Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Investors who have been sticking to their 60-40 portfolio over the last 3 years

Up +36% over the last 3years (+10.7% annualized) - gross of fees with annual rebalancing

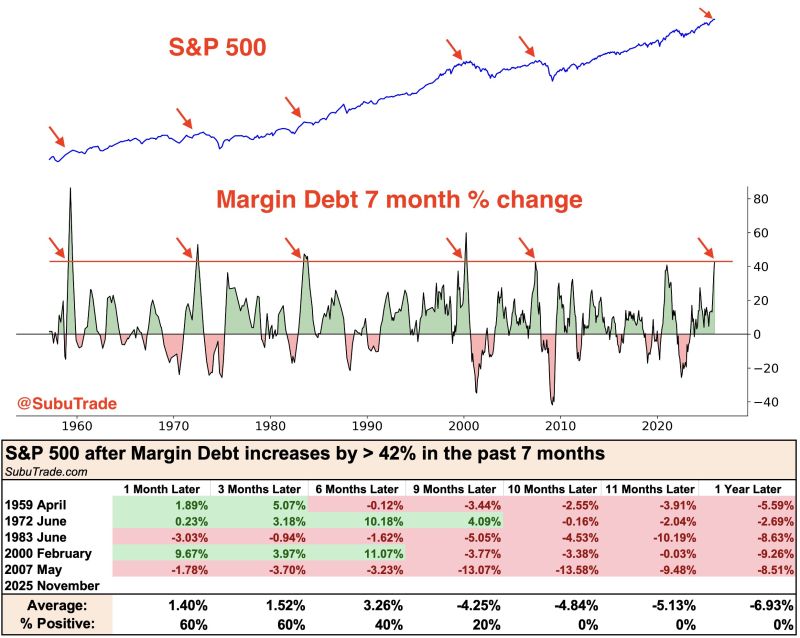

Margin Debt increased +42% in the past 7 months. Investors went all-in.

This only happened 5 times before, and the S&P 500 was lower 1 year later every time. The last 2 times? February 2000 & May 2007 Source: Subu Trade @SubuTrade

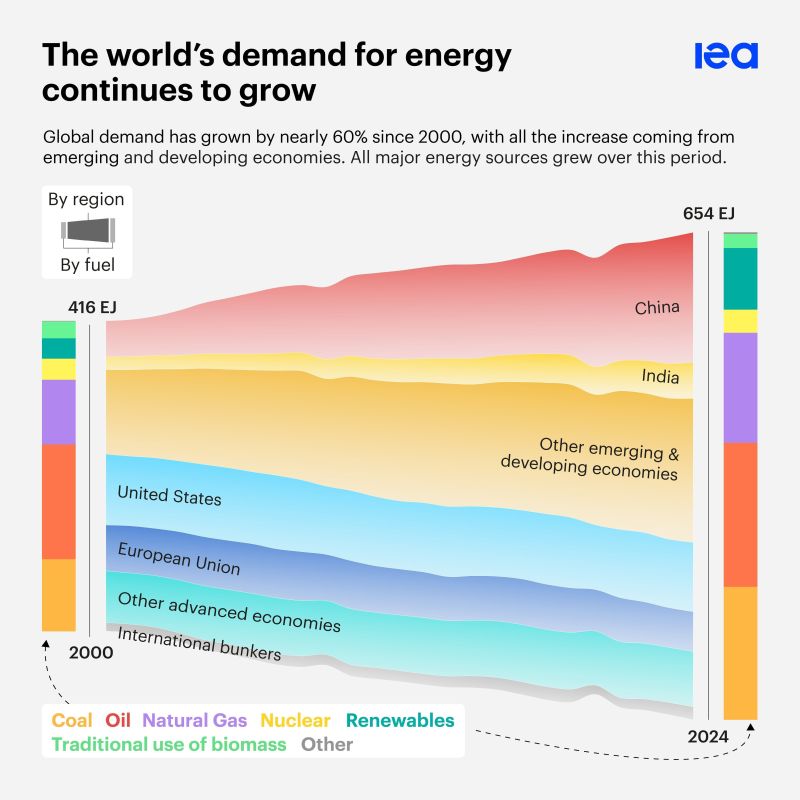

Global energy demand has risen nearly 60% since 2000, with more than half of the increase taking place in China

In the coming years, other emerging economies, led by India & Southeast Asia, are set to become increasingly influential in growth trends . Source: IEA

Oracle’s primary data center partner, Blue Owl Capital, has officially walked away from a $10B deal to fund a massive 1GW facility in Michigan.

Why? Because the "growth at all costs" era of AI is meeting a harsh new reality: Debt. The Breakdown: 🚀 The Ambition: Oracle is trying to build a $300B infrastructure bridge for OpenAI. 💸 The Debt: Oracle’s net debt has ballooned from $78B to $105B in just one year. Forecasts show it hitting $290B by 2028. 🛑 The Pivot: Lenders are getting nervous. They are demanding stricter terms, higher rates, and more collateral. The Lesson for Leaders: Even the giants aren't immune to market sentiment. Blue Owl—the pioneer of these massive sale-leaseback deals—decided the risk no longer matched the reward. While Oracle says they are moving forward with a new (unnamed) partner, the message from Wall Street is clear: The blank check for AI infrastructure is being cancelled. Investors are no longer just asking "How fast can you build?" They are asking "How are you going to pay for it?" We are moving from the Hype Phase of AI into the Sustainability Phase. Only those with the strongest balance sheets will survive the transition. Oracle $ORC stock is down -5% on the news!

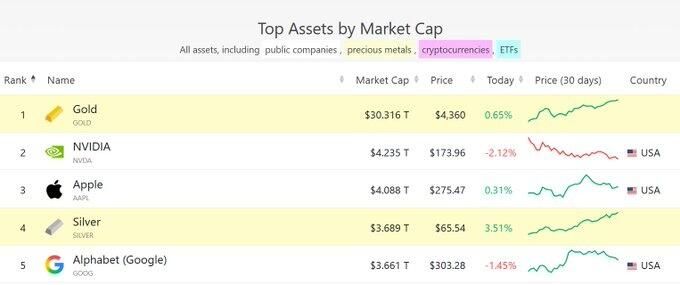

Silver's surge yesterday moved it above Google as the 4th largest asset by market cap...

Source: zerohedge

🔥Gold and silver are moving almost perfectly in line with Japanese government bond yields:

Japan's 10-year government bond yield has risen roughly 1.5 percentage points since the beginning of 2023, reaching 1.98%, the highest level since the 1990s. During this same period, gold and silver prices have skyrocketed by 135% and 175%, respectively. Are precious metals being used as a primary hedge against the rising cost of government debt? Source: Global Markets Investor

🚨 REMINDER: Bank of Japan expected to hike rates 25 bps Friday

Nobody knows when the real consequences will materialize, but after a prolonged period of extremely low rates, this continued shift will likely drain liquidity from markets, potentially causing a ripple effect through margin calls and other forced deleveraging. Rates will probably rise to 0.75%, which is still low by global standards. However, what matters most here is the rate of change, rather than the absolute level of rates. Higher Japanese rates = stronger yen → yen carry trade unwinds → investors sell foreign assets (U.S. Treasuries) → upward pressure on U.S. yields → global liquidity contracts Will it happen? Or is it already priced by the market? Source: Guillaume Tavares, Bitcoin Archive

2026 Warning 🚨: Going back to 1926, the S&P 500 has seen an average drawdown of 18.2% in the 12 months before midterm elections

📉 Going back 60 years, the smallest drawdown has been 7.4% while the largest was 41.8% 🤯 After the midterms, all is well, but before? 🤔👀 Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks