Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"Bad" newspaper headlines do not always translate into bad equity returns...

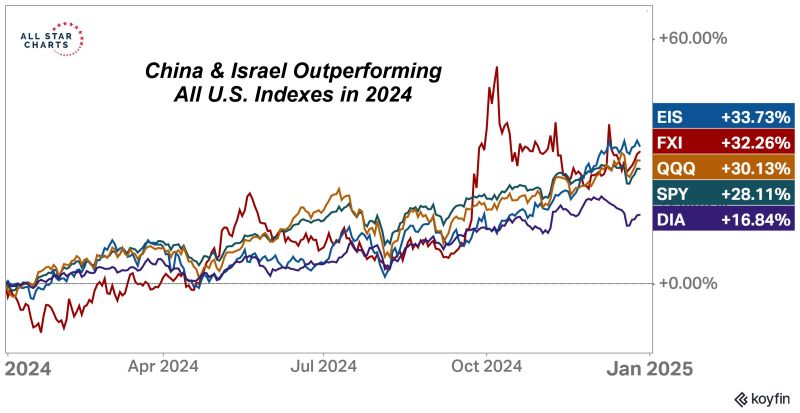

Believe it or not but both Israel and China outperformed all the major U.S. Indexes in 2024. Source: J-C Parets

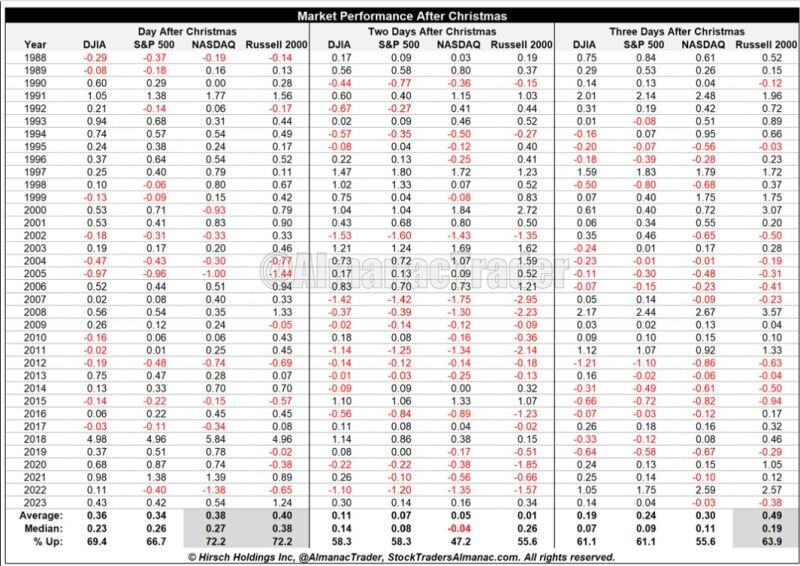

Market Performance After Christmas

Day after Christmas – NASDAQ & Russell 2000 Up 72.2% of time with average gains of 0.38% and 0.40% respectively. source : almanactrader

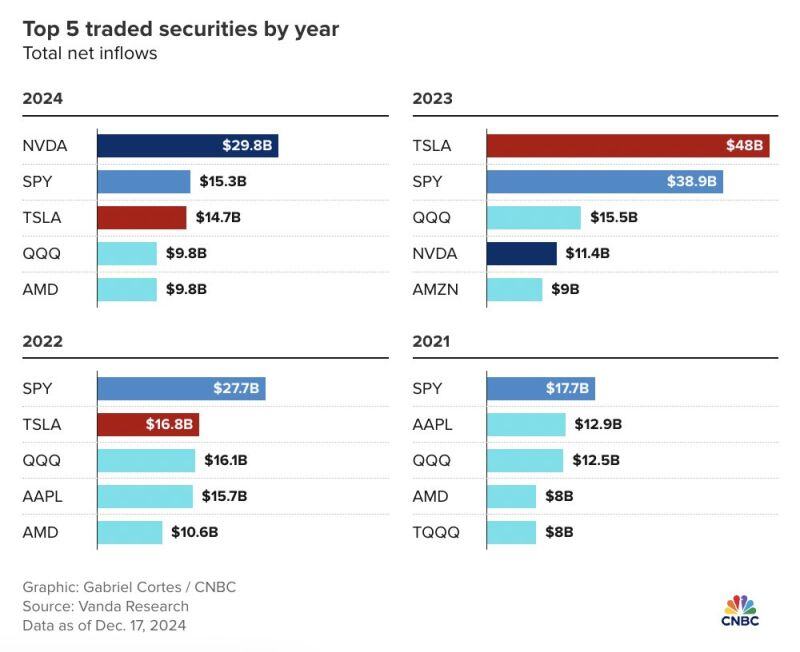

Nvidia $NVDA was the most-bought stock by retail traders on net in 2024

Source: CNBC, Evan on X

Top stock market of the year: Argentina’s index up 163% this year, outperforming the world

@JMilei Source: Sara Eisen @SaraEisen

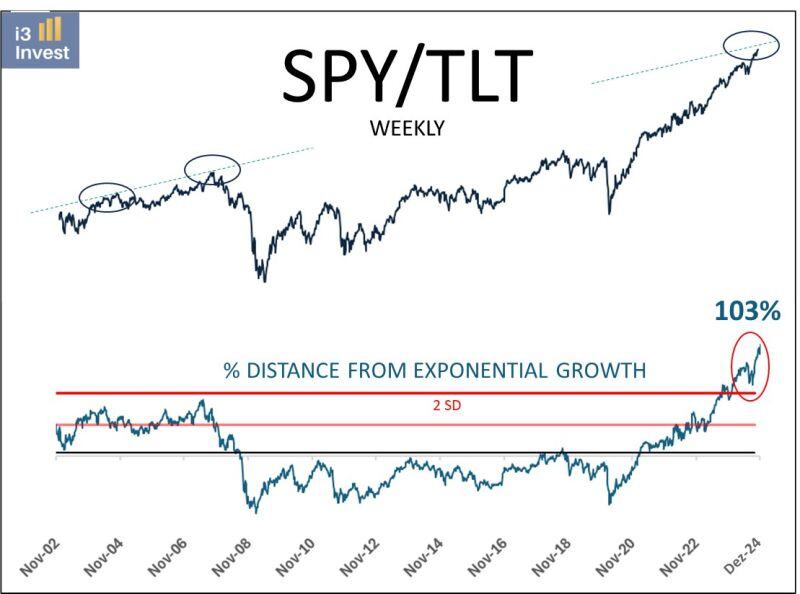

The long S&P500 ($SPY) / short US treasuries 20y+ ($TLT) makes a lot of sense from a macro perspective but is very consensual and looks very extended

See ratio below "In the end, trees don't grow to the sky, and few things go to zero." Howard Marks Source: Guilherme Tavares @i3_invest

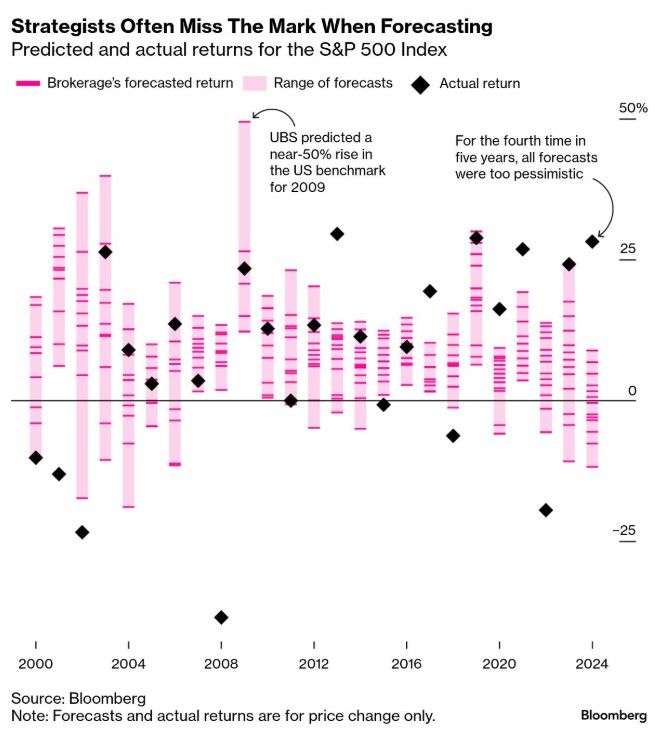

Can Wall Street Get It Right?

The annual tradition of predicting where the S&P 500 will land at year-end has once again raised eyebrows. As Wall Street strategists share their projections for 2025, historical missteps in forecasting cast doubt on their accuracy. 2022: A challenging year where the S&P 500 fell by 19.4%, far worse than predictions. 2023: Despite experts forecasting a modest gain of 6.2%, the index surprised with a remarkable rise of 24.2%. 2024: A consensus estimate of 3% growth was dwarfed by an actual gain of nearly 24% by mid-December. For 2025, the consensus now points to a 9.6% price gain, translating to an 11%+ total return with dividends. source :bloomberg, economicstime

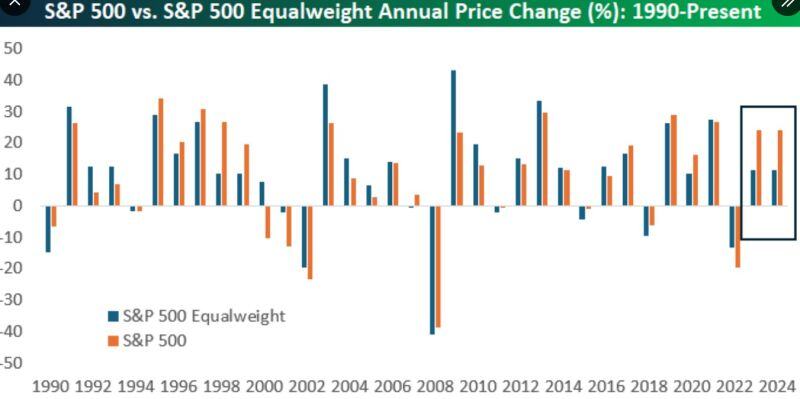

The S&P 500 and S&P 500 Equalweight are on track to have roughly the same price gain in 2024 as they did in 2023.

Equalweight in 2023: +11.56 Equalweight in 2024: +11.47 Cap-weighted in 2023: +24.23% Cap-weighted in 2024: +24.34% source : bespoke

Investing with intelligence

Our latest research, commentary and market outlooks