Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

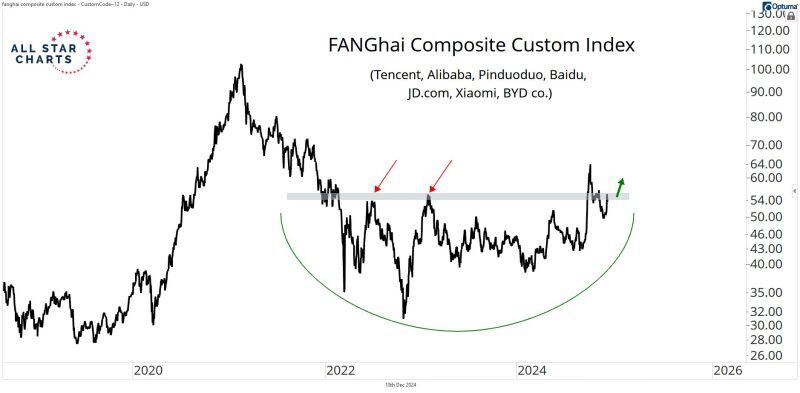

J.C. Parets, CMT / All Star Charts created a brand new Index on China stocks

the FANGhai Composite Index which includes BABA, PDD, BIDU, BYDDF, XIACY, JD & TCEHY. Below is what this index chart looks like. Full article >>> Think about this Index as representing the most important companies in China that trade on US exchanges. Here's a quick rundown of China's "Magnificent 7": -> Alibaba Group (BABA): Leading global e-commerce and cloud services giant, often compared to Amazon. This is truly the "Amazon of China,” with a heavy footprint in e-commerce and digital services. -> Pinduoduo (PDD): E-commerce platform rapidly growing through its group-buying model. Think of this one as the discount online marketplace of China, focusing on social commerce and price-conscious consumers. -> Baidu (BIDU): China's top search engine and a leader in AI development, particularly autonomous driving and voice recognition. Think of this one as the "Google of China,” with a strong emphasis on AI and search. -> BYD Co. Ltd. (BYDDF): A major manufacturer of electric vehicles (EVs) and batteries. This is the "Tesla of China.” It even trades more like Tesla than it does Chinese Stocks. -> Xiaomi Corp (XIACY): A leading Chinese electronics manufacturer known for its smartphones, smart home devices, and plans for electric vehicles (EVs). This one is emerging as the “Apple of China,” or at least one of them. Their phones & electronics have a huge presence in Asia & Latin America. -> JD.com (JD): Another e-commerce retailer in China. JD is actually the largest by sales and has become a leader in logistics with a robust ecosystem of physical and digital stores. Think of this one as a Chinese hybrid of Walmart and Amazon. JD’s subsidiary, JD Health, is the largest online healthcare platform in China. -> Tencent (TCEHY): A global leader in social media (WeChat), gaming (Riot Games), and digital payments and services. This is basically the “Facebook of China.”

China consumer inflation rate drops to a five-month low, missing expectations as economy slows. ARE MORE STIMULUS COMING?

China’s consumer prices rose less-than-expected in November, climbing 0.2% from a year ago, according to data from the National Bureau of Statistics released Monday. Analysts polled by Reuters had expected a slight pickup in the consumer price index to 0.5% in November from a year ago, versus 0.3% in October. China’s producer price index declined for the 26th month. Producer inflation fell by 2.5% year on year in November, less than the estimated 2.8% decline as per the Reuters poll. Source: CNBC, Evan

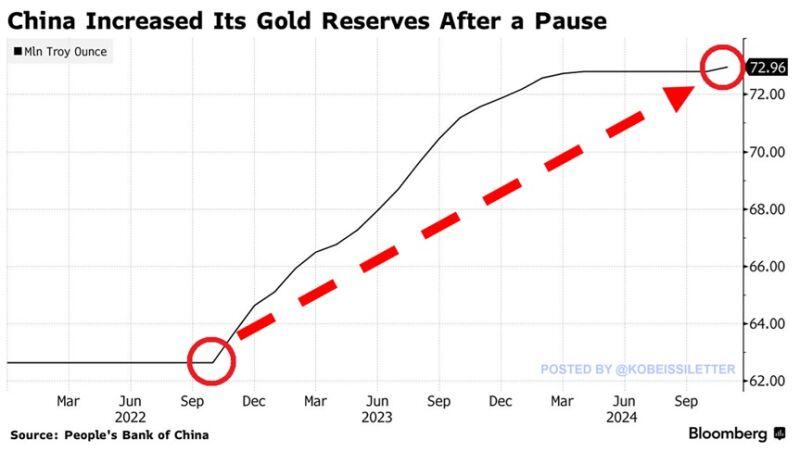

China’s central bank gold reserves hit a record 72.96 million fine troy ounces in November.

China bought 160,000 fine troy ounces of gold last month, resuming purchases after 6 months. China’s gold reserves have risen by a whopping 10 million ounces over the last two years. As a result, the value of the country’s gold reserves reached $193 billion in November, near the record $199 billion posted in October. Meanwhile, gold prices have rallied 28% year-to-date, and trade just 5% below all-time highs. China's gold stockpile is back on the rise. Source: The Kobeissi Letter, Bloomberg

China ups stimulus response, shifts monetary policy stance for the first time in 14 years.

Politburo vows to stabilise both housing and stock markets. China stocks, commodities prices jump. CHINA EASES MONETARY POLICY STANCE FOR FIRST TIME SINCE 2011 *POLITBURO: CHINA MONETARY POLICY TO BE MODERATELY LOOSE *POLITBURO: CHINA'S FISCAL POLICY TO BE MORE PROACTIVE NEXT YEAR *POLITBURO: WILL STABILIZE THE PROPERTY AND STOCK MARKETS Source: Bloomberg, David Ingles

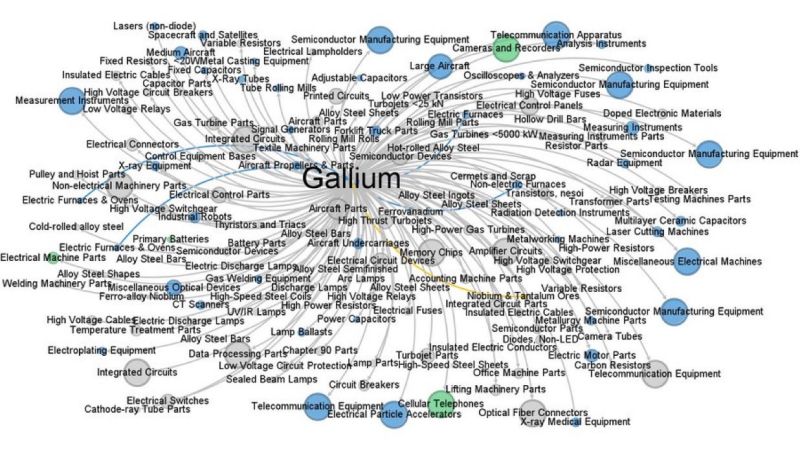

🚨China export bans Gallium & Germanium🚨

Why it matters: Gallium is central to countless downstream industries: semiconductors, aerospace, telecommunications, & more. This image shows how interconnected it is👇 Source: DeepBlueCrypto

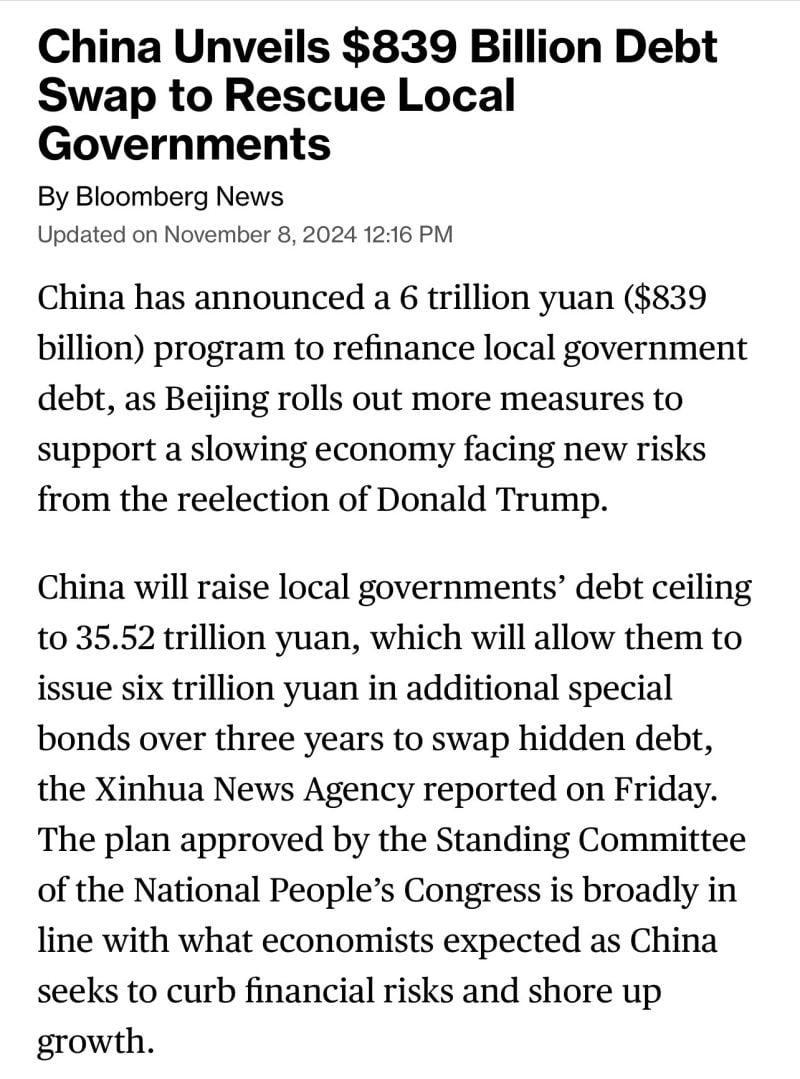

China on Friday announced a five-year package totaling 10 trillion yuan ($1.4 trillion) to tackle local government debt problems, while signaling more economic support would come next year.

The debt swap program, however, fell short of many investors’ expectations for more direct fiscal support. Source: Bloomberg

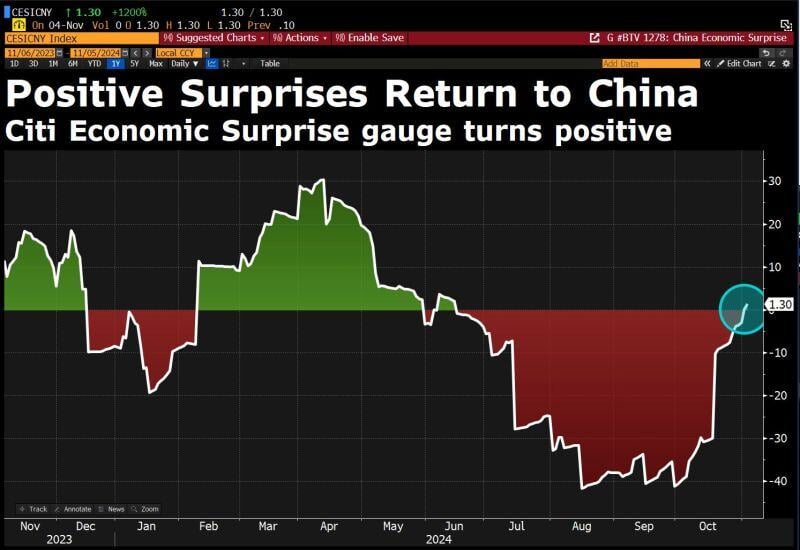

China economic surprise index turns positive

Source: David Ingles, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks