Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Bank of Japan had to intervene twice this week to slow gains in govt bond yields, underscoring its determination to curb sharp moves in rates.

Nevertheless, the 10y Japanese yield has skyrocketed to 0.65%, well above the 0.5% from the YCC. Source: Bloomberg, HolgerZ

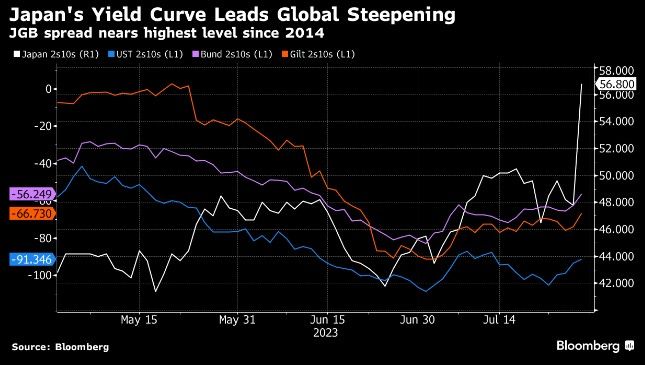

🌎 Global yield curve steepening gained momentum last week as a sign that major central banks are nearing the end of their tightening cycles

Source: Bloomberg, Fast reveal

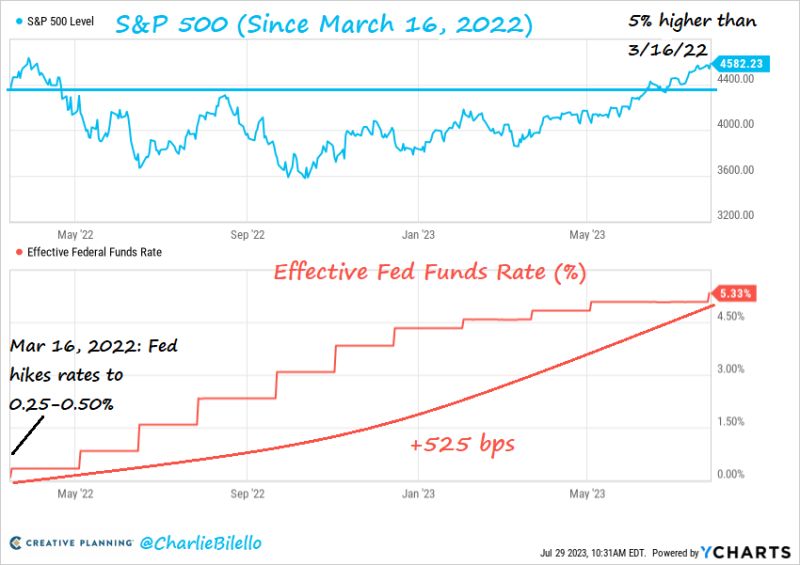

The SP500 is now 5% higher than where it was when the Fed started hiking rates in March 2022. $SPX

Source: Charlie Bilello

There it is. The BoJ adjusts Yield Curve Control (YCC)

Japan’s central bank on Friday pledged greater flexibility in yield curve control policy, while keeping its ultra loose interest rate intact and revising its median consumer inflation forecast upward for the current fiscal year. - The Bank of Japan added it will offer to purchase 10-year JGBs at 1% every business day through fixed-rate operations, unless no bids are submitted — a move that effectively expands its tolerance by a further 50 basis points. - In a policy statement, the Bank of Japan said it will “continue to allow 10-year JGB yields to fluctuate in the range of around plus and minus 0.5 percentage points from the target level.” - “While it will conduct yield curve control with greater flexibility, regarding the upper and lower bounds of the range as references, not as rigid limits, in its market operations,” it added. - Still, the BOJ held its short-term interest rate target at -0.1% after a two-day meeting. It also raised its median forecast for inflation to 2.5% for fiscal 2023 after its July meeting, up from its 1.8% prediction in April. Market reaction? The Japanese yen strengthened and 10-year JGB yield rose after the Bank of Japan statement: - Yields for 10-year Japanese government bonds rose to 0.575% for the first time since September 2014. - The yen was trading at 138.64 against the dollar at 12:35p.m. Hong Kong and Singapore time. Source: Viraj Patel, CNBC, Bloomberg

ECB raised rates by 25bps as expected

Deposit rate to 3.75pct, higher since April 2001. The main refinancing rate is now 4.25pct, highest since 2008. It is the 9th consecutive hike in a cycle that started exactly one year ago. APP portfolio is declining at a measure and predictable pace. Balance sheet should thus continue to shrink By stating that inflation Is coming down but is staying above target for an extended period means that the ECB keeps the door open to further rate hiles. A slight tweak in the statement: the ECB interest Rates will be SET at sufficiently restrictive levels for as long as necessary … (instead of BROUGHT at sufficiently…) NEW: the ECB decided that going forward, the minimum reserves banks need to hold won‘t receive any interest. In this way, the ECB could prevent the losses of the ECB and the national central banks from increasing too much. Bank shares like DB drop following the News Source: Bloomberg, HolgerZ, www.zerohedge.com

ECB deleveraging continues.

Ahead of this weeks meeting, CenBank shrank its balance sheet by €18.6bn to €7,186.9bn as matured bonds were not replaced by new ones. ECB's total assets are now equal to 53% of Eurozone GDP vs Fed's 31%, SNB's 121%, BoJ's 129%. Source: Bloomberg, HolgerZ

The disconnect between Fed net liquidity (grey) and the S&P 500 (purple) is growing by the day

source: Markets & Mayhem

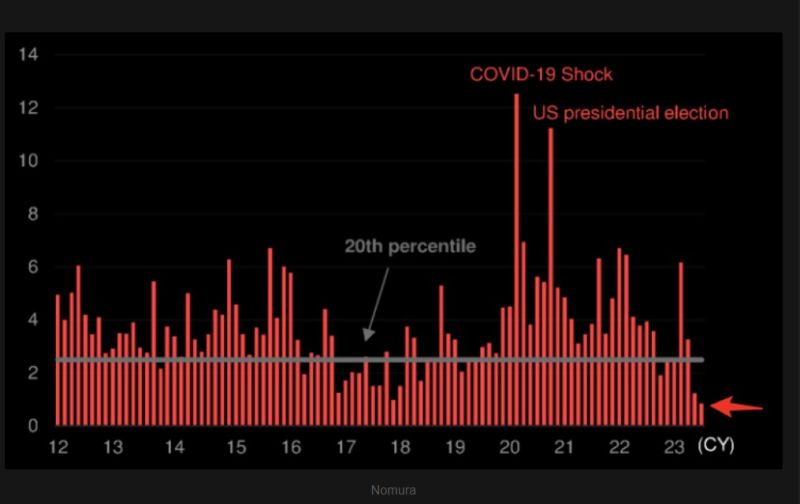

The market has NO FEAR. Extremely little risk priced for the FOMC meeting.

Chart shows SPX 1 week implied volatility skew within one week of FOMC meetings. Source: TME, Nomura

Investing with intelligence

Our latest research, commentary and market outlooks