Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

To put things into perspective:

Chip specialist Broadcom has added $324bn to its market value in just 2 days—exceeding the entire market value of Germany's largest company, SAP, which is worth $310bn. Source: HolgerZ, Bloomberg

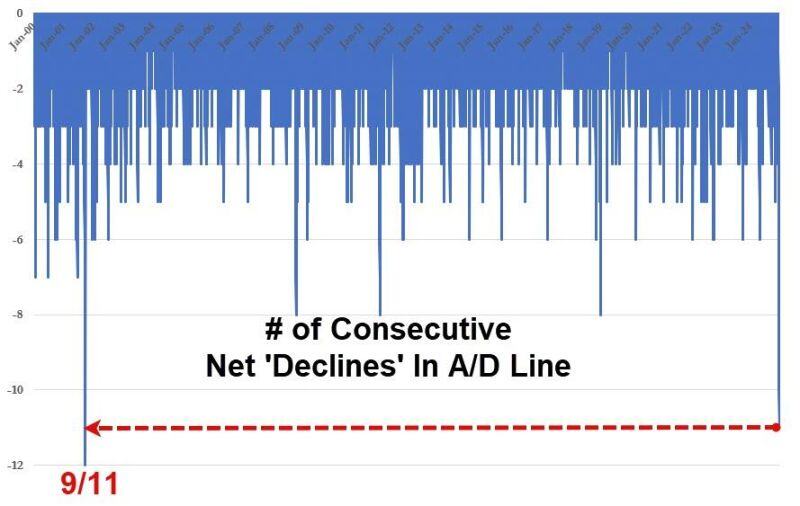

This is crazy: 11 consecutive days of more decliners than advancers in the S&P500.

First time since Sept 11, 2001 Source: zerohedge

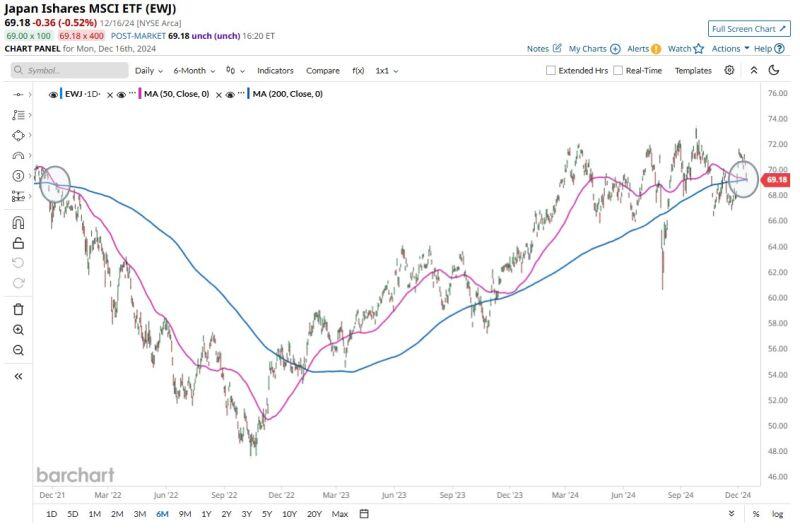

BREAKING 🚨: Japan

Japanese Stocks $EWJ formed a Death Cross for the first time since December 2021 ☠️ The last one saw stocks enter a bear market with a plunge of more than 30%. Source: Barchart

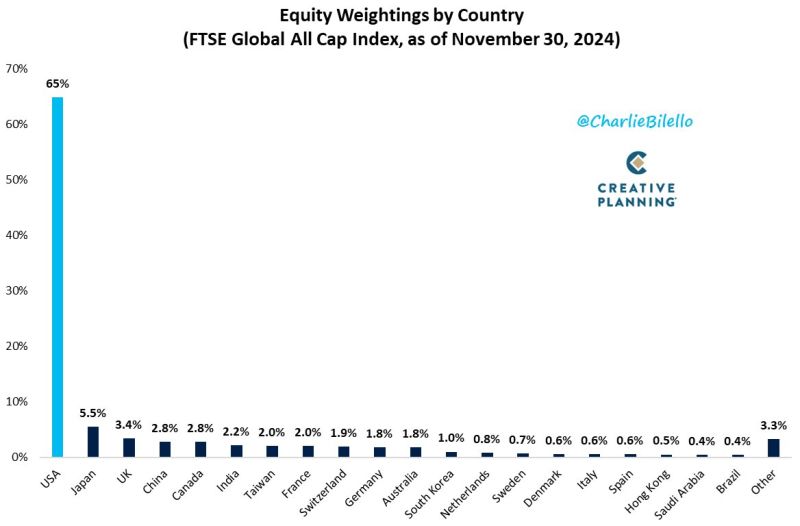

US stocks now make up 65% of the global equity market, their highest weighting in history.

This is more than 11x bigger than the second largest country by market cap (Japan at 5.5%). Source; Charlie Bilello

🚨 The S&P 500 P/E Ratios Heat Map.

What do you notice? $SPY Source: Jesse Cohen @JesseCohenInv

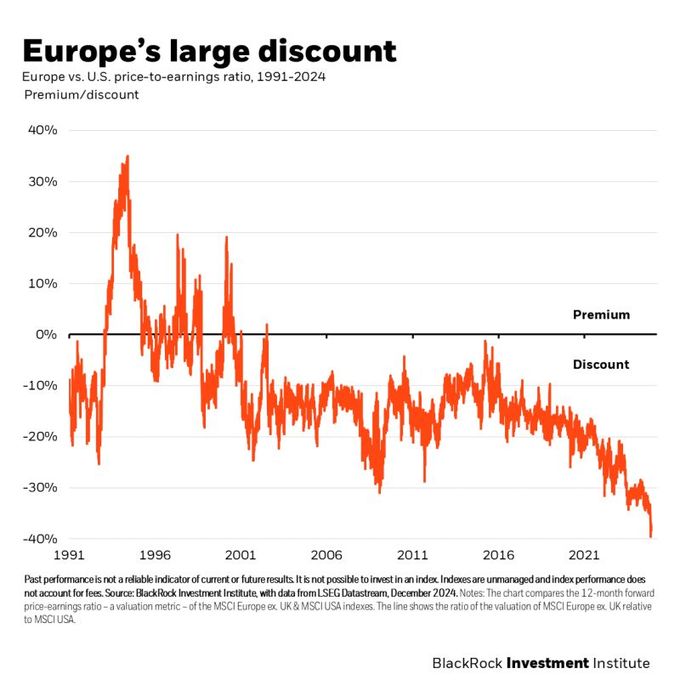

European Stocks trading at an all-time record discount relative to US Stocks

Source: Barchart, Blackrock

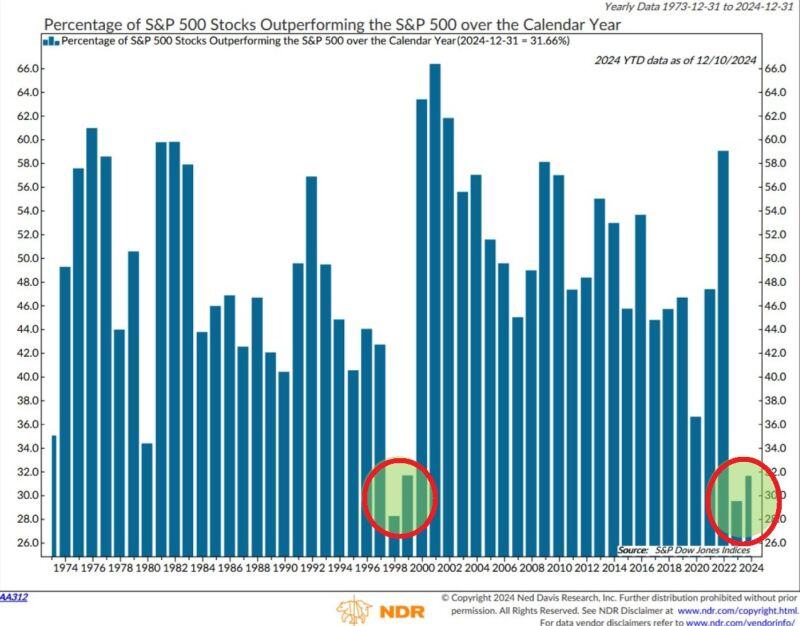

🚨Only 32% of the S&P 500 firms have outperformed the index year-to-date after 29% in 2023, one of the lowest readings on record.

In other words, 32% of companies gained more than 27% this year. In the past, this happened only once, in the 1998-1999 Dot-Com Bubble. Source: Global Markets Investor

BREAKING: Corporate executives are now selling their stock at record levels, with the ratio of sellers to buyers hitting 6x.

Why are insiders cashing out? Source. The Kobeissi Letter, FT

Investing with intelligence

Our latest research, commentary and market outlooks