Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

China Sept. used home prices -0.64% m/m; drop faster than Aug.

China Sept. new home prices -0.41% m/m; drop faster than Aug. China's largest asset by a factor of 2 continues to disintegrate... Source: zerohedge, GS

Liquidity back to normal? Standing Repo facility (SRF) usage from $8.35BN to $0

Note however that SRF dropping to zero doesn’t mean liquidity is back to normal. It just means no one tapped it today. The stress can still be there, just shifted elsewhere. Time will tell.

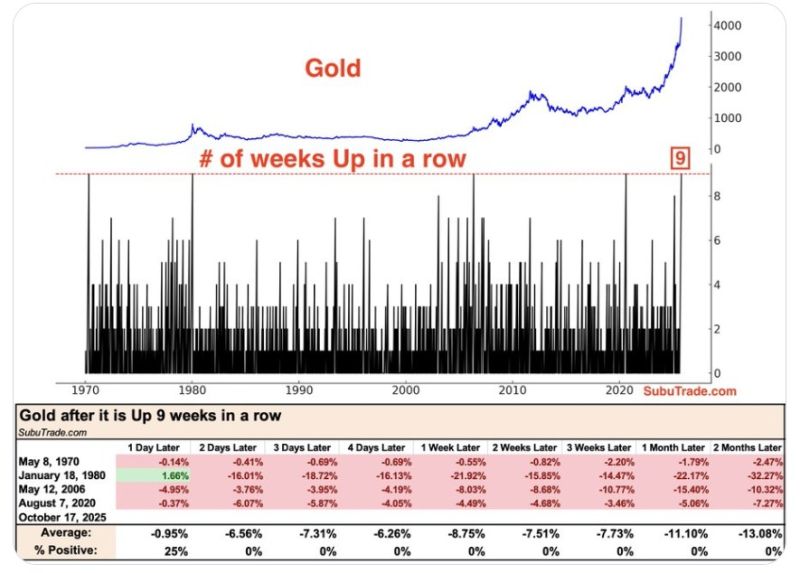

Gold is Up 9 weeks in a row.

Gold has never gone up 10 weeks in a row before. Source: Subu Trade on X

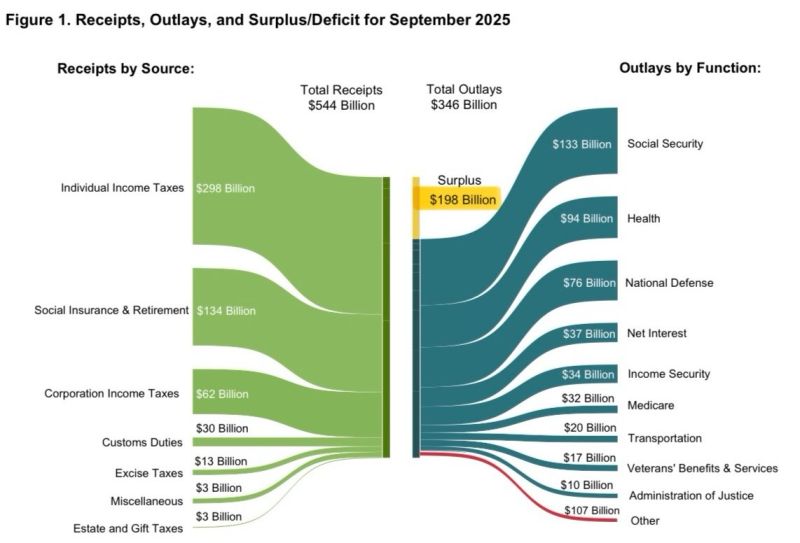

The US just posted a massive surplus of +$198 Billion for the month of September.

Total Receipts: $544B Total Outlays: $346B $30 Billion in tariffs collected. Source: Geiger Capital

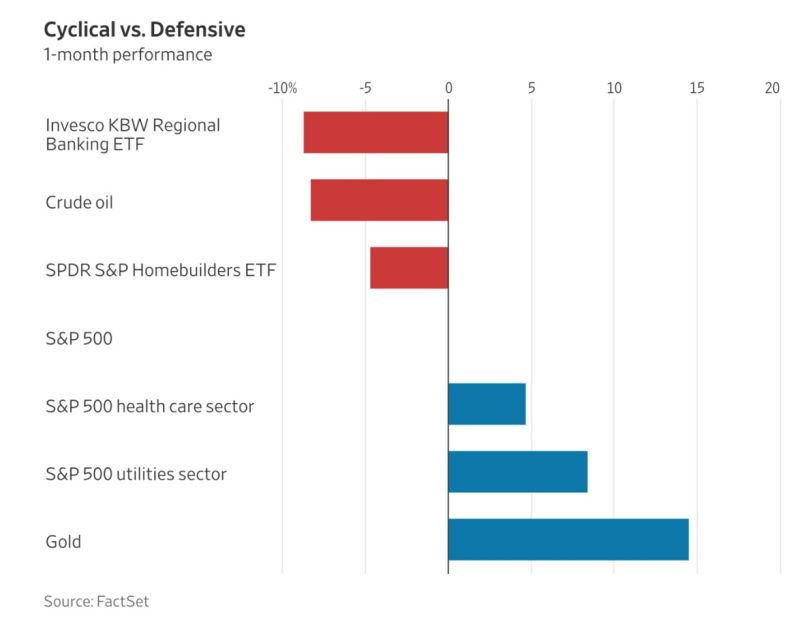

Interesting comment on X by @Andreas Steno on X about a worrying development that took place yesterday.

As financials and regionals are getting hammered with signs of stress in USD money market, the SOFR - Fed funds spread keeps widening… Maybe the Fed will be involved earlier than they think on the QT ending stuff...

FT investigation: "How the Trump companies made $1bn from crypto"

>>> https://lnkd.in/eSXMsMra The president and his family have built a rapidly growing digital assets empire which has been fuelled by the administration’s industry-friendly policies. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks