Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

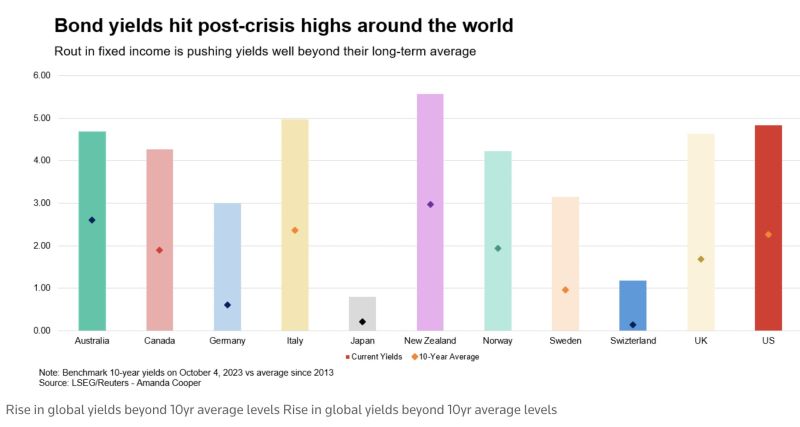

The global bond markets rout in one chart

The world's biggest bond markets hit by heavy selloff: Bond yileds hit post-crisis highs around the world: US 30y yields hit 5% before retreating. German bund yields hit 3%. Bond rout sounds alarm bells globally. Source: HolgerZ

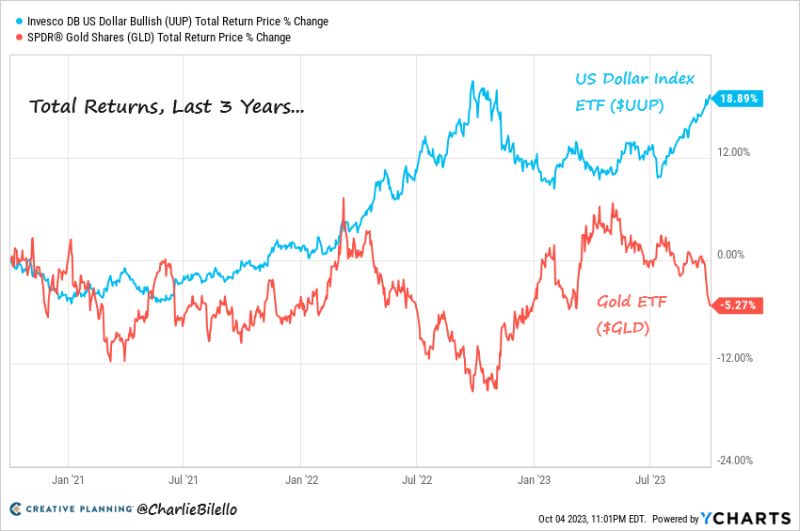

Over the last 3 years, the US Money Supply (M2) has increased by 14%, US inflation (CPI) has increased by 18%, and National Debt has grown by 24%

And over that time the US dollar Index ETF has gained 19% while the Gold ETF has lost 5%. As eveyone predicted... Source: Charlie Bilello

Looks like oil prices and bond yields have decoupled

Although the oil price has crashed sharply in the past 2 days, US 10y yields have fallen only slightly. Source: HolgerZ, Bloomberg

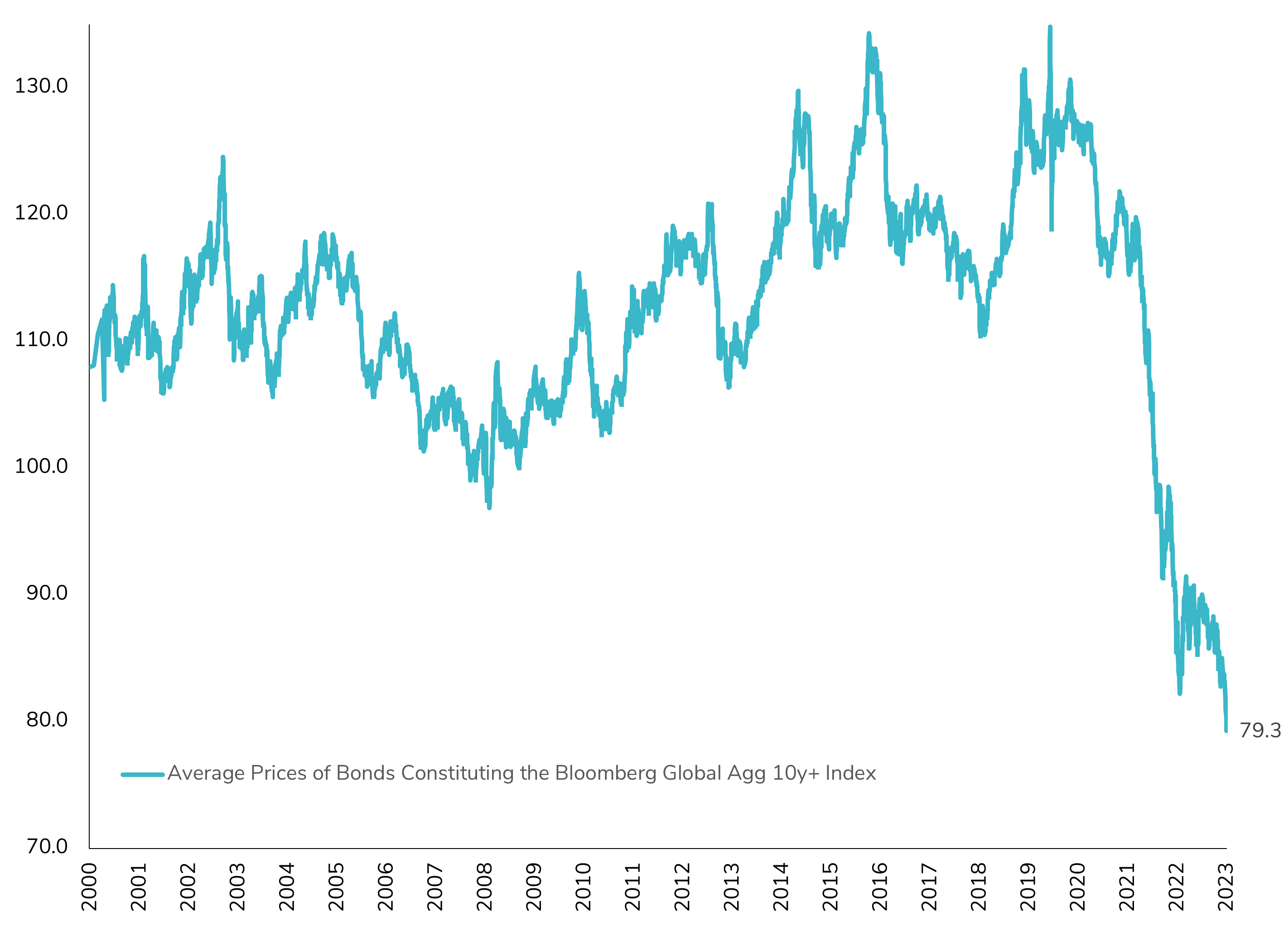

Long-Term Bond Prices Hitting Historic Lows in Global Aggregate Bonds Index: A Cautionary Tale of Convexity?

The average price of long-term bonds has recently reached historic lows, a significant development since the inception of the Bloomberg Global Aggregate Bonds Index in the early 2000s. If the "higher for longer" narrative materializes and persists, it carries substantial implications for bond investors, especially those with long-term bond holdings. This pertains to the convexity of long-term bonds, a crucial yet often underestimated aspect of fixed-income investments. Choosing to retain long-term bonds with reduced prices and the associated lower coupon payments may lead to overlooking the attractiveness of short-term bonds, which currently offer more technically appealing yields. This decision could potentially entail a nuanced opportunity cost in the short term, especially if the 'higher for longer' scenario (which implies a soft landing) persists. Source : Bloomberg

The construction sector in Germany is really crashing. The German PMI Construction Index fell to 39.3 in Sep from 41.5 in Aug, and the lowest level since statistics began

Source: HolgerZ, Bloomberg

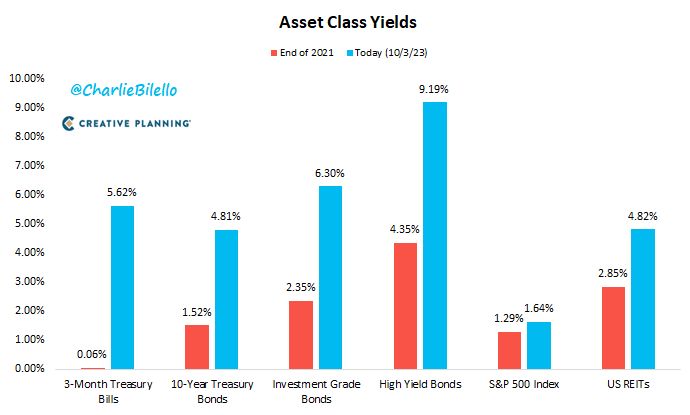

A lot has changed over the last two years...

Source: Charlie Bilello

Gold reaching key support level

Gold (XAU) is reaching key support level 1808. Keep an eye. Source : Bloomberg

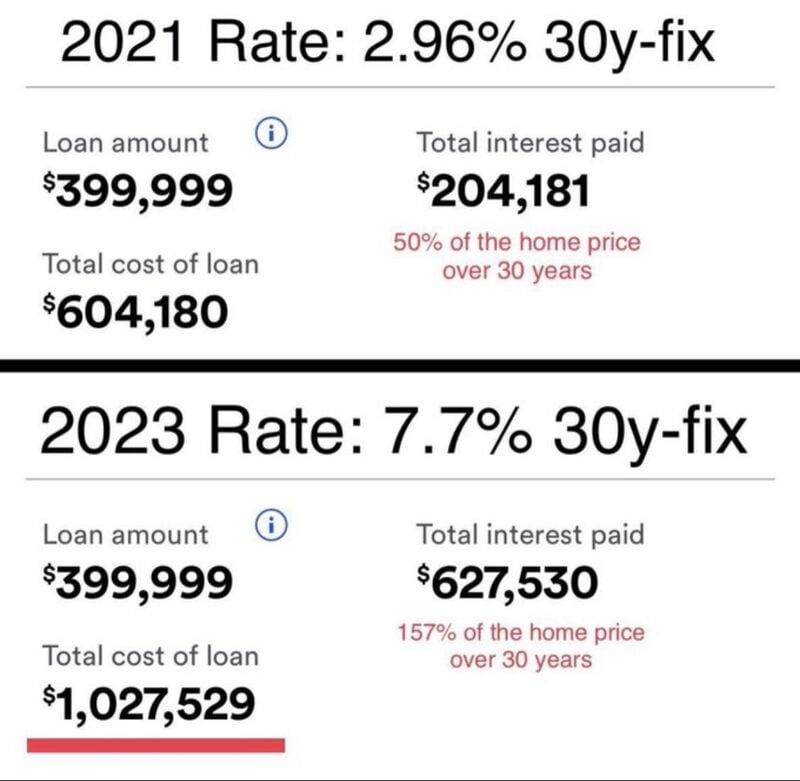

The impacts of rising interest rates on the costs of your mortgage over the life of the loan

In the US, A $400,000 house now costs over $1,000,000, with interest rates now at 7.7% from 3%. Source: WallStreet Sliver

Investing with intelligence

Our latest research, commentary and market outlooks