Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

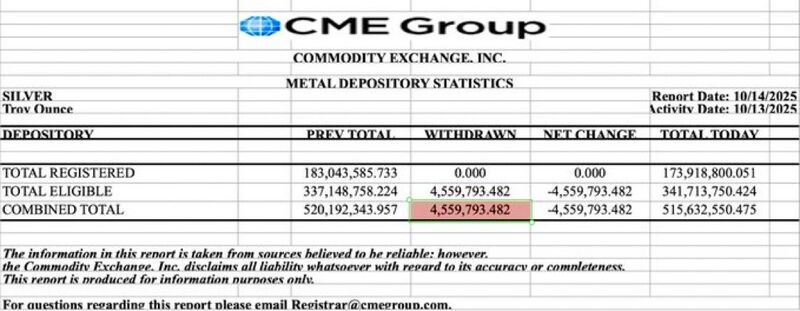

Silver continues leaving COMEX, another 4.56 million ounces withdrawn in a single day.

That means traders are actually taking physical delivery instead of just trading paper contracts. It’s happening because the London silver price is higher than New York’s, so traders are pulling real metal from U.S. vaults to sell it where it’s worth more. Each withdrawal tightens supply further and shows how physical demand is outpacing what’s left on paper. Source: StockMarket.news

OKLO

One year ago: $OKLO $9/share, $0 in revenue. Today: $OKLO $175/share, still $0 in revenue. Source: Trend Spider

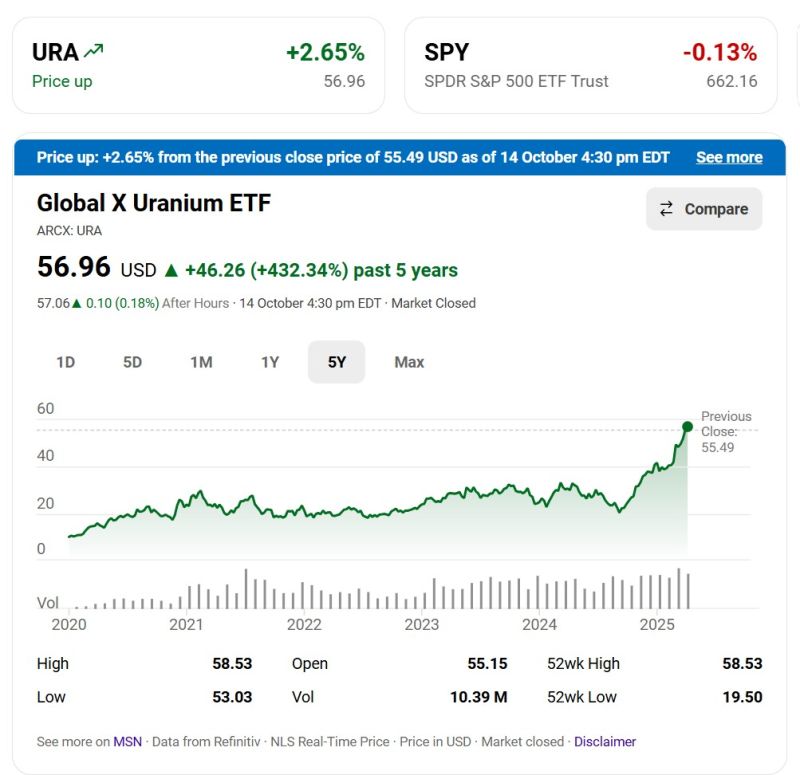

$URA Global X Uranium miners ETF was up another +2.7% yesterday.

It is up +432.34% over the past 5 years

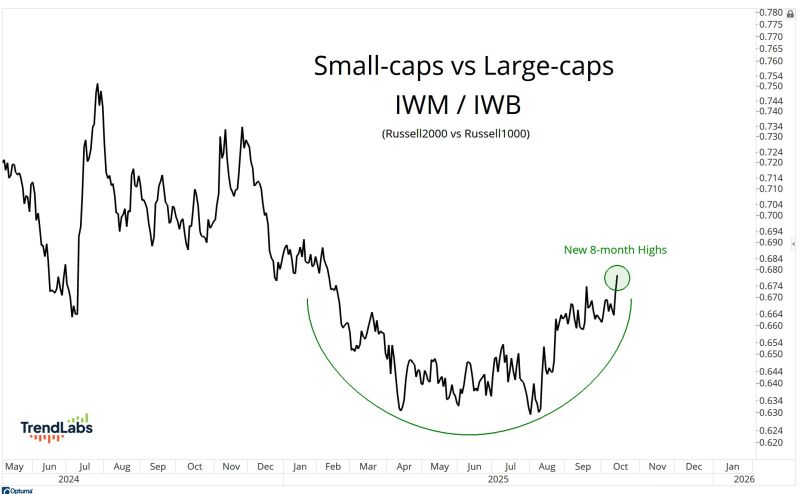

US small-caps yesterday hit the highest levels since February relative to Large-caps

Source: J-C Parets

JPMorgan is launching a $1.5 Trillion initiative to boost critical industries in America:

“It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products and manufacturing.” -Jamie Dimon Source: Geiger Capital

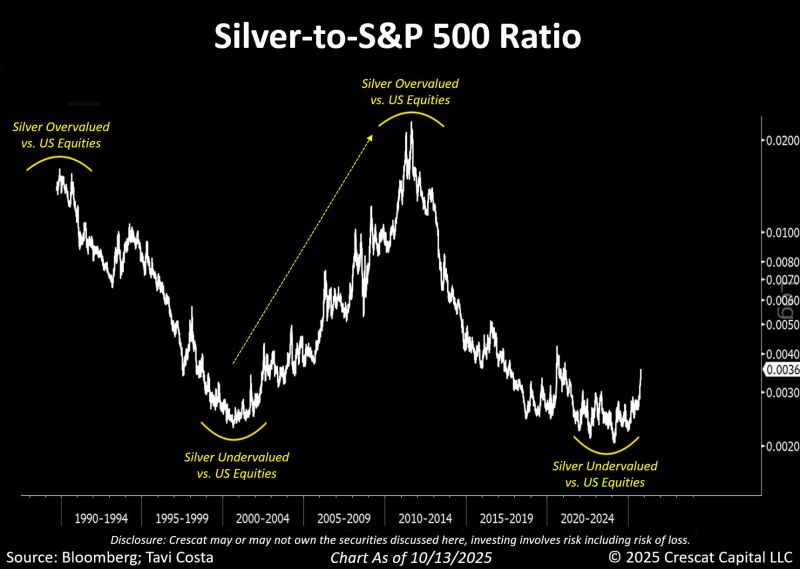

Are we still in the early stages of a major cycle where silver outperforms U.S. equities????

This chart by Otavio (Tavi) Costa highlights just how early we might be in a broader trend of capital rotating into hard assets. Source: Crescat, Tavi Costa, Bloomberg

Quantum stocks surged yesterday after @JPMorgan’s $10B strategic tech investment sparked institutional inflows.

Major movers like $RGTI, $QBTS, $IONQ & $QUBT are up today. Source: Vest @VestExchange

Gold reaches most overbought level in history after hitting 91.8 on the monthly RSI

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks