Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Japan's government says it may "intervene" before the Japanese Yen to US Dollar ratio reaches 160.

Over the last 2 months, the Yen has gone from 145 to 157 as a $110B+ stimulus package is coming. We are ~2% away from "intervention." Source: The Kobeissi Letter @KobeissiLetter

According to a Bloomberg article, Michael Saylor’s company, Strategy $MSTR, faces one of its most significant challenges yet:

the risk of being removed from major stock indexes like the MSCI USA and the Nasdaq 100, according to JPMorgan analysts. Such exclusions could trigger up to $2.8B in outflows from MSCI-linked funds alone and threaten nearly $9B of passive exposure tied to the company. A decision is expected by January 15, 2026. The threat strikes at the core of Strategy’s identity. The firm became a mainstream proxy for bitcoin by issuing stock to buy bitcoin, then using rising BTC prices to fuel more issuance and accumulation. At one point, the company traded at a large premium above its Bitcoin reserves — but that premium has now evaporated, reflecting weaker investor conviction. MSCI is reconsidering its index rules, proposing to exclude companies whose digital asset holdings exceed 50% of total assets, classifying them more like investment funds. This puts Strategy directly in the crosshairs. Meanwhile, both Bitcoin and Strategy’s share price have plunged, with the stock down more than 60% from its peak and Bitcoin down over 30% from its recent high—breaking the feedback loop that once boosted Strategy’s valuation with each BTC purchase. Its equity now trades only slightly above the value of its Bitcoin holdings. Despite the pressure, Saylor continues aggressively buying Bitcoin—adding 8,178 BTC this week, bringing total holdings to 649,870 BTC.

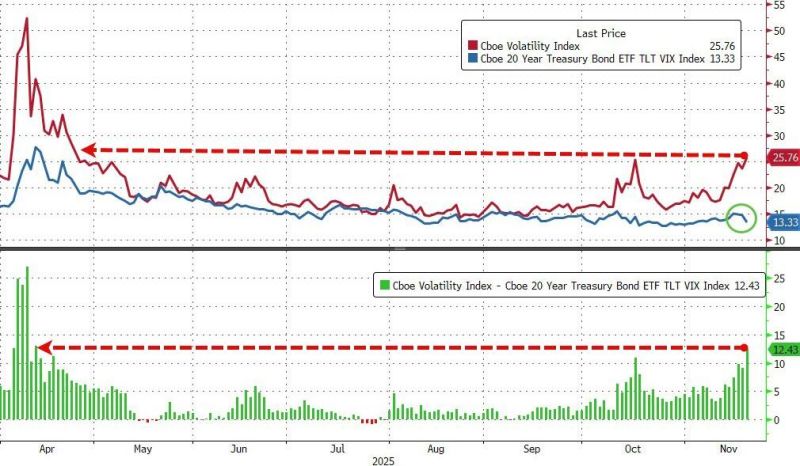

VIX (equity vol) exploded higher yesterday, topping 28 at its peak, and dramatically decoupling again from bond vol (biggest divergence since Liberation Day fallout)...

Source: zerohedge

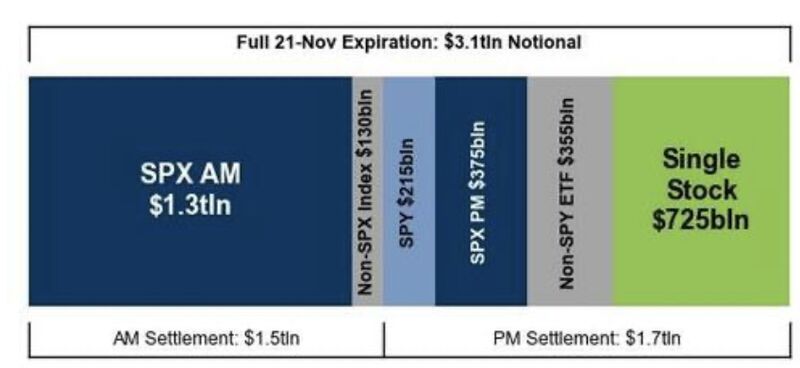

TODAY is estimated to be the largest November expiration EVER.

We’re talking $3.1 TRILLION worth of options contracts expiring all at once. Source: StockMarket.news

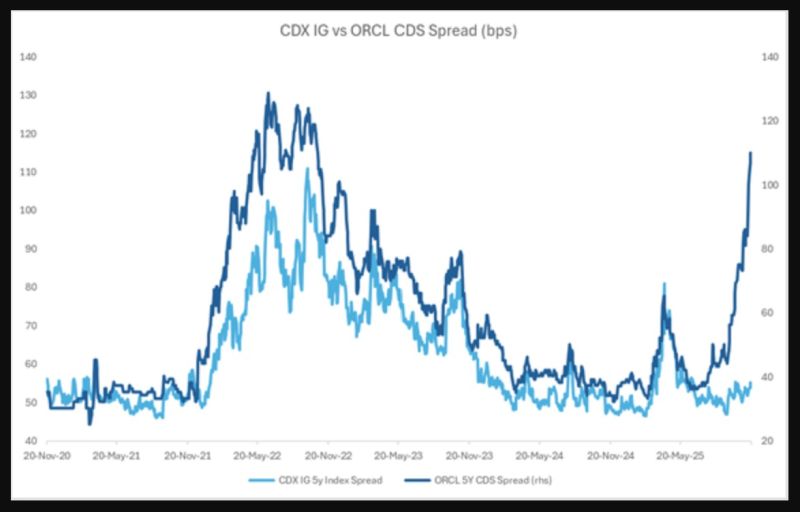

An important chart to watch: Investment grade credit default swaps are seeing a meaningful divergence from ORCL CDS

So no contagion at this stage Source: zerohedge

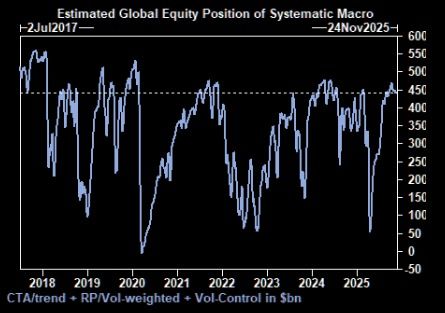

If markets keep sliding, Goldman’s “down big” scenario implies CTAs could unload ~$220bn of global equities over the next month.

Source: The Market Ear, Goldman Sachs

Kraken Files for IPO

Kraken has confidentially submitted a draft registration statement on Form S-1 with the US Securities and Exchange Commission (SEC), marking an official request to offer common stock in an initial public offering. The number of shares on offer and the price of the initial stock offering has yet to be determined. According to a Nov. 19 blog post on the Kraken website, the IPO is expected to occur after the SEC completes its review process. Ahead of the firm’s Form S-1 filing announcement, Kraken also announced the successful completion of an $800 million fundraising effort across tranches. The first, led by institutional investors including Jane Street, DRW Venture Capital, HSG, Oppenheimer Alternative Investment Management, and Tribe Capital, also included a significant commitment from Kraken Co-CEO Arjun Sethi’s family. Meanwhile, the second tranche involved a subsequent $200 million strategic investment from Citadel Securities and, according to a Nov. 18 press release, was executed at a $20 billion valuation. Citadel Securities will also provide Kraken with differentiated liquidity provision, risk management expertise, and market structure insights. Source: yahoo!finance

Walmart to Transfer Stock Exchange Listing to Nasdaq

Walmart Inc today announced it will transfer the listing of its common stock to The Nasdaq Stock Market LLC (Nasdaq). The company expects its common stock to begin trading on the Nasdaq Global Select Market on December 9, 2025, under its current ticker symbol "WMT". source : bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks