Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

2024 is shaping up to be a big year for privately-held companies, with over 1,200 unicorns globally, up from just 590 in 2021!

(A "unicorn" refers to privately held companies valued at over one billion dollars). Leading the charge is ByteDance (TikTok's parent) at a whopping $220B 💰, followed by SpaceX 🚀 at $180B and OpenAI 🤖 at $100B. Noticeably, the US and China lead the world in both the number of unicorns and their combined market value. Source: Genuine impact

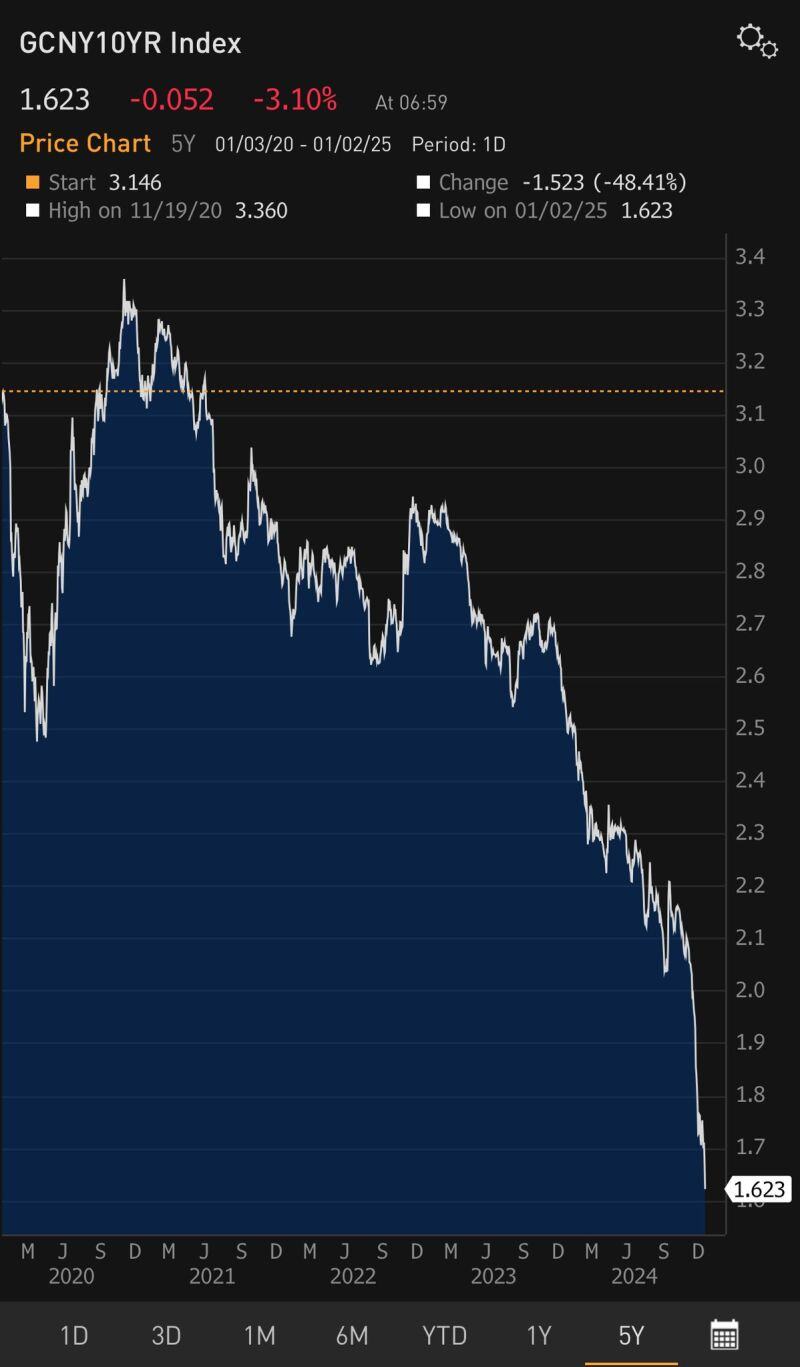

China 10 Yr Yield is dropping like a stone.

Irving Fisher Debt Deflation spiral in real time? 1.63% Source: James E. Thorne @DrJStrategy

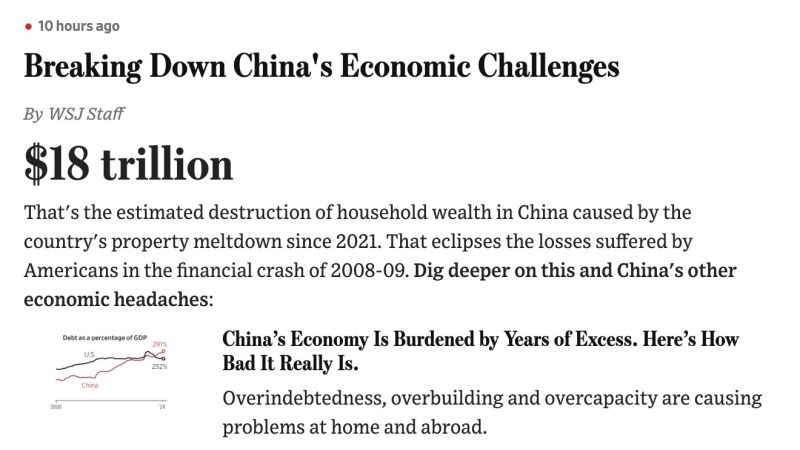

BREAKING 🚨: China

The Chinese Property Market has seen a total loss of $18 Trillion over the past 3 years, surpassing the losses suffered by the U.S. during the Global Financial Crisis. Source: Barchart

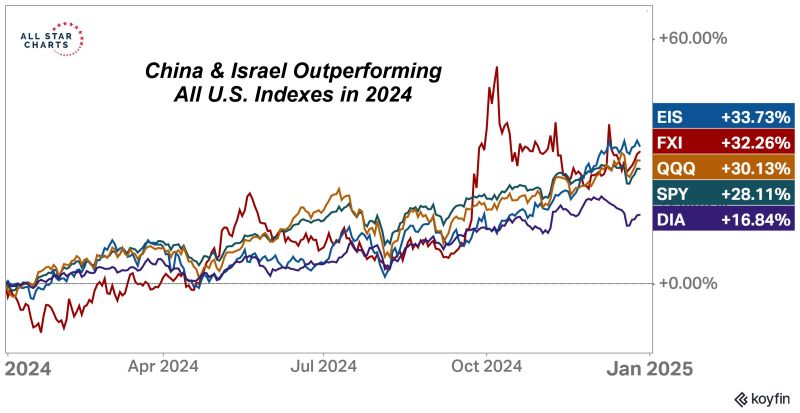

"Bad" newspaper headlines do not always translate into bad equity returns...

Believe it or not but both Israel and China outperformed all the major U.S. Indexes in 2024. Source: J-C Parets

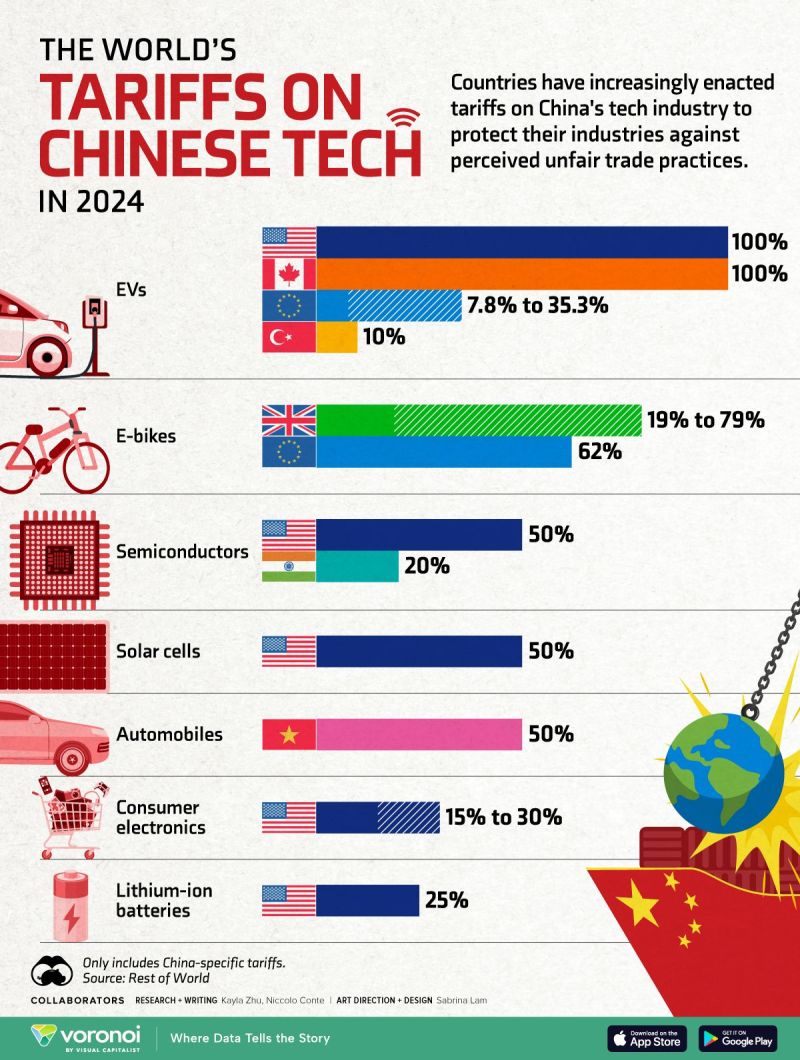

Which countries are putting tariffs on China tech ?

Source: Visual Capitalist

In case you missed it... China is beating the S&P 500 YTD

$FXI $SPY Source: Mike Zaccardi, CFA, CMT, MBA

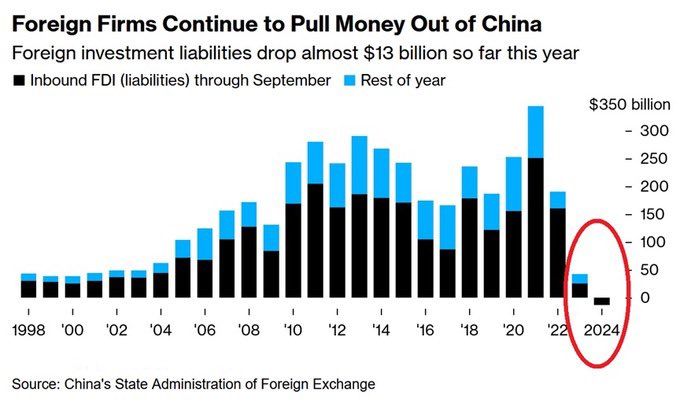

Foreign firms are concerned about China. Global Investors have withdrawn$12.8 billion from China this year, the most since at least 1998.

Source: Bloomberg

According to Goldman, China Secretly Buying Up Massive Amounts Of Gold, 10x More Than Officially

👉According to the Goldman Sachs nowcast of central bank and other institutional gold buying on the London OTC market, October saw central banks buy a whopping 64 tonnes in October (vs. pre-2022 average of 17 tonnes), with China once again the largest buyer adding 55 tonnes, which is striking since the official number reported by the PBOC was one-tenth that, or just 5 tonnes. In other words, China is secretly buying up ~10x more gold than it admits. 👉Commenting on the surge in purchases, the Goldman analyst writes that "surveys and history suggest that EM central banks buy gold as a hedge against financial and geopolitical shocks" and adds that "central bank purchases will remain elevated because fears about geopolitical shocks have structurally risen since the freezing of Russian reserves in 2022, and because relatively low gold shares in EM central banks reserves vs. DMs leaves room for growth." In fact, 81% of the central banks surveyed by the World Gold Council expect global central bank gold holdings to rise over the next 12 months, with none anticipating a decline. 🚨 As shown on the chart below, what is far more striking is the staggering (and growing) divergence between the modest amounts of gold purchases reported by the hashtag#PBOC and the far greater amount China has actually purchased on the London OTC market, in a clear attempt to mask its staggering demand for the precious metal, and be extension, its diversification away from the dollar... Source; www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks