Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

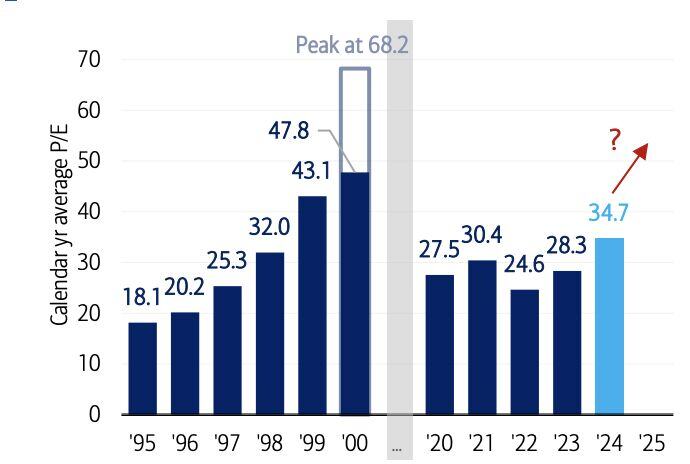

DOTCOM BUBBLE vs. TODAY

Tech P/E Ratio are still half of the peak P/E Ratio from the Dotcom era and still well below the 1999 average P/E Ratio. Source: Seth Golden

In case you missed it... China is beating the S&P 500 YTD

$FXI $SPY Source: Mike Zaccardi, CFA, CMT, MBA

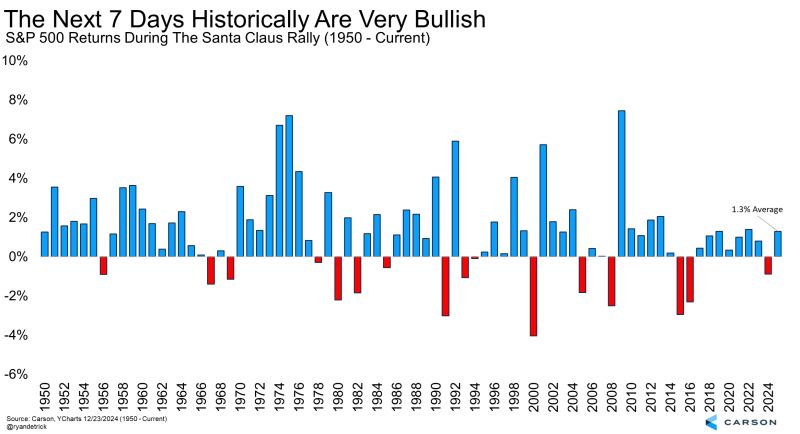

The next 7 days are officially the Santa Claus Rally period.

Down last year, but down back-to-back years only twice since 1950. Source: Ryan Detrick, CMT @RyanDetrick

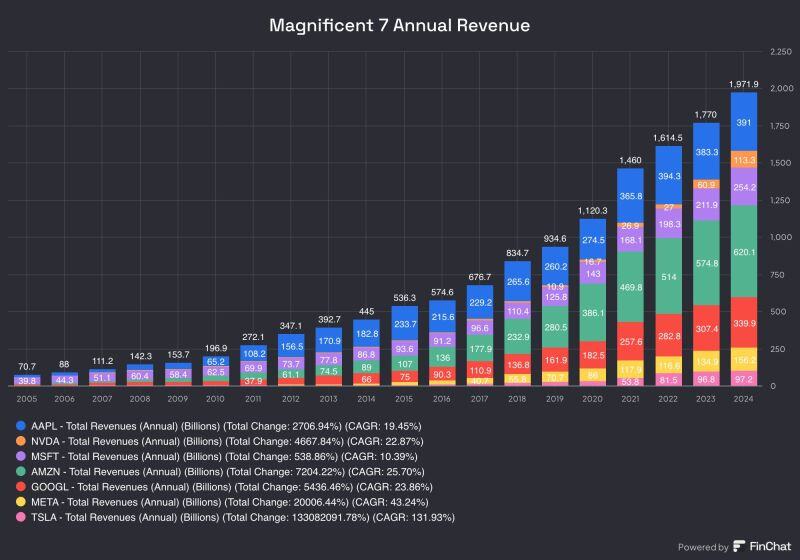

The Magnificent 7 has brought almost $2 Trillion of combined revenue over the last year up from $445 Billion a decade ago.

Source: Evan @StockMKTNewz, Finchat

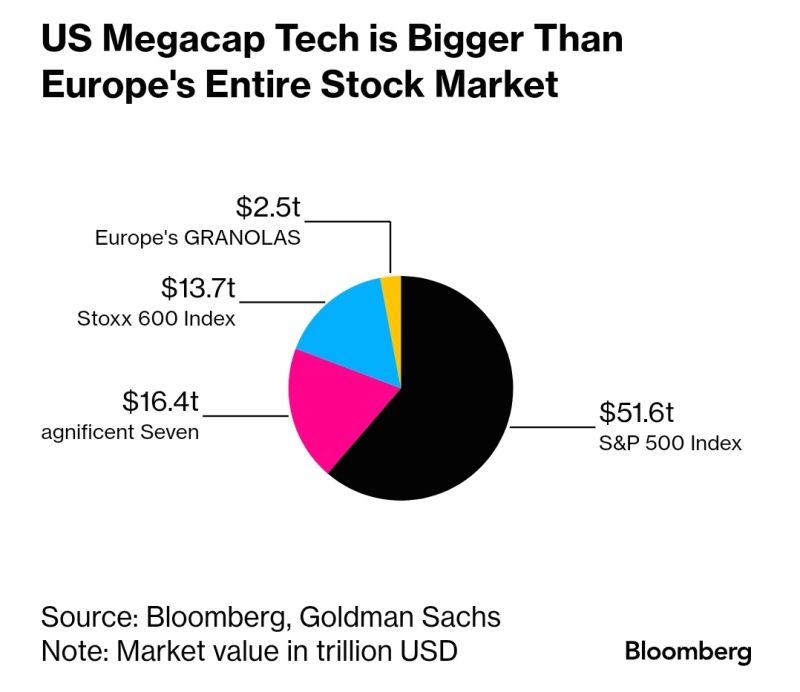

US Megacap Tech is Bigger Than Europe's Entire Stock Market

Source: Tracy Shuchart (𝒞𝒽𝒾 ) @chigrl

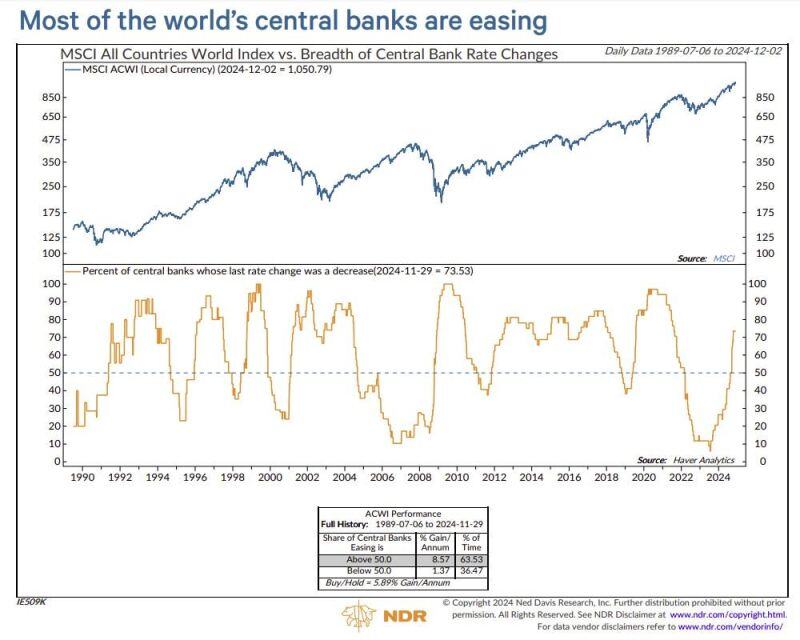

Most of the world's central banks are easing.

(see NDR analysis below)

Investing with intelligence

Our latest research, commentary and market outlooks