Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

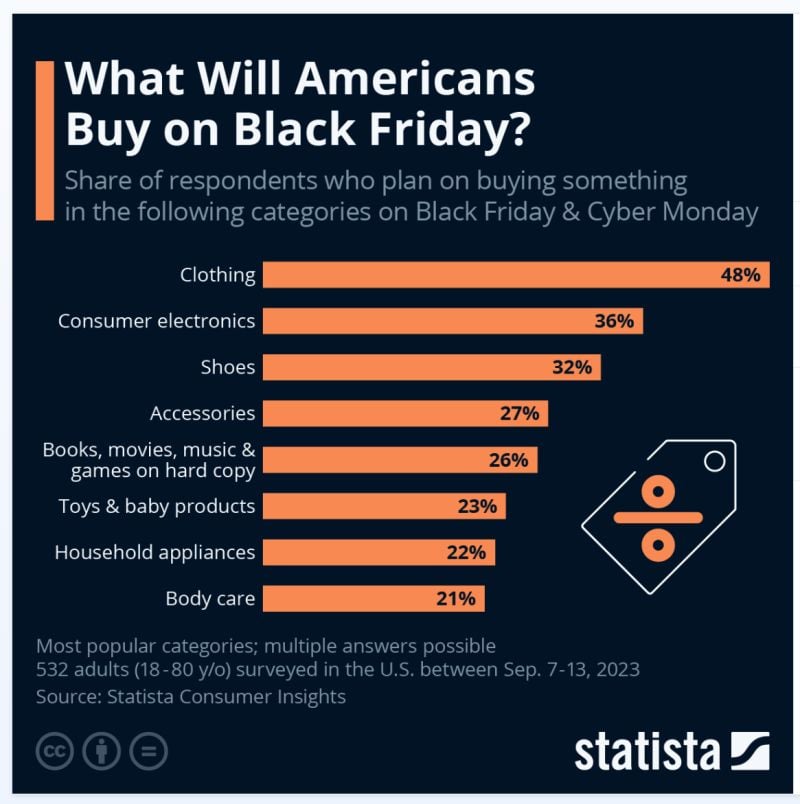

What Will Americans Buy on Black Friday?

TODAY IS BLACK FRIDAY... Black Friday falls on the fourth Friday of November each year, with Cyber Monday following just three days later. The two shopping days are some of the busiest of the year in the United States, with an estimated $19.6 billion raked in over the 2021 Thanksgiving weekend in e-commerce revenue alone. U.S. shoppers keen to make the most of discounted prices were asked in a Statista survey which items they were planning on buying. As the following chart shows, clothing, electronics and shoes are among the most popular choices this year. In terms of other shopping behaviors, the same survey found that where 41 percent of U.S. respondents said they would be shopping via online stores, 28 percent were undecided and 25 percent planned on heading to brick-and-mortar shops. Source: Statista

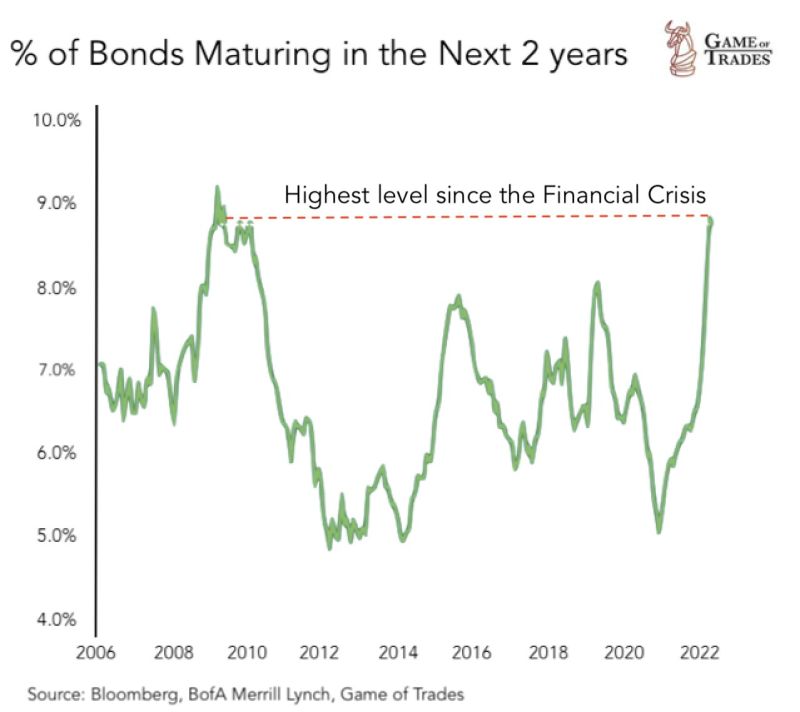

This level was last seen during the Financial Crisis

9% of bonds are due to mature within the next 2 years. High interest rates will make it harder to refinance. Source: Game of Trades

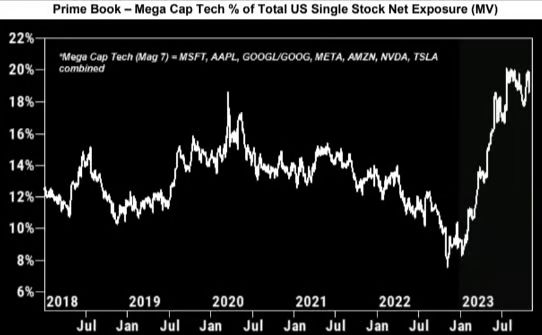

Hedge Fund exposure to the Magnificent Seven is quite high, according to data from Goldman Sachs

Source: Markets Mayhem

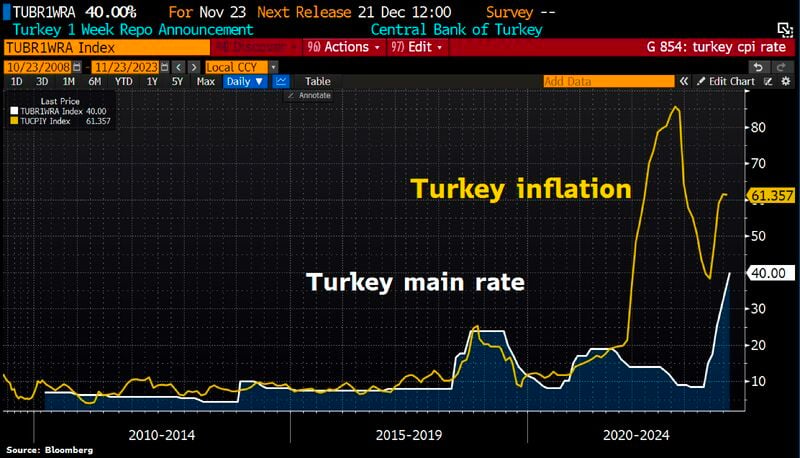

Turkey’s central bank hiked its key interest rate to 40% on Thursday

The lira was trading at 28.766 to the dollar following the news, slightly stronger against the greenback. The rate increase was double economists’ expectations, who had forecast a 250-basis-point hike. The move was seen as a continuation of the bank’s attempt to combat high inflation and a falling lira. Inflation in the country came in at a whopping 61% in October Source: Bloomberg, CNBC

