Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

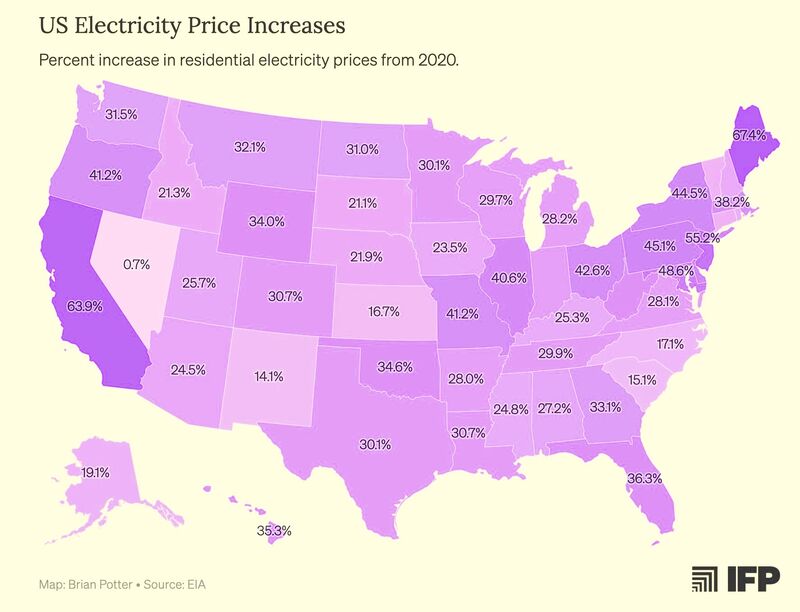

Electricity prices in the US have exploded since 2020.

Across the U.S., residential power costs are up more than 40% in many states and over 60% in places like California and Maine. Should be see this as the early stage of an energy crisis? Source: StockMarket.news

I’m not a gold buyer, it costs 4% to own it,”

Dimon said Tuesday at Fortune’s Most Powerful Women conference in Washington, referring to storage costs for billionaires who have to store several hundreds gold bars worth billions, and clearly not referring to 99% of actual gold buyers who own a little gold at home and which costs them 0% to own it. That said, Dimon admitted that gold “could easily go to $5,000, $10,000 in environments like this. This is one of the few times in my life it’s semi-rational to have some in your portfolio.” Source: zerohedge, metals mine

$GLD Gold Trust ETFD just broke out of a 5-year cup & handle vs $SPY S&P 500 index ETF.

COVID highs are now in sight. Source: Trend Spider

For now, China–U.S. trade tensions continue to escalate ahead of the scheduled October 29 meeting between President Trump and President Xi.

Source : Financial Times

Billion dollar companies with no revenues.

$RGC Regencell Bioscience $QMMM QMMM $DGNX Diginex $TMC TMC the metals company $OKLO Oklo $TMQ Trilogy Metals $ASTS AST SpaceMobile $RGTI Rigetti Computing $QS QuantumScape $CRML Critical Metals $LAC Lithium Americas $PPTA Perpetua Resources $USAR USA Rare Earth $JOBY Joby Aviation $NNE NANO Nuclear Energy $NXE NexGen Energy $ACHR Archer Aviation $QUBT Quantum Computing $SERV Serve Robotics Source: Lin @Speculator_io

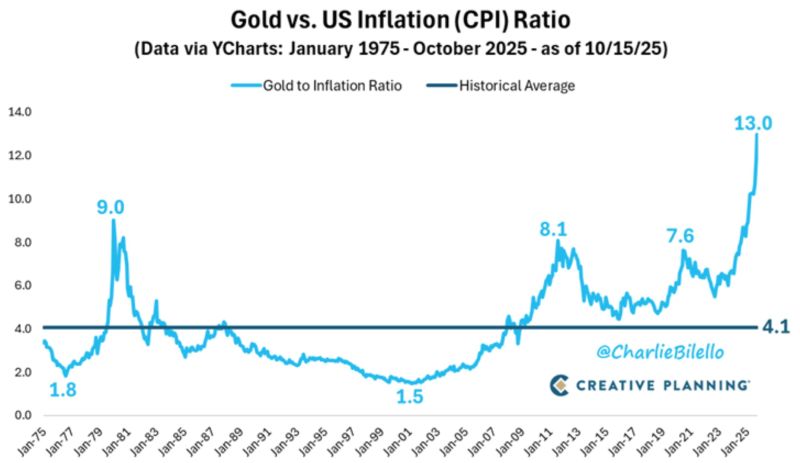

Relative to inflation, Gold has never been higher than it is today. 13x vs. 9x at the peak in 1980.

Source: Charlie Bilello

The U.S. government shutdown is now in its third week after the Senate again rejected a temporary funding bill.

Polymarket odds now show a 73% chance the shutdown lasts over a month. Source: Cointelegraph, Polymarkets

Nestlé – Trend Reversal Confirmed

After a 46% consolidation since January 2022, we finally have confirmation that the trend is reversing. The breakout above 78.27 marks the end of the consolidation phase, establishing 70.42 as the likely low. Interestingly, the stock broke below its 2003 long-term trend in July this year, but has now reclaimed it, confirming that this historical level remains valid. While a pullback could occur following a new high, it’s still too early to define a swing top — momentum is clearly back. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks