Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

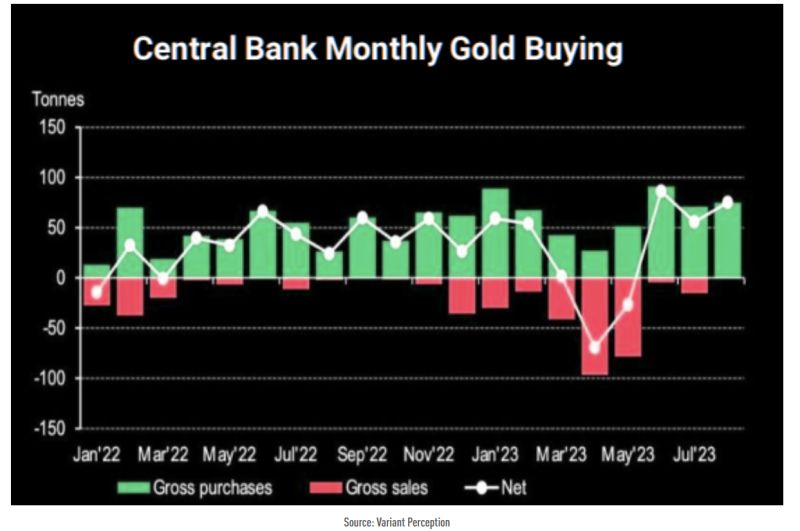

Central banks have continued to load up on the yellow metal

They added 77 tonnes to their gold reserves in August. Net buying is closing in on recent "highs". Gold is trading without much trend, but we are at very big levels. Source: Variant perception, TME

A big intra-day reversal yesterday...

The SP500 just made a near 100 point reversal in 2 hours, adding +$660 billion in market cap... After jobs report numbers nearly doubled expectations, we saw a sharp move lower Friday morning. Expectations of a more hawkish Fed grew which pressured equities. But later in teh session, markets started buying the news on hopes of downward revisions and adjustments in the numbers... Source: Barchart, The Kobeissi Letter Activate to view larger image,

The Federal Reserve Board has just joined Instagram

The aim is to "increase the accessibility and availability of Board news and educational content." Let see if the young generation finds this picture inspiring...

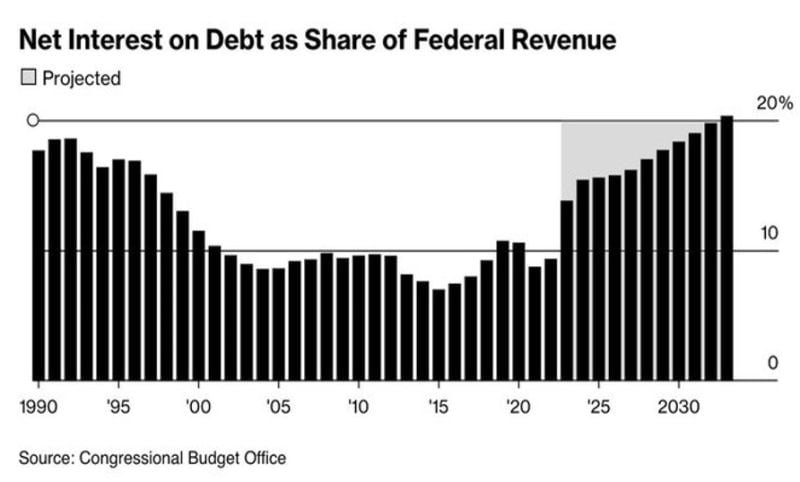

For the next 45 days or so, the US government will NOT be shut down - this is most likely a relief for markets

Still, this stopgap bill is only a temporary solution. They are just kicking the can down he road another time. Indeed, the House and Senate are both struggling to approve yearlong spending bills, and the gulf between the two parties remains vast. And as highlighted by the Kobeissi letter, there is still NO LONG-TERM PLAN. For nearly 20 years, it was effectively free for the US to issue debt as debt service costs were ~1.5%. Now, debt service costs have doubled to 3% and will rise toward 5% as rates skyrocket. To put this in perspective, 5% on $33 trillion is ~$1.7 trillion PER YEAR on interest expense. As deficit spending rises, rates are also rising as the US issues trillions in bonds to cover the deficit. It's a never ending cycle of borrowing to spend which is driving rates higher and leading to interest expense being 20% of US revenue... How are they going to fix this? Source: CBO, The Kobeissi Letter

As highlighted in a tweet by HolgerZ, the S&P 500 is running in tandem with the Fed net liquidity

So it's not so much the peak or pause in rate hikes that matters, but rather what happens to the Fed balance sheet & reverse repo operations. Source: HolgerZ, Bloomberg

GS Financial conditions index is tightening significantly, now at the tightest since November 2022...

This is probably what the FED wants to see...until something breaks... Source: www.zerohedge.com, Bloomberg

US 10-year Treasury yield is skyrocketing and now at 4.63%, its highest since June 2007

Since last week’s Fed meeting, the 10-year note yield is up 35 basis points. Since the last Fed rate hike in July, the 10-year note yield is up 60 basis points. Meanwhile, Fed rate HIKE expectations have NOT changed. As highlighted by the Kobeissi Letter, odds of another rate hike have actually gone DOWN. But, a long Fed PAUSE is being priced-in now. All as record levels of US Treasuries are being issued while FED balance sheet reduction pace has been accelerating (QT). This bear steepening is pushing the dollar UP and weighing on stocks valuations especially long duration ones, i.e tech darlings. Source. CNBC, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks