Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

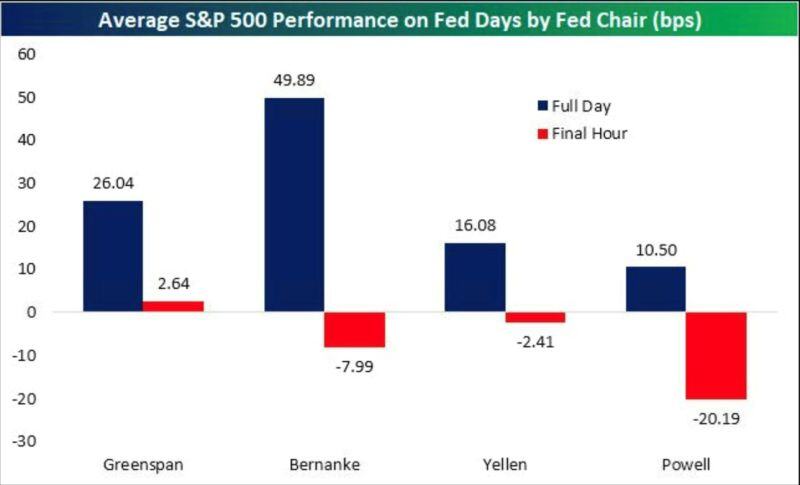

Powell is second to none when it comes to market reaction on Fed day.

He lived up to his reputation and track record yesterday. To say the least... Source: Bespoke

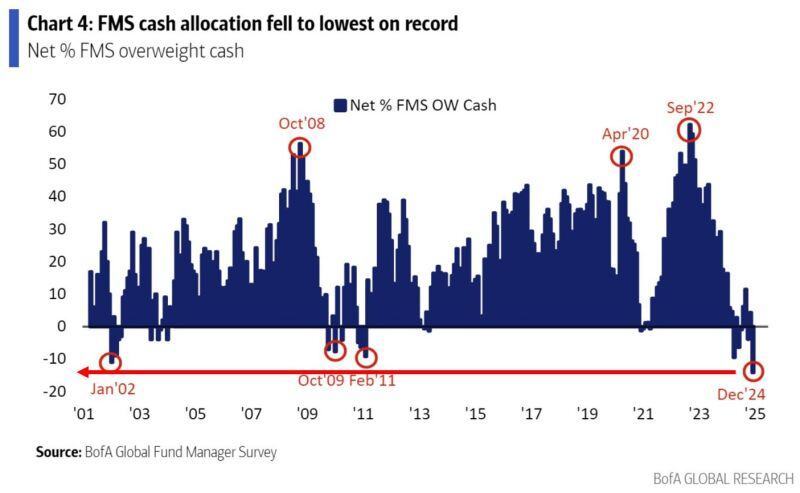

‼️AHEAD OF THE FED MEETING YESTERDAY, INSTITUTIONAL INVESTORS WERE ALL-IN ON US STOCKS AND CASH ALLOCATION AT RECORD LOW ‼️

Institutional investors* cash allocation hit the lowest level ON RECORD. This comes as allocation to US equities hit a RECORD HIGH. What will happen when stocks begin to drop? *171 Fund Managers with $450 billion in assets Source: BofA, Global Markets Investor

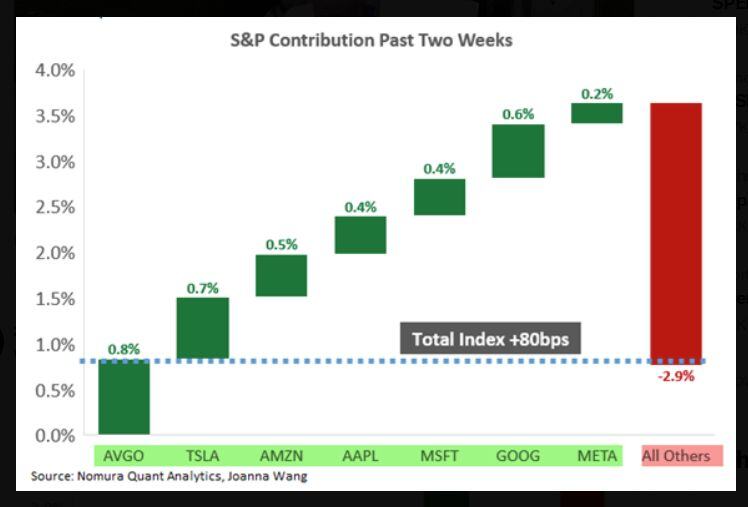

Why the S&P is up past two weeks

Source: Nomura thru zerohedge

The stat of the day >>>

Yes, the Fed has already cut near all-time-highs and you know what ❓ The Bulls 🐮 Liked it 👍 The S&P 500 is less than 2% away from all-time highs the day before a Fed decision. Since 1980, there were 20 other times they cut rates within 2% of ATHs. The S&P 500 was higher a year later 20 times 🚀 Source: Ryan Detrick, CMT @RyanDetrick

Apple now trades at over 41x earnings, its highest P/E ratio since 2007 (first iPhone was released).

When Berkshire Hathaway started buying Apple in 2016 it was trading at less than 10x earnings. Berkshire sold 67% of their stake this year. $AAPL Source: Charlie Bilello

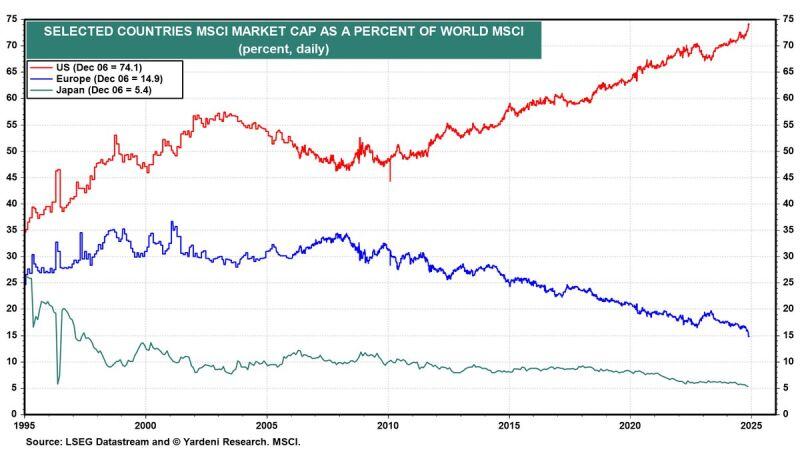

"The MSCI US now accounts for a staggering 74% of the market capitalization of the All Country World MSCI."

Source: Yardeni

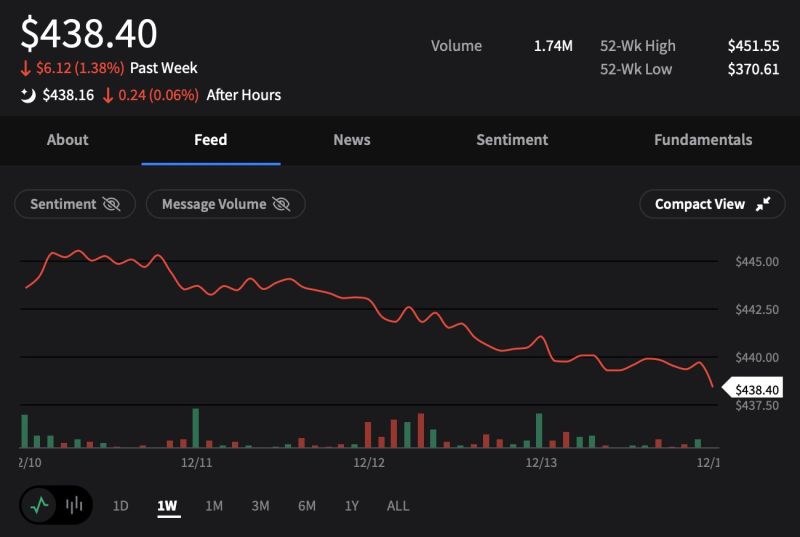

BREAKING >>> The Dow Jones just hit an 8-day losing streak

The longest since 2018 $DIA

Investing with intelligence

Our latest research, commentary and market outlooks