Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

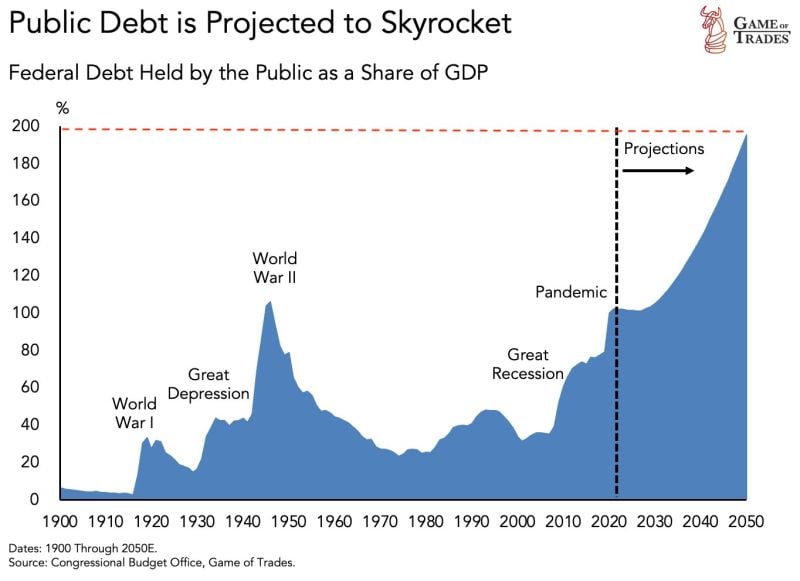

The US government has consistently shown fiscal irresponsibility

Debt-to-GDP is projected to reach 200% by 2050. The government is going to face a major problem with the amount of money they will have to pay in interest. Everybody, except the US government, seems to understand the unsustainability of this path. Source: Game of Trades

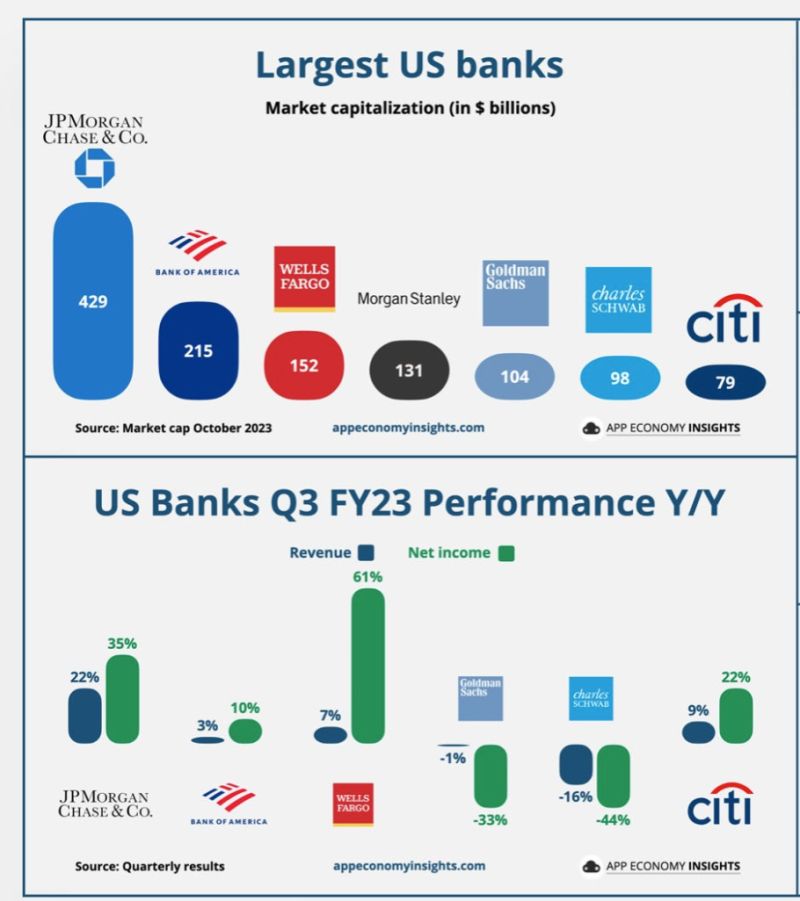

US large banks 3Q earnings season so far

Source: App Economy Insights

China shows signs of stabilization after a long period of slowdown and disappoitning data over the spring

China’s Q3 growth exceeds forecast, buoyed by consumer spending and industrial production. China posted 4.9% growth in the July to September quarter from a year earlier, stronger than the median forecast for 4.6%. Quarter on quarter, China’s GDP grew 1.3% in the third quarter, helped by a downward revision for Q2 from +0.8% to 0.5%.

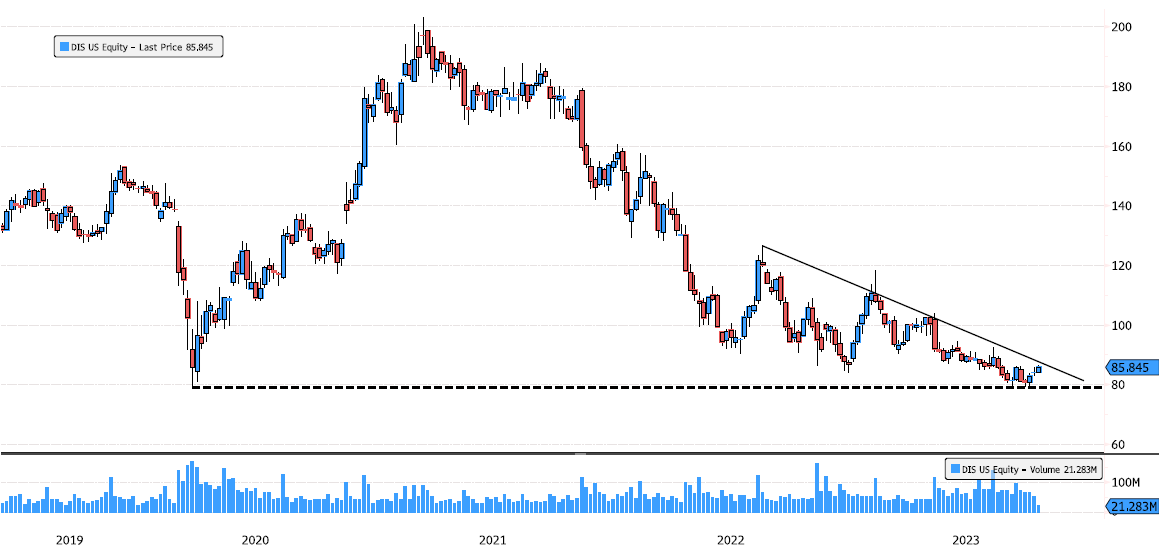

Disney towards the end of the triangle

Disney (DIS US) has now consolidated 30% since March 2021 highs. Volatility is contracting. Keep an eye on these levels. August 2022 downtrend around 88 and March 2020 support at 79. Source : Bloomberg

Ahead of Powell speech tomorrow...

Confidence in the Chair of the Federal Reserve has reached its lowest point in 20 years... By Visual capitalist

Michael Burry Stock Tracker ♟

🚨🚨Latest news on real estate market

The US 10-year note yield is now officially above the median cap rate for the first time since 2008, according to Reventure Consulting

In simple terms, the return on an investment property is now BELOW the 10-year note yield. It should be no surprise that investor house purchases are now down a massive 45% this year. Source: The Kobeissi Letter

After adjusting for inflation, US retail sales fell 0.7% over the last year, the 11th consecutive YoY decline

That's the longest down streak since 2009. Nominal retail sales increased 3.0% YoY vs. a historical average of 4.7%. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks