Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

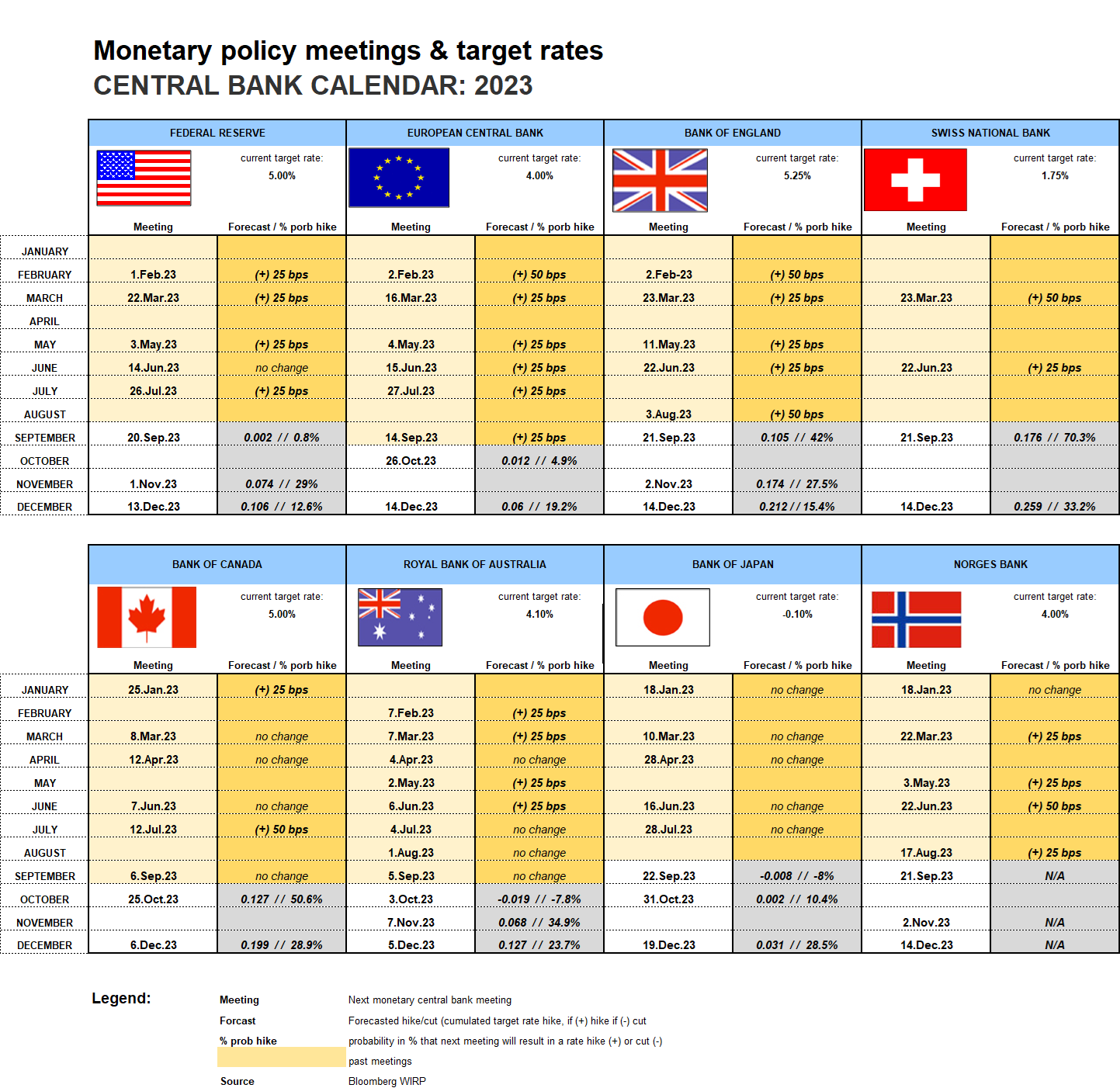

Can be the second half of 2007 be a good parallel for today's market?

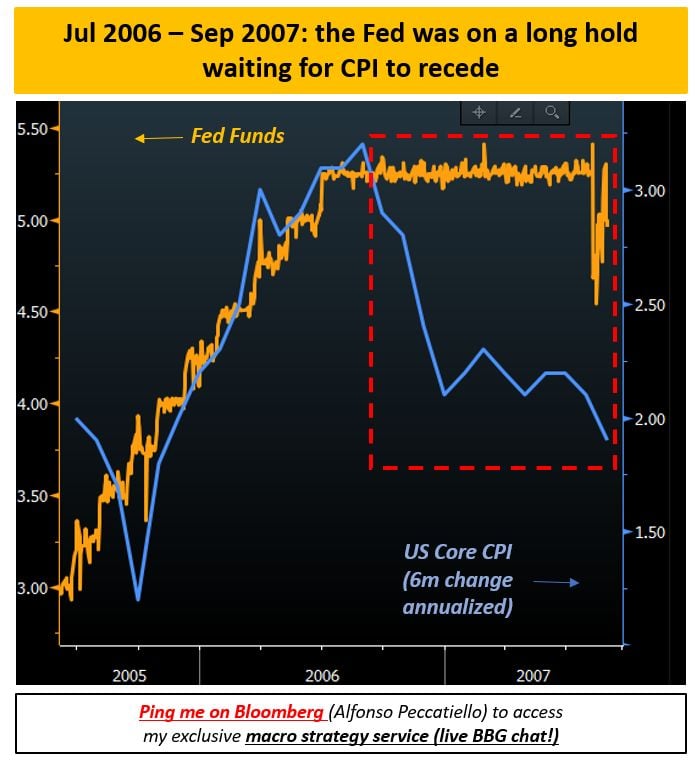

As highlighted by MacroAlf, back in 2007, the FED kept rates at 5.25% (orange) despite core inflation was trending around 2% (blue) for quarters already. That ''higher for longer'' stubborness kept policy unnecessarily tight - as we figured out in 2008... Source: Alfonso Peccatiello

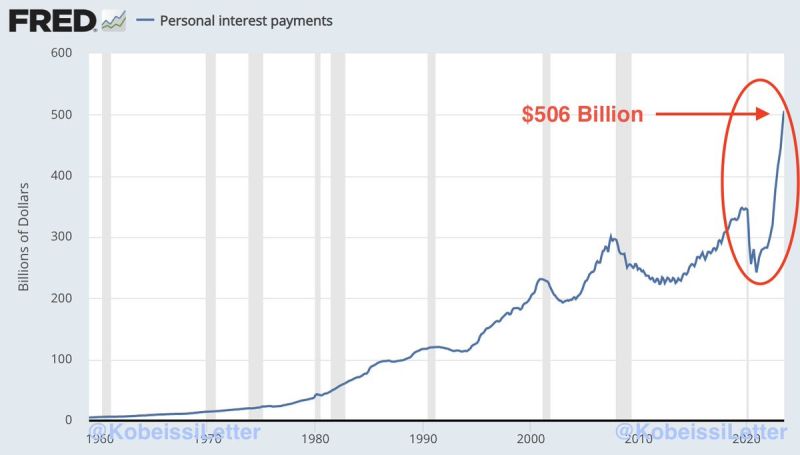

JUST IN: Personal interest payments in the US hit a record $506 BILLION in July

During the first 7 months of 2023, Americans paid a total of $3.3 TRILLION in personal interest. This is up a staggering 80% since 2021 and nearly above the entire 2022 total. The worst part? These numbers do NOT include interest on mortgage payments. Source: The Kobeissi Letter, FRED

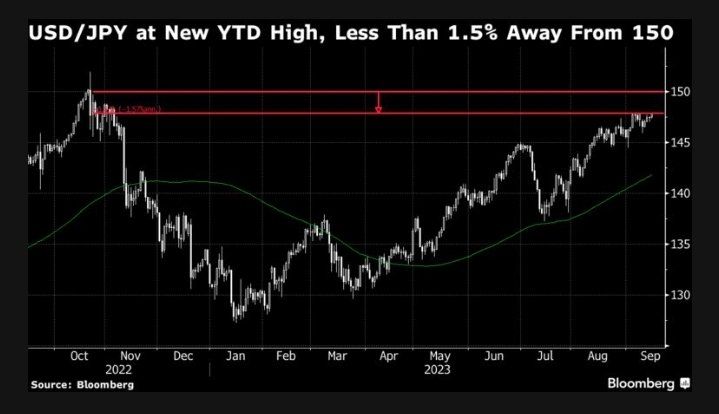

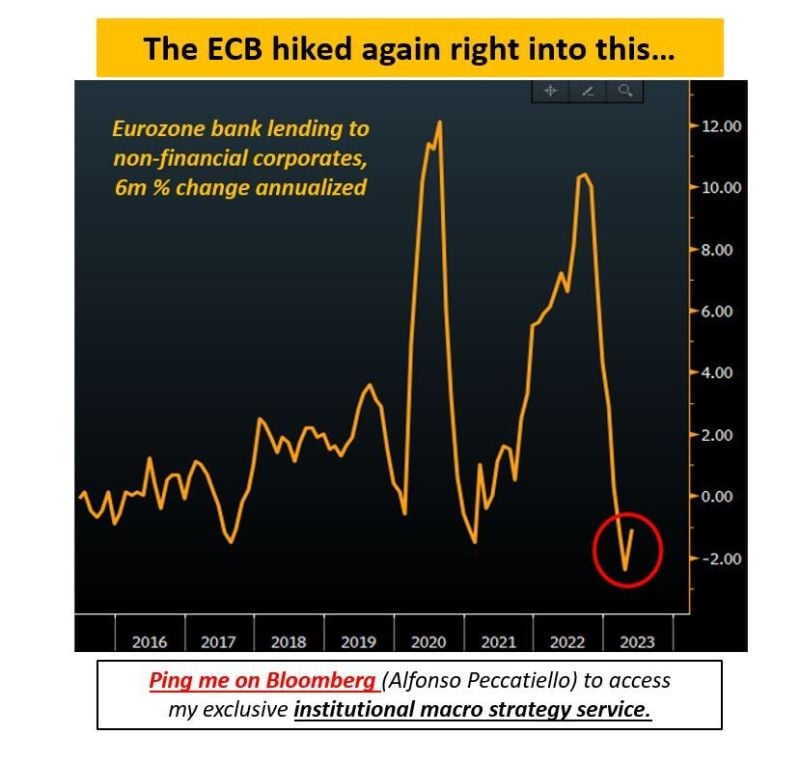

Some interresting comments by Themacrocompass.com / Alfonso Peccatiello

on yesterday's ECB hike and Lagarde's comments: "The demand for corporate loans in Europe has plummeted as borrowing costs remain prohibitively high. The Eurozone credit creation process is quite reliant on bank lending, so this matters. And indeed markets aren't reacting as if the ECB just hiked - quite the opposite: bond yields have moved lower and the EUR has taken another dip. The risks of an ECB policy mistake keep growing".

China’s retail sales and industrial production picked up pace in August with better-than-expected growth, according to National Bureau of Statistics data released Friday

Retail sales grew by 4.6% in August from a year ago, beating expectations for 3% growth forecast by a Reuters poll. The increase was also faster than the 2.5% year-on-year pace in July. Industrial production grew by 4.5% in August from a year ago, better than the 3.9% forecast and faster than the 3.7% increase reported for July. Fixed asset investment, however, grew by 3.2% year-on-year in August on a year-to-date basis. That missed expectations for a 3.3% increase and was slower than the 3.4% pace reported as of July. The figure was dragged down by a steeper drop in real estate investment, and a slowdown in infrastructure investment. Only manufacturing saw the pace of investment pick up. Statistics bureau spokesperson Fu Linghui said the real estate market was still in a period of “adjustment” and noted declines in sales and investment. Source: CNBC

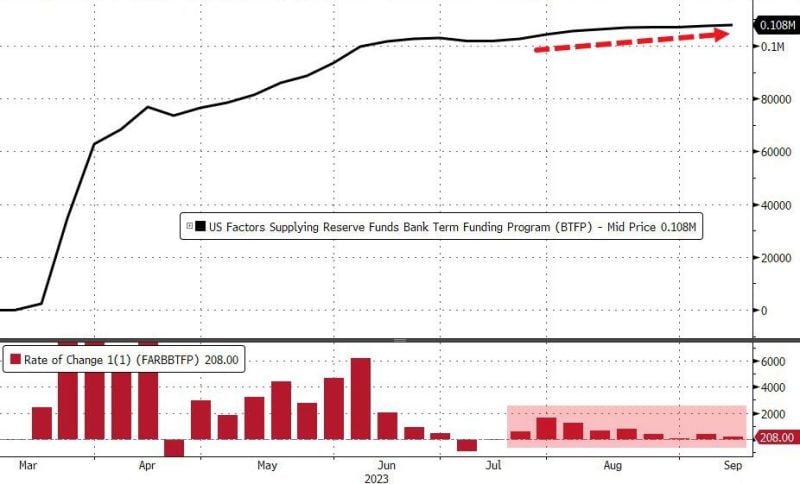

OOPS! A bank liquidity indicator sounds the alarm!

Usage of The Fed's emergency bank funding facility rose once again (+$208M) to a new record high over $108BN as long-term government bond yields keep rising... Source: Bloomberg

European Central Bank hikes rates to a record 4% as inflation risks outweigh economic gloom.

- The ECB just raised its key rates again today, by 25bp (main Refi rate at 4.50%, deposit rate at 4.00%) - Concerns around the underlying inflation dynamic appear to have overwhelmed the ongoing negative (and concerning) dynamic in Europe’s economic growth: "inflation continues to decline but is still expected to remain too high for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. In order to reinforce progress towards its target, the Governing Council today decided to raise the three key ECB interest rates by 25 basis points." Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks