Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

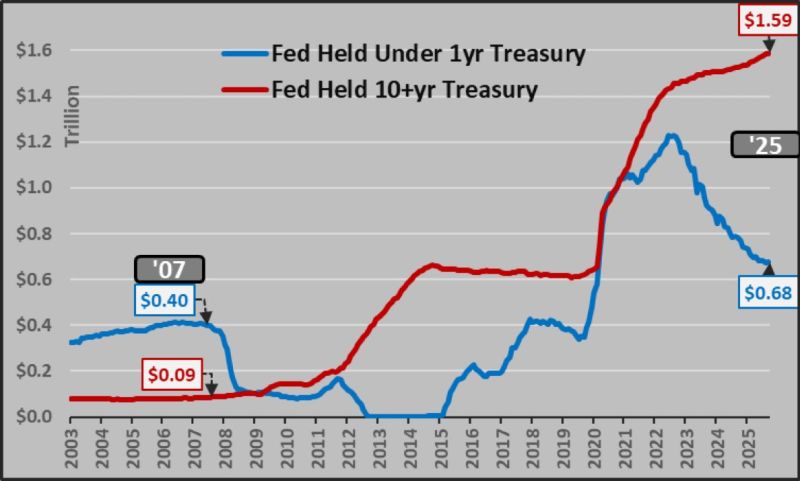

Really important chart from @Econimica

QT NEVER happened in 10+yr USTs post-2022. The Fed still holds a large amount of long-term debt. The QT mainly took place through short-term Treasuries (the blue line). As explained by StockMarket.news, over the last few years, the Fed has been draining some money out of the system but doing it in a very controlled way. It’s avoiding a big sell-off in long-term bonds because that could cause interest rates to spike and hurt the economy. So while it looks like the Fed is being tough with QT, the reality is softer the real tightening is happening with short-term bonds, while the long-term side still has a safety net. It’s a reminder that even when the Fed says it’s tightening, it’s still making sure the markets don’t fall apart.

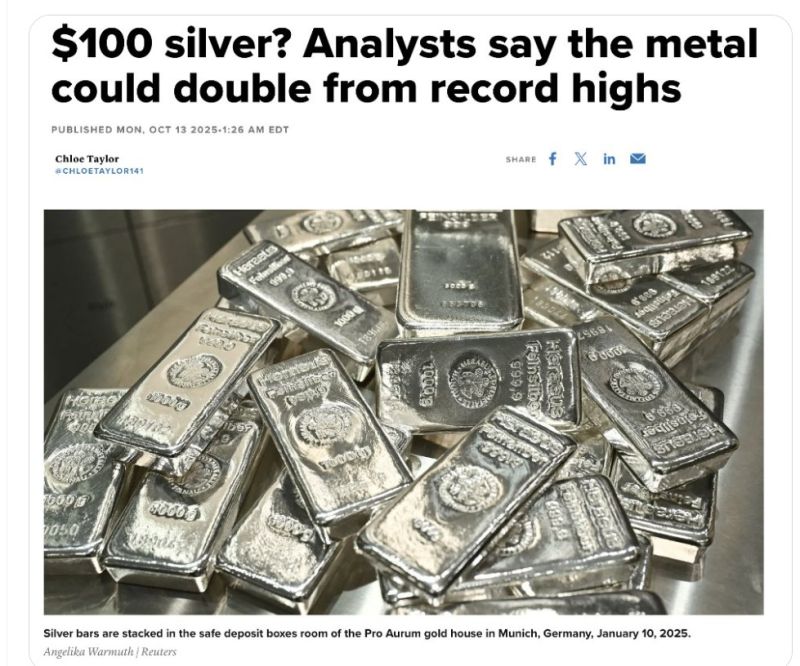

Silver to hit $100 by the end of 2026 says BNP Paribas and Solomon Global

Source: Barchart

China's deflationary vortex is getting worse:

*CHINA SEPT. CONSUMER PRICES FALL 0.3% Y/Y; EST. -0.2% *CHINA SEPT. PRODUCER PRICES FALL 2.3% Y/Y; EST. -2.3%

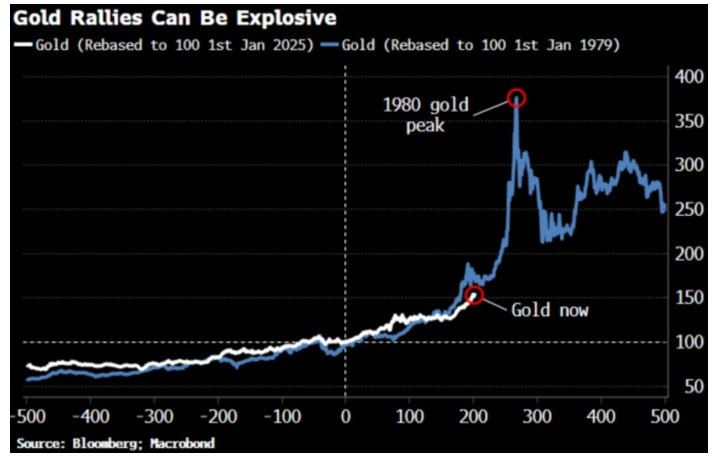

Will gold rally be as explosive as the one in the 80s ???

Source: Macrobond, Bloomberg, Incrementum AG

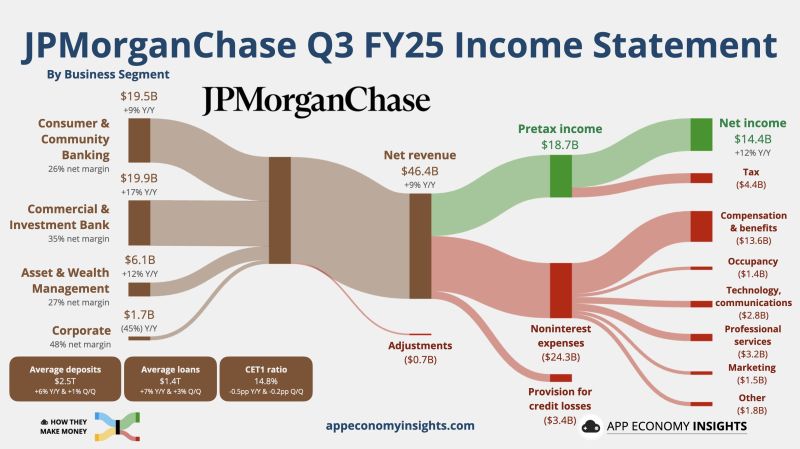

J.P. Morgan Crushed Q3 Earnings Estimates as Wall Street’s Dealmaking and Trading Revenue Explosion Drive Revenue Beat

JPMorgan just beat Q3 2025 earnings with net income jumping 12% to $14.4B ($5.07/sh), vs estimates of $4.85-$4.87 per share Revenue climbed 9% year-over-year to $46.4 billion, topping the $45.3-$45.5 billion Street expected. What Drove This? - Investment Banking: IB fees surged 17% to $2.6B as JPM stays #1 on the IB deal making tables for fees - Trading: Trading revenues were also up 25% this quarter to $8.94B despite Q3 being generally slower in markets - Loans: Net Interest Income (NII) came in at $24.1B, up from previous quarters, management raised guidance for 2025 The bank maintained solid capital ratios with ROE at 17% and ROTCE at approximately 19-21% What Happens from Here? - CEO Jamie Dimon noted the U.S. economy showed resilience during Q3 but cautioned about “significant risks” - These include tariffs, trade uncertainty, geopolitical tensions, fiscal deficits, and elevated asset prices - He mentioned that JPM was prepared for a variety of outcomes $JPM JPMorganChase Q3 FY25. • Net revenue +9% Y/Y to $46.4B ($1.5B beat). • Net Income +12% Y/Y to $14.4B. • EPS: $5.07 ($0.23 beat). • FY25 NII ~$95.8B ($0.3B raise). Source: App Economy Insights @EconomyApp Perplexity Finance @PPLXfinance

In case you missed it...

A Swiss court has ruled that regulators’ decision to wipe out SFr16.5bn (£15.5bn) of Credit Suisse bonds as part of a government-orchestrated rescue was unlawful but stopped short of ruling whether investors should be repaid. The case was brought by about 3,000 investors across 360 cases after Swiss financial regulator Finma ordered the bank’s Additional Tier 1 (AT1) bonds be written off in March 2023, as part of Credit Suisse’s emergency rescue by UBS. The Swiss Federal Administrative Court said that Finma had no clear legal basis for the move. The court found that the regulator’s decree had been invalid but did not rule on whether the bonds should be reinstated or repaid. Source: FT https://lnkd.in/eTfcR2yT

Silver was brutally slammed by $3.75/oz, or 7%, in the early hours of the morning.

Is someone (a bank?) trying to force prices below the critical $50 level ??? Source: Jesse Columbo

Investing with intelligence

Our latest research, commentary and market outlooks