Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Ahead of Powell speech tomorrow...

Confidence in the Chair of the Federal Reserve has reached its lowest point in 20 years... By Visual capitalist

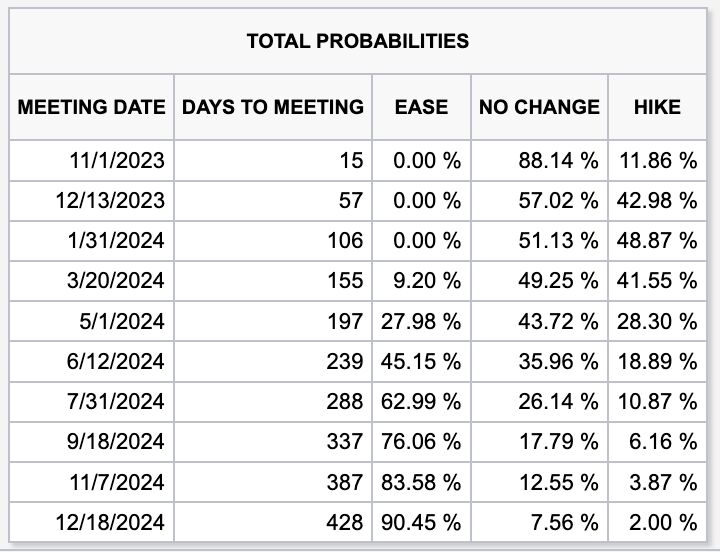

Stunning to see that markets are beginning to price-in chances of rate HIKES all the way until December 2024

There's now a ~49% chance of a rate hike by January 2024. There is even an 11% chance of a rate hike in July 2024... Meanwhile, the 10-year note yield is nearing 4.90% right now. Will 8% mortgages soon going to look like a good deal? Source: The Kobeissi Letter

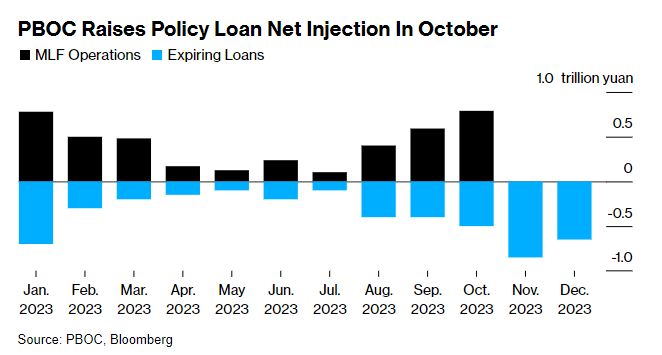

China | PBOC adds net 289 billion yuan via medium-term facility as Debt Sales Surge

The move adds to recent efforts to ensure hitting GDP target - Offers Most Cash Support Since 2020 - Bloomberg China’s central bank is making the biggest medium-term liquidity injection since 2020, stepping up efforts to support the nation’s economic recovery and debt sales. The People’s Bank of China added a net 289 billion yuan ($39.6 billion) into the financial system via a one-year policy loan on Monday, the most since Dec. 2020. At the same time, it drained a net 134 billion yuan of short-term liquidity through open-market operations.

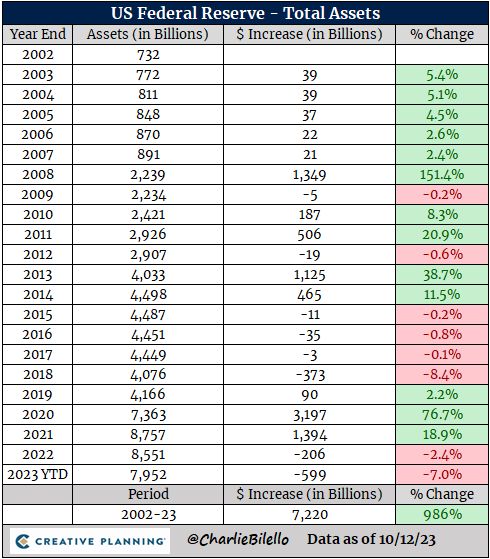

The Fed's balance sheet hit its lowest level since June 2021 this week, down over $1 trillion from the peak in April 2022

Annual changes in the Fed's balance sheet since 2002... Source: Charlie Bilello

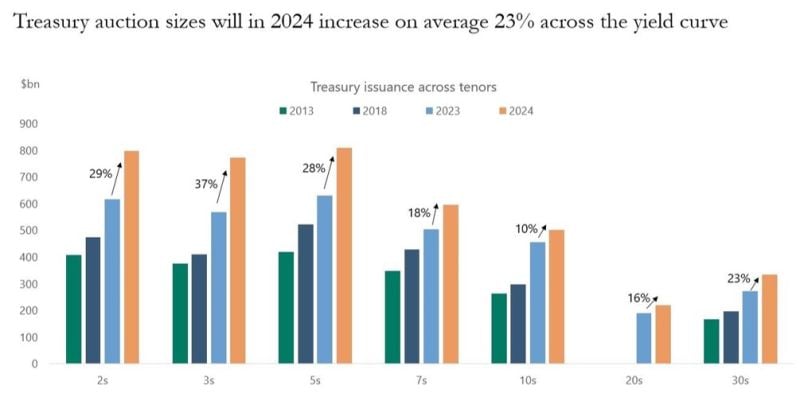

Heavy Supply remains a risk for US Treasuries

How long will the Fed be able to continue with QT? Source: Michel A.Arouet

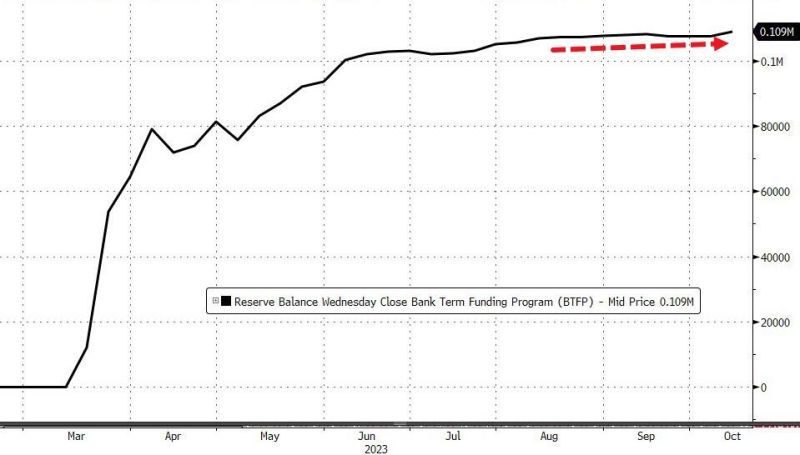

Usage of The Fed's emergency funding facility rose to a new record over $109BN...

This week saw the biggest jump in the BTFP since July. Source: Bloomberg, www.zerohedge.com

Fighting the Fed has transformed bond ETFs into cash incinerators..

$TLT has come out of nowhere to hit #3 on the Top 20 Cash Burning ETFs list (lifetime flows minus aum today) with over $10b lost. Top of list used to be -2x/-3x, VIX, commodity ETFs. Now its vanilla bond ETFs... Great table from psarofagis thru Eric Balchunas, Bloomberg

In case you missed it:

Fed Balance sheet has dropped <$8tn for 1st time since Summer 2021 on QT. Fed's total assets are now equal to 29.4% of US's GDP vs ECB's 50.9%, SNB's 111.5%, or BoJ's 125.7%. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks