Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Just in 🔉 Reuters sources: China's leading legislative body weighs approval of new fiscal package exceeding 10 trillion yuan ($1.4 trillion dollars) on November 8

Sources: China intends to approve raising new 10 trillion yuan debt through special treasury and local government bonds in upcoming years. fiscal plan to allocate 6 trillion yuan for local government debt and up to 4 trillion yuan for idle land and property acquisition. China could unveil enhanced fiscal measures if trump secures U.S. presidency.

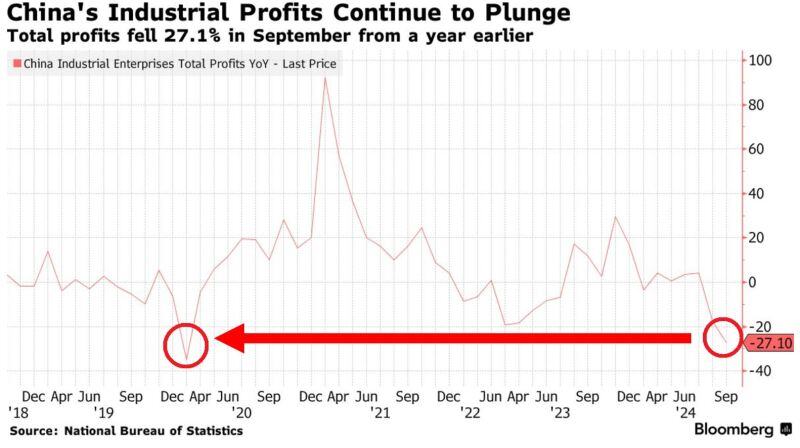

CHINA'S INDUSTRIAL PROFITS FELL TO THE LOWEST SINCE THE COVID CRISIS

Industrial profits at large Chinese companies PLUMMETED 27.1% year-over-year in September, the most since the COVID CRISIS. This is after they FELL 17.8% in August. China is in deep economic trouble. Source: Global Markets Investor, Bloomberg

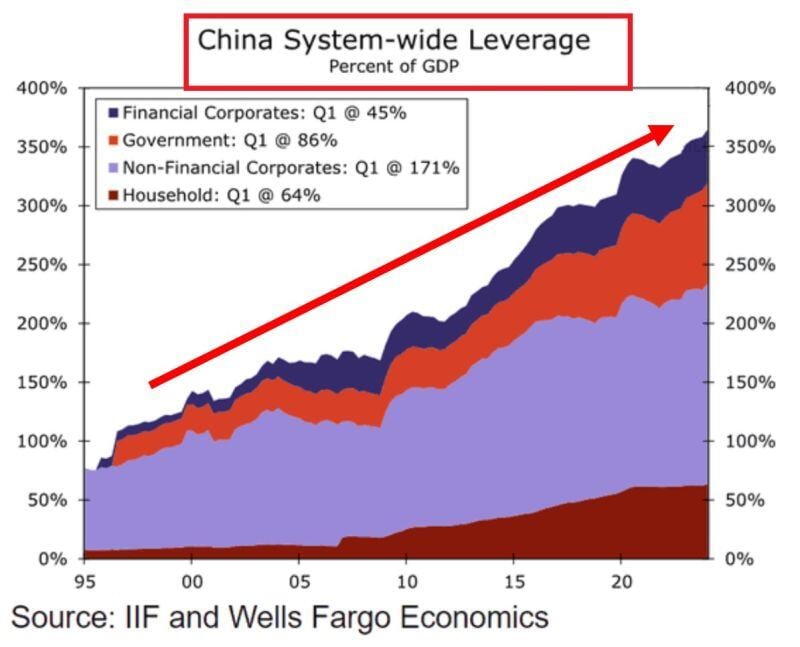

😱 The shocking chart of the day: CHINESE DEBT SIZE IS ABSOLUTELY MIND-BLOWING😱

China's debt-to-GDP ratio hit a MASSIVE 366% in Q1 2024, a new record. Since 2008, the ratio has more than DOUBLED. Breakdown: Non-Financial Corporates: 171% Government: 86% Households: 64% Financial Corporates: 45% Even with this huge debt, China cannot achieve a 5% GDP growth target. How much additional leverage do they need to boost growth? And at what cost? Source: Global Markets Investor, IIF, Wells Fargo

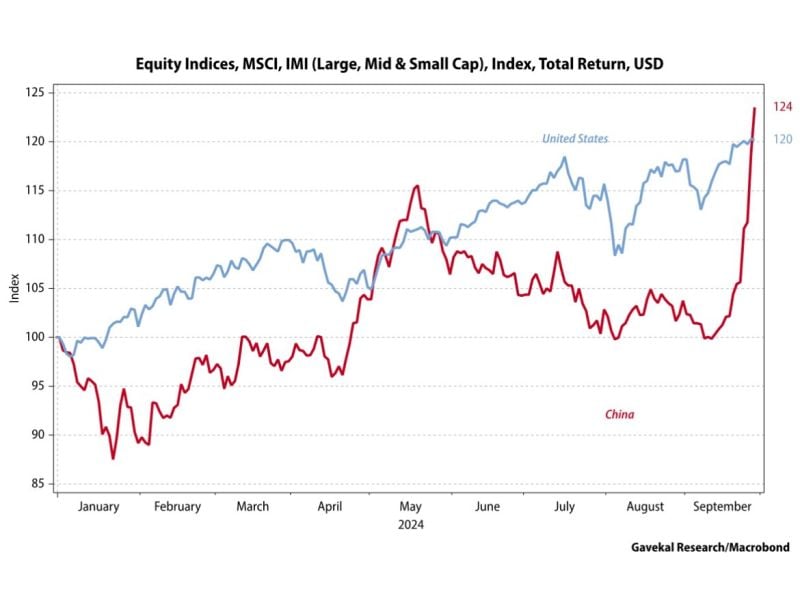

Sometimes things come at you fast: MSCI China now outperforming MSCI USA year to date

Source: Louis-Vincent Gave, Gavekal

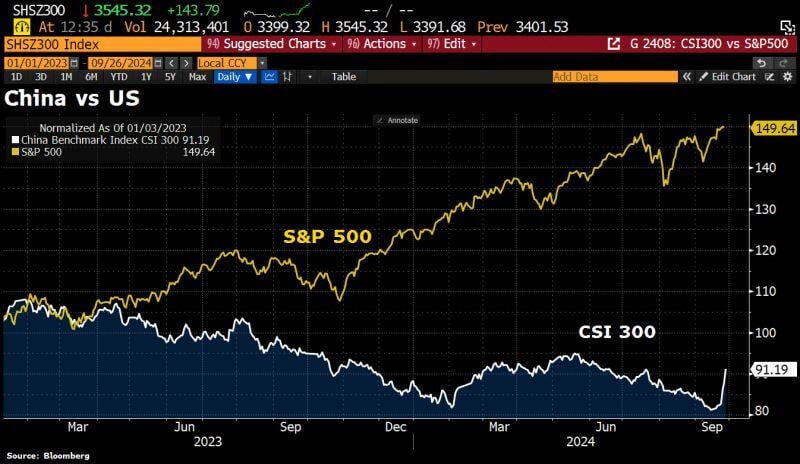

😱Yesterday's China equity market performance in one chart !!!

Below is a heat map of today's returns of the 2,230 stocks which belong to the Shanghai Composite index... Not a single one was down (the worst one was actually flat). And 10 stocks gained more than 20%... Source: Oktay Kavrak, CFA

BCA's Marko Papic (@Geo_papic) sees Chinese monetary & fiscal stimulus as a "fairly big deal": "This is Beijing’s 'Whatever It Takes' moment.

Effectively, Beijing has reached a point where the policy focus shifts from guarding against moral hazard to guarding against political risks." He bets, that we are at the start of a major rotation out of US assets. Source: HolgerZ, Bloomberg

China shorts are "ALL-IN".

Even more than at *the* Bottom. Source: Macro charts

Xi's economic adrenaline shot is only buying China a little time

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks