Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

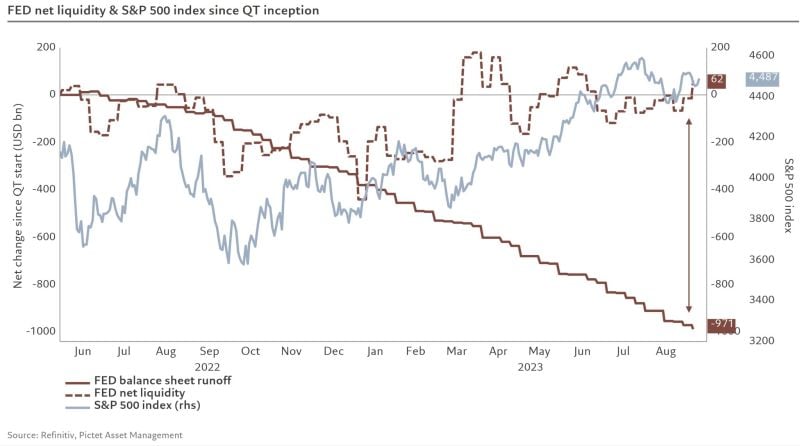

Despite QT of almost 1T$, Fed net liquidity* actually increased fueling the rally in big tech

Remarkable chart from Steve Donze at Pictet Asset Management thru Michel A.Arouet. *Net liquidity is a term that refers to the amount of cash and credit available for transactions, purchases, or investments. It is calculated by adding up the money supply and the outstanding credit in a given currency or region. Source: Pictet Asset Management, Michel A.Arouet

EURUSD pair continues a bearish trend after ECB hike

EURUSD stays on a rather bearish EUR bullish USD trend which wasn’t helped by today’s ECB decision to increase rates by another 25bps. Shortly after the ECB’s announcement, US PPI came out slightly higher than expected which led the pair to reach a low of 1.0656 before stabilizing around 1.0675.

Support: 1.0650, 1.0605, 1.0560

Resistance: 1.0720, 1.0770, 1.0810

Source: Bloomberg

Today is ECB day

What is the Taylor rule telling us when it comes to theoretical interest rates based on German data? Key interest rate should be at 10.9%, so 6.6% higher than current rate, according to Taylor Rule with German inflation at 6.4% & unemployment below NAIRU. Howeverm the spread between Taylor Rule rate & ECB key rate is lower than it has been since 2021. This might suggest that hike cycle could soon come to an end. Source: Bloomberg, HolgerZ

Stock Market: "We don't need central banks anymore, we have AI"

Source: Jeffrey Kleintop

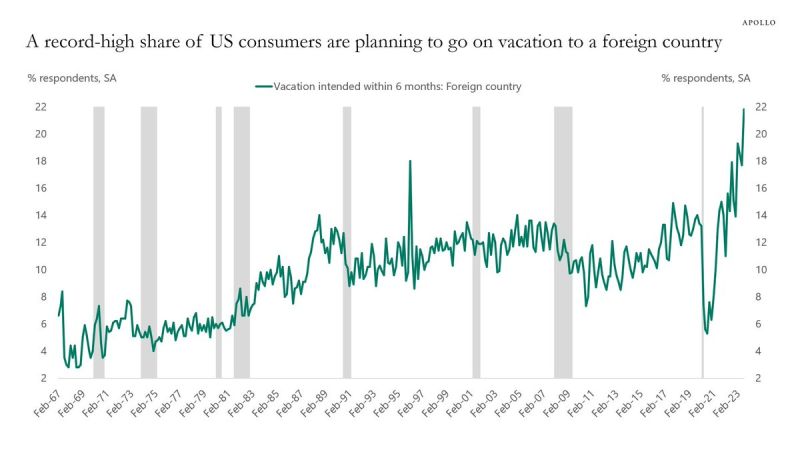

The continued strong demand for consumer services is why the Fed is unable to contain core inflation

According to Apollo, a record 22% of US consumers are planning to vacation in a foreign country. US households want to travel on airplanes, stay at hotels and eat out. The Kobeissi Letter: "That is why inflation in the non-housing service sector continues to be so high. No wonder credit card debt is skyrocketing". Source: The Kobeissi Letter, Apollo

Disinflationary forces are fading right now in Germany

Wholesale prices rose 0.2% MoM in August, after 4 consecutive months of declines. Prices of mineral oil products rose markedly (+6.9%) compared w/July 2023. More headaches for the ECB? Source: Bloomberg, HolgerZ

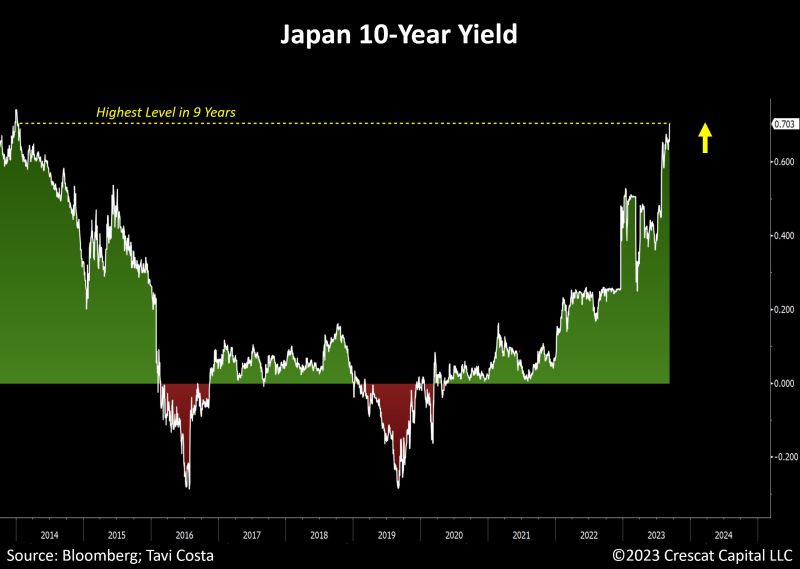

Japan's 10-year yield surged this morning to 0.70%, its highest level in almost a decade, following weekend comments by Bank of Japan (boj) Governor Kazuo Ueda

Ueda said the central bank’s lifting of its negative interest rate policy will become an option if wages and prices rise, revealing his thinking during an interview with The Yomiuri Shimbun. Ueda said that “there are various options” including lifting the negative interest rate policy once the central bank is confident that Japan has achieved sustainable price increases accompanied by rising wages. The negative interest rate policy is a pillar of the Bank of Japan’s large-scale monetary easing measures. While an easy monetary policy environment will be maintained for the time being, signs of factors could emerge that would allow a decision to be made by the end of the year, he indicated. This is the first time Ueda has given an exclusive interview to any media organization since taking office in April. Source: The Japan News, Tavi Costa, Bloomberg

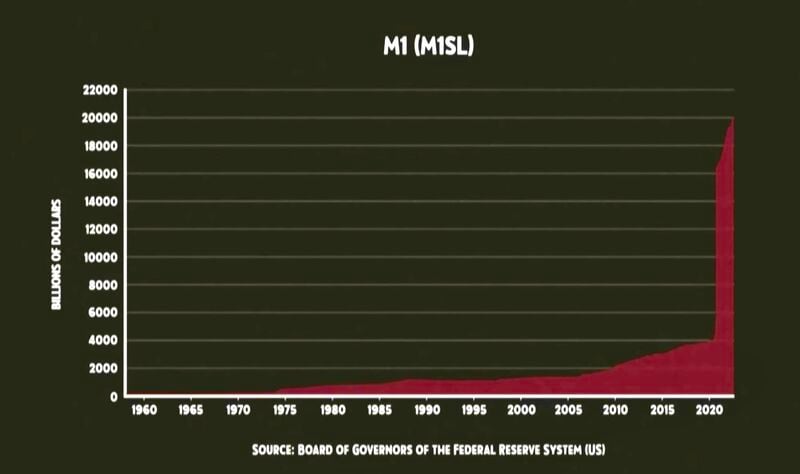

Over 80% of all US money created (US Dollars printed) took place between 2020 and 2023

Source: Win Smart

Investing with intelligence

Our latest research, commentary and market outlooks