Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

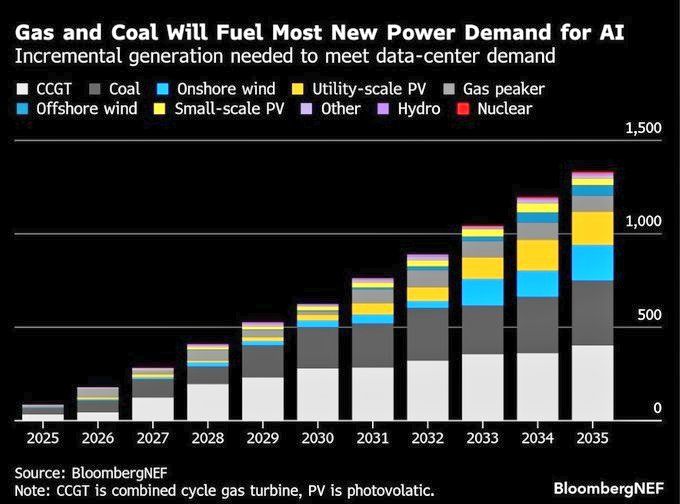

And the winner of the power demand is .... Coal !

Source: Bloomberg, @AzizSapphire

More "crockroaches" in private credit land.

Last week, lending giant BlackRock wrote down a private loan made to home improvement company Renovo Home Partners to zero. As recently as last month, BlackRock valued the loan at 100 cents on the dollar. The drastic revision comes as Dallas-based Renovo — a roll-up of regional kitchen and bathroom remodeling businesses created by private equity firm Audax Group in 2022 — abruptly filed for bankruptcy last week, indicating it plans to shut down. BlackRock held the majority of Renovo’s roughly $150 million of private debt, while Apollo Global Management Inc.’s MidCap Financial and Oaktree Capital Management held smaller chunks, according to people with knowledge of the matter, who asked not to be identified discussing a private transaction…” When one of America’s largest, most sophisticated lenders takes a 100% loss on a loan over the course of one month, it begs the question: what other "cockroaches" are hiding in the shadows? Source: Ross Hendricks @Ross__Hendricks

The 🇺🇸 Senate just passed a bill to fund the government and end the longest shutdown in U.S. history

The bill which passed 60-40 will now be sent to the House of Representatives ... If it passes in both chambers of Congress, it will head to President Donald Trump to be signed into law - CNBC, Evan

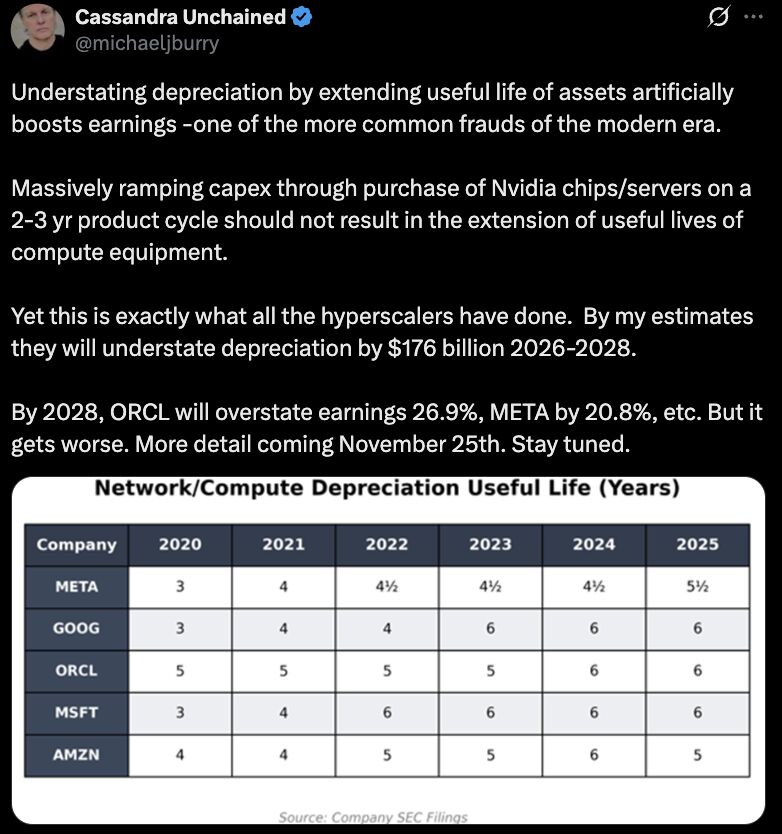

Michael Burry has said that Oracle, $ORCL, and Meta, $META, could overstate earnings by 26.9% and 20.8%.

He adds: "It gets worse." Source: unusual_whales @unusual_whales

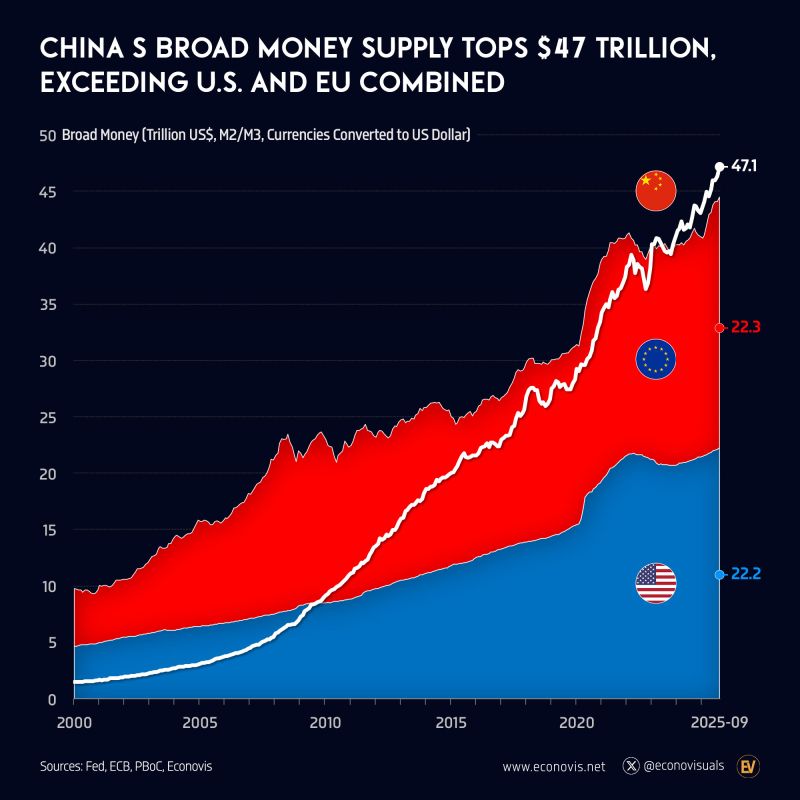

📈 China’s Broad Money Supply Surpasses Combined U.S. and EU Since 2023

China’s broad money supply (M2) reached $39.7 trillion in September 2023, surpassing for the first time the combined total of the United States and the European Union ($39.6 trillion). By September 2025, China’s M2 had expanded further to $47.1 trillion—5.9% higher than the combined $44.5 trillion of the U.S. ($22.2 trillion) and EU ($22.3 trillion). This reflects the continued rapid expansion of China’s financial system and credit base relative to Western economies. Source: Econovis

🚨 TSMC’s Growth Just Slowed — and the Entire AI Supply Chain Is Watching

Bloomberg reports TSMC’s October sales rose 16.9% — still strong, but slower than the recent surge. Why it matters: TSMC sits at the choke point of advanced chips. When it slows, the ripple hits GPUs, memory, packaging, the whole AI stack. 📉 A slowdown in monthly sales doesn’t always mean weak demand. It can be: - Order timing (customers shifting deliveries) - Yield ramps (new node transitions) - Inventory digestion (buyers catching up) But zoom out… 💰 Cloud giants plan to spend >$400B on AI infrastructure next year — a 21% jump. That money flows straight into NVIDIA GPUs, high-bandwidth memory, advanced packaging, and TSMC’s cutting-edge wafers. 🗣️ NVIDIA’s CEO says demand is “getting stronger month by month” and even met with TSMC’s CEO to ask for more capacity. Translation: supply, not demand, is still the bottleneck. TSMC also builds for AMD, Qualcomm, and Apple — so who gets priority at the fab affects entire product launches. 🎯 The company says capacity is “very tight,” and chip designers are literally chasing slots in Hsinchu. Source: Bloomberg, Rohan Paul @rohanpaul_ai

Elon predicts that OpenAI will eat Microsoft alive and believes MSFT should stop supporting it.

Source: The AI Investor @The_AI_Investor

Investing with intelligence

Our latest research, commentary and market outlooks