Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

$1.5 TRILLION. 🚀 Donald Trump calls for 50% increase in US defence spending by 2027

Here is the breakdown of what this means for the US, the economy, and the defense industry: 1. The "Tariff-Fueled" Growth 💰 The President is pivotting away from traditional debt-funding. The plan? Use tariff revenue to bridge the gap from $901B to $1.5T. While skeptics point to CBO deficit warnings, the administration is betting big on trade levies to fund national security and even pay a "dividend" to the middle class. 2. A New Era for Defense Contractors 🛠️ The days of "business as usual" for the Big Defense are over. The President is demanding: - No more share buybacks or dividends if production speeds don't meet his standards. - Massive upfront investment in plants and equipment. - Executive pay tied to production, not short-term financial metrics. The message to giants like Raytheon is clear: Innovate or be sidelined. 3. "The Department of War" Mindset 🌎 With recent operations in the Atlantic and Venezuela—and Greenland back on the table—the military is being positioned as the primary tool for foreign policy. We are moving from a posture of deterrence to one of active assertion. The Bottom Line: We are witnessing a radical decoupling of defense spending from traditional fiscal constraints, fueled by a "Production First" mandate for the private sector. Is this the necessary evolution for "dangerous times," or a fiscal risk too far? Source: FT

The US Supreme Court might rule on the Trump tariffs this Friday. 🏛️

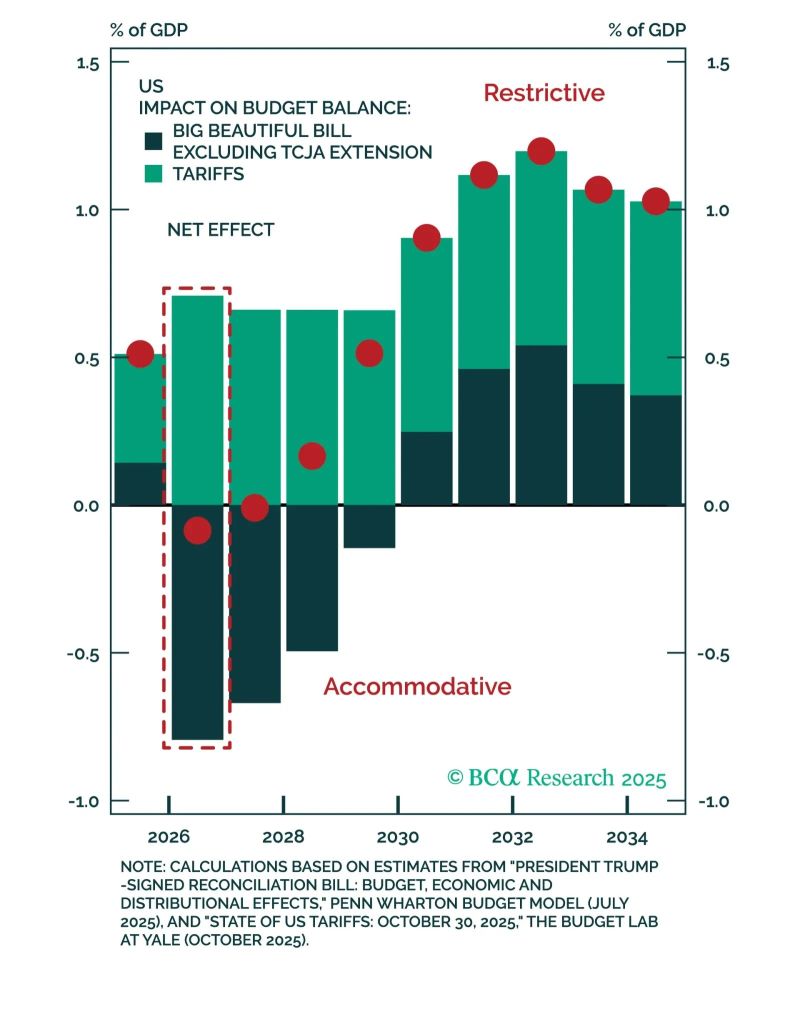

Investors are scrambling to figure out the "Day After" playbook. If the Court overturns them, we aren’t just looking at a policy shift—we’re looking at a complete market regime change. Here’s the bull vs. bear breakdown: ✅ The "Soft Landing" Bull Case Overturning tariffs = Instant Disinflation. Core goods inflation drops. Consumer purchasing power gets a massive boost. Short-term relief for the American wallet. ❌ The "Fiscal Nightmare" Bear Case It’s not all sunshine and roses. Fiscal Sustainability: Our deficit takes a direct hit (check the chart below 📉). Labor Heat: A boost in spending could supercharge labor demand, sparking structural inflation down the road. The "Wild Card" Factor 🃏 Don't expect the Administration to sit idly by. If the Court says "No," the White House will likely pivot to a raft of new legal avenues to keep protectionist measures alive. The $10 Trillion Question: How does the Fed react? If the Fed sees tariff removal as a green light for more rate cuts, we are looking at a "Risk On" environment. The Play: Long duration might be the winner. 📈 The Risk: If the term premium spikes because of fiscal concerns, that "Long" call could turn "Short" faster than you can hit 'sell.' Source: BCA, Jonathan LaBerge

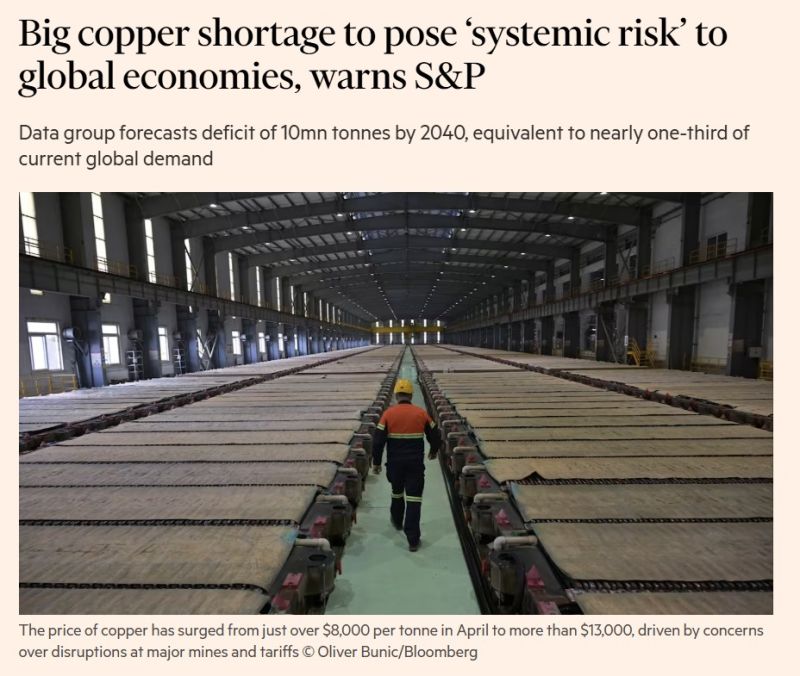

COPPER: The next global bottleneck? 🔴⚡️

We talk about chips, we talk about data, but we’re forgetting the "Red Metal" that powers it all. S&P Global just released a report that should be a wake-up call for every tech leader and policymaker: The world is facing a 10 million tonne copper deficit by 2040. That isn't just a "shortage"—it’s a systemic risk to the global economy. Why the sudden surge? 📈 We are witnessing a "Perfect Storm" of demand: The AI Revolution: Data centers aren't just about code; they are massive physical infrastructures. Copper demand for AI and robotics is set to more than double by 2040. The Energy Transition: You can't have an EV or a green grid without copper. It is the "Great Enabler" of electrification. Geopolitical Stakes: Access to copper is now a national security issue. If you don't have the metal, you can't build the future. The Supply Reality Check 🛠️ The numbers are sobering: Demand is jumping from 28mn tonnes to 42mn tonnes. Mine production is expected to peak in 2030 and then decline. New mines take years (sometimes decades) to bring online. The "Bottleneck" Warning ⚠️ As Daniel Yergin, Vice-chair of S&P Global, puts it: “At stake is whether copper remains an enabler of progress or becomes a bottleneck to growth and innovation.” With prices already surging from $8,000 to over $13,000 per tonne, the cost of building the future just got a lot more expensive. The big question for the industry: Will we see a massive pivot to copper recycling and new mining tech, or will the "Green Transition" and "AI Boom" stall out due to a lack of raw materials? Source: FT

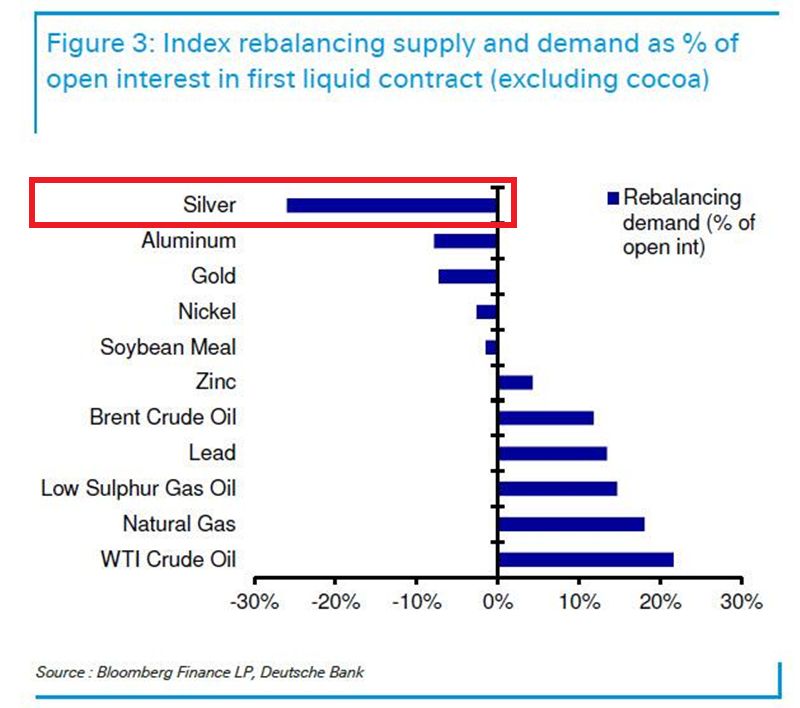

Are silver prices about to CRASH next week?

Next week's commodity index rebalancing could force massive selling of silver futures, pushing prices lower regardless of fundamentals. Silver faces the largest selling pressure among major commodities, with rebalancing demand at -25% of open interest. Index funds will be forced to dump silver futures just to rebalance. Why? Silver's recent surge was driven by speculation, not fundamentals, fueled by ETFs, retail traders, and thin liquidity. Source: DB, Global Markets Investor

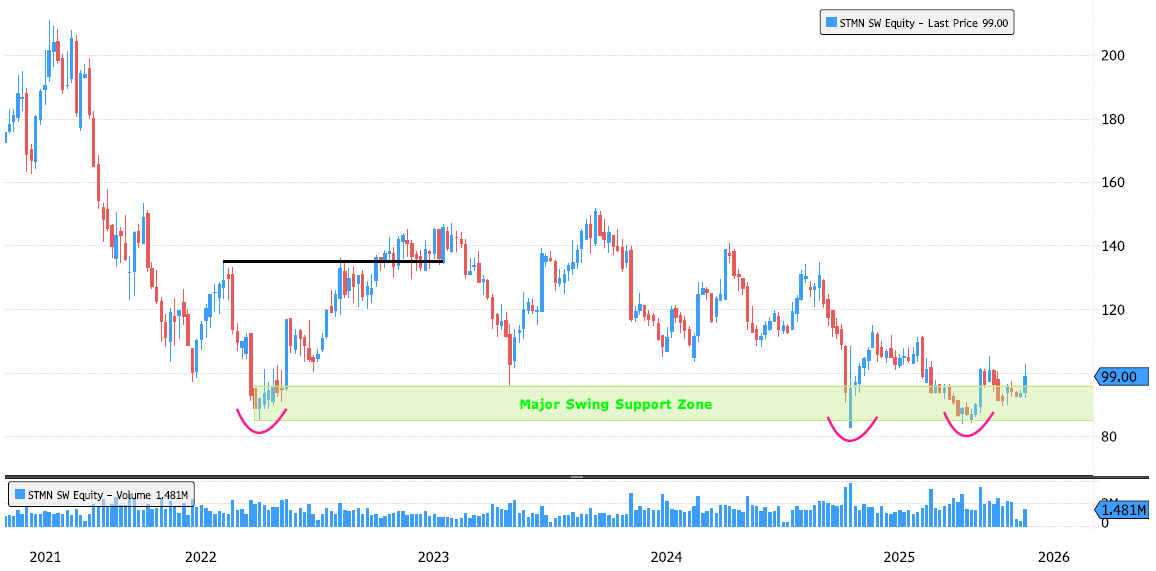

Straumann — Is a low forming?

Back in March 2023, the trend flipped from bearish to bullish after a ~59% consolidation over 10 months. Following nearly two years of another consolidation, we’re now seeing early signs of a bottoming process. 📊 Key technical observations: Strong volume reaction on the major swing support zone (85–95) Structure suggesting a potential inverted Head & Shoulders Still early-stage, but clearly one to monitor closely 🎯 Next resistance: 105.25 If confirmed, this setup could lay the groundwork for the next bullish leg. Confirmation remains essential. Source: Bloomberg

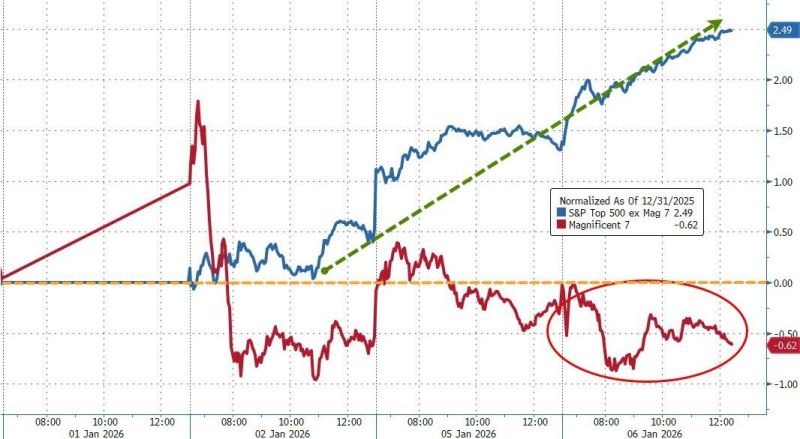

From Mag7 to Lag7...

Mag7 stocks have significantly lagged the rest of the market in 2026 so far... The S&P 493 is up 2.5% YTD, Mag7 -0.6%... Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks