Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

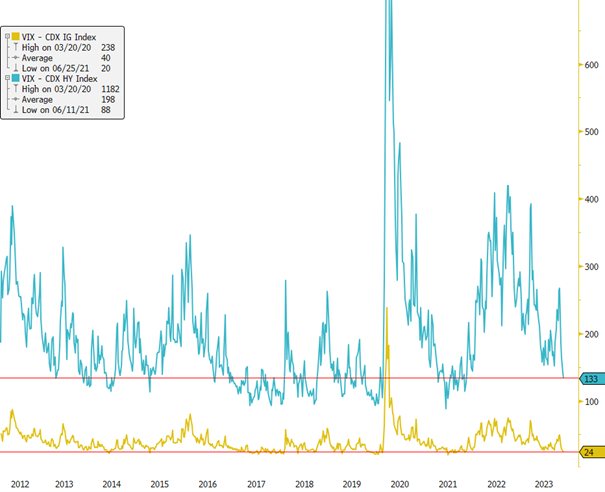

Record-Low Volatility in the US Credit Market! 📉🌐

Amidst ongoing rate volatility (MOVE index) showing a persistent high, albeit with a decreasing trend over the past two months, the volatility in credit markets has taken a different turn. Currently, volatility in US Investment Grade (IG) corporate bonds has reached levels not seen since 2021, hovering close to record lows. Additionally, the volatility in US High Yield (HY) has experienced a significant drop in the past month. With low volatility and tight credit spreads, the question arises: Is there still room to extract excess returns from the US credit market in 2024? 🤔 Source: Bloomberg #CreditMarkets #Volatility #FinanceInsights

According to an FT article published on Tuesday, Blackstone is to close a fund that offers investors exposure to a range of hedge funds and other trading strategies

This comes after assets fell nearly 90 per cent in four years amid lacklustre returns. The US alternative asset manager has told investors it will wind down the Blackstone Diversified Multi-Strategy fund by the end of the year, the group told the Financial Times. The so-called Ucits fund is governed by EU rules that make it easier for non-specialist investors to buy. Multi-strategy Ucits funds such as this are in part an attempt by managers to capitalise on the success of giant hashtag#hedgefunds such as Citadel and Millennium, which employ teams of traders across a wide range of strategies and which were among the biggest hedge fund winners from the coronavirus pandemic. The fund’s closure, which has not previously been reported, demonstrates how hard it can be to capture and package that success for a wide audience. Source: Financial Times

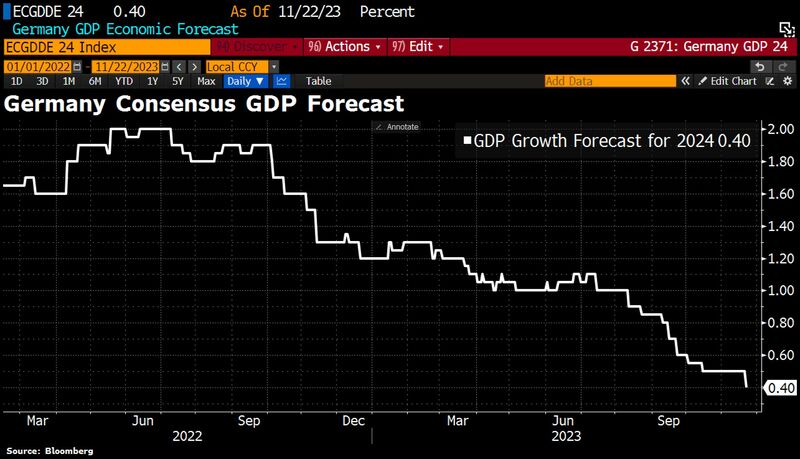

German growth forecasts for 2024 have been cut following the budget chaos after the Constitutional Court declared govt's spending plans unconstitutional

The consensus now expects GDP growth for Germany of just 0.4% for the coming year. Source: Bloomberg, HolgerZ

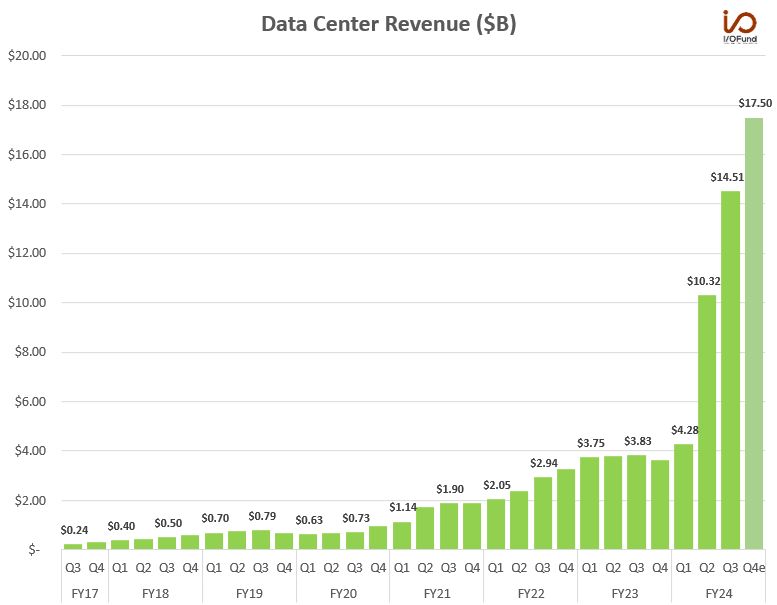

A look back on just how rapid Nvidia's $NVDA data center growth has been

· +79.7% CAGR since Q3 FY17's $240M revenue. · Reached record levels at $1.9B in Q3 FY21. · Grown 664% since then to $14.51B in Q3 FY24. · Projected to reach $46.6B in FY24, 56x more than FY17's $830M. Source: Beth Kindig

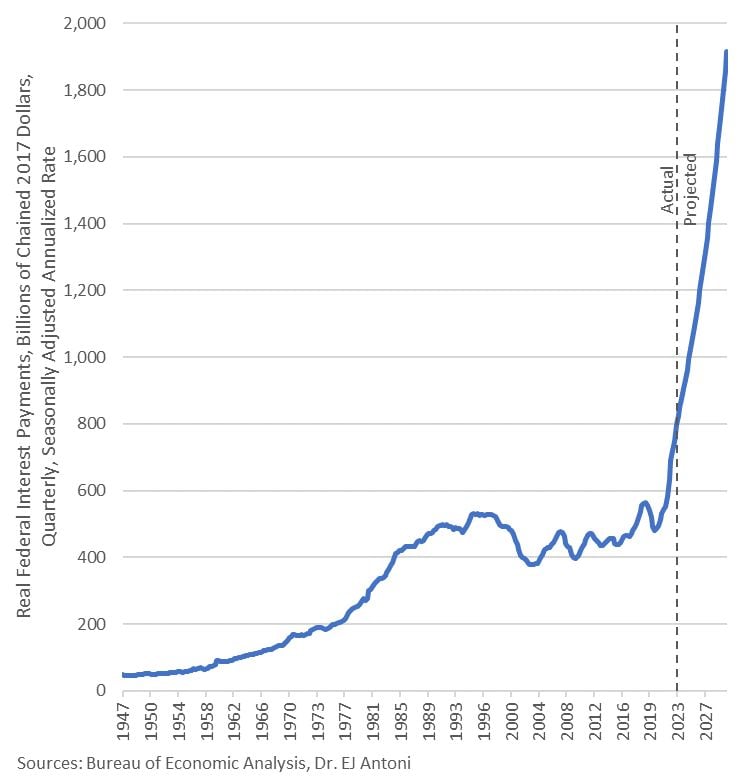

The US government collects about $2.5 trillion per year in personal income taxes. Of that about $1 trillion per year (40%) is being consumed by interest on the national debt

Interest on the debt is growing as old cheap debt matures and gets refinanced at the new higher rates. Plus new debt added every year. Within a few more years, at this pace, 100% of personal income taxes will be going to pay interest on the US national debt. Source: E.J Antoni, WallStreetSilver, BEA

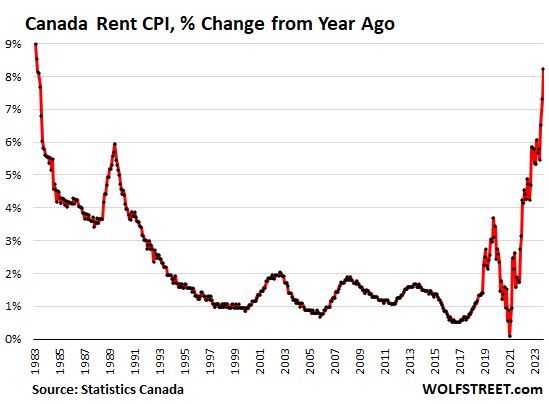

Compared to a year ago, the CPI for rent spiked by 8.2% in October, up from 7.3% in September, and the biggest year-over-year spike since April 1983

Soure: Wolfstreet.com, WallStreetSilver

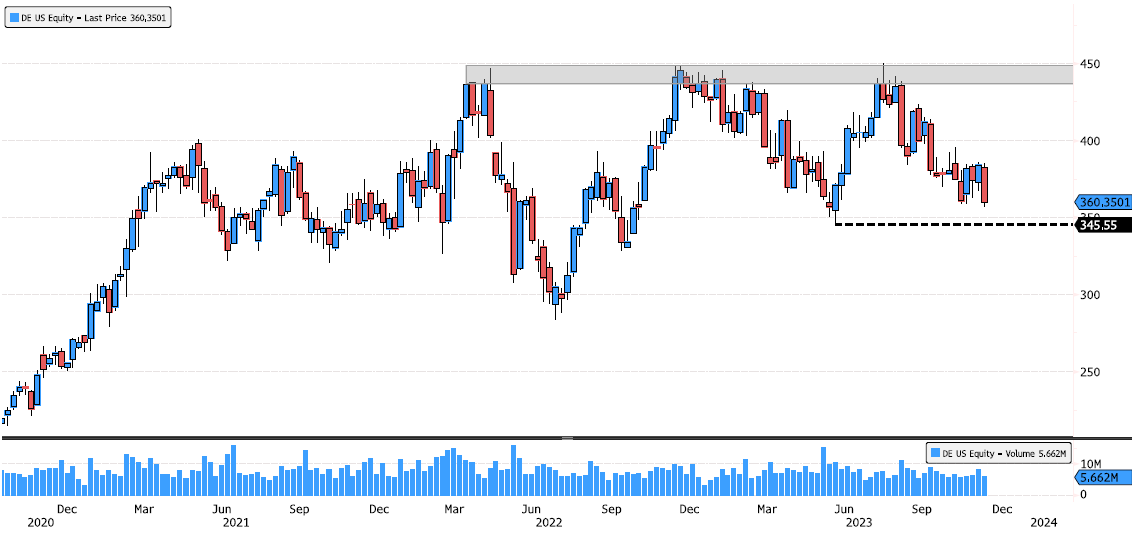

Deere looking for support after earnings

Deere (DE US) is down 6% today and testing first support 358.80. If it breaks, next level to look at will be 345.55. Source : Bloomberg

Uranium surges above $80 for the first time in more than 15 years

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks