Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

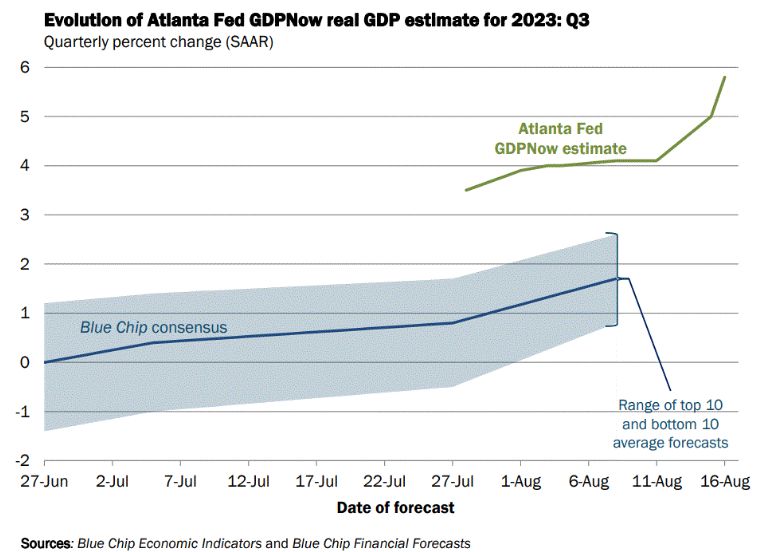

Ahead of Jackson Hole this week, Atlanta Fed GDP Now for US real GDP in 3Q is at 5.8%...

Way ahead of Street consensus and with a clear acceleration since early August...

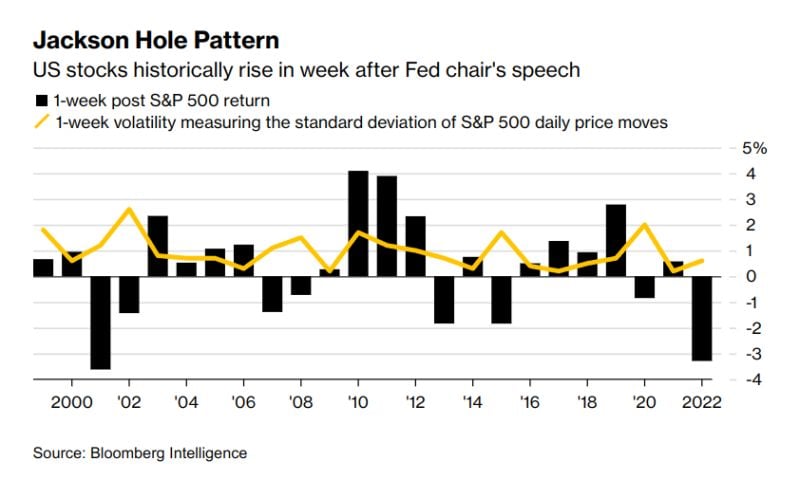

More often than not, stocks rise the week after Jackson Hole Will this year follow the pattern, or will it be one of the outlier years with a sell-off?

Source: Markets & Mayhem, Bloomberg

China’s central bank issues Sunday statement

They said that on Friday, China’s central bank and financial regulators met with bank executives and told lenders again to boost loans to support a recovery, adding to signs of heightened concern from policymakers about the deteriorating economic outlook. Authorities also urged for adjustments and an optimization of policies for home mortgages at the meeting on Friday, according to a statement from the People’s Bank of China on Sunday, without elaborating on the housing initiatives. China is expected to make the biggest cuts this year to two of its core lending rates as pressure mounts on policymakers and banks to reverse slowing momentum and revive flagging demand in the world’s second-biggest economy.

The PBoC is putting more measures in place to slow the depreciation trend in the yuan

Overnight, the Chinese central bank set its yuan fixing at 7.2006 per dollar compared to the average estimate of 7.3047. The gap - an unprecedented 1,041 pips - was the largest gap to estimates since the poll was initiated in 2018. Source: Bloomberg, zerohedge

CHINA: BIG MISSES ON MACRO DATA & SURPRISE RATE CUTS

China’s central bank unexpectedly cut key policy rates for the second time in three months on Tuesday, in a fresh sign that the authorities are ramping up monetary easing efforts to boost a sputtering economic recovery. This move opens the door to a potential cut in China’s lending benchmark loan prime rate (LPR) next week.Earlier this morning, China reported big data miss in July. Retail sales rose by 2.5% in July from a year ago, below expectations for a 4.5% increase, according to analysts polled by Reuters. A spokesperson for the National Bureau of Statistics said the bureau is suspending the youth unemployment number release due to economic and social changes, and is reassessing its methodology. Source: CNBC

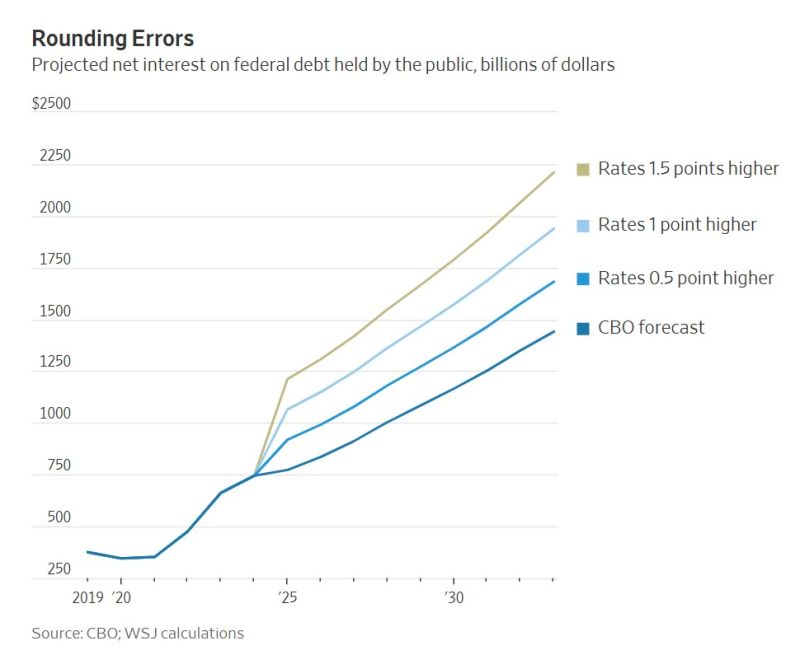

Very interesting WSJ article: "The Scary Math Behind the World’s Safest Assets. Washington has laid the seeds of a crisis that Wall Street can no longer ignore"

Here's an extract: "Consider that around three-quarters of Treasuries must be rolled over within five years. Say you added just 1 percentage point to the average interest rate in the CBO’s forecast and kept every other number unchanged. That would result in an additional $3.5 trillion in federal debt by 2033. The government’s annual interest bill alone would then be about $2 trillion. For perspective, individual income taxes are set to bring in only $2.5 trillion this year. Compound interest has a way of quickly making a bad situation worse—the sort of vicious spiral that has caused investors to flee countries such as Argentina and Russia. Having the world’s reserve currency and a printing press that allows it to never actually default makes America’s situation far better, though not consequence-free. Just letting rates rise high enough to attract more and more of the world’s savings might work for a while, but not without crushing the stock and housing markets. Or the Fed could step in and buy enough bonds to lower rates, rekindling inflation and depressing real returns on bonds".

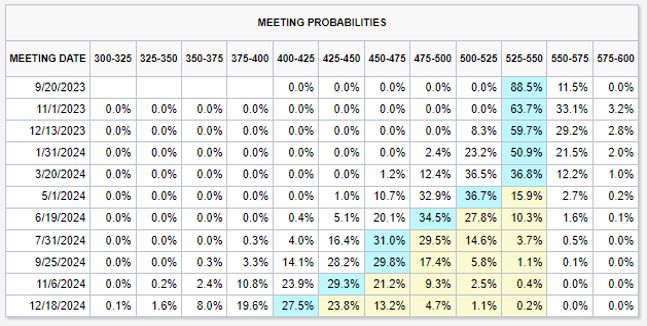

What are the latest moves when it comes to market expectations on Fed rates ?

A Fed HIKE of 25 bps by NOVEMBER moved from 30% to 33%. It is still below 50%. So not priced in. But a 3% increase (30% to 33%) is the biggest up move in a month. Furthermore, odds of rate CUTS are dropping. Markets now do not see any rate cuts until May 2024 in the base case. 3 months ago, markets expected 4 rate cuts in 2023. Markets seem to be bracing for a long Fed "pause." Source: The Kobeissi Letter, Bianco Research

Fed QT accelerates. Fed balance sheet shrank $91bn in July, -$759bn from peak, biggest drop ever to $8.2tn, lowest level since July 2021

Fed has now shed 22.3% of the Treasury securities it bought during pandemic QE. Fed's total assets now equal to 30.6% of US's GDP vs ECB's 53%, BoJ's 130%. Source: HolgerZ, wolfstreet.com

Investing with intelligence

Our latest research, commentary and market outlooks