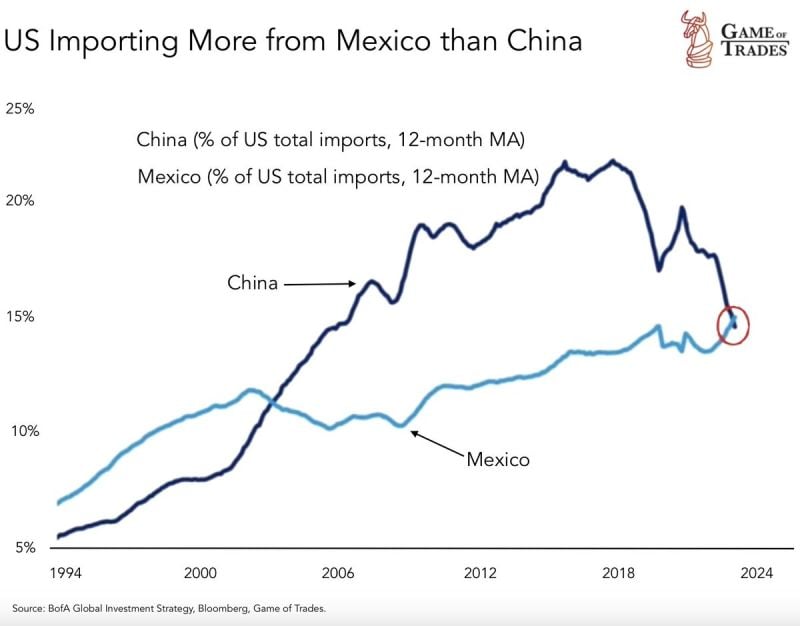

ALERT: US imports from Mexico have just surpassed those from China This has happened for the first time since in 2 decades

Source: Games of Trades

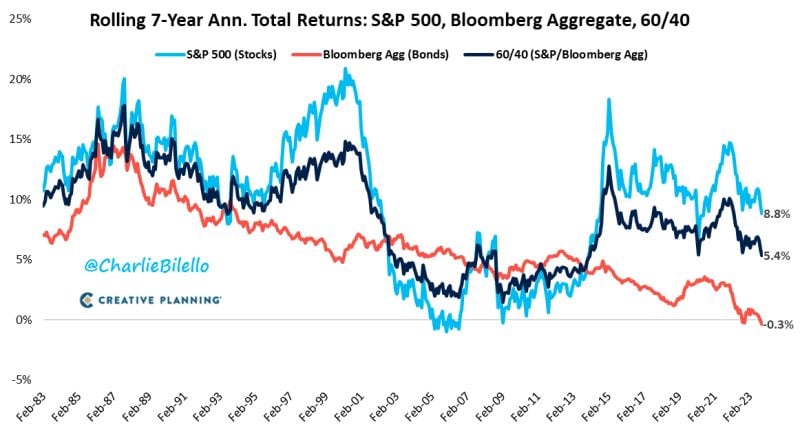

US Bonds have a negative return over the last 7 years. Does that mean the 60/40 portfolio is dead?

Source: Charlie Bilello

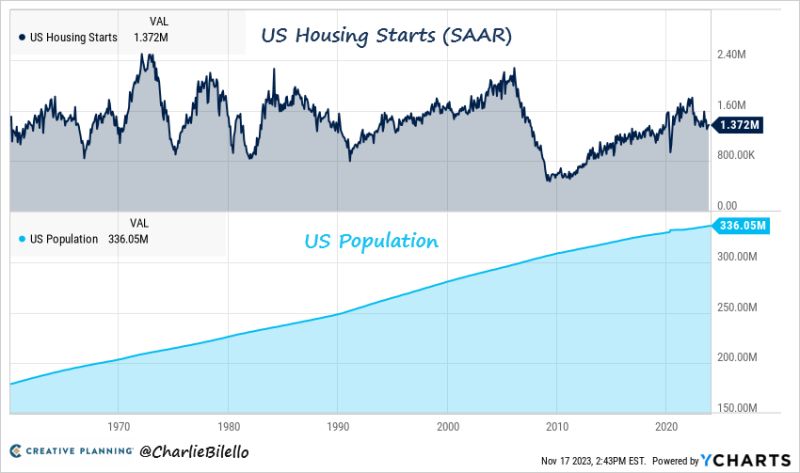

The US population has increased 87% since 1960 but fewer homes are being built today than back then

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks