Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

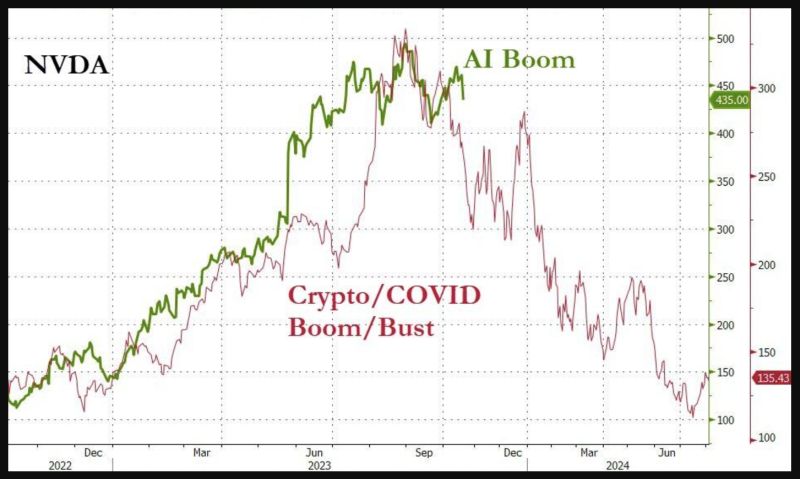

Did President Biden pop the AI nvidia bubble?

A similar boom/bust head & shoulders already happened in the recent past... Source: Bloomberg, www.zerohedge.com

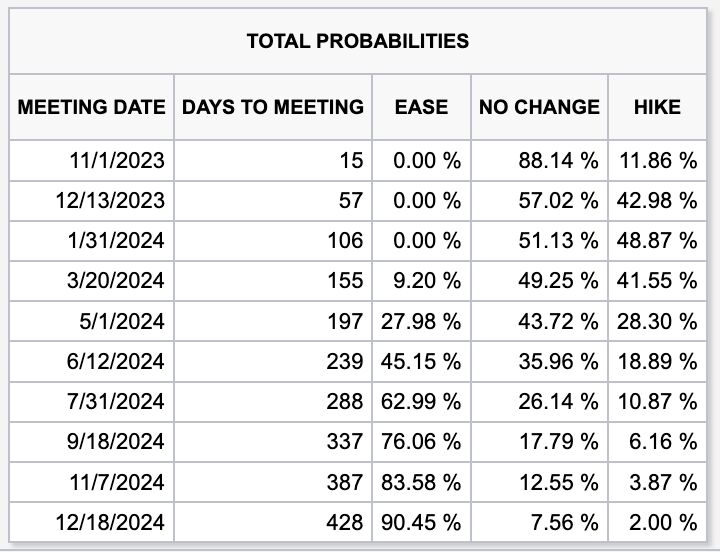

Stunning to see that markets are beginning to price-in chances of rate HIKES all the way until December 2024

There's now a ~49% chance of a rate hike by January 2024. There is even an 11% chance of a rate hike in July 2024... Meanwhile, the 10-year note yield is nearing 4.90% right now. Will 8% mortgages soon going to look like a good deal? Source: The Kobeissi Letter

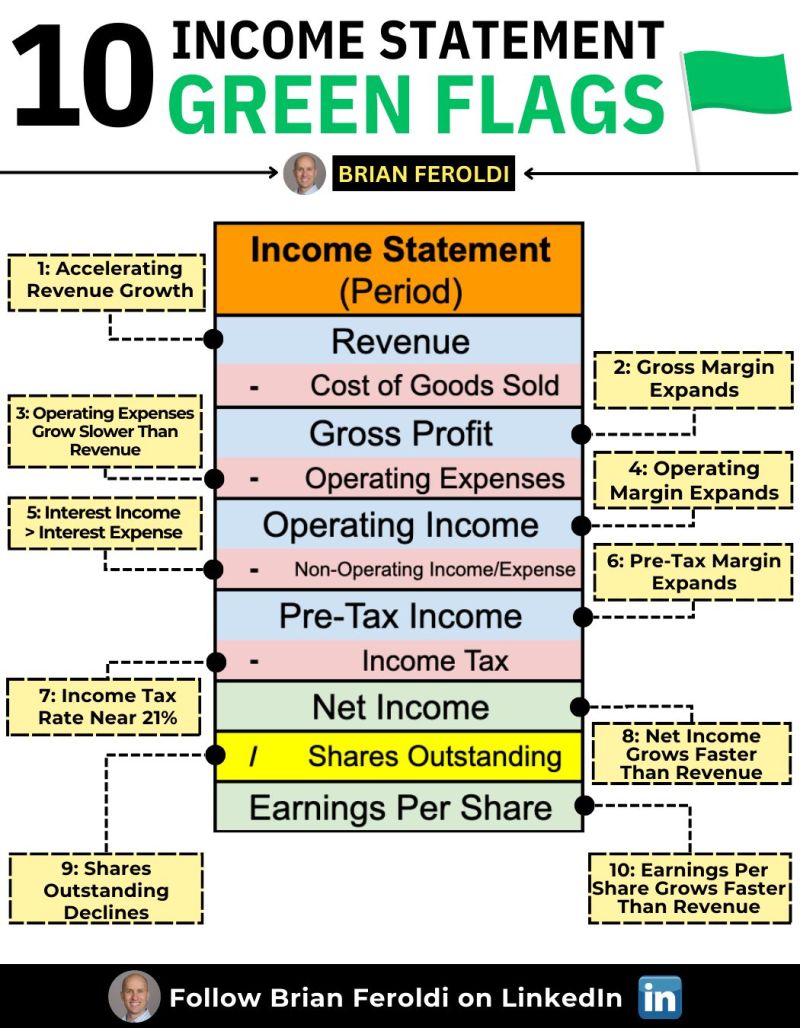

How To Analyze An Income Statement - FAST. Watch for these 10 green flags

By Brian Feroldi

There is a different culture of public debt in Germany than in France

Nevertheless, French Finance Minister Le Maire hopes to find a compromise for new budget rules w/Germany. “We will continue to work w/Christian Lindner in the coming weeks to try to reach a Franco-German accord that could serve as a basis for a wider deal,” Le Maire said ahead of a meeting with his EU peers in Luxembourg. Source: HolgerZ, Bloomberg

The Israeli Shekel has fallen to its lowest price against the U.S. Dollar since early 2015

Source: barchart

Coca-Cola on a major level

Coca-Cola (KO US) is back on September and December 2021 support. It is also back on February 2020 downtrend resistance acting as support now. Keep an eye. Source : Bloomberg

Bernard Arnault lost his spot as the world’s 2nd-richest person as a selloff in luxury stocks pushed his net worth below that of Amazon's Jeff Bezos

Arnault is now worth $155.1bn, just below Bezos’s $156.3bn, acc to Bloomberg. Within 3mths, Arnault has become $58bn poorer. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks