Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

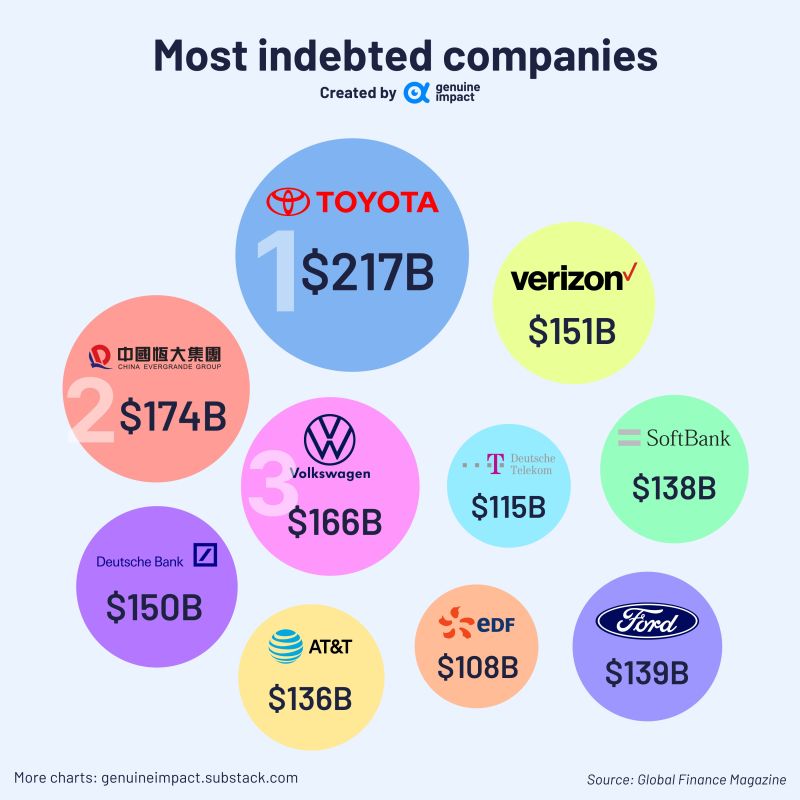

At the time of rising bond yields, here's a list of teh most indebted companies in the world by Genuine Impact

🚗Toyota Group is the most indebted company globally in 2023. 🏠While Evergrande Group, one of China’s biggest property developers, has lower debt than Toyota, its performance is significantly inferior to Toyota. It recently faced a debt crisis and is on the verge of collapse.

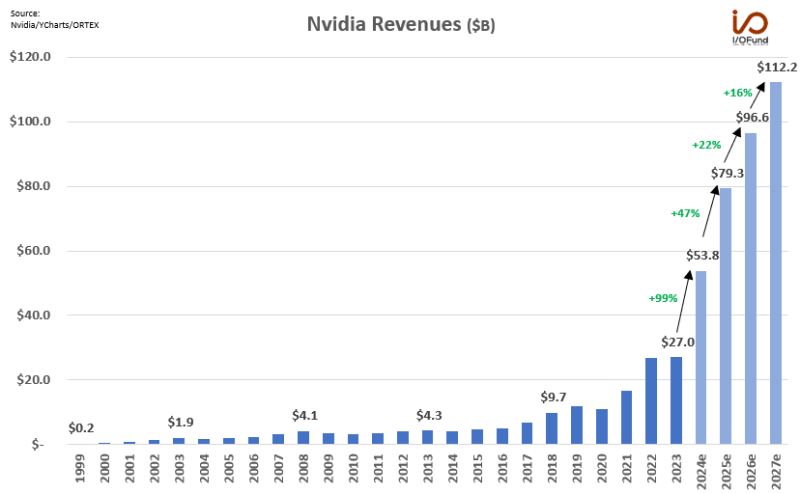

Through FY24 to FY27, Nvidia $NVDA is projected to generate a total of $342B in revenue

That forecasted total is more than double Nvidia’s lifetime revenues of $160.3B through the end of FY23. Source: Beth Kindig

EM Middle East Sovereign Bonds Impacted by the Israeli-Palestinian Conflict

Since the commencement of the Israel-Palestine conflict, the 5-year CDS (Credit Default Swap) for Middle East sovereign bonds has experienced a significant surge. 📈 Notably, the market's response doesn't reflect heightened concern. This is evident as US equities have continued to climb since the conflict's onset, while interest rates have surged back to previous highs. 📈📊 Thus far, the impact has primarily reverberated in the commodities market, with fluctuations affecting oil and gold prices. Additionally, the Middle East sovereign countries in the EM (Emerging Markets) segment have also felt the repercussions. 🛢️💰 Is the market right to be this complacent in the face of ongoing geopolitical tensions?

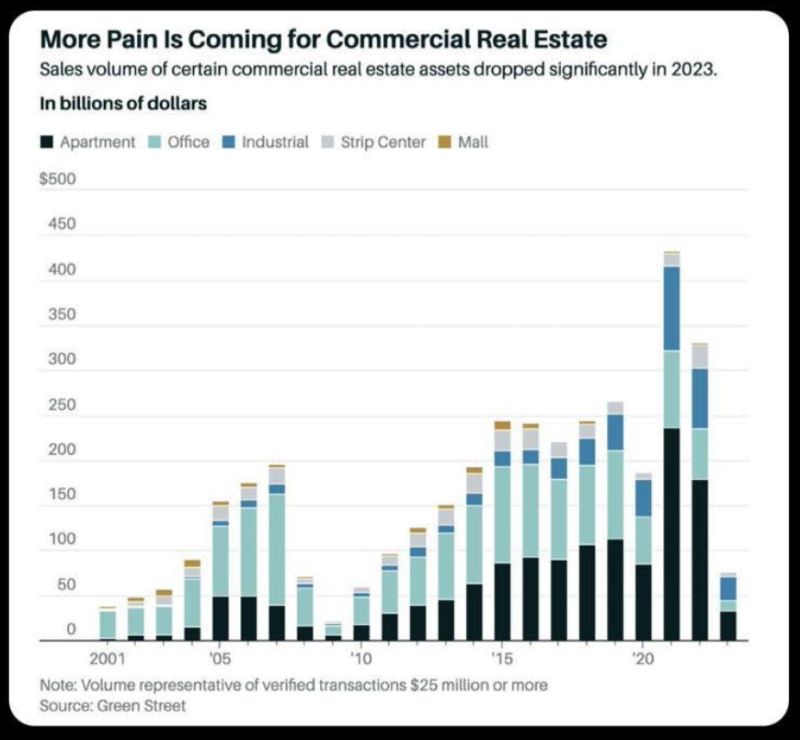

US Commercial real estate sales volume have fallen to the lowest level in 13 years

Source: Green Street

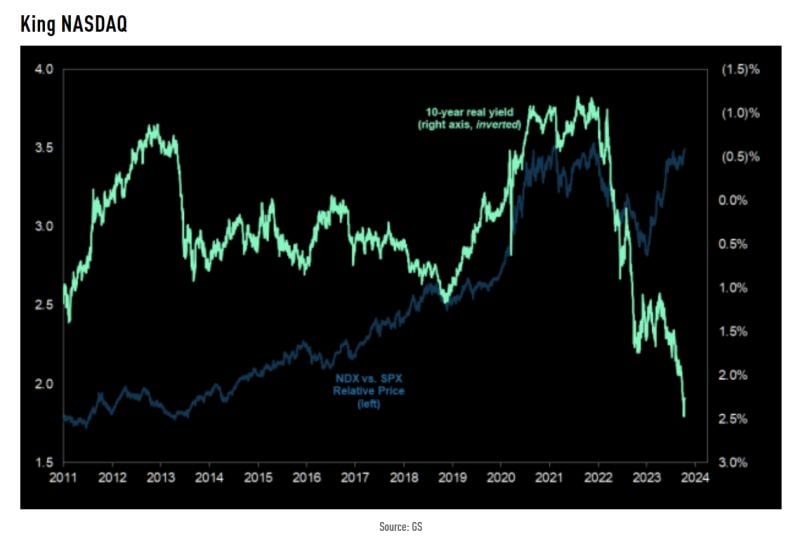

The relative Nasdaq 100 bull does not care about no rates moving higher...

Source: TME, Goldman Sachs

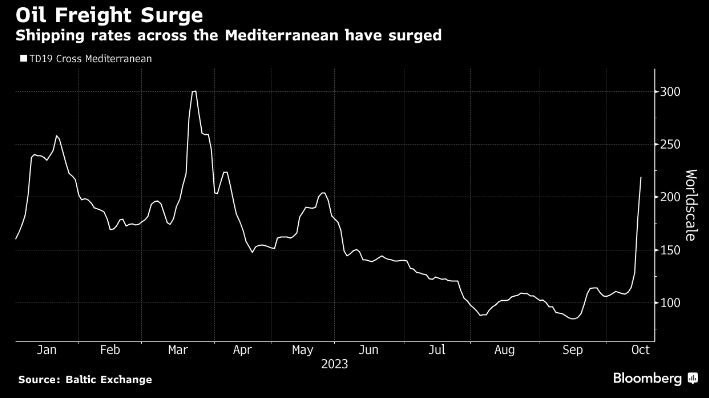

Cost to move oil has surged!

Since Hamas attacked Israel, freight rates on 16 global routes are up +50%. Biggest gain has been for shipments across the Mediterranean Sea, which are up 2x. This is inflationary Source: Bloomberg, Genevieve Roch-Decter

Investing with intelligence

Our latest research, commentary and market outlooks