Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

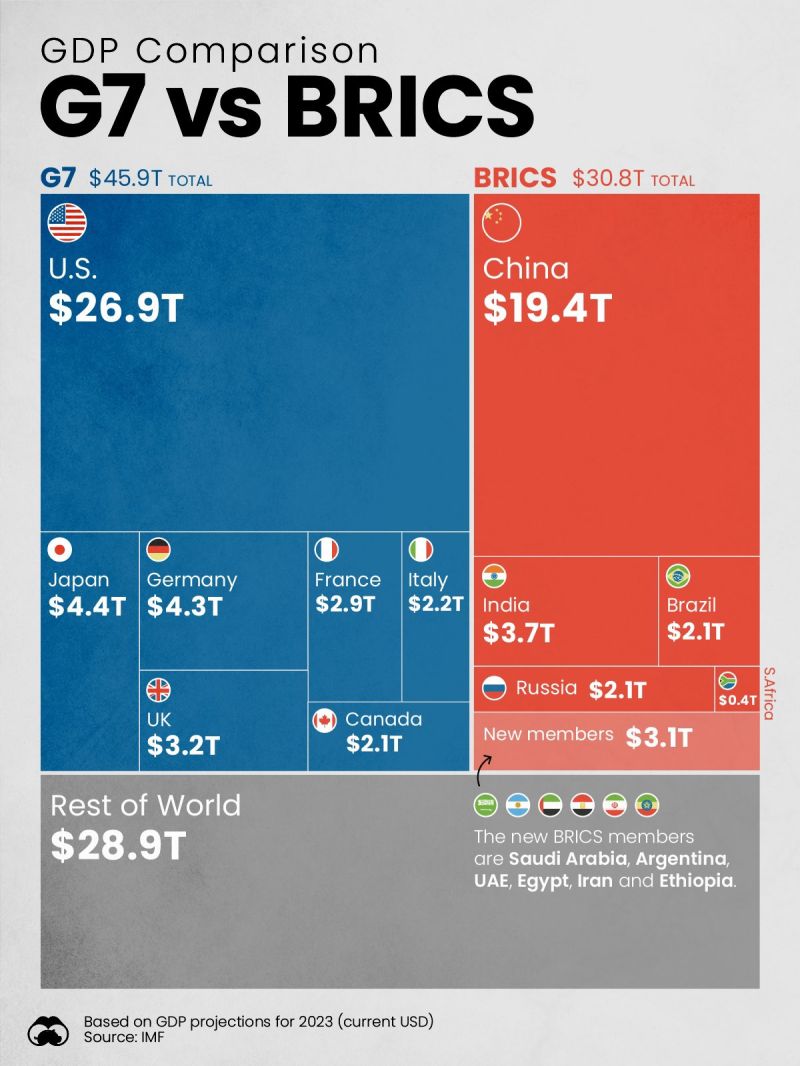

G7 vs. BRICS GDP

Source: Visual Capitalist, Barchart

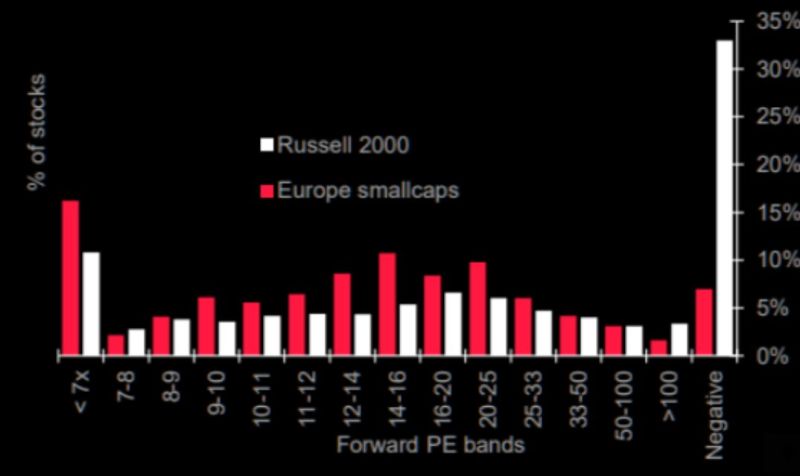

Welcome to Zombie Land

"There are some serious problems in small-caps, especially in the US. Good luck paying interest without profits. Great chart via Soc Gen showing the distribution of stock forward P/E valuations in the MSCI Europe small cap and Russell 2000 index. Source: SG, Themarketear, Lance Roberts

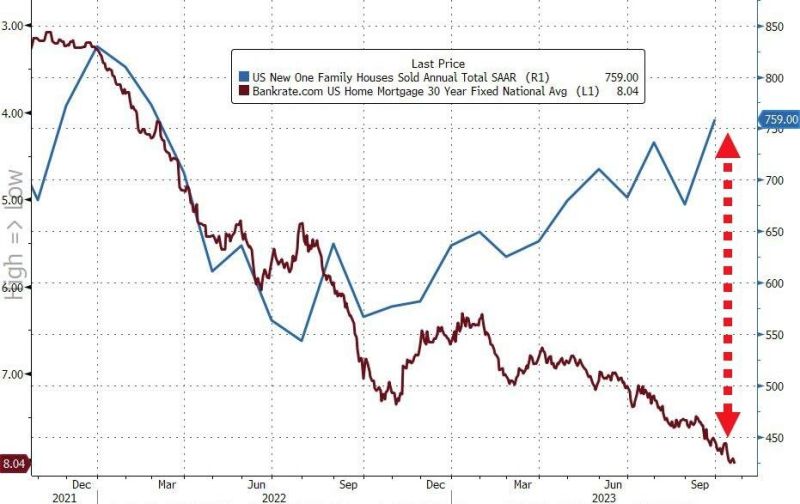

The US housing market conundrum ->

New home sales just surged 12.3% month-over-month in September, the largest jump since August 2022. Even as mortgage rates push above 8% for the first time in 23 years, new home sales are surging. The gap between new home sales and mortgage rates has never been wider. Why is this happening? Explanation by The Kobeissi Letter: -> Homebuilders are taking on some of the cost of higher mortgages AND existing home sales are at their lowest since 2010. New homes are the only option for buyers and homebuilders are helping pay for it. Source: The Kobeissi Letter, www.zerohedge.com

Nikkei 225 Index testing again support zone

Nikkei 225 Index (NKY) is testing again support zone 30'480-30'680. Keep an eye. Source : Bloomberg

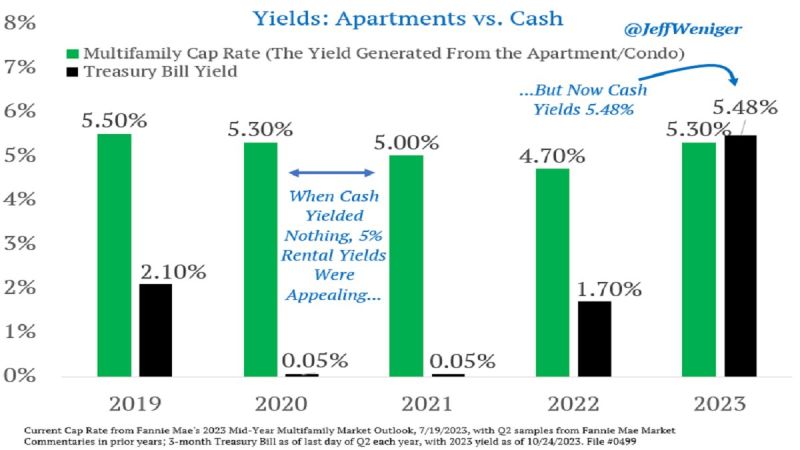

The money market yield spike upends a ton of business models. In this case, landlording in the US

Inded, multifamily cap rate is now BELOW cash rate... Source: Jeff Weniger

Bitcoin has outperformed equities, gold and USD year-to-date It has increased by more than 100% this year, despite:

- War Conflict - Elevated inflation - Rising oil prices - High-interest rates This is what happens when institutions like Blackrock jump on board Institutional adoption is going to be a major theme for this asset class. Source: Game of Trades

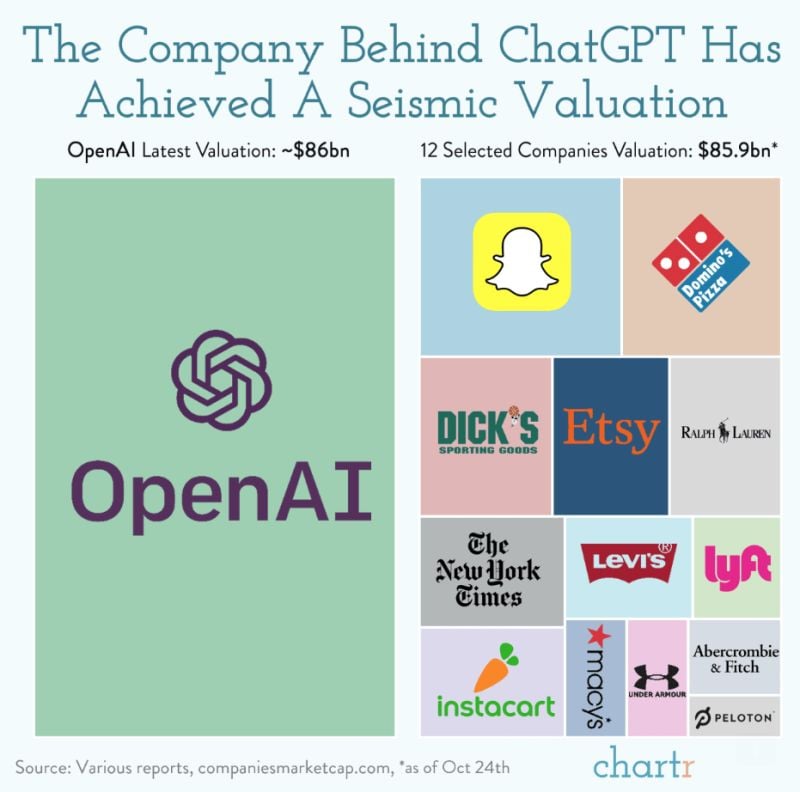

OpenAI valuation in perspective - chart by Chartr

Talk is meant to be cheap, but OpenAI, the force behind the viral hit ChatGPT, has turned it into an absolute goldmine, with the company currently in discussions to sell shares at a valuation of $86 billion. That's a remarkable three-fold increase from just 6 months ago, with the WSJ reporting an initial range of $80-90bn, before Bloomberg narrowed the figure to around $86bn, citing sources familiar with the matter. That would place OpenAI among the most valuable tech startups in the world, only behind giants like ByteDance (TikTok owner) and SpaceX. For context, it’s also roughly equivalent to the value of 12 of the biggest consumer brands in America combined — a theoretical corporate frankenstein including SNAP, The New York Times, Etsy, Domino’s and 8 others.

Meta’s ad rebound gets huge assist from China even though its services are banned there

Meta may be banned from operating in China, but the company is counting on advertisers there to boost its growth. Finance chief Susan Li told analysts on Wednesday’s earnings call that Chinese companies played a major role this quarter. Online commerce and gaming “benefited from spend among advertisers in China reaching customers in other markets,” Li said. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks