Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

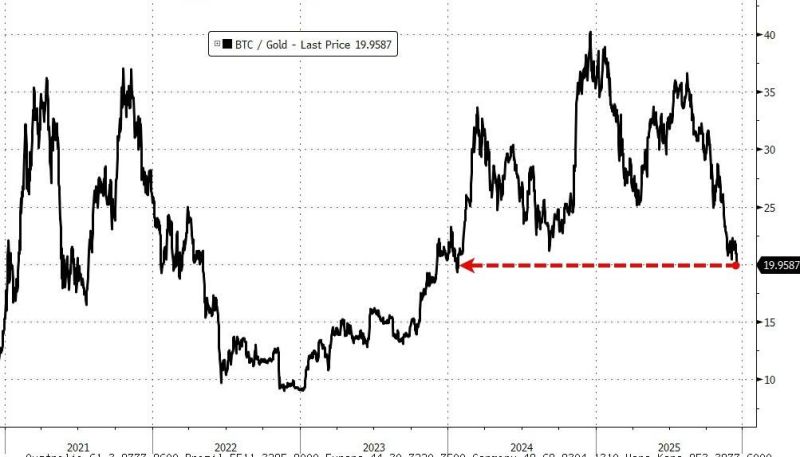

DB's chart of the day tracks 23 AI-related stocks, comparing year-to-date performance up to 29 October with returns over the roughly six weeks since.

Before 29 October, just one stock was down on the year and the group had posted an average unweighted gain of +70%; since then, the picture has shifted sharply, with 20 of the 23 now trading lower. Source: DB, The Market Ear

Everyone is talking about Oracle CDS, but Coreweave $CRWC CDS is the real gem...

Source: RBC, Bloomberg

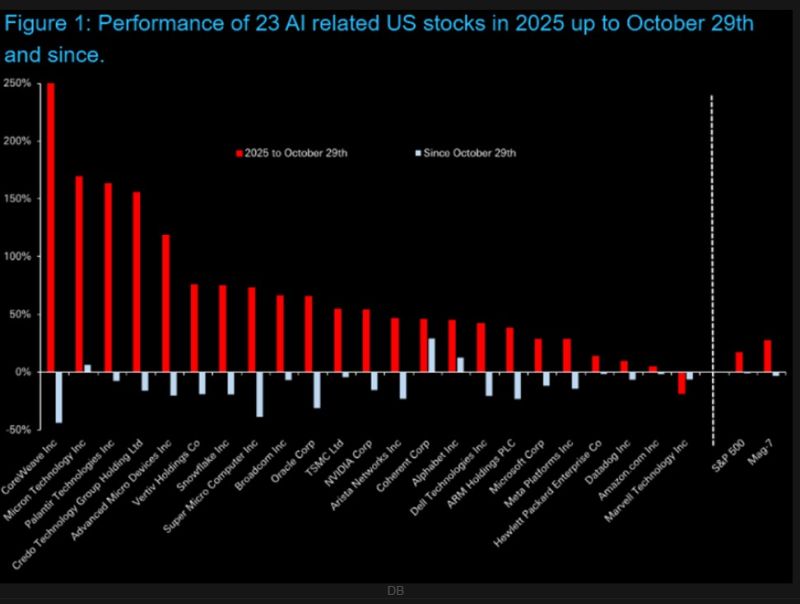

2026 is expected to be the year of BIG IPOs.

See below a nice chart from @YahooFinance on some huge IPOs expected next year. Source: Ryan Detrick

Although the Swiss Franc has been the strongest currency in the world, the purchasing power degradation in ‘real’/’hard’/gold terms over the last 20 years has been massive

Chart below shows Gold price in Swiss Francs – the “hardest” fiat currency in the world has lost 80%+ of its purchasing power !) Source: Goldman Sachs, zerohedge

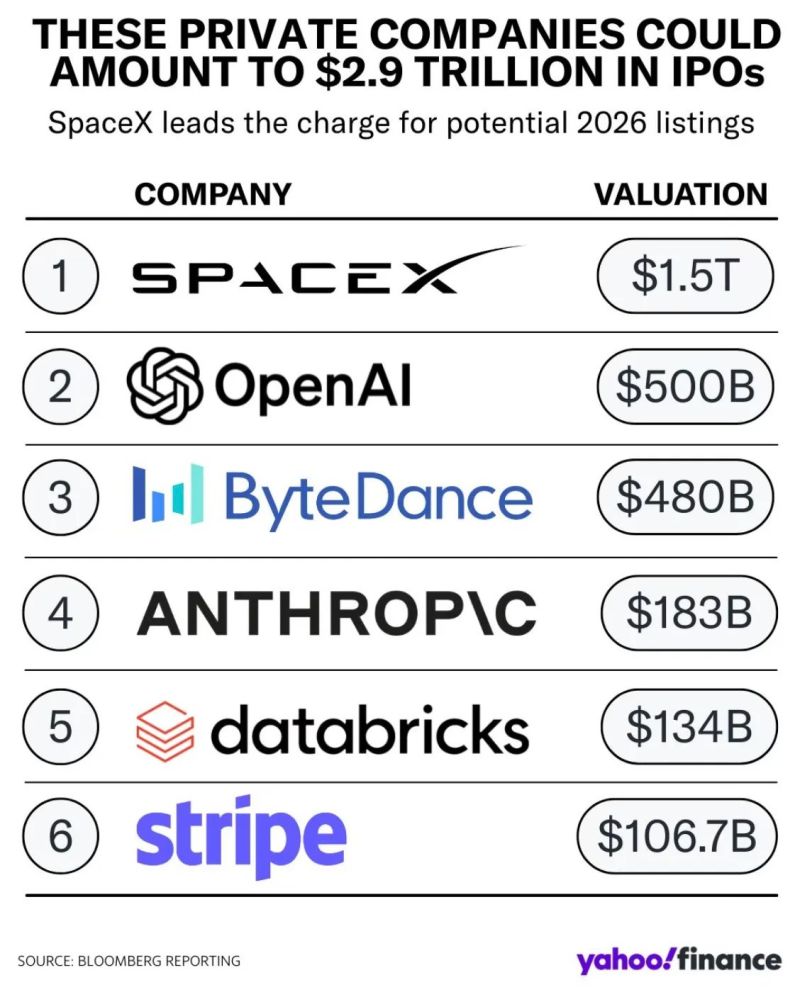

Oracle and its peers... earnings versus debt

(based on last available financial quarter) Source: Bloomberg

OpenAI will spend $6 billion on stock-based compensation this year, half of its revenue

Source: Conor Sen

Investing with intelligence

Our latest research, commentary and market outlooks