Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: China has opened antitrust investigations into Nvidia and Google just hours after imposing 10%-15% tariffs on some US imports, per FT.

China is reportedly looking for new trade war leverage against President Trump. Source: FT

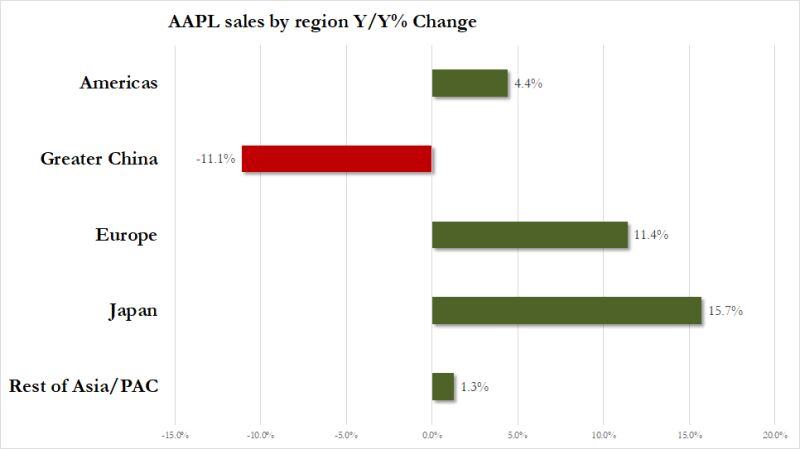

Apple Slides After iPhone Sales Miss, China Revenues Unexpectedly Tumble

The one - very big - fly in the ointment was the usual suspect: China, where revenues unexpectedly tumbled, sliding a whopping 11%, and badly missing estimates of a $21.57BN print Greater China rev. $18.51 billion, -11% y/y, estimate $21.57 billion Source: zerohedge.com

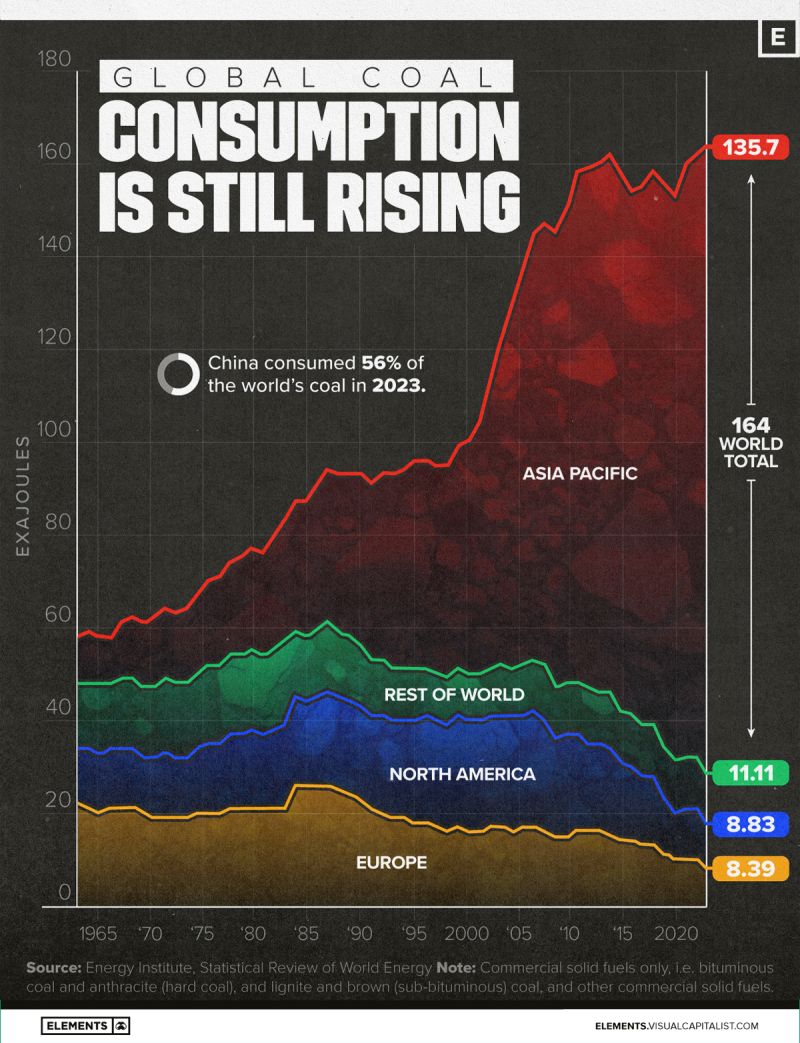

Chinese debt pile is GIGANTIC: China's total debt to GDP rose to a RECORD of ~370%.

The share has DOUBLED over the last 14 years. This does not include shadow banking (outside traditional banking sector). China has a massive debt problem and it will not go away soon. Source: Apollo, Bloomberg, Global Markets Investor

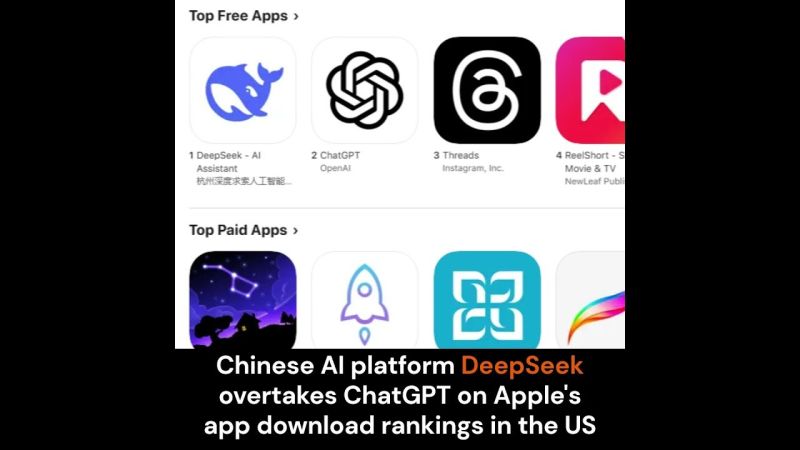

DEEPSEEK OVERTAKES CHATGPT IN APP STORE RANKINGS IN THE U.S.

👉 Chinese AI platform DeepSeek has reportedly surpassed OpenAI’s ChatGPT on Apple’s App Store rankings just a week after launch. 👉DeepSeek popularity stems from its competitive pricing, and its superior performance, reportedly achieving a higher success rate in coding tasks and outpacing OpenAI in benchmarks. Source: @spectatorindex MoneyControl thru Mario Nawfal on X

🚨 Goldman Asks If China's DeepSeek is AI's Sputnik Moment 🚨

You've heard of DeepSeek's R1. But have you heard of Bytedance's Doubao-1.5 or Moonshot's Kimi k1.5? The race to the price bottom is just starting and nobody does it like China. Still, we need to keep in mind that LLM commoditization was inevitable, but the Mag 7 are focused on the Artificial general intelligence (AGI) endgame -- building trust, infrastructure & ecosystems that China can’t match. It might just end up being noise - not a real game changer. Source. www.zerohedge.com, Goldman Sachs

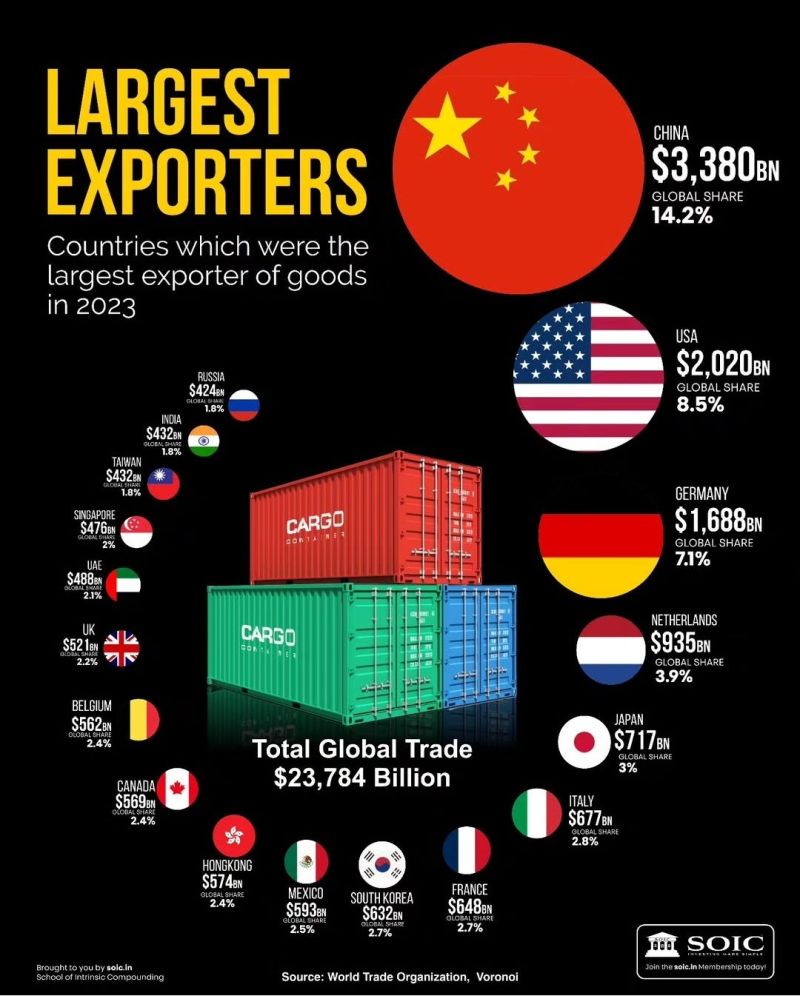

China is, by far, the largest exporter.

Source: Jason Smith @ShangguanJiewen on X

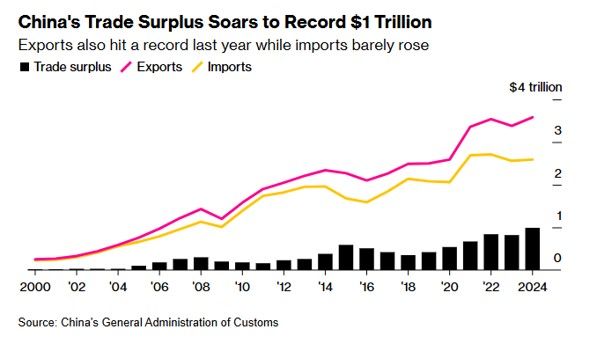

China trade surplus soared to $1 Trillion on Pre-Trump exports

👉 China’s trade data in December beat expectations by a large margin, with exporters continuing to frontload shipments as worries over additional tariffs mount, while the country’s stimulus measures appear to be supporting demand in the industrial sector. 👉 Exports in December jumped 10.7% in U.S. dollar terms from a year earlier, beating expectations of a 7.3% growth in a Reuters poll. That compares with a 6.7% growth in November and a spike of 12.7% in October. 👉Imports rose 1.0% last month from a year earlier, reversing from the contraction in the preceding two months. Analysts had forecast imports to fall 1.5% on year. That compares with a bigger drop of 3.9% in November and 2.3% in October. Source: Bloomberg, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks