Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Yields on 10-year Treasuries are now almost equal to the trailing 12-month earnings yield on the S&P 500 index. This is the first time that's the case going back to 2002

Source: Bloomberg, Lisa Abramowitz

In case you missed it. Citigroup $C yesterday closed at its lowest price since the onset of Covid...

Source: barchart

Reminiscence of 1987 crash?

Carl Quintanilla posted: “When I started in the business in 1987,” reminisces Steve Sosnick of Interactive Brokers, “bonds were mired in a bear market for most of the year while stocks rallied sharply. Until, of course, that reversed ..” John Authers Comparison for bond yields bear a scarily unwelcome resemblance to 36 years ago -> Source chart: Bloomberg

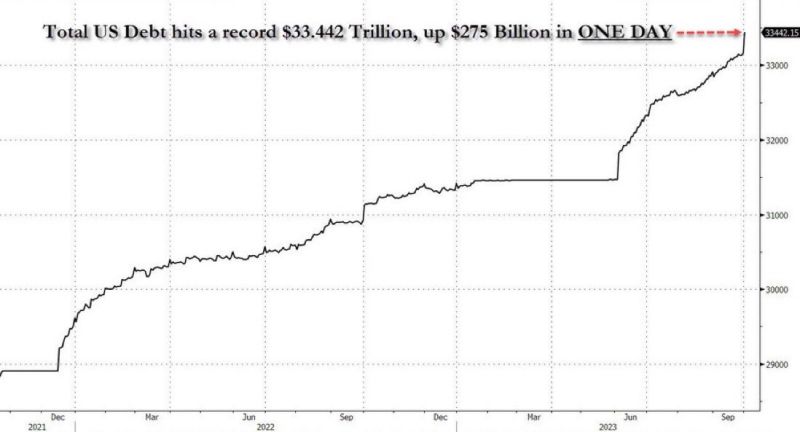

IS THE US ENTERING A DEBT SPIRAL LEADING TO A SOVEREIGN DEBT CRISIS?

Goldman, JP Morgan and BofA pull the alarm US debt is going parabolic! Total US debt rose by $275 billion in just ONE DAY. The US has added $32 billion in debt per day for the last 2 weeks. At the current pace, the US will add $1 trillion of debt in a month. Meanwhile: - David Lebovitz of JPMorgan Asset Management says something will break if rates continue to rise at the pace they've been going - "Fed hiking cycles always end with default & bankruptcy of extended governments, corporations, banks, investors." - BofA - Goldman Sachs: "There is a significant risk that FCIs continue to tighten until something breaks… (...) All roads appear to be leading to a continued sell-off in US + DM Rates as the market struggles to find the right clearing level for bonds (...) Risks are growing of a sharp, impulsive negative feedback loop in to other markets Source: Max Keiser, www.zerohedge.com

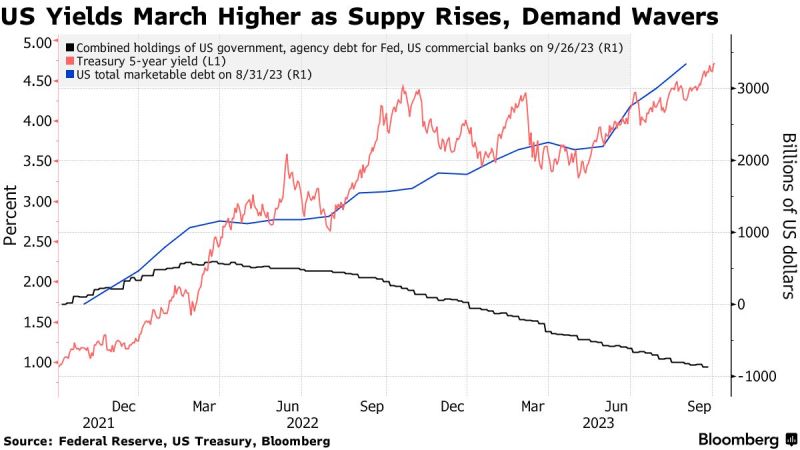

BREAKING: 30-Year Treasury Yield hits 5% for the first time in 16 years while the 10-year hits 4.8%

Macro fundamentals and inflation fears are not the only culprit. Indeed, the slide in Treasuries now seems excessive given recent economic data and Federal Reserve policy. This could suggest it’s instead being driven by fears over the swelling US deficit. As show on teh chart below (Bloomber), the supply/demand balance context is clearly not favroable to US Treasuries. The recent move shows rising alarm at what fiscal policymakers are doing. Concerns over U.S. debt levels and large Treasury issuance have prompted investors to demand more compensation for the risk of holding long term bonds, driving long-term yields higher. Source: Bloomberg

ASML still holding major support 545

ASML (ASML FP) is holding support 545 since more than two weeks. This level is very important, keep an eye on it. Source : Bloomberg

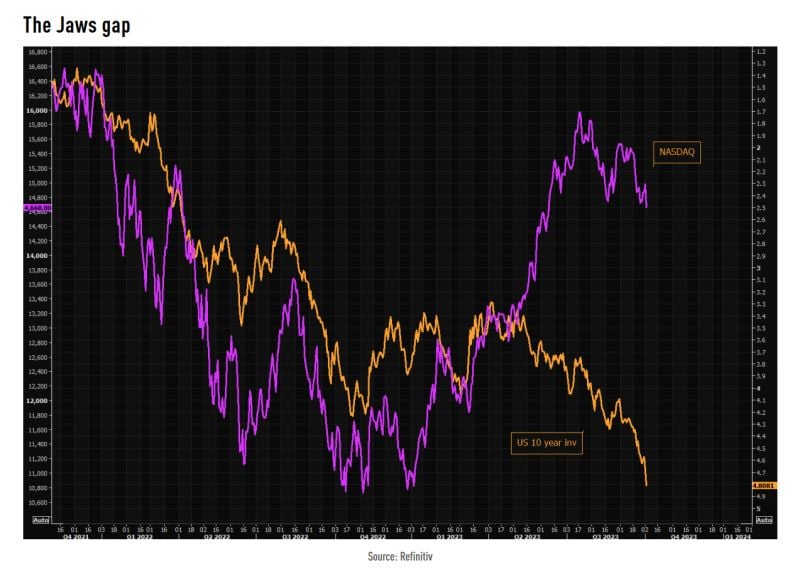

The gap between NASDAQ and the US 10 year (inv) remains absolutely massive

Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks