Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Next FOMC rate hike probabilities:

No hike → 93% 25 bps hike → 7% Source: Game of Trades

Usage of the Fed's emergency bank funding facility jumped by $328 million last week

It now stands at a new record high of $108 billion, even as the regional bank crisis is "over." The current rate banks are paying the Fed on these loans is an alarming ~5.5%. i.e . the banks that almost collapsed are now borrowing record levels of expensive debt from the Fed. Is the US regional banks crisis really over? Source: zerohedge, Bloomberg, The Kobeissi Letter

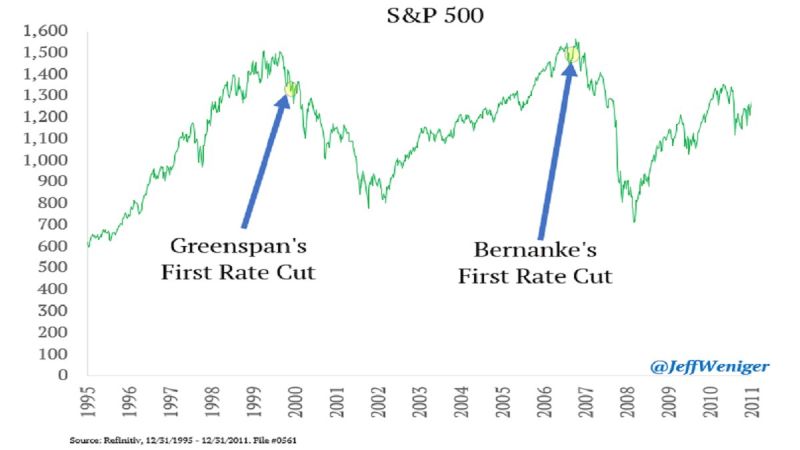

If the Fed cuts rates next year, is that a good thing?

Source: Jeff Weniger

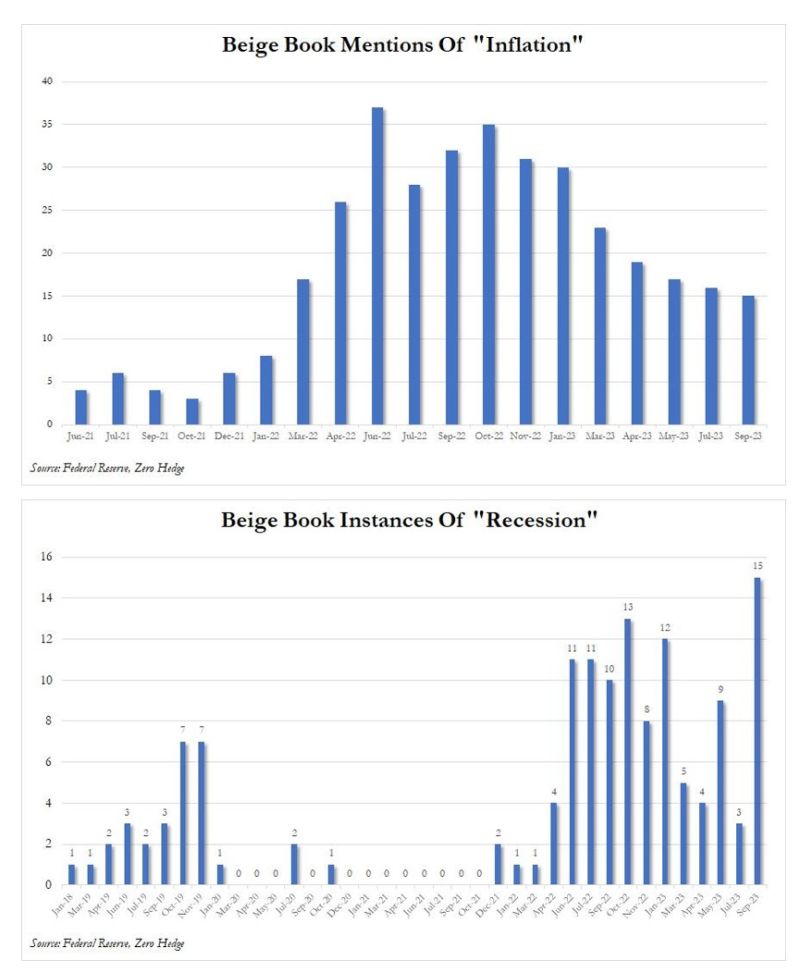

Are FED priorities shifting?

Mentions of inflation in the Fed's Beige book were the fewest since Jan 2022...Meanwhile, mentions of recession jumped to the highest level since at least 2018. The fact that there have been so many mentions of a word which as recently as 2020 and 2021 barely existed in the Beige Book vocabulary could give an indication what the Fed is most worried about today. Source: www.zerohedge.com

A BAZOOKA CUT BY THE NATIONAL BANK OF POLAND...

Is it the most dovish central bank around? Despite roughly 10% inflation, The National Bank of Poland cut rates by 75bp to 6%, versus expectations of a 25bp cut. - Poland’s central bank delivered a surprisingly steep interest rate cut in a bid to boost a slowing economy less than six weeks before a tightly-contested election, weakening the zloty and hammering banking stocks. - The decision to lower the benchmark rate by three quarters of a percentage point — the most since the fallout from the great financial crisis in 2009 — to 6% caught economists off guard. Most had predicted a quarter point reduction. - The decision takes on a political dimension coming so close to the Oct. 15 election and has left investors guessing at the next move, with some predicting that the easing cycle has ended as soon as it began. Source: Bloomberg

JACKSON HOLE: A RISK MANAGEMENT SPEECH

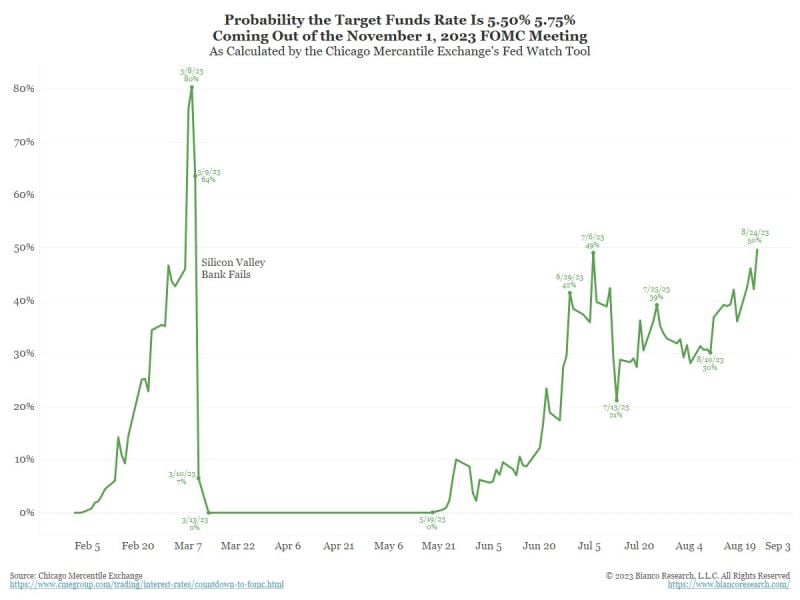

FACTS: The overall tone of Chair Powell’s Jackson Hole speech was relatively hawkish but not as hawkish as some feared on the back of recent strong data. It was also less hawkish than last year. The main message is that The Fed is definitely on hold but leaning on a more hawkish stance should data don’t show more progress in inflation / growth cooling down. OUR TAKE: The big event is now behind us, and we didn’t learn anything new. Powell believes that monetary policy is tight, but he opens the door to an even tighter one. With regards to macro data, they are going into the right direction but there is a risk of further upside, i.e interest rates path remains very data dependent which means that markets will now turn its attention to PCE inflation and US jobs data (next week). The Fed is likely to stay nervous as long as they see evidence of a serious break in job growth below the 200K pace. We are not there yet, which means that in the coming weeks, we will likely see macro volatility leading to market volatility. Our view remains that central bankers want first and foremost to avoid the big mistake (rather than targeting a pre-defined target). In the previous decade, central bankers wanted to avoid the deflation trap, hence the over-printing. This time, they want to avoid the risk of another round of inflation. Hence the temptation of over-tightening. MARKET REACTION: Rate-hike expectations initially moved lower but then reverted higher after investors actually read and listened to his speech. 2Y yields are back to July highs and equity markets are whipsawing.

Going into Jackson Hole, the probability of a September hike is just 20%, well below 50%, so not likely. But, as shown below, the probability of a hike in November (see below) is now 50/50

What will it be when Jay is done? Source: Jim Bianco

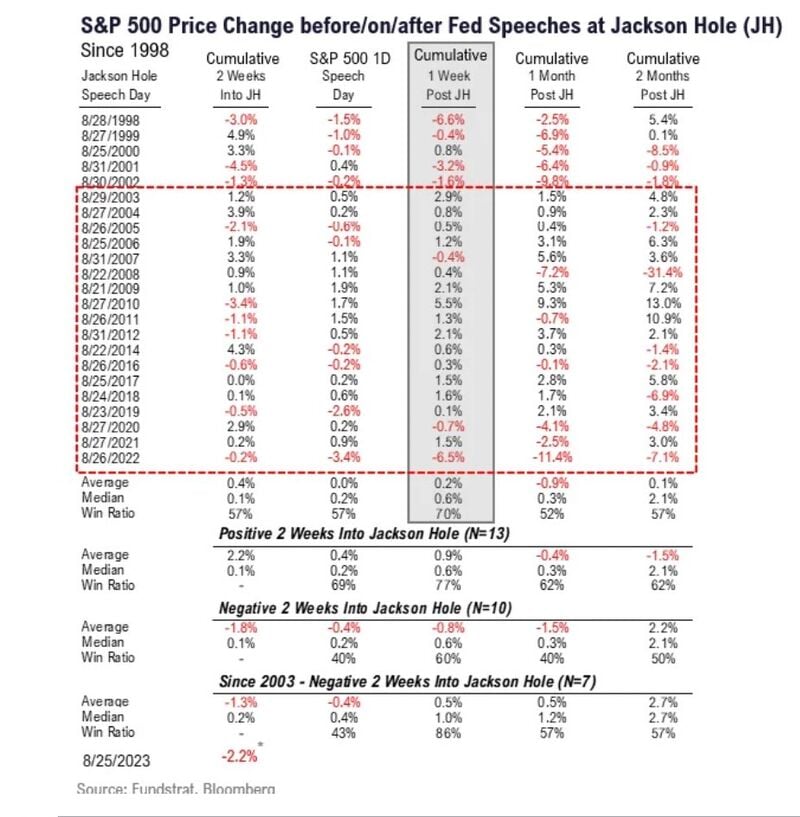

Price changes before/on/after FED speeches at Jackson hole " since 2003, there are 7 instances $SPX down 2 weeks prior to #JacksonHole .. 6 of 7 instances, equities rose in the week post-JH ..”

Source: Fund Strat thru Carl Quintanilla

Investing with intelligence

Our latest research, commentary and market outlooks