Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

U.S. Dollar Index $DXY heating up, now above 99 for the first time in 1 month

Source: Barchart

📢 No Supreme court ruling on tariffs today.

The Supreme Court just kept the world guessing. 🏛️📉 Wall Street was holding its breath for a Friday ruling on the Trump administration’s broad tariffs. Instead? Silence. The Court released one unrelated opinion and adjourned, leaving the legality of billions in trade duties—and the fate of the U.S. fiscal deficit—hanging in the balance. Here is why this is the biggest "wait and see" in the market right now: ⚡ The $200 Billion Stakes At the heart of the case is the IEEPA (International Emergency Economic Powers Act). The Court has to decide: Legality: Can the President use emergency powers to bypass Congress and levy global tariffs? The Refund Bomb: If the tariffs are ruled illegal, will the U.S. have to pay back $150B–$200B to importers who already paid up? ⚖️ The "Mishmash" Theory Treasury Secretary Scott Bessent expects a "mishmash" ruling. The Court could grant limited powers or require only partial repayments. It’s rarely all-or-nothing at this level of government. 🔄 The "Workaround" Reality Even if the White House loses, don't expect a free-trade party. The "Plan B": The administration is already eyeing the 1962 Trade Act to keep tariffs at similar levels. The Impact: Analysts at Morgan Stanley see "significant room for nuance." The White House may pivot to a "lighter-touch" approach focused on affordability, but the tariffs aren't likely to vanish. 📉 The Economic Twist Despite the controversy, the data is defying the doomsayers: Inflation: Has remained surprisingly limited. Trade Deficit: October hit its lowest level since 2009. The Bottom Line: If the court blocks the tariffs, it’s a win for corporate earnings and input costs, but a massive headache for the national deficit and "onshoring" ambitions. Prediction markets only give a 28% chance that the tariffs are upheld exactly as they are.

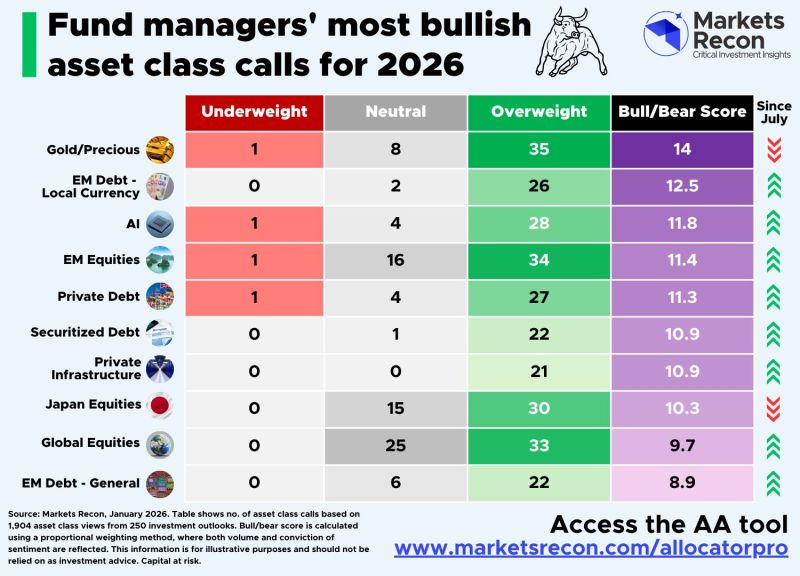

Where are fund managers most bullish for 2026? 🤔

Based on Markets Recon's review of ~250 asset manager outlooks for 2026, the most frequently mentioned overweight call was... GOLD 🥇 What else do asset managers like for 2026 portfolios? 📈 In Equities, it's AI 🤖, EM 🌍, and Japan 🇯🇵 stocks getting the most love. 📄 In Bonds, its EM Debt 🌎 and Securitised Debt 🧩. And in Private Markets, Infrastructure 🌉 is the most admired. Source: Stephen White, CAIA from Markets Recon

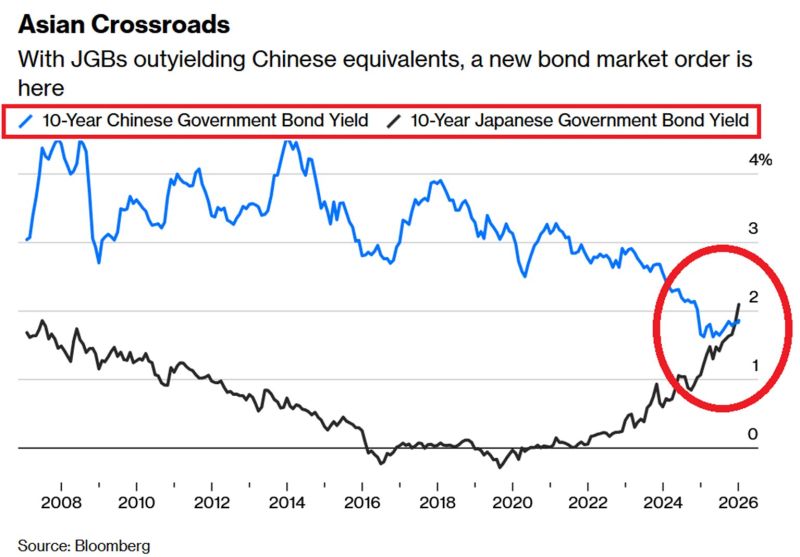

🚨 A HISTORIC REVERSAL IN ASIA. 🚨

For 15+ years, one rule dominated the macro landscape: Chinese yields stay higher than Japanese yields. China was the growth engine; Japan was the land of "Lower for Longer." That world just ended. 🌏 For the first time in decades, Japanese 10-year yields have officially overtaken China’s. We are witnessing a total regime shift in real-time. 📈 The Great Divergence: By the Numbers JAPAN: 10-year JGB yields have skyrocketed from -0.28% (2019) to 2.10%—a level not seen since 1999. CHINA: 10-year yields have plummeted from 3.05% to 1.86%, hovering near record lows. Why is this happening? It’s a tale of two opposite crises: 🇯🇵 In Japan: The BoJ is hiking to 30-year highs. Prime Minister Takaichi is pushing a record FY2026 budget with massive military spending. Fiscal expansion + Rate hikes = A bond market under siege. 🇨🇳 In China: The real estate downturn is biting hard. Deflation risks are mounting, and the central bank is forced to keep easing just to keep the lights on. The "Lose-Lose" Trap for JGB Investors 🪤 If you're holding Japanese bonds, where is the exit? Scenario A (Growth Re-accelerates): The BoJ is forced to hike faster than anyone expects. Bond prices tank. 📉 Scenario B (Growth Slows): JGBs underperform higher-yielding peers like US Treasuries. Investors flee for better returns elsewhere. ⚠️ The Contagion Risk This isn't just a Japan problem. This is a Carry Trade Nightmare. For years, traders borrowed "cheap" Yen at 0% to bet on global assets. Now, the cost of that debt is exploding. If the Yen strengthens and yields keep climbing, the "unwind" could send shockwaves through global markets. The era of free money in Japan is officially dead. Is your portfolio prepared for a world where Japan is no longer the "anchor" of low rates? 💬👇 Source: Global Markets Investor

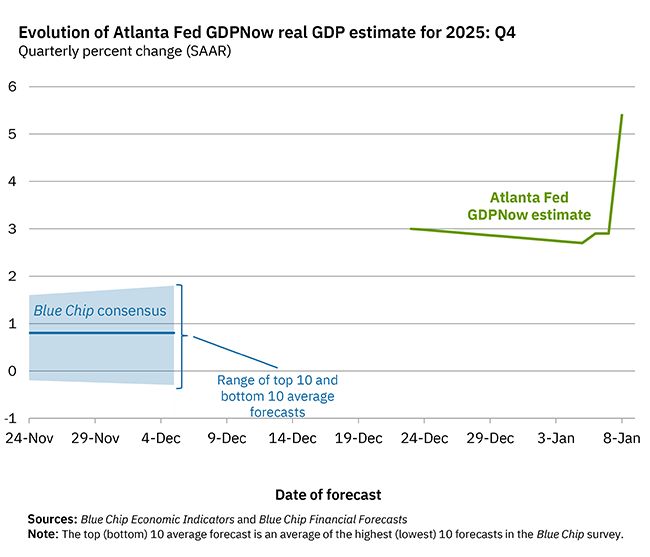

On January 8, the Atlanta Fed GDPNow model nowcast of real GDP growth in Q4 2025 is +5.4% from 2.7% previously.

That's a significant move upward. Yes you read it correctly +5.4% !!!! Real personal consumption expenditures growth increased from 2.4% to 3.0%. Net exports increased from -0.30% to 1.97%. Colling inflation, higher production, and higher GDP growth all seem very promising for the US economy. What comes next is $350B tax cut, Fed balance sheet expansion and maybe more Fed rate cuts... Source: Truflation, AtlantaFed

VIX seasonality is about to kick in right here...

Source: Equity clock, The Market Ear

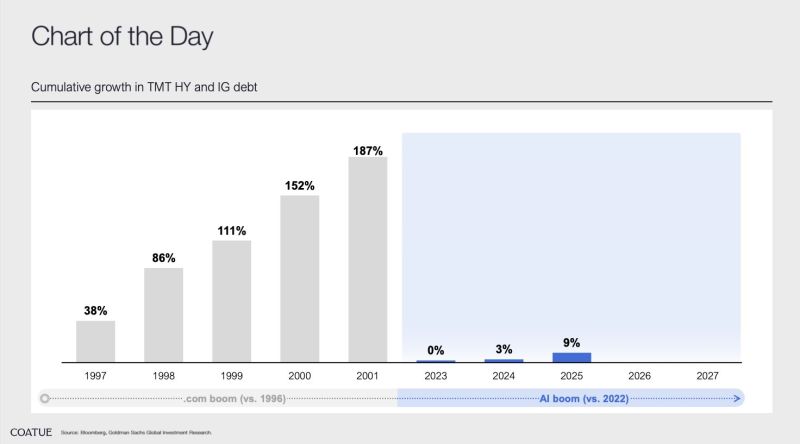

The dot-com boom ran on debt. The AI boom runs on balance sheets.

That difference matters. Source: Goldman Sachs, COATUE

The defense squeeze

European aero and defense index, SXPARO, has surged by some 13% YTD. The squeeze has been absolutely huge since the start of the week, with RSI now trading at 80! Source: The Market Ear, LSEG Workspace

Investing with intelligence

Our latest research, commentary and market outlooks