Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A fascinating chart that shows how important social skills really are.

High social skills + High maths skills = holy grail Source: nxthompson @nxthompson, FT

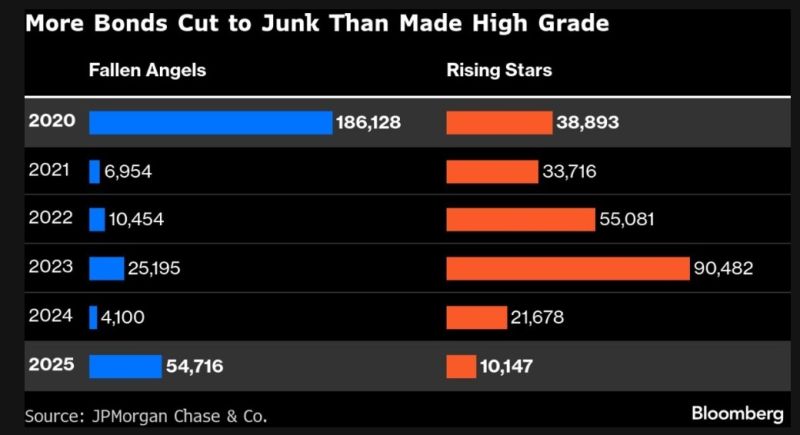

More Bonds Are Teetering on the Brink of Junk

JPMorgan doesn’t anticipate market turmoil anytime soon. Demand from investors is still strong, and earnings will probably be relatively strong in the coming weeks, leaving spreads relatively rangebound. But there are still risks in credit. About $55 billion of US corporate bonds migrated from investment-grade to junk status in 2025, becoming “fallen angels,” according to JPMorgan. That far exceeds last year’s $10 billion of “rising stars,” or firms elevated to high-grade. And the trend is set to continue, the strategists say. Source: Bloomberg, Tracy Shuchart (𝒞𝒽𝒾 ) @chigrl

Gold and Silver just hit a new all-time high as the US dollar weakened after Powell accused Trump of targeting the Fed.

Now the Fed’s independence is at risk, so investors are dumping dollar and buying metals for safety hedge. The precious metal bull run still shows no signs of stopping in 2026. Source: Bull Theory @BullTheoryio

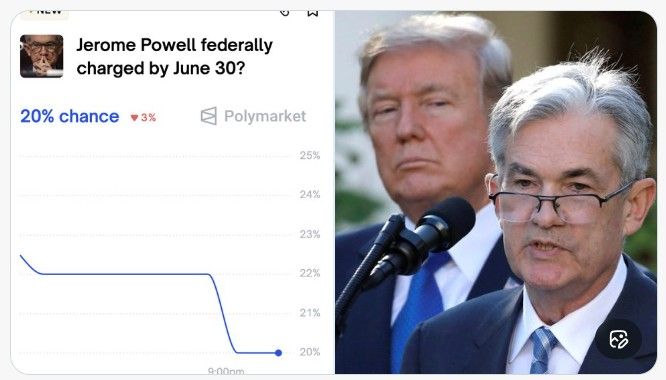

NEW POLYMARKET: JPow charged?

Will Trump follow through? Source : Polymarket

Powell has the highest approval rating of any “political leader” in the country.

Source: Joe Weisenthal @TheStalwart Gallup

Is the volatility index VIX set to spike?

Asset managers have aggressively increased their VIX futures shorts to the highest level since July 2024. In other words, funds are betting heavily on continued low stock market volatility. Such extreme short VIX positioning often leaves markets vulnerable to sharp volatility spikes if sentiment turns. A similar setup occurred in July-August 2024, when a sudden shift in risk appetite drove a nearly -10% market drop. Are we heading for a pullback? Source. Global Markets Investors

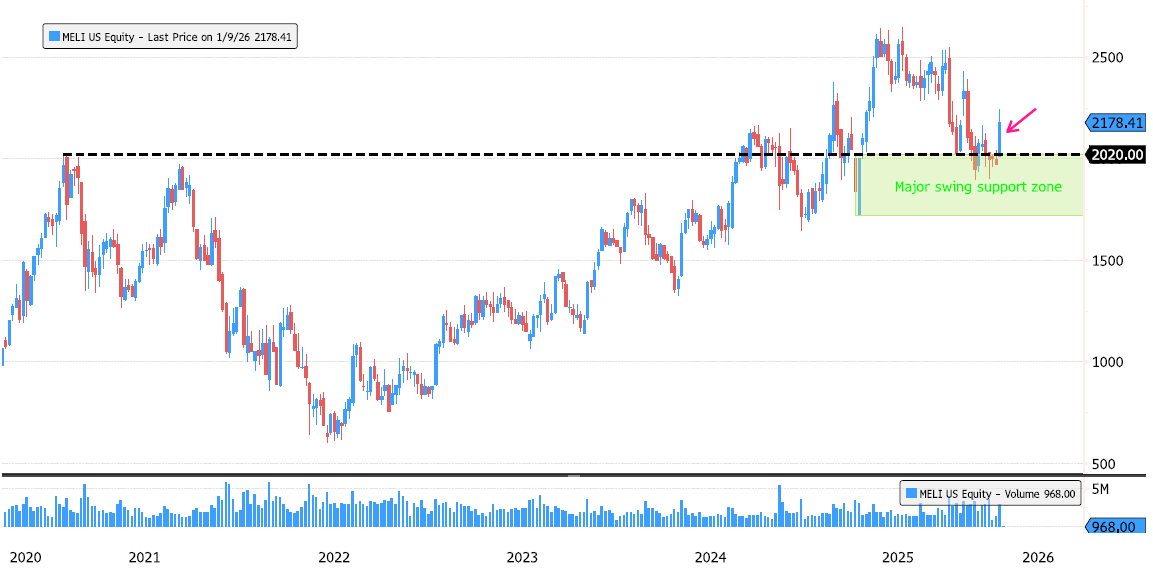

MercadoLibre bouncing off a major long-term level

After a +28% consolidation from the July 2025 highs, MercadoLibre (MELI US) is showing constructive technical signals. 🔹 Price has pulled back to the 78.6% Fibonacci retracement 🔹 A double bottom is forming on the last swing support zone 1,724 – 2,020 🔹 This area is technically critical: - Former 2021 highs - A 5-year consolidation zone - Strong historical demand level This confluence makes the current zone a key structural support, worth close monitoring for confirmation of a medium-term rebound.

A fascinating chart that shows how important social skills really are.

High social skills + High maths skills = holy grail Source: nxthompson @nxthompson, FT

Investing with intelligence

Our latest research, commentary and market outlooks