Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

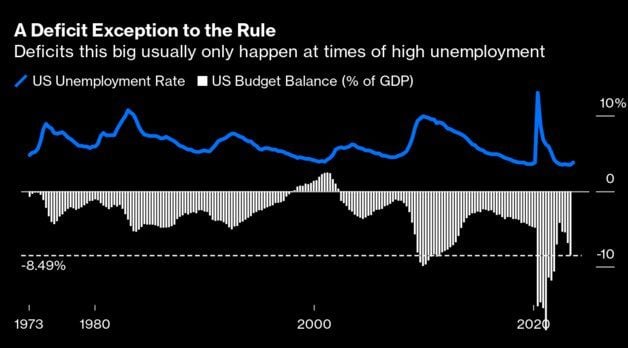

The US is running 10% deficit with record low unemployment

Imagine the deficit in next recession, whenever it may come. Enjoy these positive real rates as long as they last. Source: Michel A.Arouet, Bloomberg

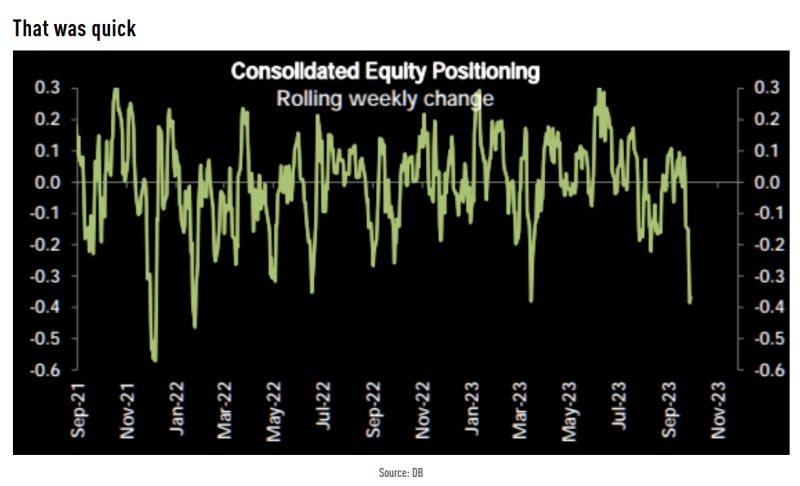

We have seen one of the fastest drops in equity positioning since early 2022. Time to think about the upside pain trade?

Source: TME, DB

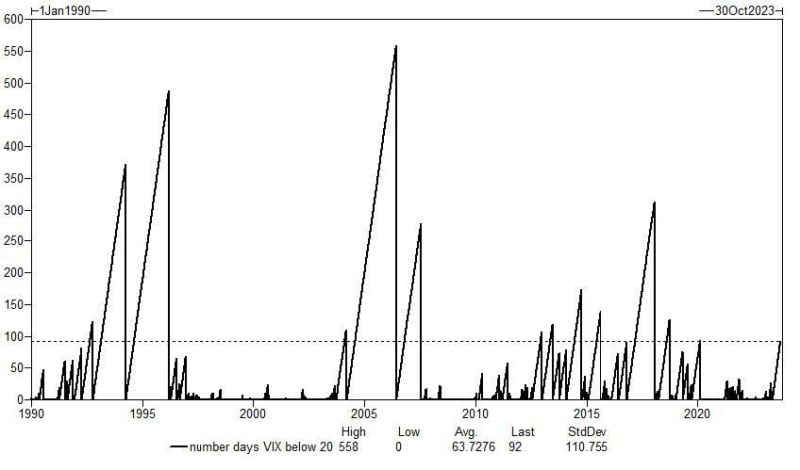

Investors complacency in one chart

VIX has spent 92 sessions below 20, the longest streak since Covid, yet low implied vol regimes can last significantly longer. Source: Goldman Sachs

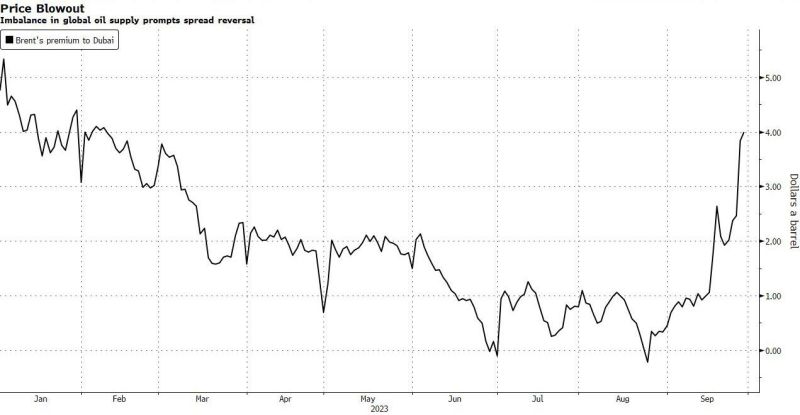

Plunging US Supply sends oil prices around the world soaring

>>> In recent months, the US had helped fill a void left in the market, routinely sending more than 4 million barrels every day to sate global appetite. Between overseas shipments and strong domestic demand, stockpiles quickly declined in the US. As oil stockpiles are running out in the US, they’re also running out in Europe, because it relies on US exports. As supplies collapse, cargoes of WTI Midland crude for January delivery to Asia are being offered for sale at premiums of $9 a barrel above benchmark Dubai oil, the highest premium seen this year, data compiled by Bloomberg show. In the futures market, the tightness in US supplies narrowed the gap between US crude and international benchmark Brent to under $3 a barrel, the smallest since May last year. Meanwhile, the spread between Brent and Middle East’s Dubai marker — also known as Brent-Dubai EFS — has skyrocketed (See below). Source: www.zerohedge.com

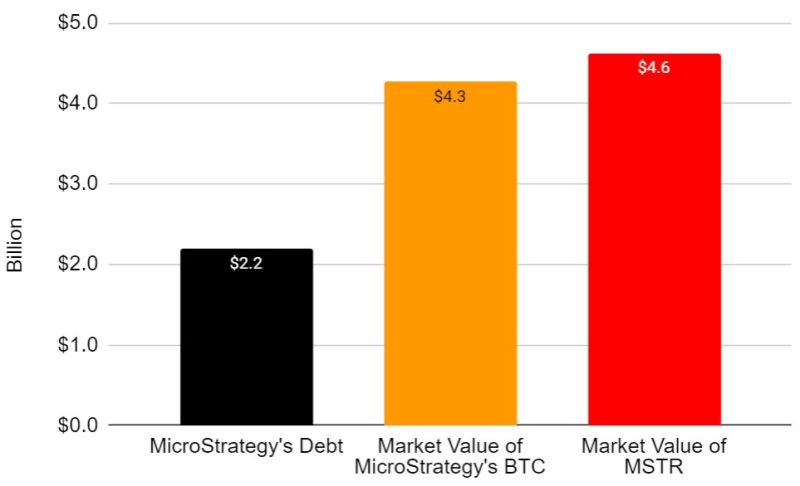

MicroStrategy has been able to outperform the underlying Bitcoin price mostly because of its use of leverage

Specifically, $MSTR took on a total of $2.2 billion in debt to purchase its BTC, the earliest of which matures at the end of 2025. This debt has a blended interest rate of only 1.6%. The markets in 2021 were distorted, and $MSTR capitalized by offering $1.05 billion in convertible debt with a 2027 maturity at 0%, which it used to buy $BTC. In other words, MSTR was able to borrow $1.05 billion until 2027 at 0% interest! This $2.2 billion of debt finances a $BTC position with a current market value of $4.3 billion. Source: Mark Harvey

For the next 45 days or so, the US government will NOT be shut down - this is most likely a relief for markets

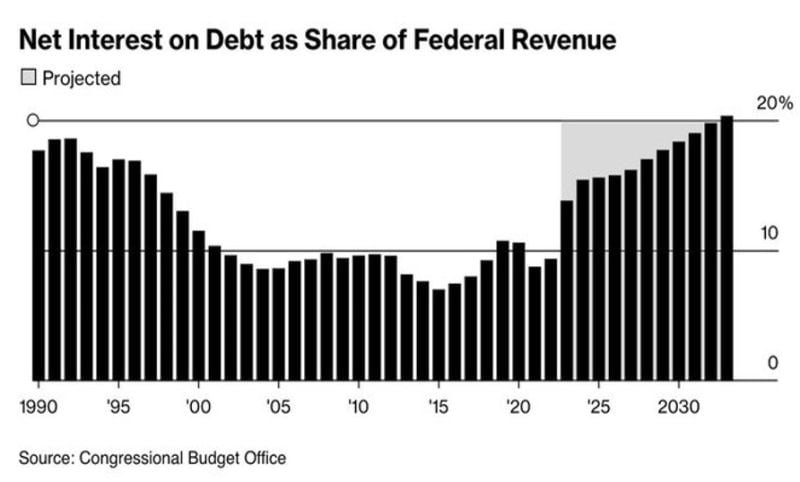

Still, this stopgap bill is only a temporary solution. They are just kicking the can down he road another time. Indeed, the House and Senate are both struggling to approve yearlong spending bills, and the gulf between the two parties remains vast. And as highlighted by the Kobeissi letter, there is still NO LONG-TERM PLAN. For nearly 20 years, it was effectively free for the US to issue debt as debt service costs were ~1.5%. Now, debt service costs have doubled to 3% and will rise toward 5% as rates skyrocket. To put this in perspective, 5% on $33 trillion is ~$1.7 trillion PER YEAR on interest expense. As deficit spending rises, rates are also rising as the US issues trillions in bonds to cover the deficit. It's a never ending cycle of borrowing to spend which is driving rates higher and leading to interest expense being 20% of US revenue... How are they going to fix this? Source: CBO, The Kobeissi Letter

In case you missed it:

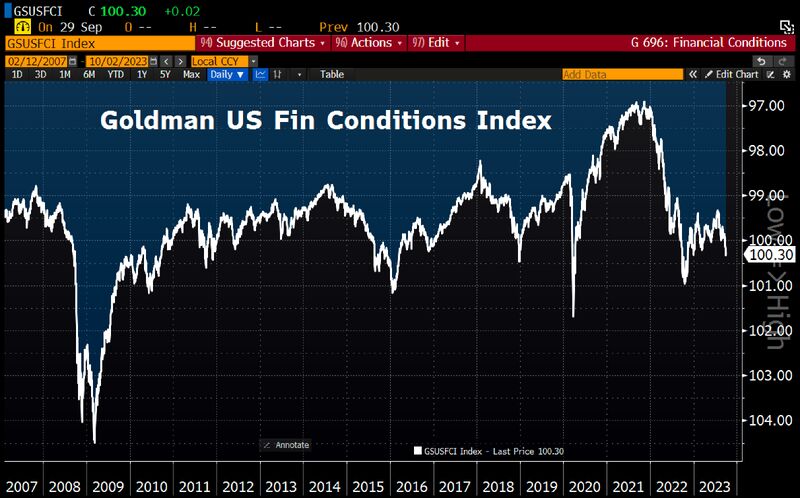

The past few months have brought a very significant tightening of US financial conditions; the Goldman Sachs Financial Conditions Index is now at the most restrictive point since November 2022. (HT GS) Source: HolgerZ, Bloomberg

ProShares Bitcoin Strategy ETF was the first Bitcoin ETF to trade on a major exchange in the US, launched Q4 2021 at the height of the last bull market

The ETF currently holds 35,890 BTC, and is the oldest and largest fund in the space. How much Bitcoin does each ETFs hold? 👇 Source: Coingecko

Investing with intelligence

Our latest research, commentary and market outlooks