Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

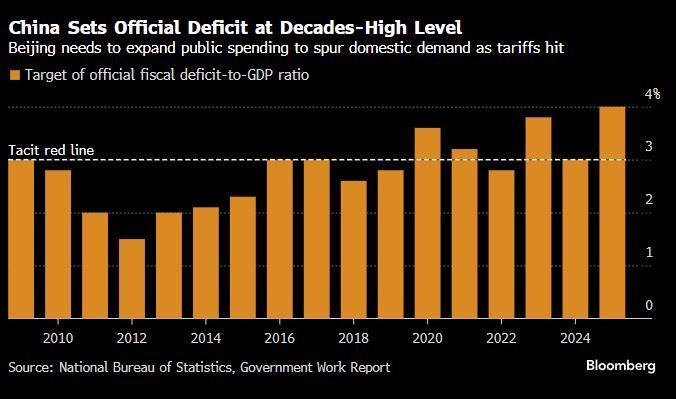

China's out with some proper fiscal firepower: Highest official deficit target in 30+ years

Plus... CNY1.3 trillion in ultra-long special sovereign bonds CNY4.4 trillion in new special local govt bonds CNY500 billion in special sovereign bonds China on Wednesday set its GDP growth target for 2025 at “around 5%” and laid out stimulus measures to boost its economy amid escalating trade tensions with the U.S. Beijing raised its budget deficit target to “around 4%” of GDP from 3% last year, according to the official report, as the country’s top legislative body held its annual meeting. The 4% deficit would mark the highest on record going back to 2010, according to data accessed via Wind Information. The prior high was 3.6% in 2020, the data showed. Source: Bloomberg, David Ingles on X, CNBC

"... a structural regime shift is finally happening within China's equity market..."

Morgan Stanley drops bearish China call. thru David Ingles on X

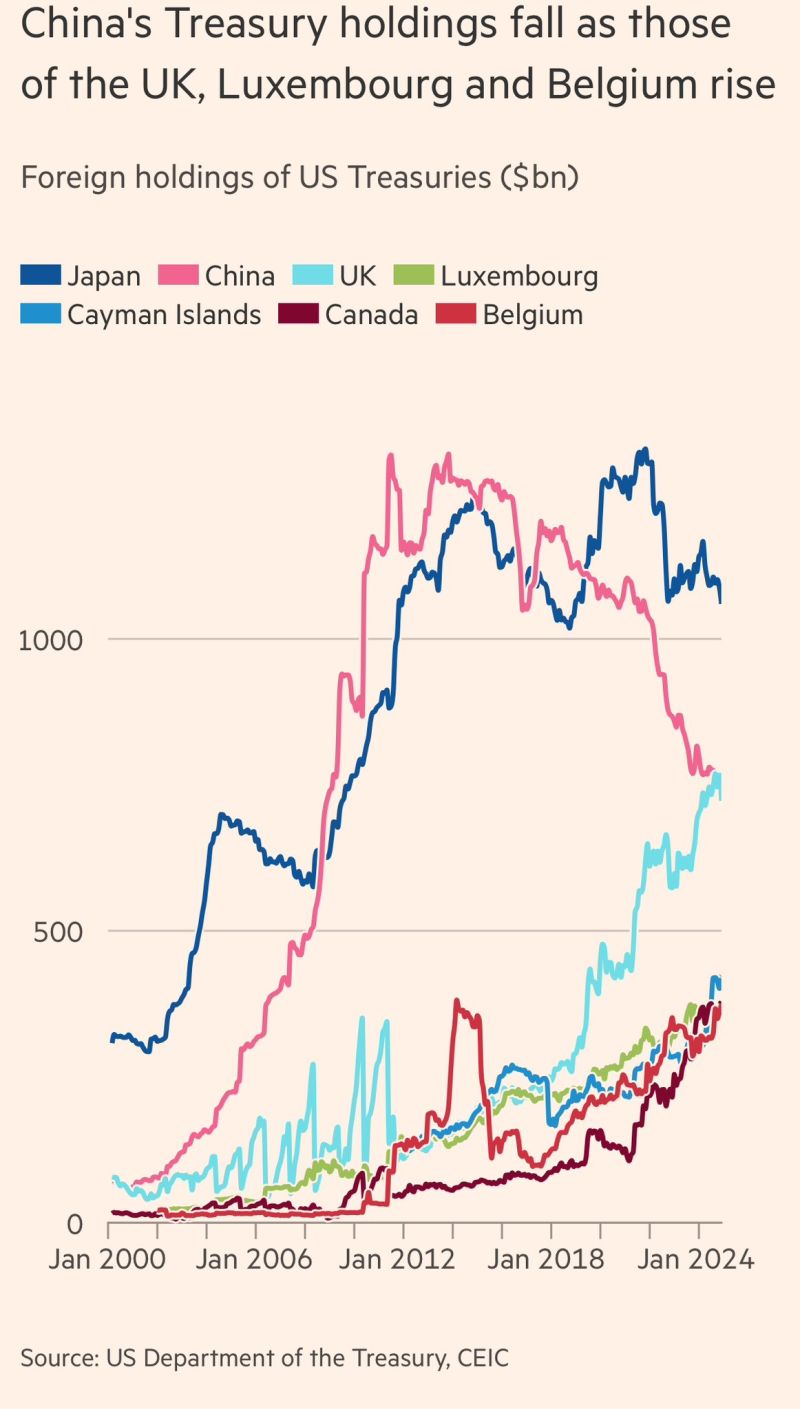

From the @FT article, “China’s holdings of US Treasuries fall to lowest level since 2009:”

“Analysts say the change partly reflects China’s desire to diversify its foreign reserves by buying assets such as gold. But they add that Beijing is seeking to disguise the true extent of its Treasury holdings by shifting them to custodian accounts registered elsewhere.” Source: FT, Mohamed El Erian

"Biggest macro imbalance in the world is the chronic undervaluation of China's Yuan. "

"China's trade surplus - once you look at goods net of commodities (blue) - was the largest ever in 2024. This is why tariffs on China will keep going higher after an already large 10% tariff..." Source: Robin Brooks

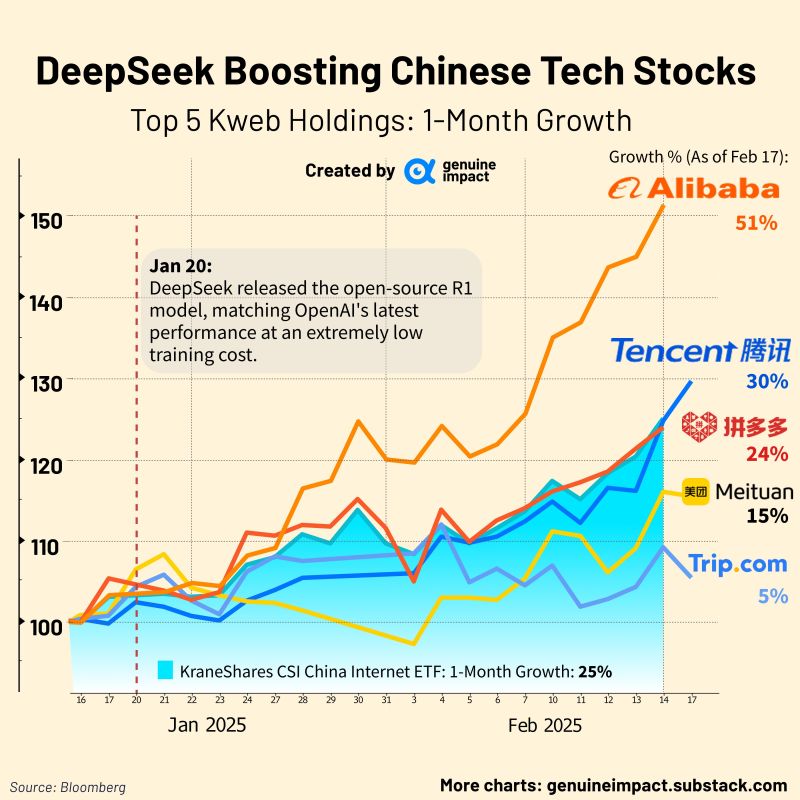

🤖After DeepSeek's release, Chinese tech stocks have surged, with Alibaba leading the way, up over 50% in just one month🚀!

The AI boom sparked by DeepSeek is prompting global investors to reassess investment opportunities in China's tech and AI sectors, particularly the AI capabilities of previously undervalued Chinese internet companies. With Alibaba collaborating with Apple to integrate AI features into the Chinese version of the iPhone and 🔵Tencent's WeChat adopting DeepSeek, the demand for AI cloud computing services in China could soon mirror the supply shortages seen in the US. It's clear that China's AI progress is catching up to the US at an accelerated pace—and costs are dropping even faster. Source: Genuine Impact

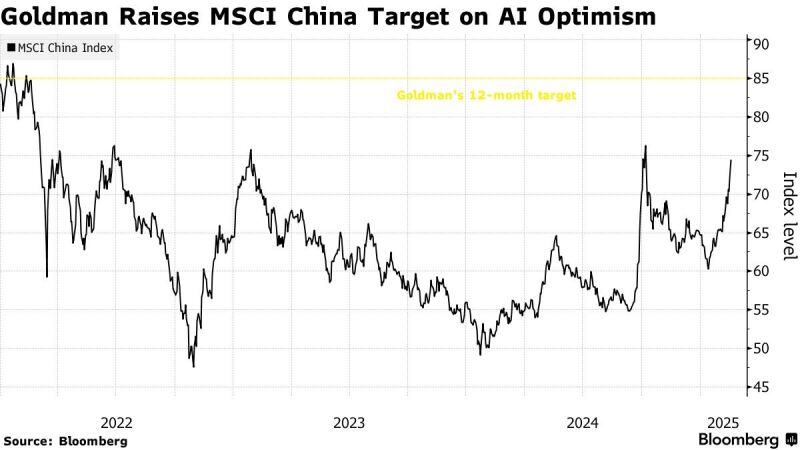

Goldman Raises MSCI China Target as DeepSeek Improves Outlook - Bloomberg

Strategists at Goldman Sachs Group Inc. expect a blistering rally in Chinese equities to continue, as the emergence of DeepSeek sparks optimism over the country’s technological advancements. Kinger Lau and his colleagues see the MSCI China Index reaching 85 over the next 12 months, up from their previous target of 75. That indicates another 16% rise from Friday’s close. The index has already entered a bull market earlier this month. Their target for the CSI 300 Index was raised to 4,700 from 4,600.

Investing with intelligence

Our latest research, commentary and market outlooks