Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

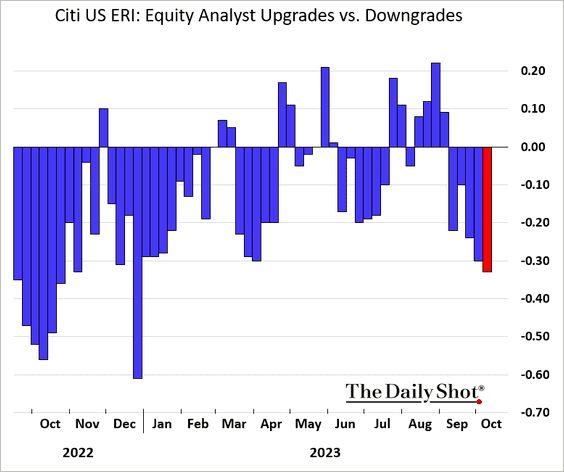

Analysts’ earnings downgrades for US companies are increasingly outpacing upgrades

Source: The Daily Shot

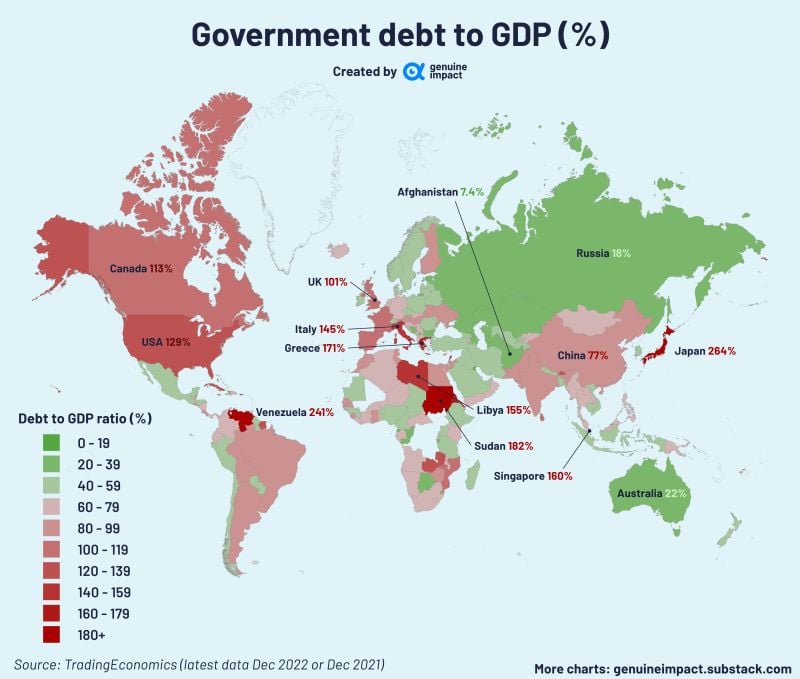

🌍Worldwide, many other countries have debt that is more than their GDP

Japan consistently ranks among the top nations with a debt-to-GDP ratio exceeding 200%. Source: Genuine Impact

Taiwan Semiconductor Manufacturing breaking June downtrend

Taiwan Semiconductor Manufacturing (TSM US) is breaking June downtrend. Strong volume due to Earnings. Keep an eye. Source : Bloomberg

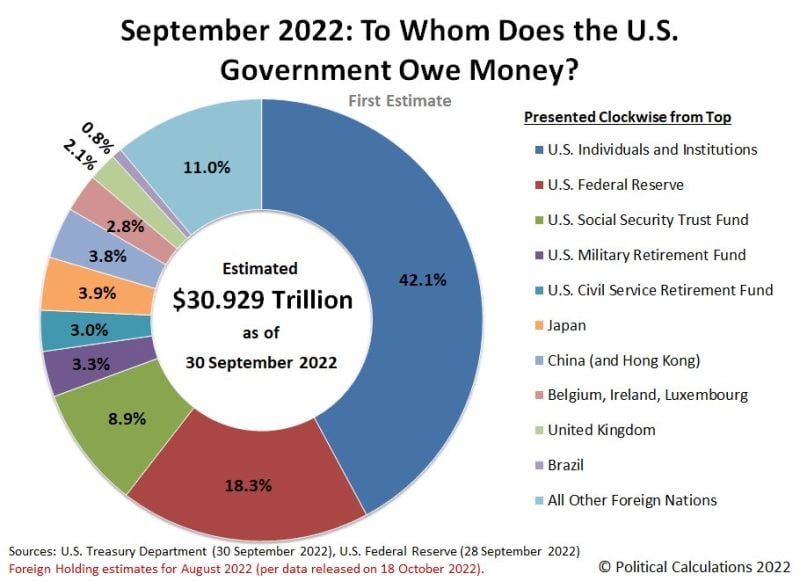

To whom the US owes money? Mostly to themselves actually...

Source: The King's Cheque En Qua

AstraZeneca retesting April downtrend

AstraZeneca (AZN LN) is back on April downtrend. This is a retest of September breakout. Keep an eye. Source : Bloomberg

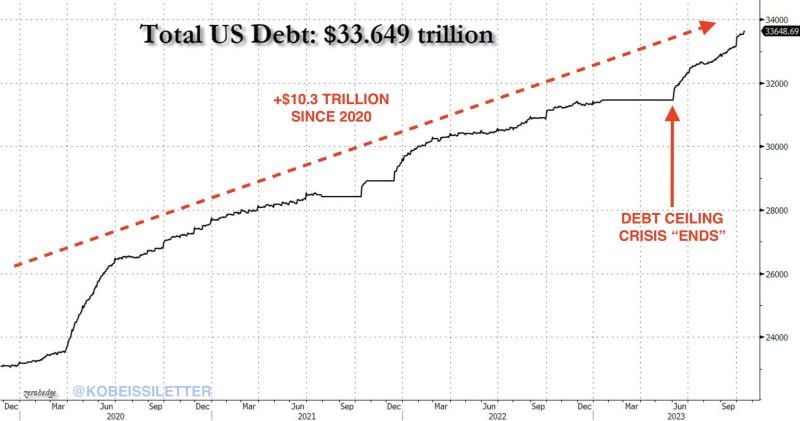

Total US debt is now up ~$650 BILLION since it crossed $33 trillion exactly 1 month ago, according to Zerohedge

Yesterday alone, total US debt jumped by another $58 billion. Total US debt has grown by ~$22 billion PER DAY for the last month. In other words, the US has added ~$915 million in debt every hour for the last month. Since the debt ceiling "crisis" ended, total US debt is up over $2 trillion. Since 2020, total US debt is officially up more than $10 TRILLION. Source: The Kobeissi Letter

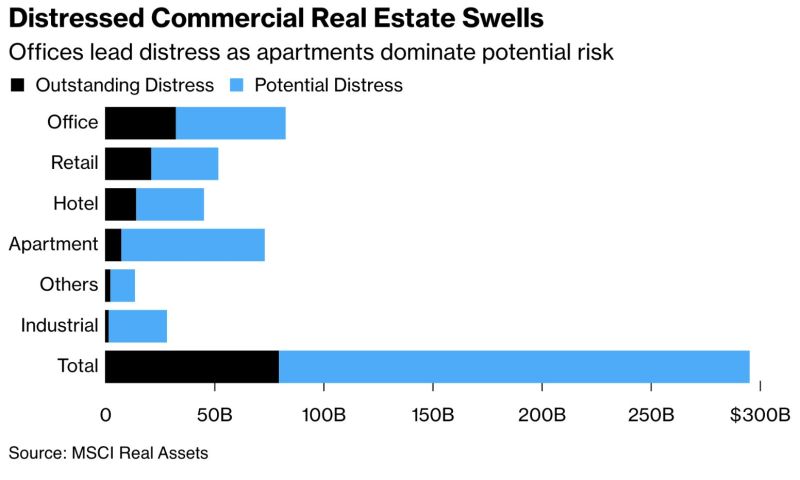

JUST IN: The Value of US Distressed commercial real-eestate is approaching $80 billion, the highest level in a decade Now less than HALF the 2008 financial crisis levels

Blackstone, Brookfield and Goldman Sachs have defaulted or relinquished offices to lenders this year. Today, Pimco walked away from 20 hotels with +$240MM in debt. Over $1.5 trillion of commercial real estate loans will mature over the next 3 years. Source: Bloomberg, Genevieve Roch-Decter, CFA, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks