Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

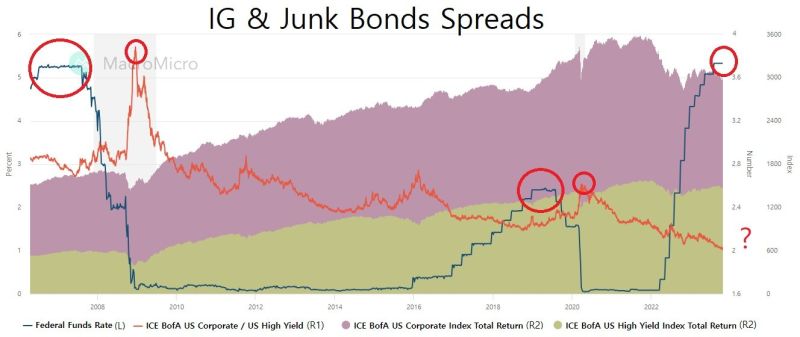

How long does it take for the FED to break the corporate bond market?

2008 : 1 year of plateau, resulted in credit event after another 1 full year. (Total 2 years) 2020 : 7 months of plateau, resulted in credit event after 6 months. (Total 13 months, 54% of 2008) 2023 : it's been 3 months into plateau so far. Chart made from MacroMicroMe - source: James Choi

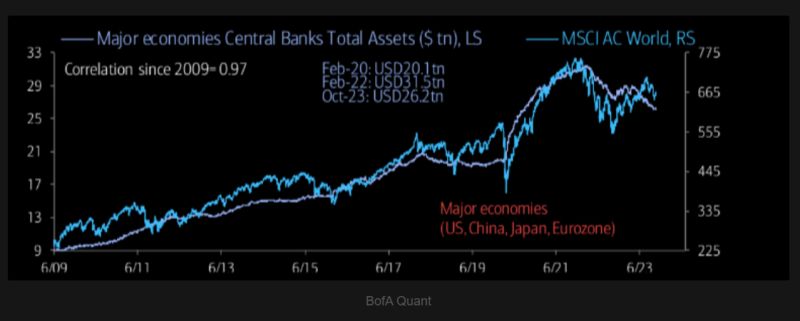

Quantitative tightening (QT) may have taken a backseat in recent months, but is still very much in vogue

Source: BofA, TME

The SP500 has now lost $3.5 trillion in value since the Fed removed a recession from their forecast

The Fed marked the exact high in July 2023 with their "no recession" call. Since then, the S&P 500 is down 9% and just hit its lowest level since May 31st. We are also 1% away from entering correction territory just as earnings season begins. Source: The Kobeissi Letter

Fed Chair Jay Powell on why longer-term yields are moving higher: “It’s not apparently about expectations of higher inflation

And it’s also not mainly about shorter term policy moves.” He probably has a point as #realyields are surging toward 2.5%, the highest since 2008. So what else can explain the surge in bond yields? Hints: 1) 1. A resilient economy — Q3 REAL GDP growth is expected to be around 3% annualized, well above trend growth of 1.5% to 2%, driven in large part by a resilient labor market and a strong consumer 2) Supply/demand imbalances — Given the growing U.S. fiscal deficit, the Treasury Department has been increasing its auction sizes for U.S. Treasury bills and notes. This year, the total amount of Treasuries issued in auctions is expected to climb to over $3 trillion, higher than at any year over the past decade (excluding 2020). This figure is expected to increase next year. Meanwhile, some of the natural demand for these bonds has moderated: The Fed is undertaking QT (reducing its holding of Treasuries by about $650 billion over the last year) and some foreign buyers, such as China, have slowly been reducing their holdings of U.S. Treasuries as well. Source: Lisa Ambramowitz, Bloomberg, Edward Jones

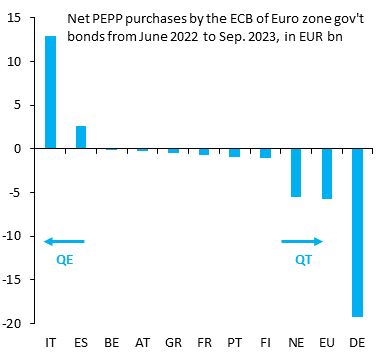

This chart from Robin Brooks highlights what is curently happening at ECB level: QE for some and QT for others

This was NOT supposed to happen. Remember: founding principle for the ECB is separation of monetary and fiscal policy. That's why ECB QE was initially subject to the capital key, so it couldn't favor one country over another. Could this last for ever? Source: Robin Brooks

The correlation was weaker in the 1980s/1990s, but starting after 2000, gold has historically done quite well whenever the Fed pauses or cuts

Source: Lyn Alden

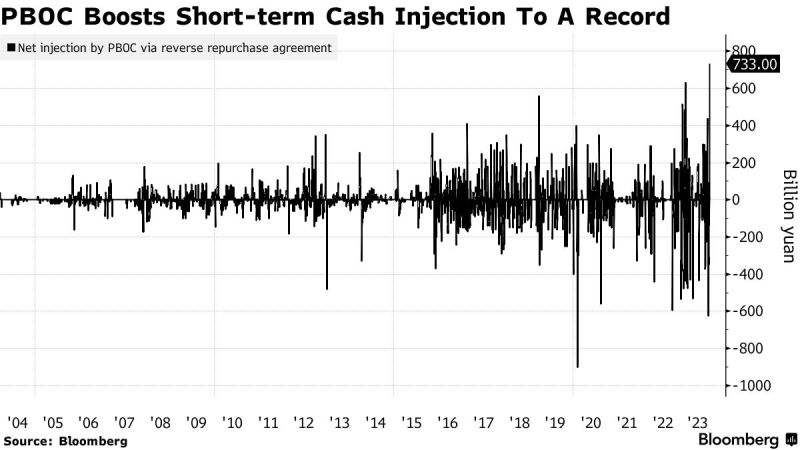

China Injects Most Short-Term Cash Into Banking System on Record - Bloomberg

China pumped the most liquidity into its financial system via short-term monetary tool on record, suggesting policymakers are keen to keep funding costs low to bolster the economy. The People’s Bank of China granted lenders a net 733 billion yuan ($100 billion) of cash with the so-called reverse repurchase contracts on Friday. That came after data released this week flashed signs of a pickup in the economy last month, when consumer spending and industrial production came in stronger-than-expected. Lenders keep one- and five-year loan prime rate unchanged. Source: Bloomberg

BREAKING >>> Powell says inflation is still too high and lower economic growth is likely needed to bring it down

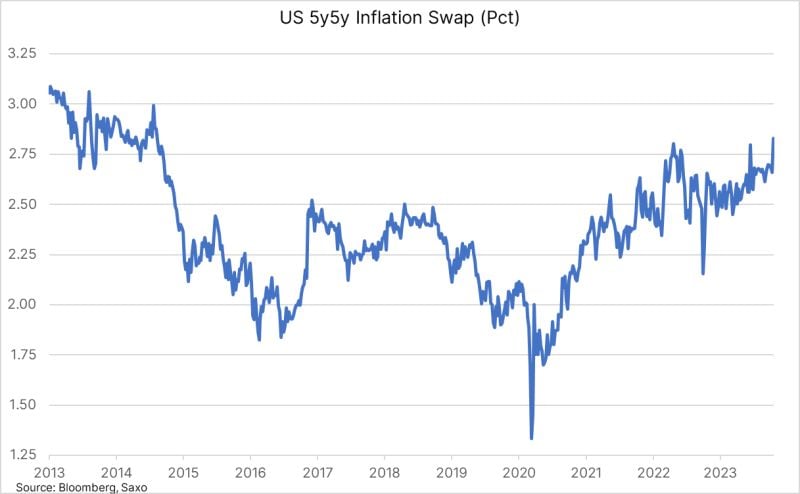

US 10-year is just 3bp shy of 5%... Federal Reserve Chairman Jerome Powell acknowledged recent signs of cooling inflation, but said Thursday that the slowing in price increases was not enough yet to determine a trend and that the central bank would be “resolute” in its commitment to its 2% mandate. “Inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” Powell said in prepared remarks for his speech at the Economic Club of New York. “We cannot yet know how long these lower readings will persist, or where inflation will settle over coming quarters.” Source: CNBC, Ole S.Hansen, Bloomberg, Saxo

Investing with intelligence

Our latest research, commentary and market outlooks