is where economic "breaks" actually happen. 2. The 15-Year Cleanup 🧹 Since 2008, while we were focused on government deficits, the private sector (US, UK, EU) was quietly de-leveraging. Households and businesses have spent over a decade cleaning up their balance sheets. 3. The "Baton Pass" 🏃♂️💨 Governments took over the burden of money creation. Massive fiscal stimulus allowed the private sector to reduce its debt as a % of GDP. Essentially, the public sector took the hit so the private sector could heal. 4. The Result? Resilience. 💪 A lean private sector can handle 5% interest rates much better than an over-leveraged one. That’s why the "inevitable" crash hasn't arrived. The Big Question for 2026: How long can governments keep expanding deficits before they hit the wall of inflation and credibility? Can this "beautiful" de-leveraging continue forever? The baton has been passed... but is the runner running out of breath? 🏃♂️⛽ Source: Alfonso Peccatiello @ The Macro Compass - Institutional Macro

Investing with intelligence

Our latest research, commentary and market outlooks