Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

“If we lose this, we do not have a future at Ford,” says Jim Farley, CEO at Ford

China added 295,000 industrial robots last year. The US? 34,000. The UK? 2,500. Source: Zane Hengsperger @zanehengsperger

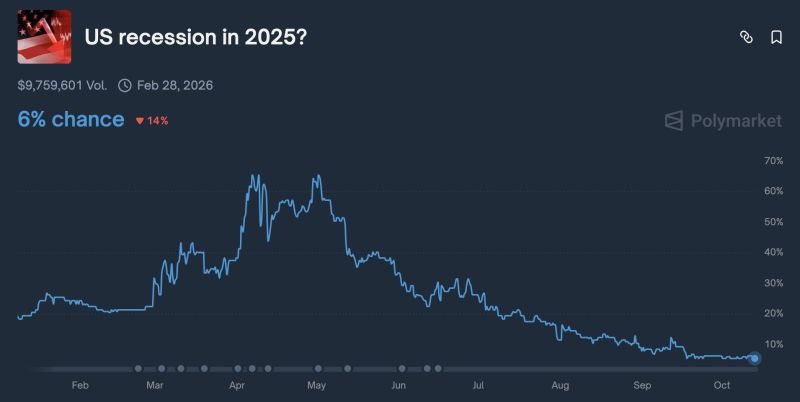

US recession odds have cratered from over 65% earlier this year to only 6% today.

Source: Anthony Pompliano @APompliano

Every deal, argument, or conflict has one secret weapon: communication control.

The FBI mastered it through decades of hostage negotiations. Here are FBI's 6 Secrets of Negotiation That Work in Business and Life: Source: Saheed @mrgroowth

Not really a signal of appeasement...

US Treasury secretary Scott Bessent has accused China of trying to hurt the world’s economy after Beijing imposed sweeping export controls on rare earths and critical minerals, hitting global supply chains. Bessent told the FT that China’s introduction of the controls, three weeks before US President Donald Trump is expected to meet his Chinese counterpart Xi Jinping in South Korea, reflected problems in its own economy. “This is a sign of how weak their economy is, and they want to pull everybody else down with them,” Bessent said on Monday. https://lnkd.in/e2YHBgxP

According to StockMarket.news

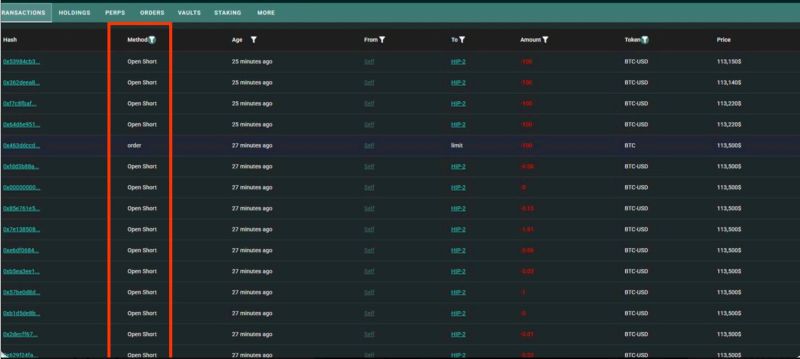

The same trader who made $192M last week thanks to almost perfect timing in his/her shorts on cryptos just opened another massive round of shorts on Hyperliquid reportedly over $160M worth. The timing is uncanny. Does he/she know something we don’t?

Negative spread for corporates vs. US Treasuries can indeed happen

Source Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks